Stock Market Valuation Concerns: BofA's Perspective And Analysis

Table of Contents

BofA's Key Valuation Metrics and Indicators

BofA employs a range of key metrics to assess stock market valuations, providing a comprehensive picture of market health and potential risks. These metrics allow them to analyze the relationship between a company's stock price and its underlying fundamentals, helping investors determine whether a stock is overvalued or undervalued.

-

Price-to-Earnings Ratio (P/E Ratio): This classic metric compares a company's stock price to its earnings per share (EPS). A high P/E ratio suggests investors are willing to pay a premium for each dollar of earnings, potentially indicating overvaluation. BofA analyzes the P/E ratios across various sectors and compares them to historical averages to identify potential overvaluations or undervaluations. For example, a consistently high P/E ratio in the tech sector might be a cause for concern, prompting further investigation.

-

Price-to-Sales Ratio (P/S Ratio): This metric compares a company's stock price to its revenue per share. It's particularly useful for evaluating companies with negative earnings, as it provides a measure of valuation relative to revenue generation. BofA considers the P/S ratio alongside other metrics to gain a holistic view of a company's valuation. A high P/S ratio might indicate overvaluation, especially if revenue growth is not substantial.

-

Shiller PE (Cyclically Adjusted Price-to-Earnings Ratio): Also known as the CAPE ratio, this metric uses average inflation-adjusted earnings over the past 10 years to smooth out short-term fluctuations in earnings. This provides a more stable measure of valuation and can be helpful in identifying long-term overvaluation or undervaluation trends. BofA utilizes this metric to assess long-term market valuation trends and identify potential market bubbles. High Shiller PE ratios often signal an elevated risk of market correction.

BofA's interpretation of these metrics in the current market context often involves comparing current valuations to historical averages. Significant deviations from historical norms might signal potential risks or opportunities. While specific data points from BofA reports are constantly evolving, their analysis consistently emphasizes the importance of a diversified approach to mitigate risk.

Sector-Specific Valuation Concerns (BofA's Analysis)

BofA's analysis often highlights specific sectors as either overvalued or undervalued based on their valuation metrics and growth prospects. For instance, certain technology sectors might be deemed overvalued due to high P/E ratios and slowing revenue growth, while cyclical sectors may appear undervalued given the potential for economic recovery.

-

Technology: BofA's recent research might highlight concerns about specific sub-sectors within technology, such as social media or cloud computing, where valuations might be considered stretched relative to earnings growth. This might involve highlighting individual companies showing signs of overvaluation based on their specific financial metrics.

-

Energy: Conversely, the energy sector might be identified as undervalued, considering the potential impact of geopolitical events and rising energy demand. This assessment would be backed by analysis of the sector's P/E and P/S ratios, potentially pointing to specific companies positioned for growth.

-

Financials: The financial sector's valuation is often heavily impacted by interest rate changes and economic growth. BofA's analysis would consider the impact of these factors on the sector's valuation, potentially flagging specific opportunities or risks depending on the predicted trajectory of interest rates.

BofA's assessment of these sectors is not static and is regularly updated based on changing market dynamics. It's crucial to refer to their latest research for the most current insights.

Macroeconomic Factors Influencing BofA's Valuation Outlook

Macroeconomic factors significantly influence BofA's valuation perspective. These factors interact to shape the overall economic environment and impact stock valuations across sectors.

-

Interest Rates: Rising interest rates typically lead to higher borrowing costs for companies, reducing profitability and potentially lowering stock valuations. BofA's analysis considers the trajectory of interest rates and their potential impact on corporate earnings and stock prices.

-

Inflation: High inflation erodes purchasing power and can negatively impact corporate profits, leading to lower stock valuations. BofA's forecasts for inflation play a crucial role in shaping their valuation outlook, with higher inflation projections typically suggesting a more cautious investment strategy.

-

Economic Growth: Strong economic growth usually supports higher corporate earnings and increased stock valuations. BofA's predictions for economic growth influence their assessment of overall market valuations and sector-specific opportunities.

