Gold's Record High: Understanding The Trade War Impact On Bullion

Table of Contents

Trade Wars and Economic Uncertainty

Trade wars inject significant uncertainty into the global economy, profoundly impacting investor confidence and driving capital towards safer assets like gold. This section will explore the mechanisms through which trade wars fuel gold price increases.

Increased Volatility in Global Markets

Trade wars inherently create market volatility. The imposition of tariffs, threats of sanctions, and retaliatory measures disrupt established trade patterns, causing uncertainty about future economic prospects. This uncertainty undermines investor confidence, leading to a flight from riskier assets and a surge in demand for safer alternatives, including gold. Fluctuations in currency exchange rates, a common byproduct of trade disputes, further enhance gold's appeal as a stable store of value.

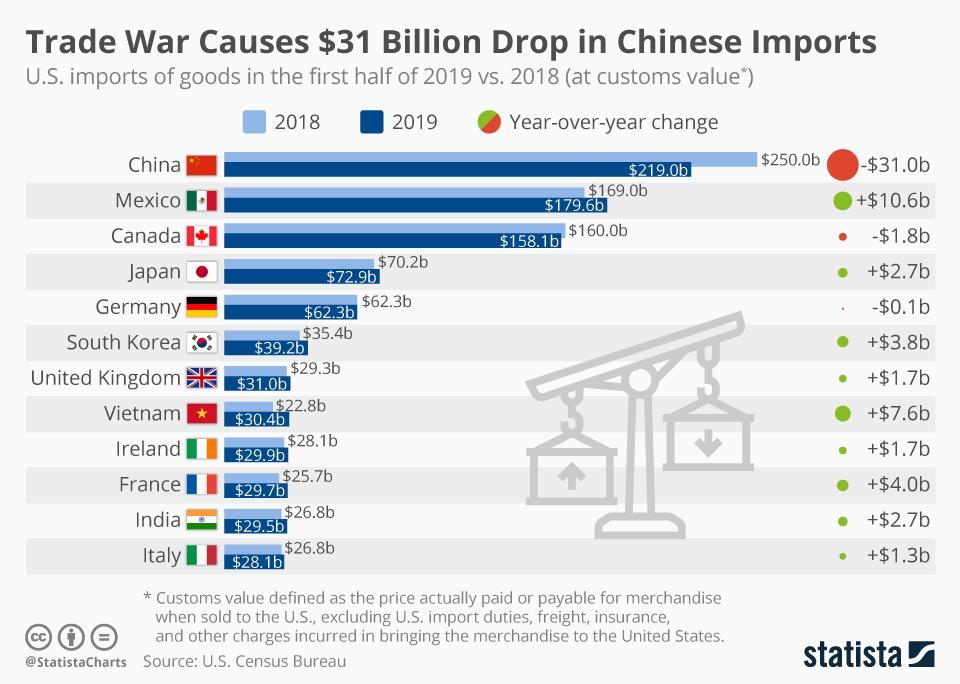

- Example: The US-China trade war of 2018-2020 saw significant market volatility, with gold prices rising concurrently as investors sought refuge from the uncertainty.

- Statistic: Studies have shown a positive correlation between periods of heightened trade tension and increased gold prices, with gold often outperforming other asset classes during such times. Specific data points would be included here if available from reputable sources.

Inflationary Pressures

Trade wars often exert inflationary pressures on economies. Increased tariffs raise the cost of imported goods, pushing up consumer prices. Disrupted supply chains due to trade restrictions lead to shortages and further price increases. Gold is traditionally viewed as a hedge against inflation, meaning its value tends to rise as the purchasing power of fiat currencies diminishes. This makes it an attractive investment during inflationary periods driven by trade wars.

- Inflation Rate Example: Historical data showing inflation rates during past trade wars could be cited here. The correlation between inflation and gold prices needs to be analyzed using verifiable economic data.

- Inflation Hedge: Gold's inherent scarcity and its long history as a store of value contribute to its role as an inflation hedge. Its price tends to appreciate when the value of other assets declines due to inflation.

Gold as a Safe Haven Asset

Gold has long been recognized as a safe haven asset, a characteristic that becomes particularly pronounced during periods of geopolitical and economic turmoil. This inherent safety makes it a preferred investment choice when uncertainty reigns.

