Trade War Fears Fuel Gold Price Surge: Is Bullion A Smart Investment?

Table of Contents

The Correlation Between Trade Wars and Gold Prices

Throughout history, periods of geopolitical uncertainty, including trade wars, have consistently seen a rise in demand for gold. Trade wars introduce economic instability, causing investors to seek refuge in assets perceived as less risky. Gold, with its long-standing reputation as a safe haven, benefits significantly from this flight to safety.

Numerous studies and market analyses demonstrate a strong correlation between escalating trade tensions and gold price movements. For example, during the US-China trade dispute of 2018-2020, we witnessed a noticeable uptick in gold prices as investors reacted to increased market uncertainty.

- Increased market volatility during trade disputes: Trade wars inject unpredictability into the markets, making investors nervous about their existing investments.

- Weakening of currencies during trade wars: Trade wars can destabilize currencies, making gold, a globally recognized asset, an attractive alternative.

- Safe haven demand for gold during economic uncertainty: As investors seek stability, the demand for gold as a safe haven asset increases, pushing its price higher.

Gold as a Safe Haven Asset

Gold's status as a safe haven asset stems from several key factors. Its limited supply, coupled with its tangible nature, makes it an attractive option during times of economic distress. Historically, gold has performed well during economic crises, demonstrating its resilience against market downturns.

When compared to other asset classes like stocks and bonds, gold often exhibits a negative correlation during periods of trade war uncertainty. While stocks and bonds might plummet, gold frequently holds its value or even appreciates, offering a crucial buffer for investors' portfolios.

- Gold's inherent value and scarcity: Unlike fiat currencies, gold's value isn't subject to the whims of government policy. Its limited supply ensures its long-term value.

- Gold's lack of correlation with other asset classes: This makes it a valuable tool for diversification, mitigating overall portfolio risk.

- Gold as a hedge against inflation: During inflationary periods, the value of gold typically rises, protecting investors from the erosion of purchasing power.

Factors Affecting Current Gold Price Surge

While trade war anxieties are a significant driver of the current gold price surge, other economic indicators play a role. Current low interest rates, coupled with inflationary pressures in many economies, are contributing factors. The strength or weakness of the US dollar also influences gold pricing, as gold is typically priced in USD.

Furthermore, various geopolitical events, from regional conflicts to political instability, can impact investor sentiment and gold's price.

- Current interest rate environment: Low interest rates make gold, a non-yielding asset, more attractive.

- Inflationary pressures: As inflation rises, the purchasing power of fiat currencies falls, increasing the demand for gold as a store of value.

- US dollar strength/weakness: A weaker dollar typically boosts gold prices, as it becomes cheaper for investors using other currencies to buy gold.

- Other relevant geopolitical factors: Global instability, regardless of its source, tends to drive investors toward safe haven assets like gold.

Is Gold Bullion a Smart Investment for You?

Investing in gold bullion offers several advantages, including diversification, inflation hedging, and its status as a safe haven. However, it's crucial to acknowledge the drawbacks. Gold bullion investments are subject to price volatility, and unlike stocks or bonds, they don't generate dividend income. Storage and security are also considerations.

- Pros: Diversification, inflation hedge, safe haven.

- Cons: Price volatility, storage costs, lack of yield.

- Alternative investments: ETFs, mutual funds, other precious metals.

Before investing in gold bullion, it's essential to weigh these pros and cons carefully, considering your individual risk tolerance and investment goals. Alternative investments like gold ETFs or mutual funds might offer a less hands-on approach for those seeking exposure to the gold market without the complexities of physical bullion storage.

Conclusion

The current gold price surge is inextricably linked to trade war anxieties and broader economic uncertainties. Gold's role as a safe haven asset remains crucial during periods of market volatility. While investing in gold bullion can be a strategic move to diversify your portfolio and protect against inflation, it’s vital to understand the associated risks. Understanding the current gold price surge and its underlying factors empowers you to make informed decisions about gold investments. By carefully considering your risk tolerance and financial objectives, you can determine whether incorporating gold into your investment strategy is the right approach to navigate the complexities of the gold market and the ongoing impact of trade war fears.