BofA regularly publishes research reports detailing their predictions for these factors and their potential effects on the market. These reports offer valuable insights for investors seeking to understand the macroeconomic backdrop influencing stock valuations.

BofA's Recommendations and Investment Strategies

Based on their valuation analysis, BofA offers recommendations and investment strategies to help investors navigate the market. These strategies are typically adjusted based on their outlook for the macroeconomic factors discussed earlier.

-

Sector Rotation: BofA might recommend shifting investments from overvalued sectors to undervalued sectors to optimize portfolio performance. This approach aims to capitalize on market inefficiencies.

-

Defensive Positioning: In times of uncertainty, BofA might suggest a more defensive investment strategy, focusing on lower-risk, stable investments like high-quality bonds or dividend-paying stocks.

-

Active Management: Given the complexity of the current market environment, BofA often suggests active management of investment portfolios, requiring close monitoring and adjustments based on evolving market conditions.

Disclaimer: Investing involves risk, and BofA's recommendations are not guaranteed. Individual investors should conduct their own thorough research and consider their own risk tolerance before making investment decisions.

Conclusion

Understanding stock market valuation concerns is crucial for navigating the current market climate. BofA's analysis, incorporating key valuation metrics, sector-specific assessments, and macroeconomic forecasts, provides a valuable framework for investors. By carefully considering BofA's analysis and conducting thorough due diligence, investors can develop a robust investment strategy to mitigate risk and capitalize on opportunities. Learn more about BofA's perspectives and refine your understanding of stock market valuation concerns today!

