The American Battleground: Taking On The World's Wealthiest

Table of Contents

The Growing Gap: Understanding American Wealth Inequality

The gap between the rich and the poor in the US is widening at an alarming rate, creating a significant challenge to the nation's social and economic fabric. Wealth inequality, often confused with income inequality, refers to the unequal distribution of assets like property, stocks, and savings, reflecting a broader picture of economic disparity than simply yearly earnings. Net worth, the total value of assets minus liabilities, is a key metric used to measure this inequality.

- Statistics on the concentration of wealth among the top 1%: Studies consistently show that the top 1% of Americans control a disproportionately large share of the nation's wealth, a percentage far exceeding their representation in the population. This concentration has been steadily increasing over the past several decades.

- Comparison of wealth distribution in the US versus other developed nations: Compared to other developed nations, the US exhibits a significantly higher level of wealth concentration. This disparity highlights a critical issue within the American economic system.

- Impact of tax policies on wealth inequality: Tax policies, particularly those affecting capital gains and inheritance taxes, have a significant impact on wealth distribution. Favorable tax treatments for the wealthy can exacerbate existing wealth disparity. Understanding the impact of tax loopholes and their historical context is crucial to addressing this issue. The debate over progressive taxation versus regressive taxation plays a pivotal role in this context. This relates to the broader conversation on economic inequality in America.

The Power Players: Who Holds the Wealth and How?

Understanding American wealth inequality requires identifying the key players and the mechanisms that allow them to accumulate and maintain their vast fortunes.

- Corporations: Large multinational corporations, often shielded by complex financial structures and advantageous tax laws, contribute significantly to wealth concentration. Their immense profits often benefit a small number of shareholders, widening the income gap.

- Inherited Wealth: The legacy of inherited wealth plays a significant role in perpetuating wealth concentration. Generational wealth provides a significant advantage, compounding over time and creating vast disparities in opportunity.

- Tech Billionaires: The rise of the tech industry has created a new class of billionaires, further intensifying wealth disparity. The concentration of wealth within this sector exemplifies the challenges of regulating rapidly growing industries.

Mechanisms contributing to wealth concentration include:

- Tax loopholes: Exploiting loopholes in the tax code allows the wealthy to significantly reduce their tax burden, exacerbating economic inequality.

- Globalization: While globalization has created economic opportunities, it has also contributed to wealth concentration by shifting manufacturing and jobs overseas, impacting many American workers.

- Lobbying: Powerful lobbying efforts by corporations and wealthy individuals influence economic policy, often leading to legislation that benefits their interests at the expense of the broader population. The influence of lobbying efforts is a significant factor in shaping the economic power structure in the United States.

The Fightback: Strategies for Addressing American Wealth Inequality

Addressing American wealth inequality requires a multifaceted approach involving significant policy changes and social action. Several strategies are being debated and implemented:

- Progressive Taxation: Implementing a more progressive tax system, where higher earners pay a larger percentage of their income in taxes, could help redistribute wealth and fund social programs. This is a key element in the fight for economic justice.

- Wealth Taxes: A wealth tax, levied on the net worth of the wealthiest individuals, is another proposed mechanism to reduce wealth disparity. This is a controversial topic, with arguments regarding its feasibility and potential economic consequences.

- Stronger Labor Unions: Empowering labor unions to negotiate for better wages and benefits for workers is crucial for reducing income inequality and improving social mobility.

- Social Safety Nets: Expanding and strengthening social safety nets, such as unemployment benefits, affordable healthcare, and subsidized housing, can provide crucial support for low- and middle-income families.

The political and social challenges involved in implementing these strategies are substantial. Overcoming entrenched interests and fostering public support for significant policy changes are major hurdles.

- Examples of successful policies implemented in other countries: Examining successful policies in other developed nations, such as Nordic countries with strong social safety nets, can provide valuable lessons and insights.

- Arguments for and against specific policy proposals: A thorough understanding of the arguments for and against each proposed policy is crucial for informed public discourse and effective policymaking.

