US Stock Market Today: Dow Futures Uncertain, China's Economic Response To Tariffs

Table of Contents

Dow Futures and Current Market Sentiment

As of this writing, Dow futures are showing [insert current Dow futures data – percentage change and specific numbers]. This reflects a [bullish/bearish/neutral] market sentiment. The prevailing sentiment is largely driven by [explain the reasons behind the current sentiment – e.g., concerns about inflation, interest rate hikes by the Federal Reserve, or geopolitical instability].

- Current Dow Jones Industrial Average (DJIA) value: [Insert current DJIA value]

- Percentage change from previous closing: [Insert percentage change]

- Key factors influencing investor sentiment:

- Recent interest rate hikes by the Federal Reserve, impacting borrowing costs and corporate profitability.

- Latest inflation data releases, indicating potential inflationary pressures or easing of inflation.

- Geopolitical events, such as escalating tensions in [mention specific geopolitical hotspots], impacting global market stability.

- Analysis of technical indicators: [Mention any relevant technical indicators like RSI, MACD, etc., and their interpretation. Only include if data is available and relevant.]

China's Economic Response to Tariffs

China's response to the recent US tariffs has involved a series of economic countermeasures aimed at mitigating the negative impacts on its economy. These actions have significant implications for the US economy and the US stock market.

- Specific examples of China's economic countermeasures:

- Imposition of retaliatory tariffs on various US goods.

- Potential adjustments to its currency exchange rate (e.g., currency devaluation).

- Restrictions on imports of certain US products.

- Analysis of the effectiveness of these countermeasures: [Discuss the perceived effectiveness of China's responses and their actual impact on the US economy.]

- Potential repercussions for US businesses and consumers: [Explain potential consequences for US businesses, such as reduced exports, increased prices, and potential job losses. Also, address the potential impact on US consumers through higher prices.]

- Long-term implications for US-China trade relations: [Analyze the long-term consequences of this trade conflict on the relationship between the two economic giants and the potential for future trade agreements.]

Impact on Specific Sectors

The ongoing trade tensions are disproportionately affecting certain sectors of the US economy. The technology sector, heavily reliant on global supply chains, is particularly vulnerable. Similarly, the agricultural sector is significantly impacted by trade disputes, as are manufacturing industries.

- Analysis of the performance of relevant stock indices: The [Nasdaq/S&P 500] index is currently showing [insert performance data]. This reflects the impact on specific sectors within that index.

- Examples of affected companies and their stock performance: [Give examples of companies in various sectors – technology, agriculture, manufacturing – and analyze how their stock prices have reacted to recent events.]

- Predictions for future sector performance based on current trends: [Offer cautious predictions for the performance of these sectors based on current market conditions and ongoing trade negotiations. Avoid making definitive statements without sufficient data.]

Other Factors Influencing the US Stock Market

Beyond the China trade war, several other factors are influencing the US stock market's current volatility. Understanding these contributing factors provides a more holistic view of the market's current state.

- Current interest rate environment and its effect on borrowing costs: [Discuss the impact of current interest rates on corporate borrowing, investment decisions, and overall economic growth.]

- Recent economic data releases: [Mention recent data releases, such as GDP growth, unemployment figures, and consumer confidence indices, and their influence on market sentiment.]

- Geopolitical events and their market implications: [Discuss any other significant geopolitical events and their potential influence on market stability.]

- Potential for unexpected market corrections or surges: [Acknowledge the possibility of unexpected market movements due to unforeseen events or shifts in investor sentiment.]

Conclusion

The current uncertainty in the US stock market is a multifaceted issue arising from a confluence of factors, primarily the ongoing trade disputes between the US and China. Understanding China's economic response to tariffs and its ripple effects across various sectors is crucial for informed investment decisions. While Dow futures remain volatile, keeping abreast of relevant economic indicators and geopolitical developments is paramount for making sound judgments within the US stock market. Continue to monitor the US stock market closely and stay updated on the latest news and analyses. For a more comprehensive understanding and tailored investment advice, consult a qualified financial professional.