Investor Sentiment and Flight to Safety

During times of heightened economic or geopolitical uncertainty, investor sentiment shifts dramatically. Investors tend to reduce their exposure to riskier assets and increase their holdings in perceived safe havens like gold. This "flight to safety" significantly increases demand for gold, driving its price upwards. Gold's historical track record as a reliable store of value during crises further reinforces its safe haven status.

- Historical Data: Charts and graphs showcasing gold's price performance during past economic crises (e.g., the 2008 financial crisis) would be included here to illustrate its role as a safe haven.

- Institutional Investment: Examples of large institutional investors increasing their gold holdings during times of trade war uncertainty could be provided to further highlight this trend.

Diversification and Portfolio Protection

Including gold in a diversified investment portfolio is a widely accepted risk-management strategy. Gold's price tends to move independently of other asset classes, meaning it can act as a buffer against losses in stocks, bonds, or real estate during periods of market instability. This is particularly beneficial during trade wars, when other markets experience heightened volatility.

- Portfolio Diversification: Discussion of different portfolio diversification strategies incorporating gold and the associated risk reduction benefits.

- Volatility Reduction: Explanation of how gold's low correlation with other assets helps reduce overall portfolio volatility.

Analyzing the Impact of Specific Trade Wars on Gold Prices

To illustrate the relationship between trade wars and gold prices, let's examine specific historical and current examples.

- US-China Trade War: A detailed analysis of the US-China trade war's impact on gold prices, using charts and graphs to visually represent the correlation between trade war escalations and gold price movements. This would include specific data points showing price increases and analysis of market sentiment during the period.

