US Market Slumps As Emerging Markets Erase Losses

Table of Contents

Factors Contributing to the US Market Slump

Several interconnected factors have converged to contribute to the recent US market slump. Understanding these forces is crucial for navigating the current economic climate.

High Inflation and Interest Rate Hikes

Soaring inflation has been a major headwind for the US economy. The Federal Reserve's aggressive interest rate hikes, aimed at curbing inflation, have inadvertently dampened economic activity.

- Reduced consumer spending: Higher interest rates increase borrowing costs, leading to reduced consumer spending and decreased demand for goods and services.

- Increased borrowing costs for businesses: Businesses face higher costs for borrowing money to invest and expand, hindering economic growth.

- Decreased corporate profits: Reduced consumer demand and increased borrowing costs squeeze corporate profits, impacting stock valuations.

For instance, the US inflation rate reached a 40-year high in 2022, prompting the Fed to raise interest rates sharply. This, in turn, contributed to a slowdown in GDP growth.

Geopolitical Uncertainty

Geopolitical instability significantly impacts investor sentiment and market volatility. The war in Ukraine, ongoing tensions with China, and other global events have created uncertainty that undermines confidence in the market.

- Supply chain disruptions: The war in Ukraine disrupted global supply chains, leading to shortages and price increases for various commodities.

- Energy price volatility: The conflict exacerbated energy price volatility, further fueling inflation.

- Increased risk aversion: Geopolitical uncertainty increases risk aversion among investors, leading to capital flight from riskier assets.

The impact of these geopolitical factors on the US economy is substantial, contributing to the overall market slump.

Tech Sector Slowdown

The tech sector, a significant driver of US economic growth in recent years, has experienced a notable slowdown. This downturn has had a ripple effect throughout the broader market.

- Reduced valuations of tech companies: Investor concerns about growth prospects have led to a significant decline in the valuations of many tech companies.

- Layoffs in the tech sector: Several major tech companies have announced layoffs, signaling a shift in the industry's outlook.

- Decreased investor confidence in the tech sector: The combination of reduced valuations and layoffs has eroded investor confidence in the tech sector, contributing to the overall market slump.

The Nasdaq Composite, a major tech-heavy index, has reflected this downturn, experiencing significant declines.

The Rise of Emerging Markets: A Counterpoint to the US Slump

While the US market slumps, many emerging markets are exhibiting remarkable resilience and even strong growth. This divergence highlights a significant shift in the global economic landscape.

Strong Economic Growth in Emerging Economies

Several emerging economies, including India, Brazil, and several Southeast Asian nations, are experiencing robust economic growth.

- Strong domestic demand: Strong domestic consumption fuels growth in these economies.

- Infrastructure investments: Significant investments in infrastructure development are driving economic activity.

- Increased foreign direct investment: Emerging markets are attracting increased foreign direct investment, further fueling growth.

For example, India's GDP growth has consistently outpaced that of many developed economies.

