Trump's Tariffs: CEOs Highlight Negative Impact On Economy And Consumer Confidence

Table of Contents

Rising Prices and Reduced Consumer Spending

Trump's tariffs, designed to protect domestic industries, inadvertently increased the cost of imported goods, triggering a ripple effect throughout the economy. This section analyzes the resulting inflationary pressures and weakened consumer confidence.

Inflationary Pressures

Tariffs directly increase the cost of imported goods, leading to higher prices for consumers. This reduces purchasing power and dampens consumer spending. The impact is felt across various sectors, from manufacturing to retail.

- Increased costs for manufacturers translate to higher prices for finished goods. Companies facing higher input costs due to tariffs on raw materials or intermediate goods are forced to pass these costs onto consumers to maintain profit margins. This price increase affects everything from clothing and electronics to automobiles and building materials.

- Reduced disposable income forces consumers to cut back on non-essential purchases. Higher prices for everyday goods mean less disposable income for consumers. This leads to decreased spending on discretionary items, impacting retail sales and overall economic growth.

- Case studies: Specific examples of price increases on consumer goods due to tariffs. For example, tariffs on steel and aluminum led to increased prices for automobiles and construction materials. The increased cost of imported components for electronics also resulted in higher prices for consumers.

Weakened Consumer Confidence

The uncertainty and higher prices associated with tariffs erode consumer confidence, leading to decreased spending and economic slowdown. This negative sentiment further exacerbates the economic impact.

- Surveys showing declining consumer confidence indices following tariff implementations. Numerous economic surveys demonstrate a correlation between the implementation of tariffs and a decline in consumer confidence indicators. Consumers are less likely to spend when they feel uncertain about the future economic climate.

- Reduced investment in consumer durables due to price concerns. Higher prices for large-ticket items, such as automobiles and appliances, discourage consumers from making significant purchases. This decreased investment in consumer durables further slows economic growth.

- Analysis of consumer spending patterns before and after tariff imposition. Comparing consumer spending data before and after the implementation of tariffs reveals a clear decline in spending across various categories.

Negative Impact on Business Investment and Growth

Beyond the immediate impact on consumers, Trump's tariffs significantly hampered business investment and overall economic growth. The uncertainty and increased costs created an environment hostile to expansion and job creation.

Increased Uncertainty and Reduced Investment

The unpredictability of trade policy under Trump's administration created significant uncertainty for businesses, leading to decreased investment in expansion and hiring. This risk aversion stifled economic growth.

- CEO statements expressing hesitation to invest due to tariff uncertainty. Numerous CEOs publicly expressed concerns about the unpredictable nature of trade policy, stating that this uncertainty made long-term investment planning extremely difficult.

- Decline in business investment figures following tariff announcements. Economic data shows a clear correlation between tariff announcements and a subsequent decline in business investment. Businesses were less likely to invest in new projects or expansions amidst this trade uncertainty.

- Reduced capital expenditures by businesses in affected sectors. Industries directly impacted by tariffs, such as manufacturing and agriculture, experienced significant reductions in capital expenditures. This lack of investment hampered productivity and growth within these sectors.

Disrupted Supply Chains and Increased Costs

Tariffs disrupted global supply chains, increasing costs and reducing efficiency for businesses. This complexity added to the overall economic burden.

- Examples of supply chain disruptions due to tariff-related delays and increased costs. Tariffs led to delays in the delivery of goods, increased transportation costs, and added complexity to the logistics of global trade.

- Increased reliance on more expensive domestic suppliers due to tariffs. Businesses were forced to shift their sourcing to more expensive domestic suppliers, further increasing their production costs.

- Analysis of the impact on various industries (e.g., manufacturing, agriculture). Both manufacturing and agriculture were heavily affected, experiencing increased input costs, reduced competitiveness, and disrupted supply chains.

Retaliatory Tariffs and Global Trade Wars

Trump's tariffs triggered retaliatory tariffs from other countries, escalating trade conflicts and harming global economic growth. This escalation had far-reaching consequences.