- Discussion of the role of social movements and activism in driving change: Social movements and activism play a vital role in raising awareness, mobilizing public opinion, and pressuring policymakers to address American wealth inequality.

The Role of Technology in Exacerbating and Addressing Inequality

Technological advancements have played a significant role in both exacerbating and potentially addressing American wealth inequality.

- Automation: Automation has led to job displacement in certain sectors, contributing to income inequality. However, it also presents opportunities for creating new, higher-skilled jobs.

- Gig Economy: The rise of the gig economy has created both flexibility and precariousness for workers, exacerbating technological inequality. Many gig workers lack benefits and job security.

- Digital Divide: The digital divide, where access to technology and the internet is unequally distributed, further widens the gap between the rich and the poor. Addressing the digital divide is crucial for ensuring equal opportunities in the digital age.

Conclusion

The severity of American wealth inequality is undeniable, demanding urgent attention and action. The concentration of wealth in the hands of a few, facilitated by various economic and political factors, has created a system that undermines the very essence of the American Dream. The strategies discussed—progressive taxation, wealth taxes, stronger labor unions, and expanded social safety nets—offer potential avenues for addressing this critical issue. However, the path toward a more equitable future requires sustained effort, political will, and public engagement. The battleground for economic justice is here, and understanding American wealth inequality is the first step towards creating a fairer and more equitable future. Get involved today!

