Today's Stock Market: Dow Futures Movement And China's Economic Response To Tariffs

Table of Contents

Dow Futures Movement: A Key Indicator of Market Sentiment

Dow Futures contracts are derivative instruments whose price is tied to the anticipated future value of the Dow Jones Industrial Average (DJIA). Understanding their behavior offers valuable insight into the overall market sentiment and potential future trends.

Understanding Dow Futures Contracts

- Dow Jones Industrial Average (DJIA): The DJIA is a price-weighted average of 30 large, publicly owned companies based in the United States. It's a widely followed benchmark of the US stock market's performance.

- Futures and the Actual Index: Dow Futures contracts allow investors to buy or sell the DJIA at a predetermined price on a future date. Their price reflects the market's expectation of the DJIA's value at that time.

- Contract Expirations: Dow Futures contracts have various expiration dates, offering flexibility to investors depending on their investment horizon. Near-term contracts are more sensitive to short-term market fluctuations.

Dow Futures react swiftly to various economic news and events. For example, unexpected interest rate changes by the Federal Reserve, geopolitical tensions, and significant economic data releases (like employment numbers or inflation reports) can significantly influence Dow Futures prices.

Technical analysis plays a crucial role in predicting Dow Futures movements. Traders utilize chart patterns (e.g., head and shoulders, double tops/bottoms), indicators (e.g., moving averages, RSI), and other technical tools to identify potential trends and trading opportunities.

Analyzing Recent Dow Futures Activity

Recent Dow Futures activity has been characterized by [insert description of recent trends - e.g., increased volatility, periods of consolidation, sustained upward/downward movement]. Several key factors have contributed to these movements:

- Economic Data Releases: [Mention specific recent economic data releases (e.g., stronger-than-expected GDP growth, disappointing employment figures) and their impact on Dow Futures.]

- Geopolitical Events: [Discuss the influence of geopolitical events (e.g., international trade disputes, political instability) on Dow Futures prices.]

- Corporate Earnings Reports: [Analyze the effect of major company earnings announcements on market sentiment and Dow Futures.]

The overall sentiment reflected by recent Dow Futures performance can be described as [insert assessment - e.g., cautiously optimistic, increasingly bearish, relatively stable]. [Include relevant charts and graphs to visually represent the movement of Dow Futures.]

China's Economic Response to Tariffs: Impact on Global Markets

China's economic response to US tariffs has had profound consequences for global markets, creating significant uncertainty and impacting investor confidence.

China's Retaliatory Measures

In response to US tariffs, China has implemented various retaliatory measures, including:

- Tariffs on US Goods: China imposed tariffs on a wide range of US goods, affecting sectors like agriculture, manufacturing, and technology.

- Currency Devaluation: While debated, some analysts suggest China has allowed for a degree of Yuan depreciation to offset the impact of tariffs.

- Trade Diversification: China has actively pursued trade agreements with other countries to reduce its reliance on the US market.

The effectiveness of these measures is a subject of ongoing debate. While some have aimed to protect domestic industries, others have had unintended negative consequences on the Chinese economy and global supply chains.

The Economic Impact on China

The trade war and China's retaliatory measures have had a multifaceted impact on its economy:

- GDP Growth: [Discuss the impact on China's economic growth rate, citing specific data or projections.]

- Employment: [Analyze the effects on employment levels in different sectors of the Chinese economy.]

- Foreign Investment: [Assess the impact on foreign direct investment (FDI) into China.]

The potential for long-term economic repercussions remains a concern, particularly regarding the sustainability of China's growth model and its ability to maintain its position in the global economy. The implications for other Asian economies, deeply integrated with China's supply chains, are also significant.

The Interplay Between China's Response and Dow Futures

China's economic policies directly and indirectly affect the Dow Futures market through various mechanisms:

- Investor Sentiment: Negative news regarding the Chinese economy often translates into decreased investor confidence, potentially leading to a decline in Dow Futures prices.

- Supply Chain Disruptions: Trade tensions and retaliatory tariffs disrupt global supply chains, impacting the profitability of US companies and affecting Dow Futures.

