Credit Card Industry Faces Headwinds Amidst Reduced Consumer Spending

Table of Contents

Declining Consumer Confidence and Spending Habits

The current economic climate is characterized by decreased consumer confidence, directly impacting spending patterns and credit card usage. This stems largely from two key factors: inflation and rising interest rates.

Impact of Inflation and Rising Interest Rates

Inflationary pressures and increased interest rates are significantly eroding consumer purchasing power. The cost of essential goods and services, such as housing, groceries, and energy, has skyrocketed, leaving less disposable income for discretionary spending.

- Increased costs: Housing costs are at record highs in many areas, grocery bills continue to climb, and energy prices remain elevated.

- Impact on disposable income: Higher prices for essential goods mean less money available for non-essential purchases and debt repayment.

- Increased borrowing costs: Higher interest rates make borrowing more expensive, discouraging consumers from using credit cards for large purchases or financing everyday expenses. This directly affects the demand for credit card products. Increased consumer debt further compounds the issue.

The keywords "inflationary pressures," "high interest rates," "consumer debt," and "reduced spending" are all directly related to this decline in consumer spending and its impact on the credit card industry.

Shift in Consumer Priorities

Consumers are increasingly prioritizing essential spending over discretionary purchases, leading to a reduction in credit card usage for non-essential items. This shift in consumer behavior reflects a more cautious approach to personal finance.

- Increased savings rates: Many consumers are focusing on building emergency savings and reducing existing debt.

- Focus on debt reduction: Paying down existing debt, such as student loans or mortgages, becomes a priority over new credit card purchases.

- Decreased spending on travel, entertainment, etc.: Non-essential spending categories like travel, dining out, and entertainment are seeing significant cutbacks.

This change in "consumer behavior" and "spending patterns" highlights a fundamental shift in "financial priorities," directly impacting the credit card market.

Increased Risk of Credit Card Defaults

Reduced consumer spending directly correlates with an increased risk of credit card defaults. This poses a significant threat to the financial health of credit card issuers.

Rising Delinquency Rates

As consumers struggle to meet their financial obligations, delinquency rates on credit card payments are expected to rise. This poses a direct threat to the credit card industry's profitability.

- Statistics on rising delinquency rates: Industry reports are already showing a concerning upward trend in late or missed payments. Specific statistics should be sourced and included here from reputable financial news outlets.

- Potential impact on credit card issuers’ profitability: Increased defaults translate directly into lower profits for credit card companies.

Impact on Credit Card Issuers' Profitability

The combination of lower spending and increased defaults significantly impacts the profitability of credit card companies.

- Reduced interest income: Less credit card spending means less interest income for issuers.

- Increased write-offs: Defaults result in increased write-offs, further reducing profitability.

- Potential for reduced dividends: Reduced profits may lead to lower dividends for shareholders.

The terms "credit card profitability," "issuer profitability," and "financial performance" are all crucial keywords within this context.

Strategies for Credit Card Companies to Navigate the Challenges

Credit card companies are actively implementing strategies to navigate the challenges presented by reduced consumer spending and increased default risks.

Adjusting Lending Practices

Credit card issuers are tightening their lending criteria and adjusting their product offerings to mitigate risk.

- Examples of stricter credit checks: More stringent creditworthiness assessments are being used to approve applicants.

- Revised interest rates: Interest rates may be adjusted based on individual credit scores and risk profiles.

- Targeted marketing campaigns: Marketing efforts may focus on lower-risk customer segments.

Effective "credit risk management" and adaptable "lending strategies" are crucial for navigating this difficult period.

Focus on Customer Retention and Engagement

Maintaining customer loyalty and engagement is paramount during times of economic uncertainty.

- Loyalty programs: Enhanced rewards programs can incentivize continued usage and build customer loyalty.

- Improved customer service: Providing excellent customer service builds trust and encourages continued patronage.

- Personalized offers: Tailored offers and promotions can attract and retain customers.

Strategies focused on "customer retention" and "customer engagement" are vital for the long-term success of the credit card industry.

Conclusion

The credit card industry is undeniably facing significant headwinds due to reduced consumer spending, driven by inflation, rising interest rates, and shifting consumer priorities. The increased risk of defaults and the impact on credit card issuers' profitability are substantial challenges. However, by implementing strategies focused on adjusting lending practices and enhancing customer retention, credit card companies can navigate these difficulties and ensure their continued success. To stay informed about the evolving challenges facing the credit card industry, continue your research and exploration of this vital sector of the economy. Learn more about how the credit card market is adapting to reduced consumer spending by visiting [link to relevant resource].

