Credit Card Companies Feel The Pinch As Consumers Cut Back On Spending

Table of Contents

Reduced Consumer Confidence and Spending

The decline in credit card spending is largely attributed to reduced consumer confidence and overall spending. Several key factors are at play.

Inflation's Impact on Disposable Income

Rising inflation is eroding purchasing power, leaving less disposable income for non-essential purchases. This directly impacts credit card spending, as consumers prioritize essential expenses.

- Increased food and energy costs: The soaring prices of groceries and fuel are leaving less money for discretionary spending.

- Higher interest rates impacting mortgages and loans: Increased interest rates on mortgages and other loans reduce the amount available for credit card purchases.

- Reduced savings: Many consumers are dipping into their savings to cover essential expenses, leaving little room for credit card usage.

Inflation's relentless pressure on household budgets directly translates to a reduction in credit card spending. Consumers are forced to make difficult choices, often opting to forgo non-essential purchases made with credit cards. This trend is expected to continue as long as inflation remains elevated.

Recessionary Fears and Uncertainty

Concerns about a potential recession are further dampening consumer confidence and driving down credit card spending. Uncertainty about the future is prompting consumers to become more cautious with their finances.

- Delayed large purchases: Consumers are postponing major purchases like new cars or appliances, relying less on credit card financing.

- Increased savings rate: Many are increasing their savings as a precaution against potential job losses or economic hardship.

- Preference for cash over credit: Using cash allows for better budgeting and control over spending, leading to a decline in credit card reliance.

The psychological impact of recessionary fears is significant. Consumers are prioritizing debt reduction and saving, resulting in a considerable drop in discretionary credit card spending. This cautious approach is likely to persist until economic uncertainty subsides.

Shifting Consumer Preferences and Payment Methods

Beyond reduced spending, a shift in consumer preferences towards alternative payment methods is also contributing to the decline in credit card usage.

Rise of Buy Now, Pay Later (BNPL) Services

Buy Now, Pay Later (BNPL) services are gaining popularity, offering short-term financing and posing a significant challenge to credit card companies.

- Increased competition from BNPL providers: BNPL services offer a convenient alternative, often with lower upfront costs.

- Lower interest rates offered by some BNPL services: While not always the case, some BNPL options offer interest rates that are lower than credit cards, especially for smaller purchases.

- Greater accessibility for consumers with poor credit scores: BNPL services may be more accessible to consumers with lower credit scores, who might otherwise rely heavily on credit cards.

The rise of BNPL represents a serious competitive threat to the credit card industry. Its convenience and accessibility are attracting a large segment of consumers, particularly younger generations, leading to a diversion of spending away from traditional credit cards.

Increased Use of Debit Cards and Cash

Consumers are increasingly turning to debit cards and cash transactions to maintain better control over their spending.

- Emphasis on budgeting and debt avoidance: Many are focusing on stricter budgeting and actively avoiding accumulating credit card debt.

- Greater control over spending: Using debit cards and cash provides immediate feedback on spending, promoting better financial management.

- Avoidance of high interest rates: Avoiding credit card debt helps consumers prevent the accumulation of high interest charges.

The shift towards debit cards and cash reflects a conscious effort by consumers to manage their finances more effectively and avoid the potential pitfalls of high-interest credit card debt. This conscious decision significantly impacts credit card companies' bottom line.

Credit Card Companies' Response to Declining Spending

Faced with declining spending, credit card companies are responding with strategic adjustments and a renewed focus on customer retention.

Strategic Adjustments and Initiatives

Credit card companies are implementing various strategies to adapt to the changing market dynamics.

- Offering more rewards programs: Enhanced rewards programs are designed to incentivize customers to continue using their credit cards.

- Lowering interest rates on certain cards: Competitive interest rates are crucial for attracting and retaining customers in a challenging economic climate.

- Expanding into new financial services: Diversification into areas like personal loans or investment products can offset revenue losses from reduced credit card spending.

Credit card companies are actively seeking ways to remain competitive and attract customers in this evolving financial landscape. Their strategies are focused on both attracting new customers and maintaining relationships with existing ones.

Increased Focus on Customer Retention

Given the challenges in acquiring new customers, retaining existing ones has become paramount for credit card companies.

- Improved customer service: Providing excellent customer service can foster loyalty and prevent customers from switching providers.

- Personalized offers: Tailored offers based on individual customer spending habits can increase engagement and credit card usage.

- Proactive communication: Keeping customers informed about changes and benefits can strengthen their relationship with the company.

Customer retention strategies are now playing a crucial role in mitigating the impact of reduced credit card spending. By prioritizing customer satisfaction and loyalty, credit card companies aim to minimize customer churn and maintain a stable revenue stream.

Conclusion

This article highlighted the significant impact of reduced consumer spending on credit card companies. Factors like inflation, recessionary fears, and shifting consumer preferences towards alternative payment methods like BNPL services and increased use of debit cards and cash are all contributing to the decline in credit card usage and impacting credit card spending. Understanding these trends is vital for both credit card companies and consumers.

Call to Action: Understanding the current trends in credit card spending is crucial for both consumers and businesses alike. Stay informed about the evolving landscape of personal finance to make smart decisions regarding your credit card usage and financial future. Learn more about managing your credit card spending effectively by researching resources and tools available online.