Escalation of Trade Conflicts

The imposition of tariffs by the US prompted retaliatory measures from other countries, leading to a broader trade war that damaged global economic stability and growth.

- Examples of retaliatory tariffs imposed by other countries in response to Trump's tariffs. China, the European Union, and other countries responded to US tariffs by imposing their own tariffs on American goods, creating a tit-for-tat trade war.

- Analysis of the impact of retaliatory tariffs on specific US industries. Industries like agriculture and manufacturing suffered particularly from retaliatory tariffs imposed by other countries.

- Discussion on the negative consequences of trade wars for global economic stability. Trade wars disrupt global supply chains, increase uncertainty, and reduce overall economic growth.

Conclusion

The consensus among many CEOs is clear: Trump's tariffs have had a demonstrably negative impact on the US economy and consumer confidence. Rising prices, decreased consumer spending, reduced business investment, and the escalation of trade conflicts paint a concerning picture. Understanding the long-term consequences of these trade policies is crucial for informed decision-making. Further research and analysis are needed to fully assess the lasting effects of Trump's tariffs and to develop effective strategies for mitigating their negative impacts on the economy. Let's continue the conversation on the long-term implications of Trump's tariffs and their effects on our economic future.

Featured Posts

-

Todays Stock Market Dow Futures Movement And Chinas Economic Response To Tariffs

