India's Bull Market: Nifty's Rise And The Underlying Factors

Table of Contents

Strong Macroeconomic Fundamentals Fueling India's Bull Market

The impressive rise of the Nifty 50 is significantly fueled by strong India's Economic Growth. Several macroeconomic indicators point towards a robust and resilient Indian economy, creating a fertile ground for a sustained bull run in India.

-

Robust GDP Growth: India's GDP growth has consistently exceeded expectations, showcasing the nation's economic dynamism and attracting significant global attention. This sustained growth provides a solid foundation for the Indian Stock Market's continued expansion. The consistent upward trajectory boosts investor confidence, further fueling the India's Bull Market.

-

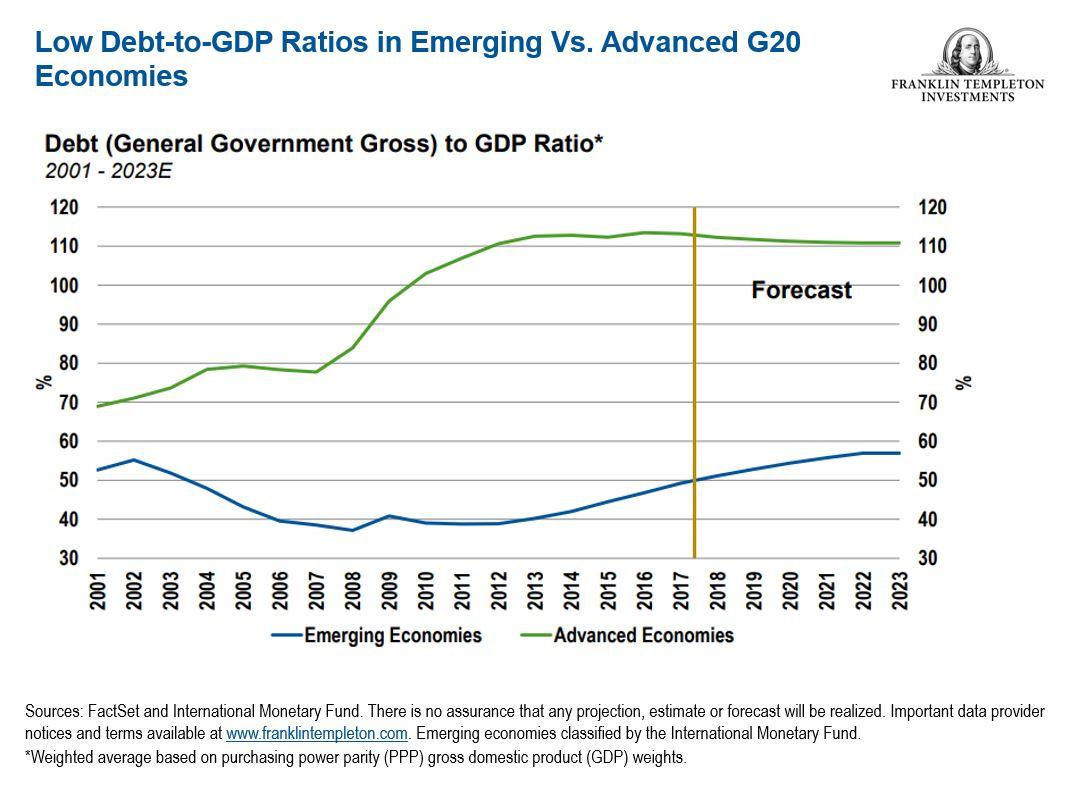

Stable Macroeconomic Indicators: Despite global uncertainties, India has maintained relatively stable macroeconomic indicators. Controlled inflation in India, coupled with prudent fiscal policy in India and effective monetary policy in India, contributes to a stable investment environment. This stability is a key attraction for both domestic and foreign investors participating in the Nifty 50.

-

Government Initiatives: The Indian government's focus on infrastructure development and digitalization through initiatives like "Digital India" has created new opportunities and boosted economic productivity. This forward-looking approach strengthens the long-term prospects of the Indian economy, making it an attractive destination for investment in India. These improvements are reflected in the performance of the Nifty Index.

-

Foreign Direct Investment (FDI): India's attractive investment climate is attracting increased Foreign Investment in India. This inflow of FDI provides crucial capital for businesses, further stimulating economic growth and contributing to the upward trajectory of the Nifty 50.

The Rise of Domestic Institutional Investors (DIIs) in India's Bull Market

The participation of Domestic Institutional Investors (DIIs) has been a crucial factor in the current India's Bull Market. Their increased involvement signifies growing confidence in the Indian economy and its potential for long-term growth.

