Colgate (CL) Sales And Profit Decline: $200 Million Tariff Impact

Table of Contents

The $200 Million Tariff Impact on Colgate's Financials

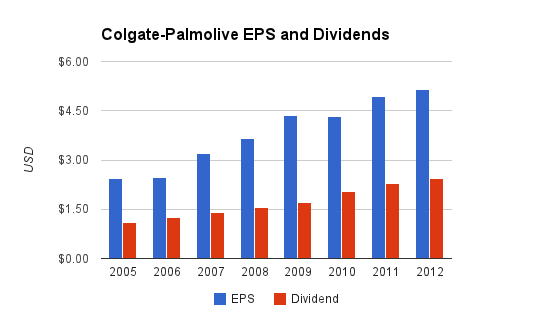

Colgate's latest earnings report paints a stark picture of the financial strain imposed by increased tariff costs. The direct correlation between rising import costs and the decline in revenue and profit margins is undeniable. This isn't simply a minor fluctuation; it represents a substantial hit to the company's bottom line.

- Specific figures: The report revealed a [insert specific percentage]% decrease in revenue and a [insert specific percentage]% drop in profit margins, directly attributed to tariff increases. These figures represent a significant deviation from previous quarters and highlight the substantial financial burden imposed by the tariffs.

- Geographical impact: The regions most severely affected include [list specific regions, e.g., Latin America, Asia]. These areas experienced heightened tariff costs impacting the cost of goods sold and negatively affecting regional sales.

- Product impact: Specific products like [mention specific product lines, e.g., certain toothpaste varieties, specific oral care products] were particularly hard-hit due to their reliance on imported components or their popularity in tariff-affected markets.

Analysis of Tariffs' Impact on Colgate's Supply Chain

The tariffs haven't just impacted Colgate's bottom line; they've also significantly disrupted its supply chain. Increased import costs for raw materials and transportation have created considerable challenges in manufacturing and distribution.

- Raw material costs: Essential components such as packaging materials and specific ingredients experienced substantial price increases due to tariffs. This resulted in higher production costs, squeezing profit margins.

- Transportation costs: Tariffs and associated trade restrictions have significantly increased transportation costs for both raw materials and finished goods. This added expense further erodes profitability.

- Sourcing strategy changes: In response, Colgate is likely exploring alternative sourcing strategies to mitigate the impact of tariffs. This may involve shifting production to different regions or finding alternative suppliers, a process that takes time and investment.

Consumer Behavior and Price Increases

Faced with rising input costs, Colgate, like many other companies, has passed some of these increased expenses onto consumers through price increases. However, this strategy hasn't been without consequences.

- Consumer resistance: Evidence suggests that consumers are exhibiting price sensitivity, leading to a decline in sales volume for some products. Market research data and sales figures reveal decreased demand in response to the price hikes.

- Competitive landscape: Competitors in the oral care market may have adopted different pricing strategies, impacting Colgate's market share. Analyzing competitor responses reveals the competitive dynamics shaped by tariff-induced price increases.

- Consumer behavior shift: The price increases have forced consumers to re-evaluate their purchasing habits, potentially switching to lower-priced alternatives or reducing overall consumption of oral care products.

Long-Term Implications and Future Outlook for Colgate (CL)

The long-term impact of these tariff-related challenges on Colgate's financial stability and future growth remains uncertain. However, several key factors will shape the company’s recovery trajectory.

- Future financial performance: Predicting future performance requires careful consideration of several factors, including the potential for tariff reductions, the effectiveness of Colgate's mitigation strategies, and the evolving consumer behavior.

- Strategic response: Colgate's ability to adapt to these challenges through innovation, strategic sourcing, and diversified product offerings will be crucial for its long-term success.

- Investment strategies: Investors need to carefully assess the risks and opportunities associated with Colgate (CL) stock, considering the ongoing impact of tariffs and the company's response to these challenges.

Conclusion

The $200 million loss attributed to tariffs represents a significant blow to Colgate's financial health, impacting revenue, profit margins, and supply chain operations. The company's response to these challenges, including its pricing strategies and supply chain adjustments, will be key factors in determining its future performance. The interplay between global trade policies and the financial well-being of consumer goods giants like Colgate (CL) underscores the need for continuous monitoring and analysis. Stay updated on the evolving situation with Colgate (CL) and the impact of tariffs on its financial performance. Learn more about how international trade policies can affect your investments in consumer goods companies like Colgate (CL).