Resilience to Global Economic Headwinds

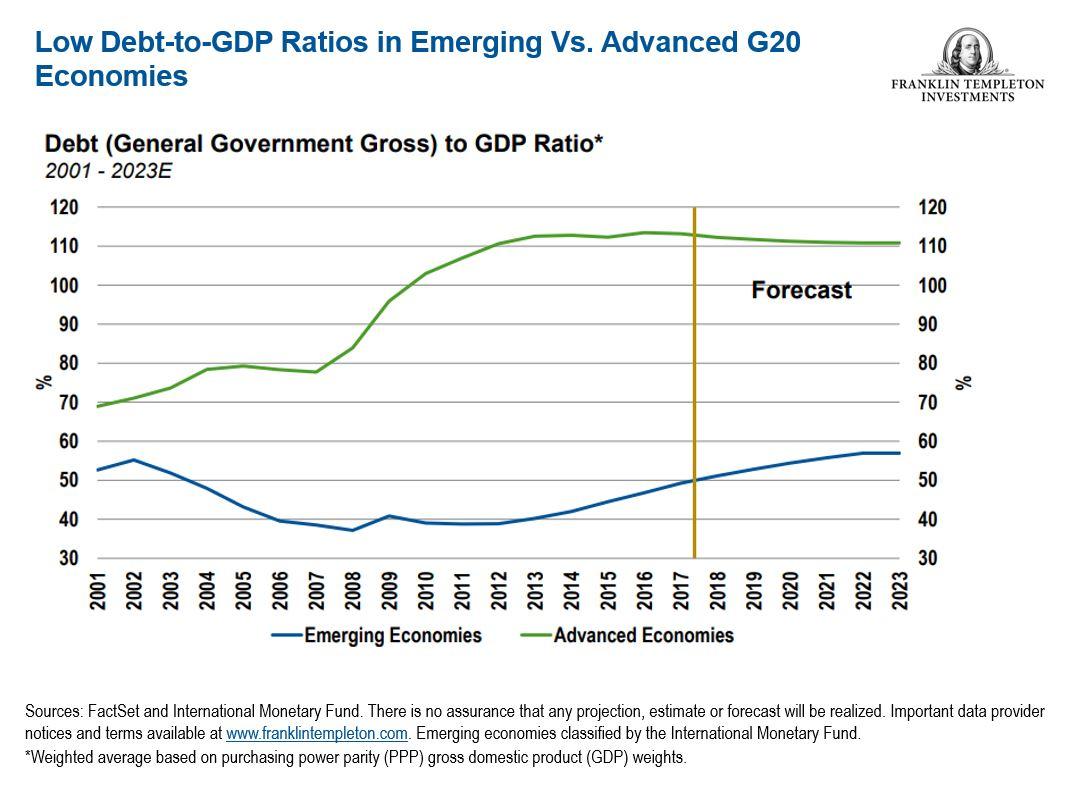

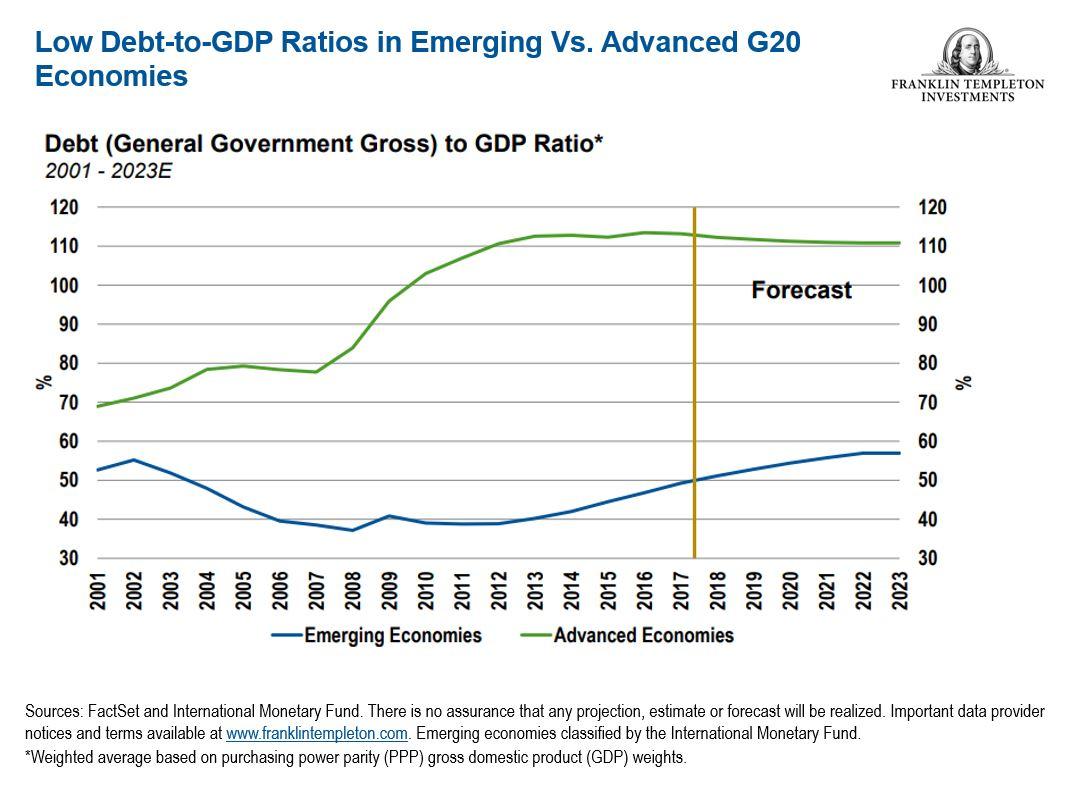

Some emerging markets have demonstrated greater resilience to global economic challenges compared to developed economies.