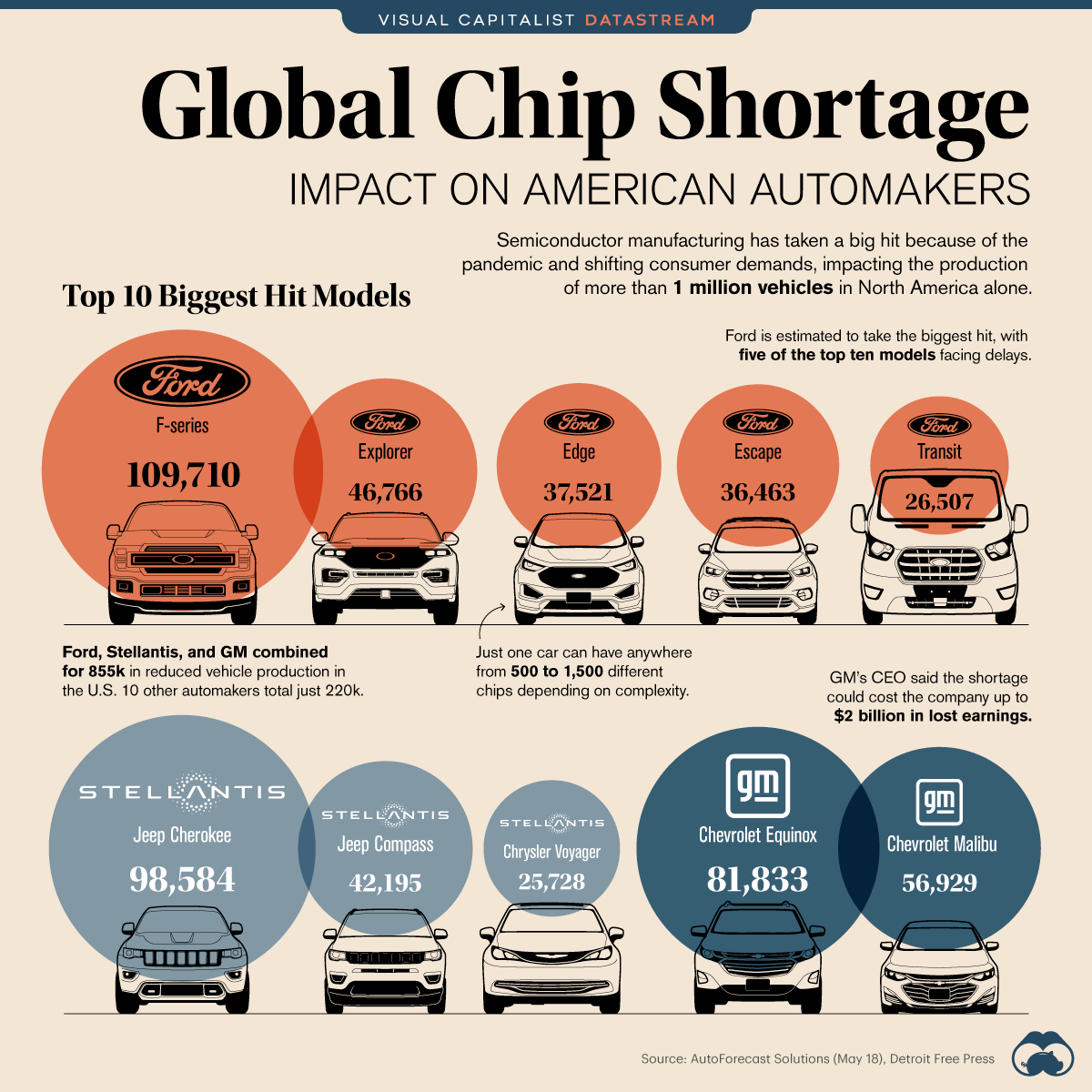

- Other Trade Wars: Analysis of other significant trade disputes and their effects on the gold market.

(Charts and graphs depicting the correlation between specific trade war events and gold price fluctuations would be incorporated here.)

Conclusion

The ongoing global trade war significantly impacts gold's record-high prices, making it a critical factor in understanding current market dynamics. Gold's role as a safe haven asset, hedge against inflation, and portfolio diversifier is magnified during periods of economic and geopolitical uncertainty such as those created by trade wars. The price of gold bullion acts as a barometer reflecting the anxieties of investors worldwide.

Understanding the impact of trade wars on gold bullion is vital for making well-informed investment decisions. Stay abreast of global trade developments and consider incorporating gold into your investment strategy to mitigate the risks associated with trade war volatility. Learn more about investing in gold and securing your financial future.

Featured Posts

-

The Rise Of Wildfire Betting A Reflection Of Modern Society

Apr 26, 2025

The Rise Of Wildfire Betting A Reflection Of Modern Society

Apr 26, 2025 -

Karen Reads Murder Trials Key Dates And Events

Apr 26, 2025

Karen Reads Murder Trials Key Dates And Events

Apr 26, 2025 -

The Rise Of Chinese Automakers A Look At Their Global Impact

Apr 26, 2025

The Rise Of Chinese Automakers A Look At Their Global Impact

Apr 26, 2025 -

Hollywood Production Grinds To Halt As Actors Join Writers Strike

Apr 26, 2025

Hollywood Production Grinds To Halt As Actors Join Writers Strike

Apr 26, 2025 -

Cassidy Hutchinsons Memoir Key Jan 6 Witness To Tell All This Fall

Apr 26, 2025

Cassidy Hutchinsons Memoir Key Jan 6 Witness To Tell All This Fall

Apr 26, 2025

Latest Posts

-

Thueringen Artenvielfalt Von Amphibien Und Reptilien Im Neuen Atlas Dokumentiert

Apr 27, 2025

Thueringen Artenvielfalt Von Amphibien Und Reptilien Im Neuen Atlas Dokumentiert

Apr 27, 2025 -

Entdecken Sie Die Amphibien Und Reptilien Thueringens Der Neue Atlas

Apr 27, 2025

Entdecken Sie Die Amphibien Und Reptilien Thueringens Der Neue Atlas

Apr 27, 2025 -

Neuer Atlas Zeigt Die Amphibien Und Reptilien Thueringens

Apr 27, 2025

Neuer Atlas Zeigt Die Amphibien Und Reptilien Thueringens

Apr 27, 2025 -

Thueringens Reptilien Und Amphibien Der Neue Atlas Ist Da

Apr 27, 2025

Thueringens Reptilien Und Amphibien Der Neue Atlas Ist Da

Apr 27, 2025 -

Thueringen Amphibien Und Reptilienatlas Ein Umfassender Ueberblick

Apr 27, 2025

Thueringen Amphibien Und Reptilienatlas Ein Umfassender Ueberblick

Apr 27, 2025