Featured Posts

-

Worlds Tallest Abandoned Skyscraper Construction To Restart After 10 Year Hiatus

Apr 26, 2025

Worlds Tallest Abandoned Skyscraper Construction To Restart After 10 Year Hiatus

Apr 26, 2025 -

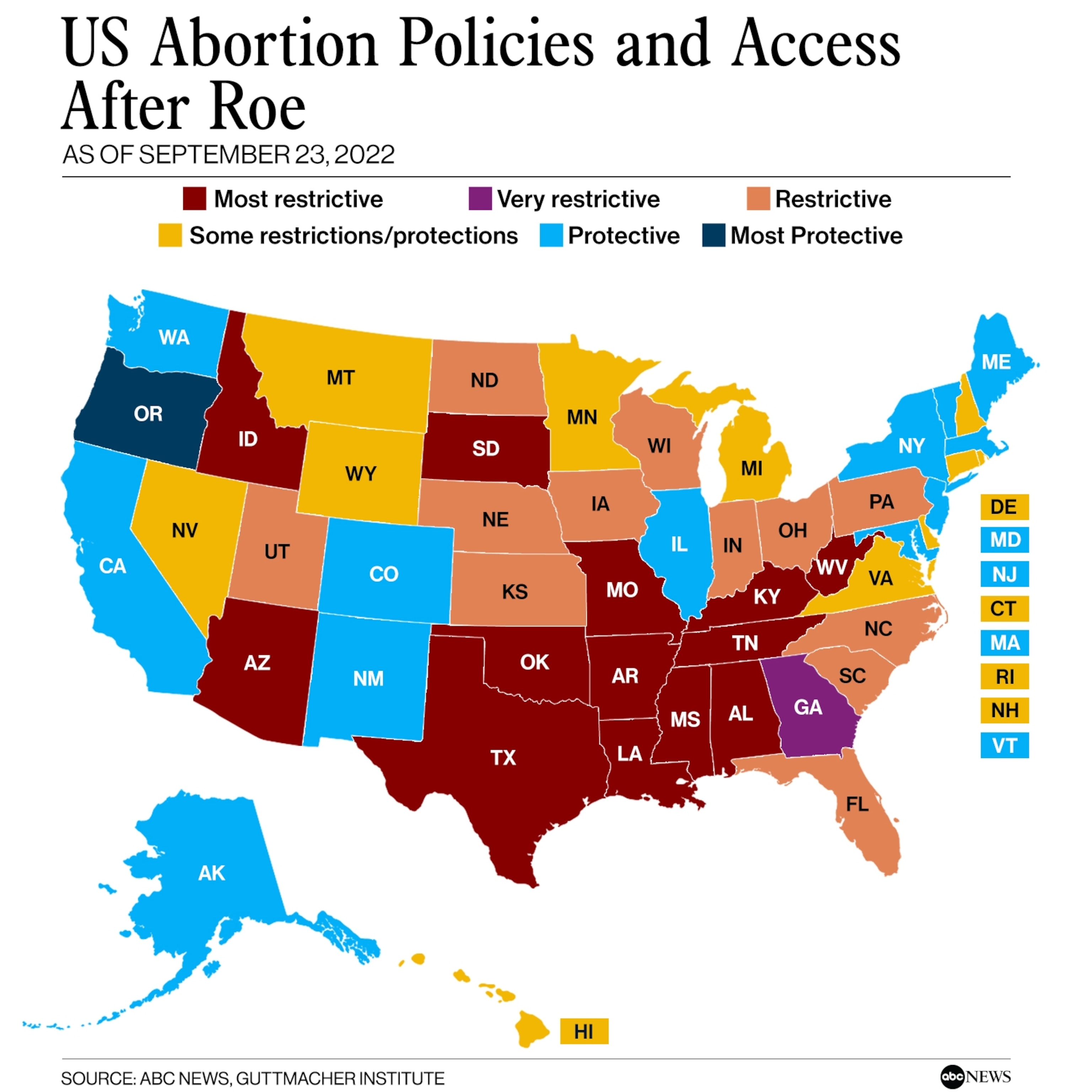

Over The Counter Birth Control Implications For Reproductive Freedom After Roe V Wade

Apr 26, 2025

Over The Counter Birth Control Implications For Reproductive Freedom After Roe V Wade

Apr 26, 2025 -

Los Angeles Palisades Fire A List Of Celebrities Who Lost Their Properties

Apr 26, 2025

Los Angeles Palisades Fire A List Of Celebrities Who Lost Their Properties

Apr 26, 2025 -

Denmark Points Finger At Russia For Fabricated Greenland News Heightening Us Disputes

Apr 26, 2025

Denmark Points Finger At Russia For Fabricated Greenland News Heightening Us Disputes

Apr 26, 2025 -

The Military Base Defining The Us China Power Dynamic

Apr 26, 2025

The Military Base Defining The Us China Power Dynamic

Apr 26, 2025

Latest Posts

-

How Professionals Helped Ariana Grande Achieve Her New Look

Apr 27, 2025

How Professionals Helped Ariana Grande Achieve Her New Look

Apr 27, 2025 -

The Impact Of Professional Help On Celebrity Image Ariana Grandes Case Study

Apr 27, 2025

The Impact Of Professional Help On Celebrity Image Ariana Grandes Case Study

Apr 27, 2025 -

Hair And Tattoo Transformations Learning From Ariana Grandes Choices

Apr 27, 2025

Hair And Tattoo Transformations Learning From Ariana Grandes Choices

Apr 27, 2025 -

Ariana Grandes Bold New Look A Look At Professional Styling And Body Art

Apr 27, 2025

Ariana Grandes Bold New Look A Look At Professional Styling And Body Art

Apr 27, 2025 -

Understanding Ariana Grandes Style Changes The Importance Of Professional Guidance

Apr 27, 2025

Understanding Ariana Grandes Style Changes The Importance Of Professional Guidance

Apr 27, 2025