Apr 26, 2025

Todays Stock Market Dow Futures Movement And Chinas Economic Response To Tariffs

Apr 26, 2025 -

The American Battleground Taking On The Worlds Wealthiest

Apr 26, 2025

The American Battleground Taking On The Worlds Wealthiest

Apr 26, 2025 -

Chinas Automotive Industry Growth Challenges And Future Prospects

Apr 26, 2025

Chinas Automotive Industry Growth Challenges And Future Prospects

Apr 26, 2025 -

Analyzing The China Market Why Bmw And Porsche Are Facing Difficulties

Apr 26, 2025

Analyzing The China Market Why Bmw And Porsche Are Facing Difficulties

Apr 26, 2025 -

2024 Nfl Draft Green Bays First Round Preview

Apr 26, 2025

2024 Nfl Draft Green Bays First Round Preview

Apr 26, 2025

Latest Posts

-

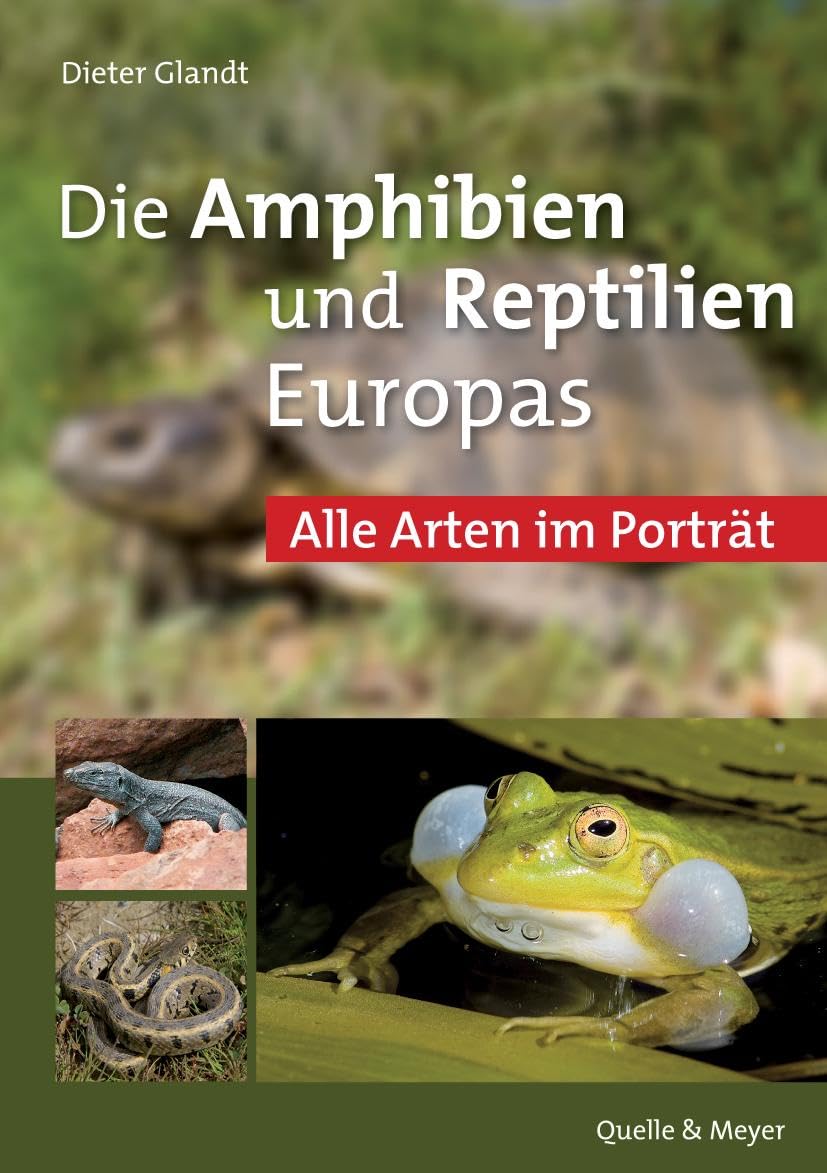

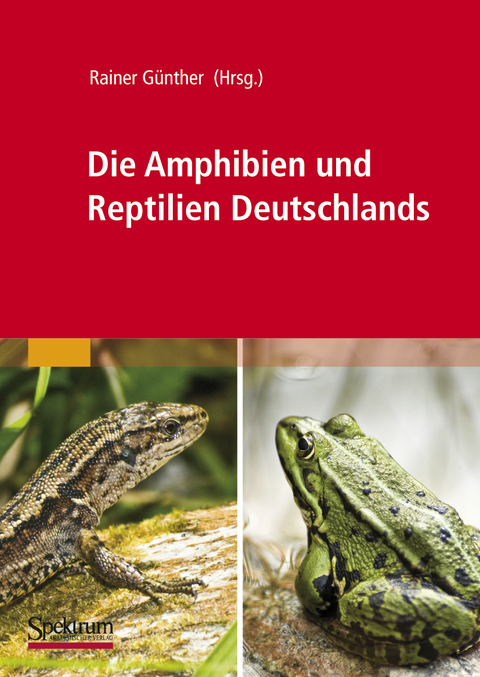

Thueringen Artenvielfalt Von Amphibien Und Reptilien Im Neuen Atlas Dokumentiert

Apr 27, 2025

Thueringen Artenvielfalt Von Amphibien Und Reptilien Im Neuen Atlas Dokumentiert

Apr 27, 2025 -

Entdecken Sie Die Amphibien Und Reptilien Thueringens Der Neue Atlas

Apr 27, 2025

Entdecken Sie Die Amphibien Und Reptilien Thueringens Der Neue Atlas

Apr 27, 2025 -

Neuer Atlas Zeigt Die Amphibien Und Reptilien Thueringens

Apr 27, 2025

Neuer Atlas Zeigt Die Amphibien Und Reptilien Thueringens

Apr 27, 2025 -

Thueringens Reptilien Und Amphibien Der Neue Atlas Ist Da

Apr 27, 2025

Thueringens Reptilien Und Amphibien Der Neue Atlas Ist Da

Apr 27, 2025 -

Thueringen Amphibien Und Reptilienatlas Ein Umfassender Ueberblick

Apr 27, 2025

Thueringen Amphibien Und Reptilienatlas Ein Umfassender Ueberblick

Apr 27, 2025