Wildfire Speculation: Examining The Market For Los Angeles Fire Bets

Table of Contents

Understanding the Market for Los Angeles Fire Bets

The market for Los Angeles fire bets, while not explicitly regulated or openly advertised like traditional sports betting, exists in various forms. Understanding its nuances is critical before considering participation.

Types of Bets Available

The types of bets available are as varied as the wildfire risks themselves. While no officially sanctioned "Los Angeles fire betting exchange" exists, informal betting could potentially encompass:

- Acreage burned: Betting on the total acreage consumed by a wildfire within a specified timeframe or geographic area.

- Location of next major fire: Predicting the general area (e.g., neighborhood, mountain range) of the next significant wildfire.

- Total cost of damages: Estimating the total financial losses due to property damage, firefighting costs, and other related expenses.

- Severity of fire season: Predicting the overall intensity of the wildfire season based on metrics like total acres burned or number of significant fires.

The legality and accessibility of these types of bets are highly questionable and depend heavily on the specific context and methods used. It is crucial to understand that engaging in unregulated betting can carry significant legal risks. Any specific examples mentioned here should not be considered endorsements or recommendations. The data used to inform these predictions, often gleaned from historical wildfire data and meteorological forecasts, may not always be complete or accurate. This introduces significant biases and limitations.

Factors Influencing Los Angeles Fire Bet Odds

The odds for Los Angeles fire bets would be heavily influenced by a complex interplay of factors:

- Santa Ana winds: The strength and duration of these strong, dry winds are a primary driver of wildfire spread and intensity.

- Drought conditions: Extended periods of drought significantly increase the flammability of vegetation.

- Vegetation density: Areas with dense, dry vegetation are more susceptible to rapid fire spread.

- Firefighting resources: The availability and effectiveness of firefighting resources (personnel, equipment, water supply) significantly influence the outcome of a fire.

- Climate change predictions: Long-term climate change predictions contribute to the overall risk assessment. Increasing temperatures and shifting weather patterns are expected to exacerbate wildfire risk.

Understanding these factors, and accessing reliable information from sources like the Los Angeles County Fire Department, the National Weather Service, and relevant scientific publications, is crucial for any informed assessment of risk.

The Ethical and Social Implications of Los Angeles Fire Bets

The existence of a market for Los Angeles fire bets raises serious ethical and social concerns.

Profiting from Disaster

Profiting from the devastation caused by a natural disaster like a wildfire raises profound ethical questions. It raises concerns about the potential for exploitation and the lack of empathy for victims.

Impact on Insurance Markets

Widespread wildfire betting could destabilize the insurance market. Increased claims and potentially inflated payouts due to speculation could lead to higher premiums for everyone, making insurance unaffordable for many.

Regulation and Oversight

The lack of clear regulations surrounding Los Angeles fire bets is a significant concern. Effective oversight is necessary to prevent fraud, manipulation, and irresponsible speculation that could exacerbate the already challenging situation faced by residents and emergency responders.

- Lack of transparency: The lack of regulation hinders transparency and accountability.

- Potential for manipulation: The potential exists for market manipulation to influence betting outcomes.

- Unforeseen consequences: The wide-ranging societal and economic consequences are difficult to predict.

Analyzing the Risks and Rewards of Los Angeles Fire Bets

While the potential for high returns may attract some, the inherent risks associated with Los Angeles fire bets are substantial.

Potential for High Returns vs. High Risk

The allure of potential high returns is tempered by extremely high risk. Inaccurate predictions, unexpected weather events, or unforeseen circumstances can lead to significant losses.

Data Accuracy and Predictive Modeling

The accuracy of predictive models used to inform bets is questionable. The complexity of wildfire behavior and the limitations of current forecasting models introduce significant uncertainty.

Diversification and Risk Management Strategies

Even if one chooses to participate, responsible risk management is critical. This includes diversifying bets (if possible), setting strict limits on potential losses, and avoiding emotional decision-making.

- Diversification: Spread your potential investment across multiple bets to mitigate risk.

