Canadian Dollar Dips: A Deeper Look At Recent Currency Movements

Table of Contents

Impact of Global Economic Uncertainty on the Canadian Dollar

Global economic uncertainty significantly influences the Canadian dollar's exchange rate (CAD). Investor sentiment plays a crucial role; during times of turmoil, investors often seek safer havens, leading to a flight to quality currencies such as the US dollar. This increased demand for the USD often comes at the expense of riskier assets, including the Canadian dollar.

- Increased global uncertainty leads to risk aversion: Geopolitical events, such as wars or escalating trade tensions, heighten risk aversion among investors. This causes capital to flow away from emerging markets and towards more stable economies, weakening the CAD.

- Geopolitical instability creates volatility in the foreign exchange market: The current global landscape is characterized by various geopolitical risks, from ongoing conflicts to rising political tensions. This uncertainty translates directly into market volatility, making the Canadian dollar more susceptible to sudden swings.

- Fears of a global recession can weaken demand for commodities: Canada is a major exporter of commodities, and a global recession often reduces demand for raw materials like oil and natural gas. This decreased demand weakens the CAD, as its value is intrinsically linked to commodity prices.

Interest Rate Differentials and Their Effect on the CAD

Interest rate differentials between Canada and other major economies, particularly the United States, play a significant role in determining the CAD's value. The Bank of Canada's monetary policy decisions directly influence interest rates and, consequently, the Canadian dollar's attractiveness to foreign investors.

- Higher interest rates in Canada attract foreign investment, strengthening the CAD: When Canadian interest rates are higher than those in other countries, foreign investors are incentivized to invest in Canadian assets to earn higher returns. This increased demand for the CAD strengthens its value.

- Conversely, lower interest rates can weaken the CAD: If the Bank of Canada lowers interest rates, it can make the CAD less attractive to foreign investors, leading to a decrease in demand and a weakening of the currency.

- The Bank of Canada's monetary policy decisions are crucial: The Bank of Canada's actions, such as interest rate hikes or cuts, are carefully considered and directly impact the CAD's trajectory. Announcements and forecasts regarding monetary policy are closely watched by currency traders worldwide.

Commodity Prices and the Canadian Dollar's Performance

Canada's economy is heavily reliant on commodity exports, particularly oil and natural gas. Therefore, the price of these commodities is strongly correlated with the Canadian dollar's performance. Fluctuations in global commodity markets directly impact the CAD's value.

- Strong commodity prices boost the CAD: When oil and natural gas prices rise, Canada's export earnings increase, leading to greater demand for the Canadian dollar.

- Fluctuations in global demand for commodities impact prices and the CAD: Global economic growth, industrial production, and even weather patterns can all influence commodity demand and subsequently affect the CAD.

- Oil price volatility is a significant driver of Canadian dollar movement: As oil is Canada's most significant export, even small changes in oil prices can have a substantial impact on the CAD.

Analyzing the Impact of Inflation on the Canadian Dollar

High inflation erodes purchasing power and can negatively impact investor confidence. When inflation is high in Canada relative to other countries, it can lead to a decrease in the value of the Canadian dollar. Furthermore, to combat high inflation, the Bank of Canada might raise interest rates, which can attract foreign investment and temporarily strengthen the CAD, but also impact economic growth. The interplay between inflation, interest rates, and the CAD is complex and dynamic.

Strategies for Navigating Canadian Dollar Fluctuations

The volatility of the Canadian dollar presents both risks and opportunities. Individuals and businesses can employ several strategies to manage these fluctuations:

- Consider currency hedging strategies: Hedging involves using financial instruments to mitigate potential losses from CAD depreciation. Options and futures contracts can be used to lock in exchange rates for future transactions.

- Diversify investments across different currencies and asset classes: Don't put all your eggs in one basket. Diversification helps reduce the overall risk associated with currency fluctuations.

- Stay informed about economic indicators and global events: Keeping abreast of economic news and understanding how global events might affect the CAD is crucial for informed decision-making.