-

Mutual Funds and Insurance Companies: A significant increase in participation by DIIs such as mutual funds and insurance companies demonstrates a strong belief in the future performance of Indian equities. This institutional backing further strengthens the Nifty Index.

-

Retail Investor Participation: The rise of retail investors, fueled by increased financial literacy and the accessibility of digital investment platforms, significantly broadens the investor base. This surge in participation fuels the momentum of the India's Bull Market, making it a truly national phenomenon.

-

Long-Term Investment Strategies: A notable shift towards long-term investment strategies among domestic investors indicates a growing understanding of the potential for long-term value creation in the Indian Stock Market. This maturity in investment approach contributes to market stability and sustainable growth.

-

Government Initiatives Promoting Financial Inclusion: Government initiatives designed to promote financial inclusion have played a crucial role in broadening participation in the stock market. This inclusion fosters wider economic participation and further fuels the upward trend of the Nifty 50.

Global Factors Contributing to the Nifty's Rise

While domestic factors are paramount, global trends also play a role in the current India's Bull Market. India's relative strength amidst global uncertainty has made it an attractive investment destination.

-

Foreign Portfolio Investment (FPI) Inflow: Increased Foreign Portfolio Investors (FPI) inflow into emerging markets, including India, reflects a global shift towards diversifying investment portfolios. India's economic resilience makes it a preferred choice for many FPIs.

-

Global Market Stability: Relative stability in global markets, despite geopolitical risks, has created a favorable environment for investment in emerging economies like India. This stability allows investors to focus on India's inherent growth potential.

-

Attractive Valuations: Compared to other global markets, Indian equities have presented relatively attractive valuations, attracting investors seeking higher returns. This valuation advantage contributes significantly to the Nifty's Rise.

-

Impact of US Interest Rate Hikes: While US interest rate hikes can influence capital flows, India's strong fundamentals have largely mitigated their negative impact, showcasing the resilience of the Indian economy.

Sector-Specific Growth Driving the Nifty's Performance

The strong performance of the Nifty 50 isn't uniform; certain sectors have outperformed others, driving significant growth.

-

IT, Pharma, and FMCG Sectors: Strong performance in sectors like IT, pharmaceuticals, and fast-moving consumer goods (FMCG) has contributed significantly to the overall market's upward trajectory. These sectors are known for their resilience and growth potential.

-

Infrastructure Sector Growth: The growth potential of the infrastructure sector, further fueled by government initiatives, offers long-term prospects for investors in the Indian Stock Market.

-

Banking Sector Performance: The banking sector has benefited from increased credit growth and heightened economic activity, driving its contribution to the overall strength of the Nifty Index.

-

Sector-Specific Analysis: A detailed sector-specific analysis can reveal specific drivers of growth within each sector and offer insights into potential future performance. This deeper understanding can inform investment strategies related to India's Bull Market.

Conclusion

India's bull market, reflected in the Nifty 50's impressive gains, is a confluence of robust macroeconomic fundamentals, increased domestic investor participation, and supportive global trends. Understanding these factors is crucial for navigating this exciting period. To stay informed about the continuing evolution of India's Bull Market, continue to research market trends and consult with financial advisors. Invest wisely and be a part of India's growth story. Remember to conduct thorough due diligence before making any investment decisions. Participate wisely in this dynamic India's Bull Market and harness the potential of the Nifty 50.

Featured Posts

-

Credit Card Companies Feel The Pinch As Consumers Cut Back On Spending

Apr 24, 2025

Credit Card Companies Feel The Pinch As Consumers Cut Back On Spending

Apr 24, 2025 -

Us Market Slumps As Emerging Markets Erase Losses

Apr 24, 2025

Us Market Slumps As Emerging Markets Erase Losses

Apr 24, 2025 -

Canadian Dollar Dips A Deeper Look At Recent Currency Movements

Apr 24, 2025

Canadian Dollar Dips A Deeper Look At Recent Currency Movements

Apr 24, 2025 -

The Bold And The Beautiful Spoilers Hopes Double Shocker Liams Promise To Steffy And Lunas Impact

Apr 24, 2025

The Bold And The Beautiful Spoilers Hopes Double Shocker Liams Promise To Steffy And Lunas Impact

Apr 24, 2025 -

Zaboravljeni Projekt Film S Travoltom Koji Tarantino Ne Zeli Vidjeti

Apr 24, 2025

Zaboravljeni Projekt Film S Travoltom Koji Tarantino Ne Zeli Vidjeti

Apr 24, 2025