Featured Posts

-

Hield And Paytons Bench Heroics Lead Warriors To Victory Over Blazers

Apr 24, 2025

Hield And Paytons Bench Heroics Lead Warriors To Victory Over Blazers

Apr 24, 2025 -

Should You Vote Liberal Analyze Their Platform First

Apr 24, 2025

Should You Vote Liberal Analyze Their Platform First

Apr 24, 2025 -

Fox News Faces Defamation Lawsuit From Ray Epps Over Jan 6th Reporting

Apr 24, 2025

Fox News Faces Defamation Lawsuit From Ray Epps Over Jan 6th Reporting

Apr 24, 2025 -

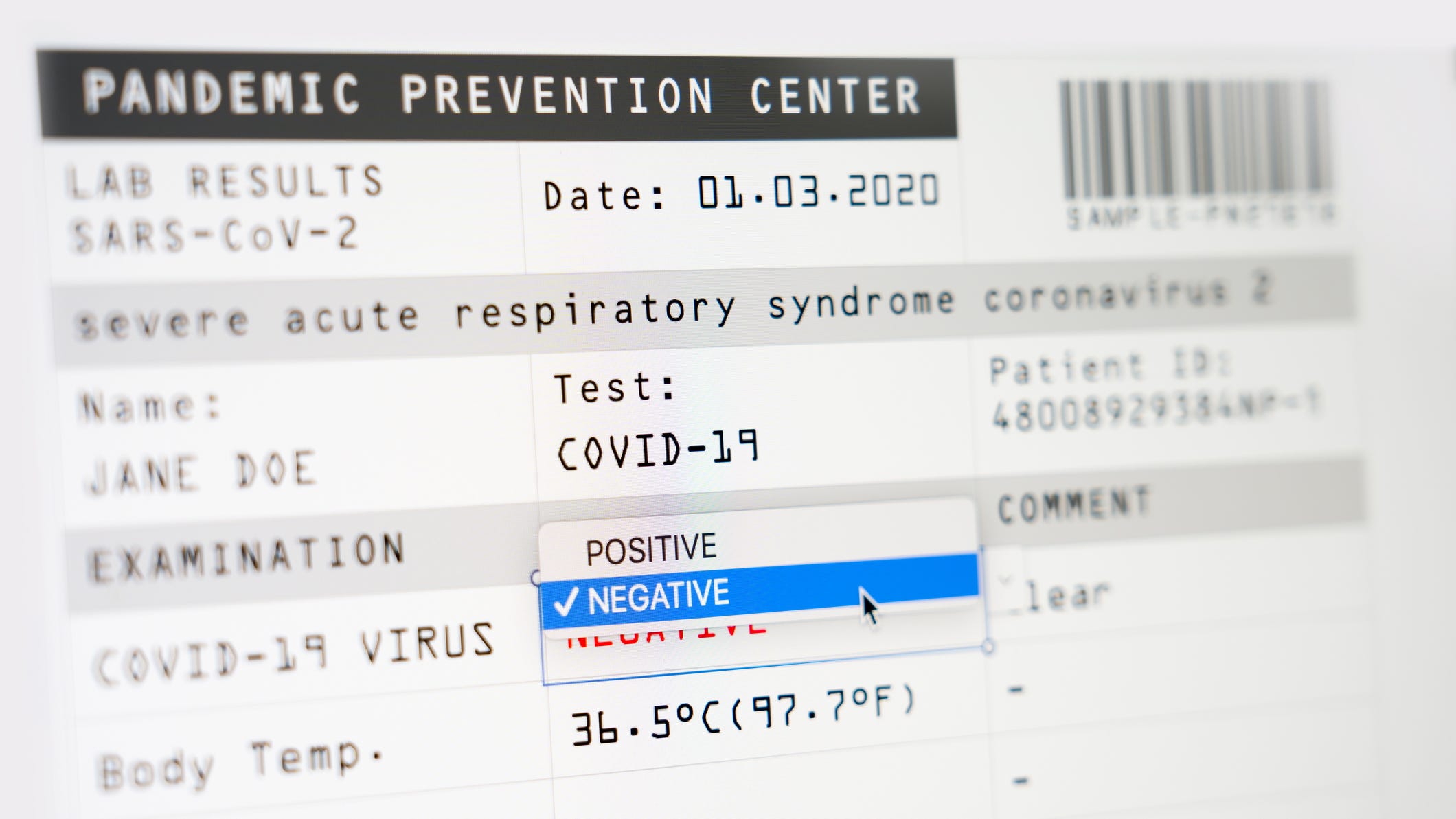

Lab Owner Admits To Faking Covid 19 Test Results During Pandemic

Apr 24, 2025

Lab Owner Admits To Faking Covid 19 Test Results During Pandemic

Apr 24, 2025 -

The Countrys Top Emerging Business Hubs A Geographic Analysis

Apr 24, 2025

The Countrys Top Emerging Business Hubs A Geographic Analysis

Apr 24, 2025