Featured Posts

-

Abb Vies Upbeat Q Quarter Number Earnings New Drugs Fuel Profit Beat

Apr 26, 2025

Abb Vies Upbeat Q Quarter Number Earnings New Drugs Fuel Profit Beat

Apr 26, 2025 -

Anchor Brewing Company To Shutter A Legacy Ends

Apr 26, 2025

Anchor Brewing Company To Shutter A Legacy Ends

Apr 26, 2025 -

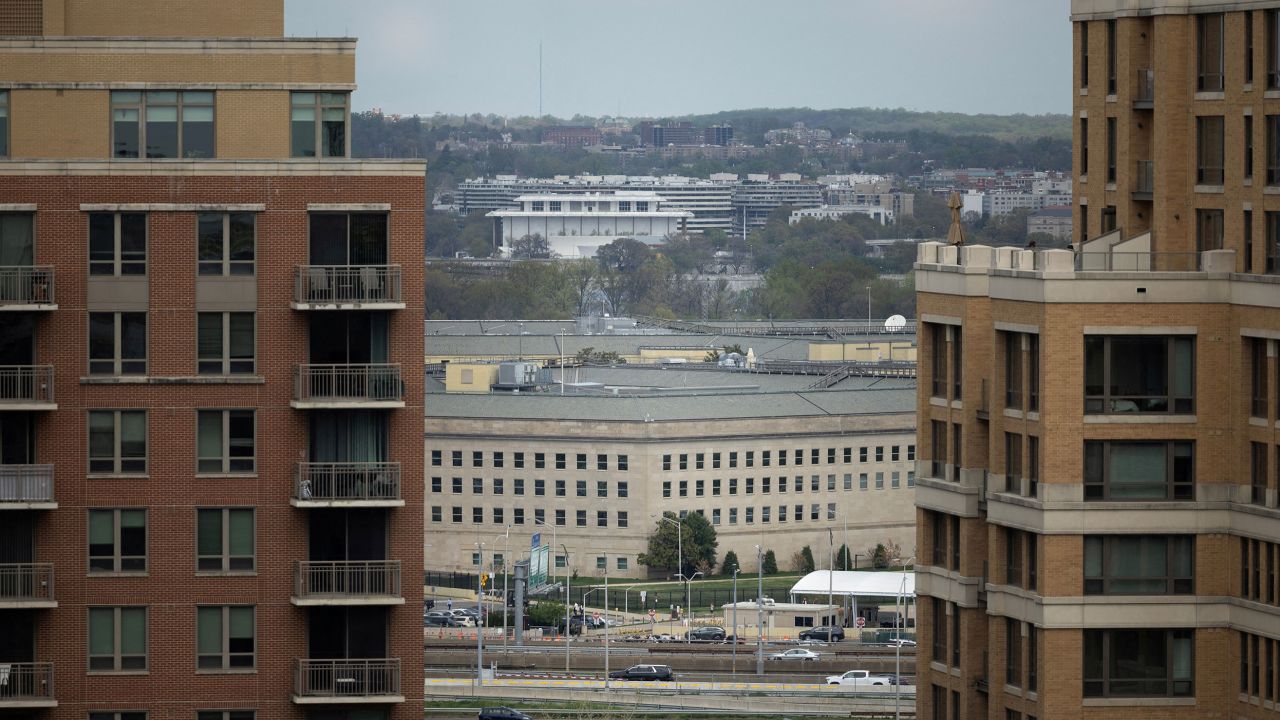

Hegseth Rattled Exclusive Details On Pentagon Leaks Infighting And Polygraph Use

Apr 26, 2025

Hegseth Rattled Exclusive Details On Pentagon Leaks Infighting And Polygraph Use

Apr 26, 2025 -

Blue Origins Rocket Launch Canceled Details On The Subsystem Issue

Apr 26, 2025

Blue Origins Rocket Launch Canceled Details On The Subsystem Issue

Apr 26, 2025 -

Open Ai Facing Ftc Investigation Concerns Over Chat Gpts Data Practices

Apr 26, 2025

Open Ai Facing Ftc Investigation Concerns Over Chat Gpts Data Practices

Apr 26, 2025

Latest Posts

-

How Professionals Helped Ariana Grande Achieve Her New Look

Apr 27, 2025

How Professionals Helped Ariana Grande Achieve Her New Look

Apr 27, 2025 -

The Impact Of Professional Help On Celebrity Image Ariana Grandes Case Study

Apr 27, 2025

The Impact Of Professional Help On Celebrity Image Ariana Grandes Case Study

Apr 27, 2025 -

Hair And Tattoo Transformations Learning From Ariana Grandes Choices

Apr 27, 2025

Hair And Tattoo Transformations Learning From Ariana Grandes Choices

Apr 27, 2025 -

Ariana Grandes Bold New Look A Look At Professional Styling And Body Art

Apr 27, 2025

Ariana Grandes Bold New Look A Look At Professional Styling And Body Art

Apr 27, 2025 -

Understanding Ariana Grandes Style Changes The Importance Of Professional Guidance

Apr 27, 2025

Understanding Ariana Grandes Style Changes The Importance Of Professional Guidance

Apr 27, 2025