- Market Speculation: Uncertainty surrounding the trade war and China's responses fuels speculation and volatility in the Dow Futures market.

Conclusion

The relationship between Dow Futures movement and China's economic response to tariffs is complex and dynamic. Understanding these interconnected factors is crucial for investors seeking to make informed decisions in today's stock market. Dow Futures act as a barometer of market sentiment, reacting swiftly to both domestic and international developments, including China's economic policies. China's retaliatory measures, while aimed at mitigating the impact of tariffs, have broader economic consequences and contribute to global market uncertainty.

To effectively navigate this challenging environment, stay informed about today's stock market, particularly concerning Dow Futures and China's economic policies. Conduct thorough research, consult with qualified financial advisors, and regularly check for updates on these crucial market drivers to develop an effective investment strategy. Understanding the nuances of Dow Futures and their correlation with China's economic response is key to mitigating risks and capitalizing on opportunities in today's stock market.

Featured Posts

-

The American Battleground Taking On The Worlds Wealthiest

Apr 26, 2025

The American Battleground Taking On The Worlds Wealthiest

Apr 26, 2025 -

The Trump Administrations Influence On European Ai Policy

Apr 26, 2025

The Trump Administrations Influence On European Ai Policy

Apr 26, 2025 -

This Cnn Anchors Favorite Place To Visit Florida

Apr 26, 2025

This Cnn Anchors Favorite Place To Visit Florida

Apr 26, 2025 -

After A Decade Of Silence Work Resumes On Worlds Tallest Abandoned Building

Apr 26, 2025

After A Decade Of Silence Work Resumes On Worlds Tallest Abandoned Building

Apr 26, 2025 -

Us Stock Market Today Impact Of Chinas Economic Policies On Dow Futures

Apr 26, 2025

Us Stock Market Today Impact Of Chinas Economic Policies On Dow Futures

Apr 26, 2025

Latest Posts

-

Crumbach Resignation Analysis Of The Spd Coalitions Future

Apr 27, 2025

Crumbach Resignation Analysis Of The Spd Coalitions Future

Apr 27, 2025 -

Bsw Leader Crumbachs Resignation Implications For The Spd Coalition

Apr 27, 2025

Bsw Leader Crumbachs Resignation Implications For The Spd Coalition

Apr 27, 2025 -

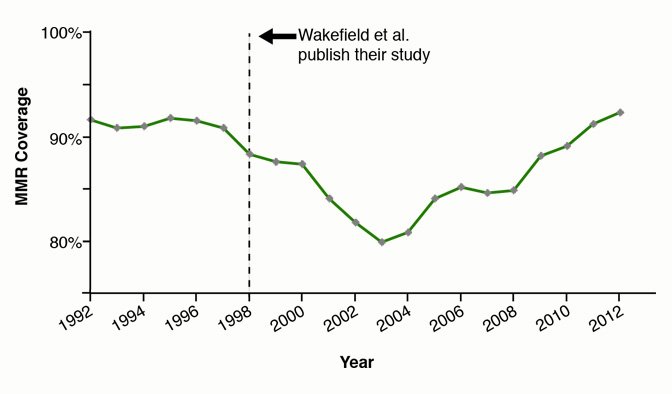

Nbc 10 Reports Hhs Uses Anti Vaccine Advocate To Examine Disproven Autism Vaccine Link

Apr 27, 2025

Nbc 10 Reports Hhs Uses Anti Vaccine Advocate To Examine Disproven Autism Vaccine Link

Apr 27, 2025 -

Anti Vaccine Activists Role In Hhs Autism Vaccine Review Sparks Outrage

Apr 27, 2025

Anti Vaccine Activists Role In Hhs Autism Vaccine Review Sparks Outrage

Apr 27, 2025 -

Hhs Controversy Anti Vaccine Advocate Reviews Debunked Autism Vaccine Connection

Apr 27, 2025

Hhs Controversy Anti Vaccine Advocate Reviews Debunked Autism Vaccine Connection

Apr 27, 2025