Conclusion

This article has explored several key factors influencing the recent dips in the Canadian dollar, including global economic uncertainty, interest rate differentials, commodity prices, and inflation. Understanding these interconnected factors is crucial for navigating the complexities of the foreign exchange market. The Canadian dollar's value is influenced by a multitude of factors, making it a dynamic and often unpredictable currency.

Call to Action: Stay informed about Canadian dollar movements and global economic trends to make informed decisions regarding your finances. Continue to monitor the Canadian dollar and its fluctuations by regularly checking reliable financial news sources and consulting with financial experts. Learn more about managing risk associated with Canadian dollar fluctuations to protect your investments and financial well-being.

Featured Posts

-

Wednesday April 9 The Bold And The Beautiful Recap Bill Finn And Liams Impact On Steffy

Apr 24, 2025

Wednesday April 9 The Bold And The Beautiful Recap Bill Finn And Liams Impact On Steffy

Apr 24, 2025 -

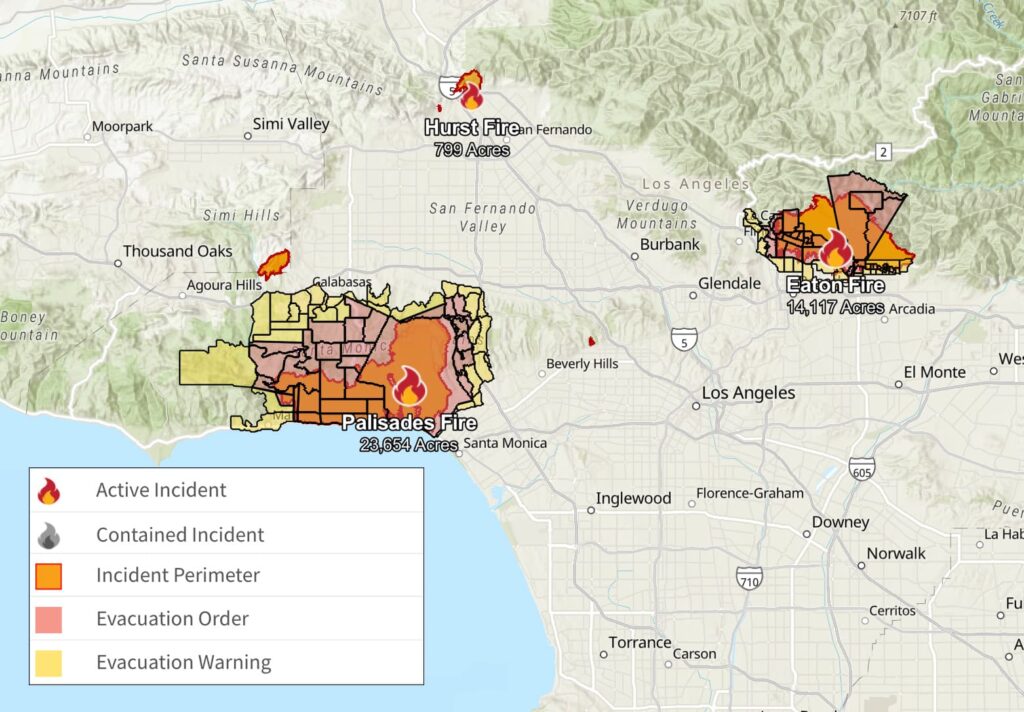

Los Angeles Wildfires The Rise Of Disaster Betting

Apr 24, 2025

Los Angeles Wildfires The Rise Of Disaster Betting

Apr 24, 2025 -

Office365 Executive Inboxes Targeted In Multi Million Dollar Hacking Scheme

Apr 24, 2025

Office365 Executive Inboxes Targeted In Multi Million Dollar Hacking Scheme

Apr 24, 2025 -

The Closure Of Anchor Brewing Company A Look Back At Its Legacy

Apr 24, 2025

The Closure Of Anchor Brewing Company A Look Back At Its Legacy

Apr 24, 2025 -

5 Key Dos And Don Ts Succeeding In The Private Credit Job Market

Apr 24, 2025

5 Key Dos And Don Ts Succeeding In The Private Credit Job Market

Apr 24, 2025