- Lower reliance on global supply chains: Many emerging markets have less reliance on global supply chains, making them less vulnerable to disruptions.

- Diversified economies: Diversification across various sectors helps to mitigate the impact of shocks to specific industries.

- Strong government support: Government intervention and policies can help to cushion the impact of global economic headwinds.

This resilience makes emerging markets an increasingly attractive destination for investors.

Attractive Investment Opportunities

The combination of strong growth potential, attractive valuations, and diversification benefits makes emerging markets an attractive investment destination.

- Higher growth potential: Emerging markets offer higher growth potential compared to many developed economies.

- Attractive valuations: Many emerging market assets are relatively undervalued compared to their developed market counterparts.

- Diversification benefits: Investing in emerging markets can enhance portfolio diversification and reduce overall risk.

This makes emerging markets a compelling alternative to the struggling US stock market.

Implications of the Shifting Global Economic Landscape

The shift in global economic power from developed to emerging markets has significant implications for investors, global trade, and geopolitics.

Implications for Investors

This changing economic landscape necessitates a reevaluation of investment strategies.

- Increased need for global diversification: Investors need to diversify their portfolios to include emerging market assets.

- Opportunities in emerging markets: Emerging markets present compelling opportunities for long-term growth.

- Re-evaluation of investment portfolios: Investors should re-evaluate their investment portfolios to account for the shift in global economic power.

A well-diversified portfolio that includes exposure to emerging markets is crucial for mitigating risk.

Impact on Global Trade and Geopolitics

The rise of emerging markets will reshape global trade dynamics and geopolitical relationships.

- Shift in global economic power: The shift in economic power will alter global trade relationships and alliances.

- Increased competition between nations: Increased competition for resources and markets will shape geopolitical relations.

- Potential for increased cooperation: However, there is also potential for increased cooperation between developed and emerging economies.

Conclusion: Navigating the Shifting Sands of the Global Market – A Focus on Emerging Markets and US Market Dynamics

The US market slumps while emerging markets surge, reflecting a fundamental shift in the global economic landscape. High inflation, interest rate hikes, geopolitical uncertainty, and a tech sector slowdown have all contributed to the US market's underperformance. Conversely, strong domestic demand, resilience to global headwinds, and attractive investment opportunities are driving the growth of emerging markets. Understanding these dynamics is crucial for investors seeking to navigate this new reality. Explore the opportunities in emerging markets amidst US market slumps, and diversify your portfolio to mitigate risks associated with a potentially prolonged period of US market volatility. Understanding the dynamics of the US market and emerging markets is key to successful long-term investment strategies. Don't let the current US market slumps blind you to the significant opportunities emerging in other parts of the world.

Featured Posts

-

Rep Nancy Mace Confronted By South Carolina Voter A Heated Exchange

Apr 24, 2025

Rep Nancy Mace Confronted By South Carolina Voter A Heated Exchange

Apr 24, 2025 -

Houston Isd Mariachis Viral Success Whataburger Video Leads To Uil State

Apr 24, 2025

Houston Isd Mariachis Viral Success Whataburger Video Leads To Uil State

Apr 24, 2025 -

Executive Producers Exit From 60 Minutes A Direct Result Of The Trump Lawsuit

Apr 24, 2025

Executive Producers Exit From 60 Minutes A Direct Result Of The Trump Lawsuit

Apr 24, 2025 -

Chinese Stocks Listed In Hong Kong Recent Market Gains Explained

Apr 24, 2025

Chinese Stocks Listed In Hong Kong Recent Market Gains Explained

Apr 24, 2025 -

Experts Link Trump Administration Cuts To Heightened Tornado Season Risks

Apr 24, 2025

Experts Link Trump Administration Cuts To Heightened Tornado Season Risks

Apr 24, 2025