Featured Posts

-

Gold Price Record Rally Bullion As A Safe Haven During Trade Wars

Apr 26, 2025

Gold Price Record Rally Bullion As A Safe Haven During Trade Wars

Apr 26, 2025 -

Colgates Q Quarter Earnings Tariff Hikes Slash Profits By 200 Million

Apr 26, 2025

Colgates Q Quarter Earnings Tariff Hikes Slash Profits By 200 Million

Apr 26, 2025 -

Sinners How Cinematography Showcases The Mississippi Deltas Expansive Landscape

Apr 26, 2025

Sinners How Cinematography Showcases The Mississippi Deltas Expansive Landscape

Apr 26, 2025 -

Exclusive Access To Elon Musk Investments A High Return Side Hustle

Apr 26, 2025

Exclusive Access To Elon Musk Investments A High Return Side Hustle

Apr 26, 2025 -

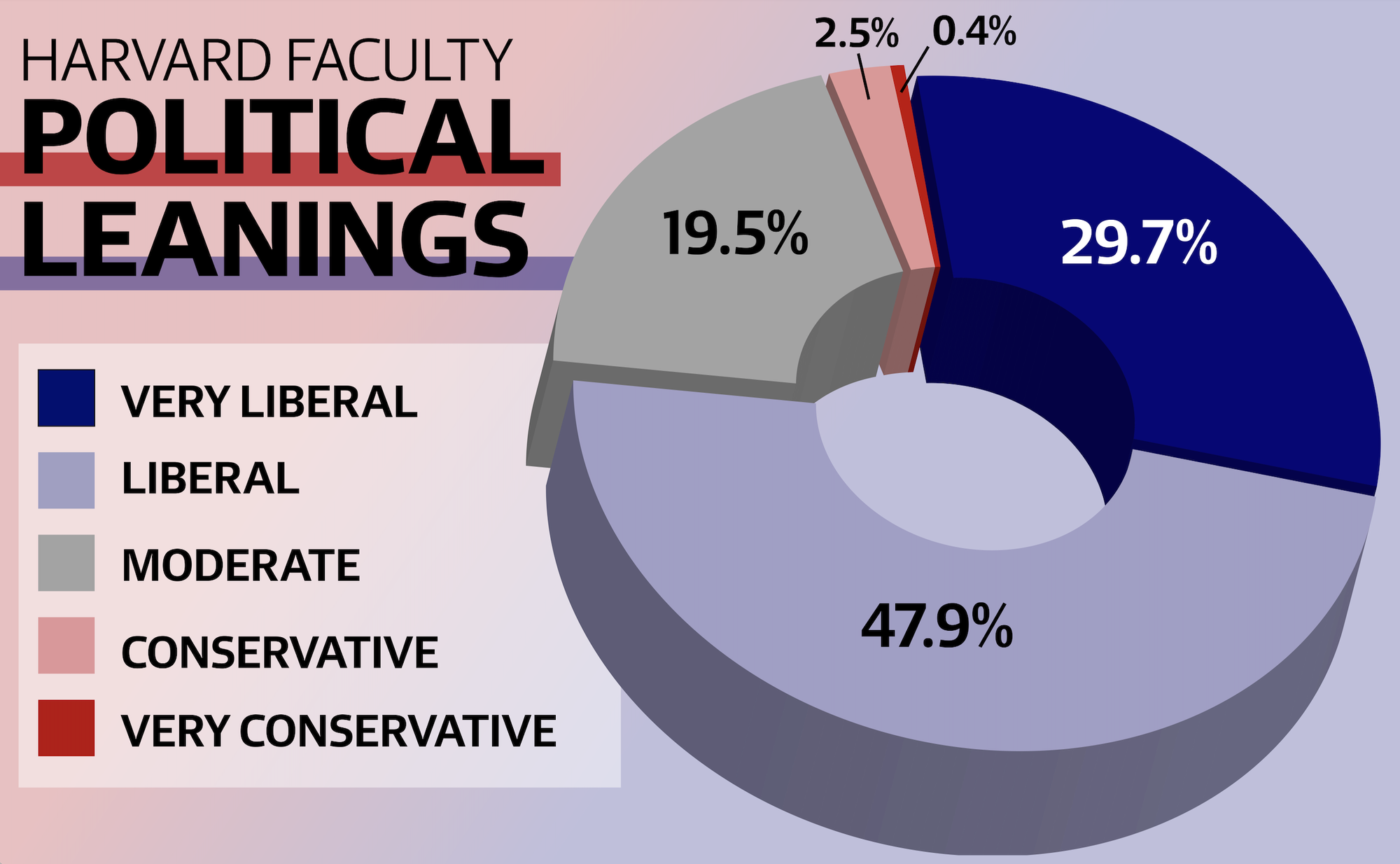

Harvard University A Conservative View On Its Revitalization

Apr 26, 2025

Harvard University A Conservative View On Its Revitalization

Apr 26, 2025

Latest Posts

-

Crumbach Resignation Analysis Of The Spd Coalitions Future

Apr 27, 2025

Crumbach Resignation Analysis Of The Spd Coalitions Future

Apr 27, 2025 -

Bsw Leader Crumbachs Resignation Implications For The Spd Coalition

Apr 27, 2025

Bsw Leader Crumbachs Resignation Implications For The Spd Coalition

Apr 27, 2025 -

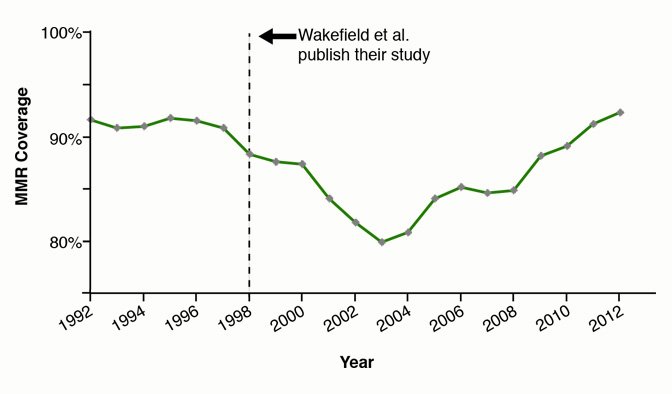

Nbc 10 Reports Hhs Uses Anti Vaccine Advocate To Examine Disproven Autism Vaccine Link

Apr 27, 2025

Nbc 10 Reports Hhs Uses Anti Vaccine Advocate To Examine Disproven Autism Vaccine Link

Apr 27, 2025 -

Anti Vaccine Activists Role In Hhs Autism Vaccine Review Sparks Outrage

Apr 27, 2025

Anti Vaccine Activists Role In Hhs Autism Vaccine Review Sparks Outrage

Apr 27, 2025 -

Hhs Controversy Anti Vaccine Advocate Reviews Debunked Autism Vaccine Connection

Apr 27, 2025

Hhs Controversy Anti Vaccine Advocate Reviews Debunked Autism Vaccine Connection

Apr 27, 2025