Featured Posts

-

Trade War Fears Fuel Gold Price Surge Is Bullion A Smart Investment

Apr 26, 2025

Trade War Fears Fuel Gold Price Surge Is Bullion A Smart Investment

Apr 26, 2025 -

The Military Base Defining The Us China Power Dynamic

Apr 26, 2025

The Military Base Defining The Us China Power Dynamic

Apr 26, 2025 -

Trump Tariffs Ceo Warnings Of Economic Uncertainty And Consumer Anxiety

Apr 26, 2025

Trump Tariffs Ceo Warnings Of Economic Uncertainty And Consumer Anxiety

Apr 26, 2025 -

The Often Overlooked Value Of Middle Managers A Strategic Asset

Apr 26, 2025

The Often Overlooked Value Of Middle Managers A Strategic Asset

Apr 26, 2025 -

Will Chinese Cars Dominate The Global Market An Analysis

Apr 26, 2025

Will Chinese Cars Dominate The Global Market An Analysis

Apr 26, 2025

Latest Posts

-

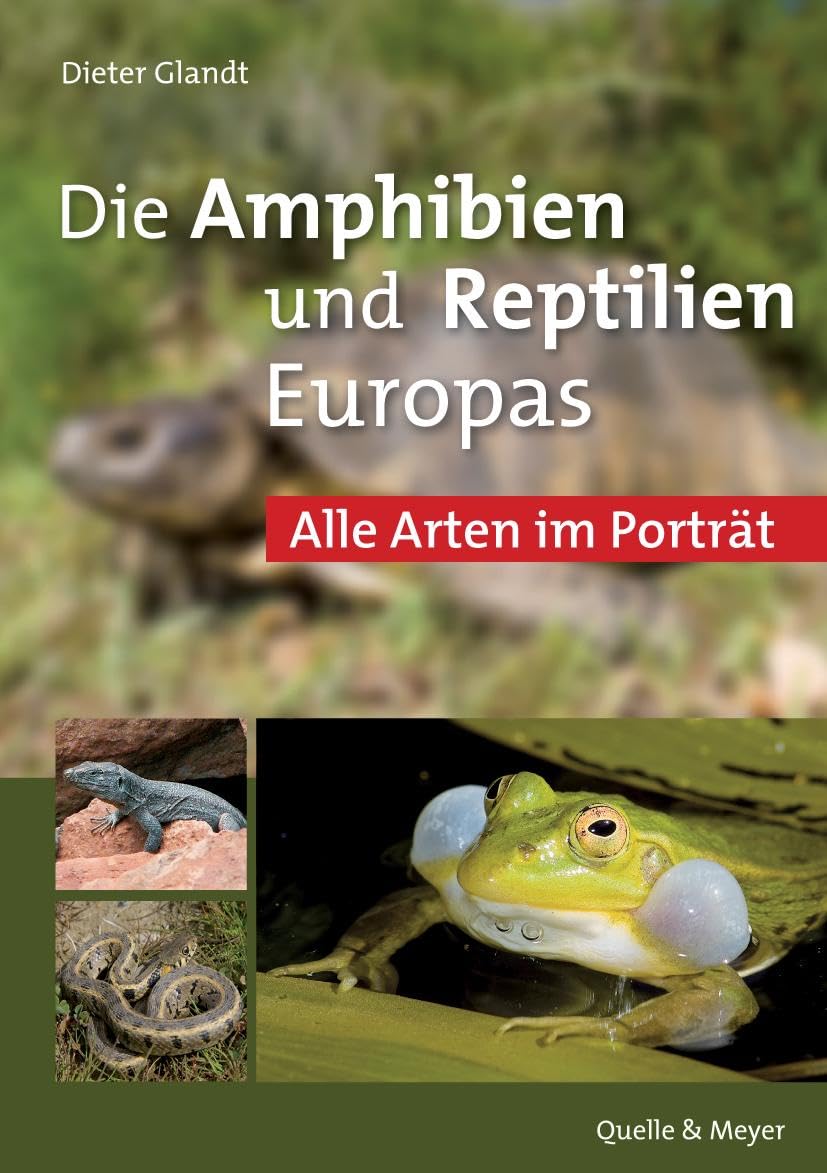

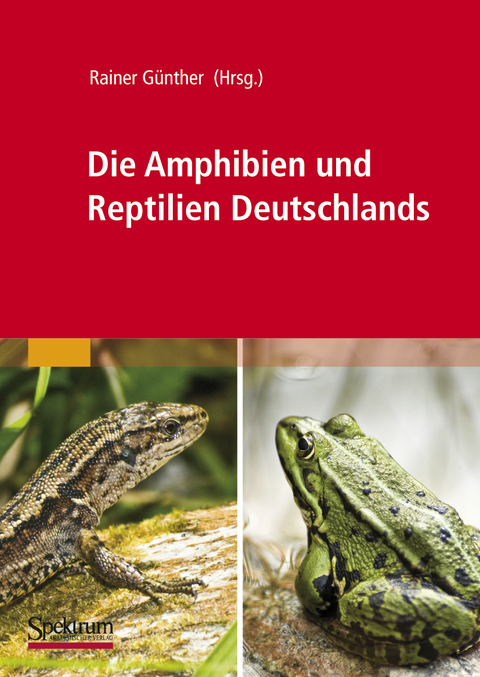

Thueringen Artenvielfalt Von Amphibien Und Reptilien Im Neuen Atlas Dokumentiert

Apr 27, 2025

Thueringen Artenvielfalt Von Amphibien Und Reptilien Im Neuen Atlas Dokumentiert

Apr 27, 2025 -

Entdecken Sie Die Amphibien Und Reptilien Thueringens Der Neue Atlas

Apr 27, 2025

Entdecken Sie Die Amphibien Und Reptilien Thueringens Der Neue Atlas

Apr 27, 2025 -

Neuer Atlas Zeigt Die Amphibien Und Reptilien Thueringens

Apr 27, 2025

Neuer Atlas Zeigt Die Amphibien Und Reptilien Thueringens

Apr 27, 2025 -

Thueringens Reptilien Und Amphibien Der Neue Atlas Ist Da

Apr 27, 2025

Thueringens Reptilien Und Amphibien Der Neue Atlas Ist Da

Apr 27, 2025 -

Thueringen Amphibien Und Reptilienatlas Ein Umfassender Ueberblick

Apr 27, 2025

Thueringen Amphibien Und Reptilienatlas Ein Umfassender Ueberblick

Apr 27, 2025