Gold Price Record Rally: Bullion As A Safe Haven During Trade Wars

Table of Contents

The Impact of Trade Wars on Global Markets

Trade wars, characterized by escalating tariffs and trade restrictions, inject significant uncertainty into the global economy. This uncertainty undermines investor confidence, leading to increased market volatility. The effects ripple across various sectors, impacting global economic growth and creating a climate of fear and speculation. Keywords like trade war impact, global market volatility, economic uncertainty, and investor confidence are central to understanding this phenomenon.

- Increased market volatility leads to capital flight: Investors withdraw from riskier assets, seeking safer alternatives.

- Slowdown in global economic growth reduces investor returns in traditional assets: The uncertainty surrounding trade policies dampens business investment and consumer spending, impacting overall economic growth and the returns from traditional investments like stocks and bonds.

- Uncertainty prompts investors to seek safety in less volatile assets: Gold, with its long history as a safe haven, becomes an attractive option.

Gold as a Hedge Against Inflation and Currency Devaluation

Historically, gold has served as a reliable hedge against inflation. Its inherent value remains relatively stable, unlike fiat currencies susceptible to devaluation. Trade wars often contribute to currency fluctuations. As countries impose tariffs and engage in retaliatory measures, their currencies can weaken, impacting the purchasing power of domestic and foreign investors. This makes gold, a stable store of value, even more appealing. Keywords such as inflation hedge, currency devaluation, store of value, and gold investment are critical here.

- Inflation erodes the purchasing power of fiat currencies: When inflation rises, the value of money decreases, meaning your money buys less.

- Gold's price typically rises during inflationary periods: As the value of currency declines, investors seek assets that retain or increase their value, driving up the demand for gold.

- Currency fluctuations impact investment returns; gold offers a stable alternative: Gold provides a hedge against currency risk, shielding investors from losses stemming from volatile exchange rates.

Increased Demand for Gold as a Safe Haven Asset

Geopolitical instability and economic uncertainty fuel a surge in demand for gold as a safe haven asset. Investors view gold as a reliable store of value during times of crisis, offering protection against potential portfolio losses. The ongoing trade wars have amplified this perception, leading to a significant increase in gold investment. Relevant keywords in this section include safe haven asset, gold demand, geopolitical risk, and portfolio diversification.

- Diversification with gold reduces overall portfolio risk: Adding gold to a portfolio can help reduce the impact of market downturns in other asset classes.

- Investors flock to gold when traditional assets underperform: During times of economic stress, investors often shift their assets to gold, seeking stability.

- Increased demand pushes gold prices higher: This increased demand creates a positive feedback loop, pushing gold prices even further upwards.

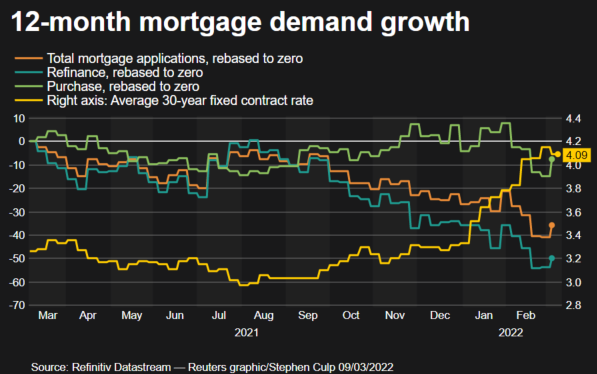

Analyzing the Gold Price Record Rally: Factors Beyond Trade Wars

While trade wars are a significant factor driving the gold price record rally, other elements contribute to this upward trend. Low interest rates, quantitative easing policies implemented by central banks, and a weakening US dollar all play a role. Keywords like interest rates, quantitative easing, US dollar, and gold price drivers are important here.

- Low interest rates make gold more attractive relative to yield-bearing assets: When interest rates are low, the opportunity cost of holding non-interest-bearing assets like gold is reduced.

- Quantitative easing increases money supply, potentially leading to inflation: This inflationary pressure can boost gold prices.

- A weaker US dollar boosts the price of gold denominated in USD: As the dollar weakens, the price of gold (typically quoted in USD) tends to rise.

Conclusion: Capitalizing on the Gold Price Record Rally

In summary, the gold price record rally is a multifaceted phenomenon driven by several factors. Trade wars, creating substantial economic uncertainty, significantly contribute to the increased demand for gold as a safe-haven asset. Coupled with low interest rates, quantitative easing, and a weakening US dollar, these factors have propelled gold prices to record highs. The importance of gold as a diversification tool within an investment portfolio during times of economic and geopolitical uncertainty cannot be overstated. Keywords such as gold investment strategy, safe haven investment, diversify portfolio, and gold price outlook are relevant for this conclusion.

To navigate the current economic climate and potentially benefit from the ongoing gold price record rally, consider adding gold to your portfolio as part of a sound investment strategy. Research different investment options, such as physical gold, gold ETFs, or gold mining stocks, to find the approach that best suits your risk tolerance and financial goals. Consult with a qualified financial advisor to determine the appropriate allocation of gold within your overall investment strategy.

Featured Posts

-

Construction Resumes On Worlds Tallest Abandoned Skyscraper

Apr 26, 2025

Construction Resumes On Worlds Tallest Abandoned Skyscraper

Apr 26, 2025 -

Analysis Dow Futures Chinas Economic Plan And Tariff Impacts On Stocks

Apr 26, 2025

Analysis Dow Futures Chinas Economic Plan And Tariff Impacts On Stocks

Apr 26, 2025 -

Are Stretched Stock Market Valuations A Worry Bof A Weighs In

Apr 26, 2025

Are Stretched Stock Market Valuations A Worry Bof A Weighs In

Apr 26, 2025 -

From Scatological Documents To Podcast Gold The Power Of Ai

Apr 26, 2025

From Scatological Documents To Podcast Gold The Power Of Ai

Apr 26, 2025 -

Cassidy Hutchinson Jan 6 Hearing Testimony And Upcoming Memoir

Apr 26, 2025

Cassidy Hutchinson Jan 6 Hearing Testimony And Upcoming Memoir

Apr 26, 2025

Latest Posts

-

Two Wind Farms And A Pv Plant Approved For Pne Group In Germany

Apr 27, 2025

Two Wind Farms And A Pv Plant Approved For Pne Group In Germany

Apr 27, 2025 -

German Renewables Expansion Pne Group Receives Permits For Wind And Pv Projects

Apr 27, 2025

German Renewables Expansion Pne Group Receives Permits For Wind And Pv Projects

Apr 27, 2025 -

Pne Group Awarded Permits For Two Wind Farms And A Solar Plant In Germany

Apr 27, 2025

Pne Group Awarded Permits For Two Wind Farms And A Solar Plant In Germany

Apr 27, 2025 -

Thueringen Artenvielfalt Von Amphibien Und Reptilien Im Neuen Atlas Dokumentiert

Apr 27, 2025

Thueringen Artenvielfalt Von Amphibien Und Reptilien Im Neuen Atlas Dokumentiert

Apr 27, 2025 -

Entdecken Sie Die Amphibien Und Reptilien Thueringens Der Neue Atlas

Apr 27, 2025

Entdecken Sie Die Amphibien Und Reptilien Thueringens Der Neue Atlas

Apr 27, 2025