- Limit setting: Establish clear loss limits to prevent significant financial harm.

- Emotional detachment: Avoid making emotional decisions based on fear or greed.

Conclusion: Navigating the Complex World of Los Angeles Fire Bets

The market for Los Angeles fire bets presents a complex interplay of potential profit, ethical concerns, and significant financial risks. While the allure of financial gain might be tempting, the potential consequences of inaccurate predictions and the ethical implications of profiting from disaster cannot be overlooked. Thorough research, responsible gambling practices, and a clear understanding of the limitations of current predictive models are paramount before considering any involvement in this speculative market. Always prioritize reliable information from official sources like the Los Angeles County Fire Department and other emergency services for wildfire safety and preparedness information. Proceed with extreme caution when considering Los Angeles fire bets or any similar forms of wildfire speculation.

Featured Posts

-

Liberal Spending Habits A Call For Fiscal Responsibility In Canada

Apr 24, 2025

Liberal Spending Habits A Call For Fiscal Responsibility In Canada

Apr 24, 2025 -

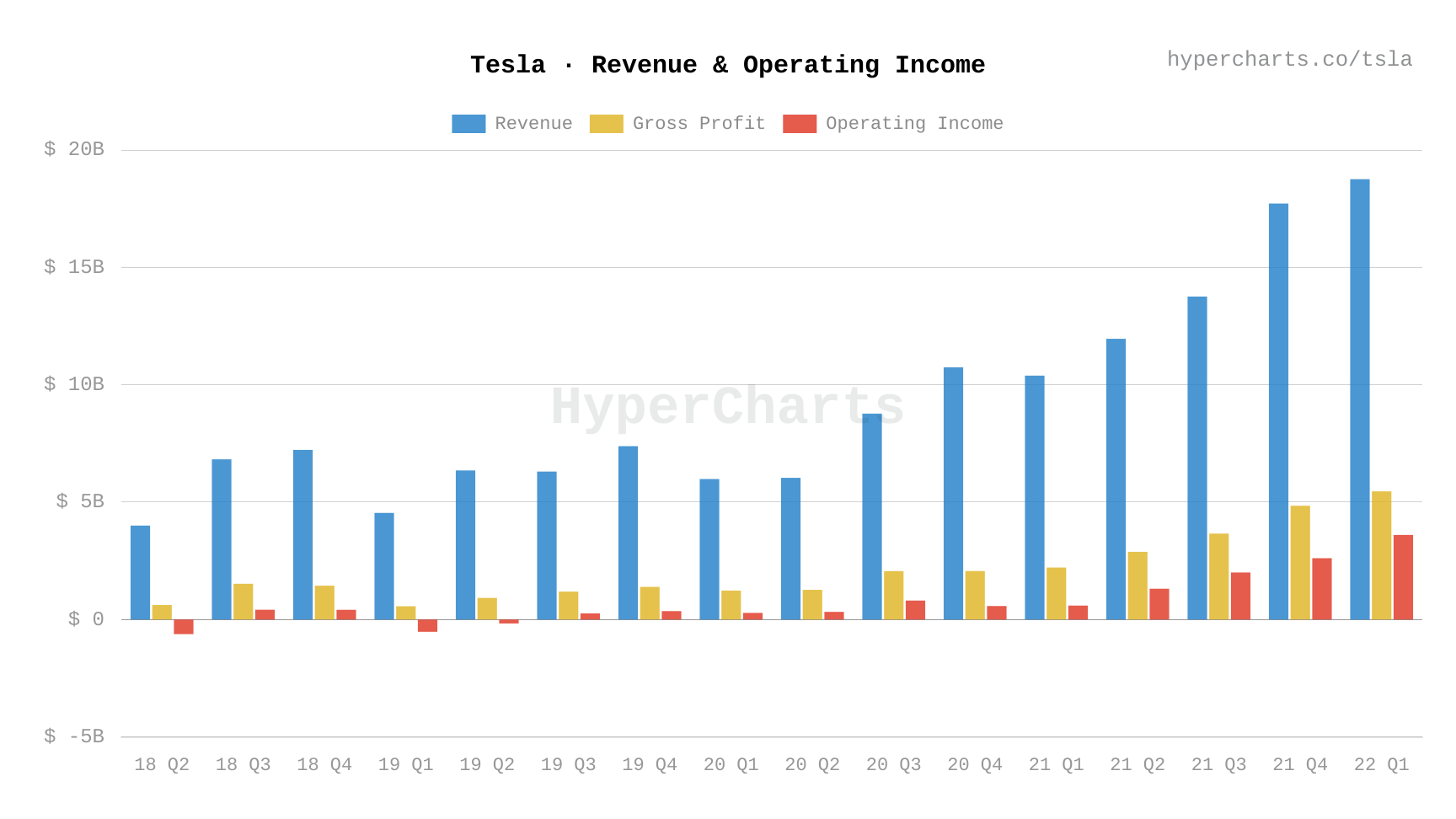

Analysis Of Teslas Q1 Earnings 71 Net Income Reduction Explained

Apr 24, 2025

Analysis Of Teslas Q1 Earnings 71 Net Income Reduction Explained

Apr 24, 2025 -

Analysis Broadcoms V Mware Acquisition And The Potential For Extreme Price Hikes

Apr 24, 2025

Analysis Broadcoms V Mware Acquisition And The Potential For Extreme Price Hikes

Apr 24, 2025 -

The Bold And The Beautiful April 3 Recap Liams Collapse After A Fierce Confrontation With Bill

Apr 24, 2025

The Bold And The Beautiful April 3 Recap Liams Collapse After A Fierce Confrontation With Bill

Apr 24, 2025 -

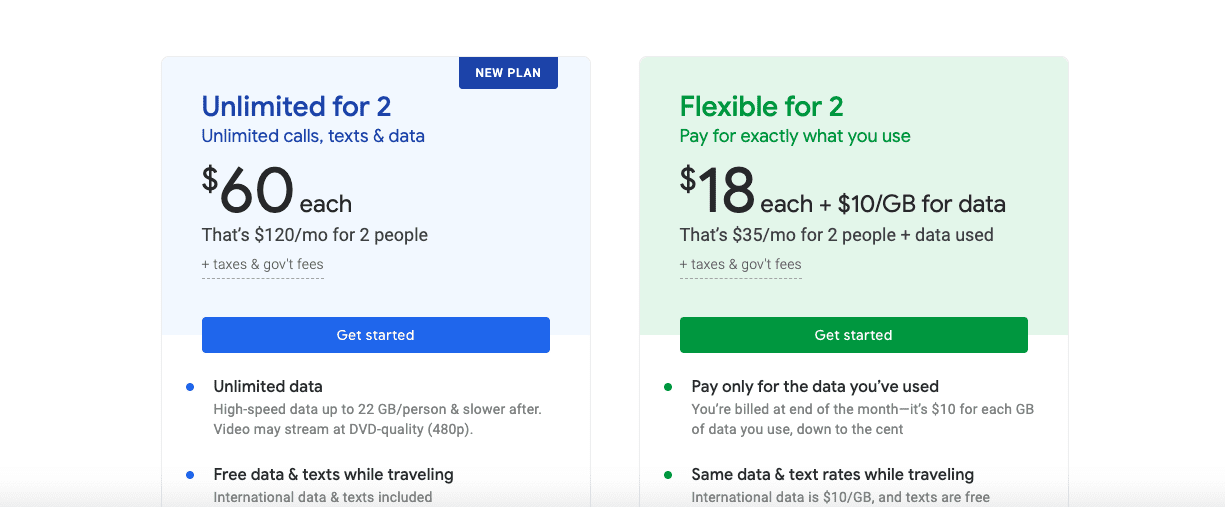

Google Fi Launches Budget Friendly Unlimited Data Plan For 35

Apr 24, 2025

Google Fi Launches Budget Friendly Unlimited Data Plan For 35

Apr 24, 2025