Featured Posts

-

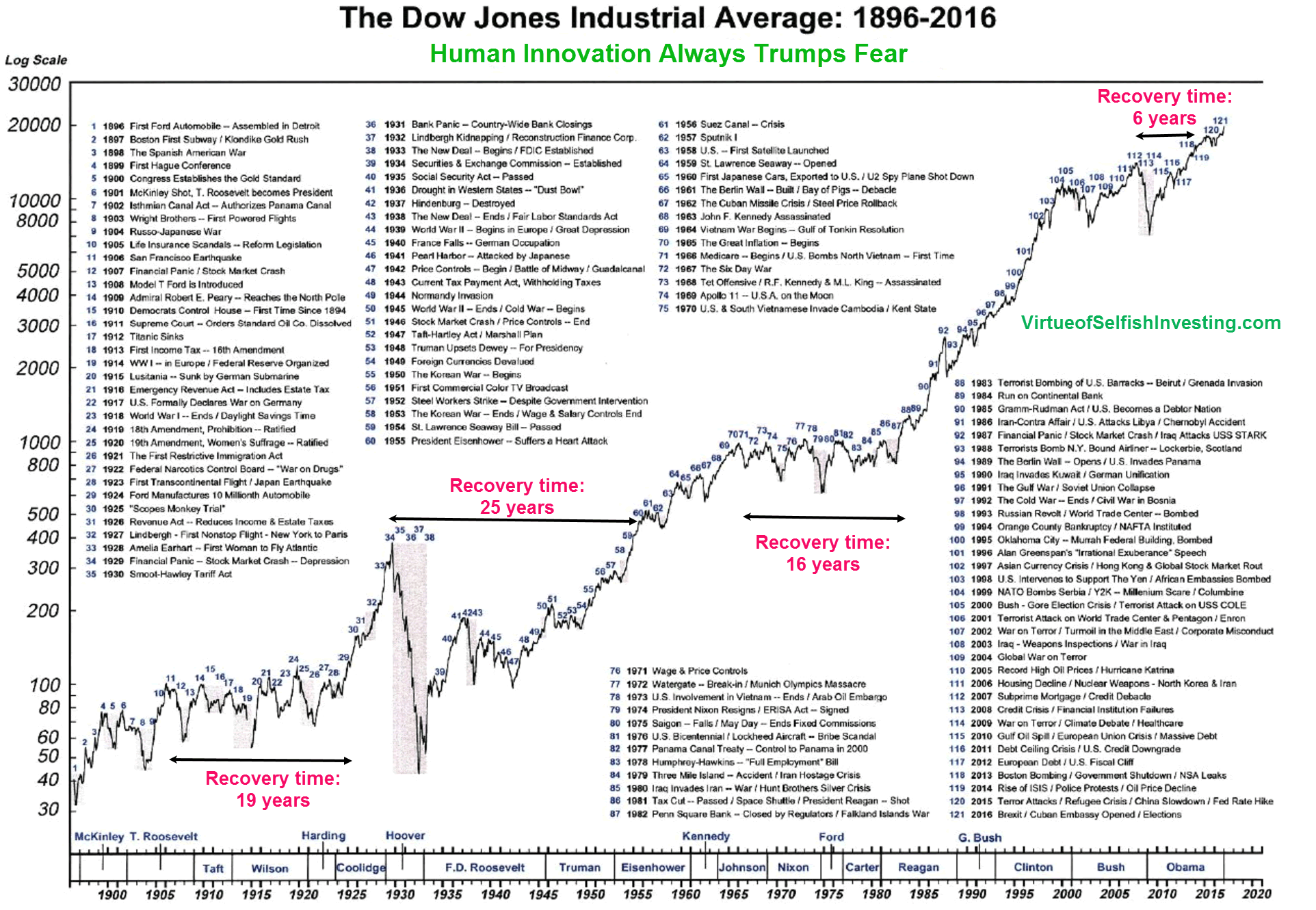

Stock Market Gains S And P 500 Nasdaq And Dows Significant Rise

Apr 24, 2025

Stock Market Gains S And P 500 Nasdaq And Dows Significant Rise

Apr 24, 2025 -

Cantor Fitzgerald In Talks For 3 Billion Crypto Spac With Tether And Soft Bank

Apr 24, 2025

Cantor Fitzgerald In Talks For 3 Billion Crypto Spac With Tether And Soft Bank

Apr 24, 2025 -

Sharp Drop In Teslas Q1 Profits The Musk Trump Administration Connection

Apr 24, 2025

Sharp Drop In Teslas Q1 Profits The Musk Trump Administration Connection

Apr 24, 2025 -

Office365 Executive Inboxes Targeted In Multi Million Dollar Hacking Scheme

Apr 24, 2025

Office365 Executive Inboxes Targeted In Multi Million Dollar Hacking Scheme

Apr 24, 2025 -

Breast Cancer Awareness Tina Knowles Experience Highlights Mammogram Importance

Apr 24, 2025

Breast Cancer Awareness Tina Knowles Experience Highlights Mammogram Importance

Apr 24, 2025