Featured Posts

-

Ahmed Hassanein An Improbable Journey To The Nfl Draft

Apr 26, 2025

Ahmed Hassanein An Improbable Journey To The Nfl Draft

Apr 26, 2025 -

Wga And Sag Aftra Strike What It Means For Hollywood And Film Production

Apr 26, 2025

Wga And Sag Aftra Strike What It Means For Hollywood And Film Production

Apr 26, 2025 -

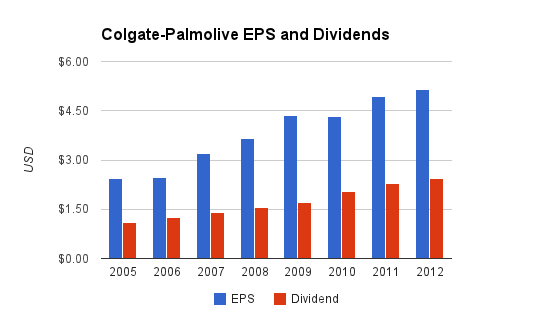

Colgate Cl Sales And Profit Decline 200 Million Tariff Impact

Apr 26, 2025

Colgate Cl Sales And Profit Decline 200 Million Tariff Impact

Apr 26, 2025 -

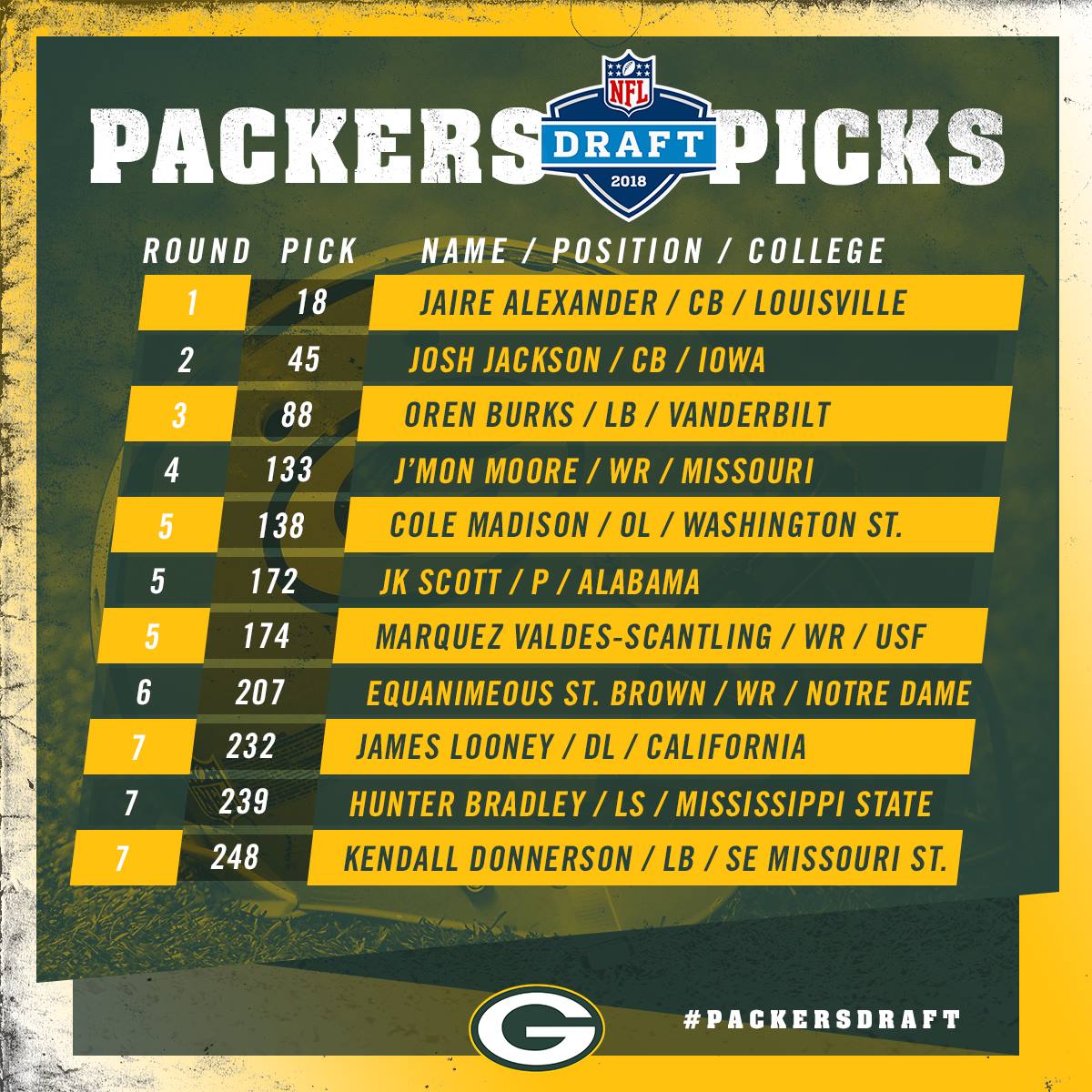

Green Bay Hosts The Nfl Drafts First Round What To Expect

Apr 26, 2025

Green Bay Hosts The Nfl Drafts First Round What To Expect

Apr 26, 2025 -

Congressional Stock Trading Ban Trumps Position Revealed In Time Interview

Apr 26, 2025

Congressional Stock Trading Ban Trumps Position Revealed In Time Interview

Apr 26, 2025

Latest Posts

-

Thueringen Artenvielfalt Von Amphibien Und Reptilien Im Neuen Atlas Dokumentiert

Apr 27, 2025

Thueringen Artenvielfalt Von Amphibien Und Reptilien Im Neuen Atlas Dokumentiert

Apr 27, 2025 -

Entdecken Sie Die Amphibien Und Reptilien Thueringens Der Neue Atlas

Apr 27, 2025

Entdecken Sie Die Amphibien Und Reptilien Thueringens Der Neue Atlas

Apr 27, 2025 -

Neuer Atlas Zeigt Die Amphibien Und Reptilien Thueringens

Apr 27, 2025

Neuer Atlas Zeigt Die Amphibien Und Reptilien Thueringens

Apr 27, 2025 -

Thueringens Reptilien Und Amphibien Der Neue Atlas Ist Da

Apr 27, 2025

Thueringens Reptilien Und Amphibien Der Neue Atlas Ist Da

Apr 27, 2025 -

Thueringen Amphibien Und Reptilienatlas Ein Umfassender Ueberblick

Apr 27, 2025

Thueringen Amphibien Und Reptilienatlas Ein Umfassender Ueberblick

Apr 27, 2025