Colgate's Q[Quarter] Earnings: Tariff Hikes Slash Profits By $200 Million

![Colgate's Q[Quarter] Earnings: Tariff Hikes Slash Profits By $200 Million Colgate's Q[Quarter] Earnings: Tariff Hikes Slash Profits By $200 Million](https://coucou-freiburg.de/image/colgates-q-quarter-earnings-tariff-hikes-slash-profits-by-200-million.jpeg)

Table of Contents

The $200 Million Impact of Tariffs on Colgate's Q3 Performance

The $200 million profit reduction represents a substantial hit to Colgate's bottom line. This translates to a significant percentage decrease compared to previous quarters (specific percentage should be inserted here based on the actual earnings report). The primary culprit? Increased tariffs on key raw materials and finished goods.

- Specific Tariff Increases: The tariffs primarily affected raw materials like resins and packaging materials, significantly increasing the cost of production for many Colgate products. (Insert specific tariff details here if available, e.g., "The 25% tariff on imported resins alone increased costs by X million dollars").

- Geographic Impact: The impact was felt across various regions, but particularly in markets heavily reliant on imported goods. (Specify affected regions based on the earnings report. Example: "The impact was especially pronounced in the Asian and European markets").

- Pricing Strategy: To partially offset the increased costs, Colgate implemented a strategic price increase on select products. However, this proved to be insufficient to completely mitigate the losses incurred by the tariffs.

Colgate's Strategic Response to Tariff Challenges

Facing this unprecedented challenge, Colgate implemented a multi-pronged strategy to mitigate the negative effects of the tariffs. While the full impact of these strategies won't be apparent for some time, the company's proactive approach is noteworthy.

- Cost-Cutting Measures: Colgate aggressively pursued cost-cutting initiatives across various departments, aiming to streamline operations and improve efficiency. (Include specific examples from the earnings report if available, e.g., "The company announced plans to consolidate manufacturing facilities, resulting in projected savings of Y million dollars").

- Supply Chain Restructuring: The company is actively exploring alternative sourcing strategies to reduce its reliance on tariff-affected suppliers. This includes investigating domestic sourcing options and potentially shifting production to regions with more favorable trade policies.

- Lobbying Efforts: Colgate, along with other consumer goods companies, has engaged in lobbying efforts to advocate for changes in tariff policies. (Mention specifics if available regarding any public statements or lobbying activities).

Impact on Consumers and Future Outlook for Colgate's Earnings

The impact of these tariffs and Colgate's responses extends directly to consumers. The price increases implemented by Colgate to offset some of the increased costs have the potential to reduce consumer purchasing power.

- Future Earnings Prediction: The long-term effect of these tariffs remains uncertain, but analysts predict a continued impact on Colgate's earnings in the coming quarters. (Insert any expert predictions or analyst forecasts here).

- Long-Term Strategy: Colgate's long-term strategy involves a diversified approach encompassing price adjustments, cost-cutting, and supply chain optimization to navigate future trade uncertainties.

- Consumer Behavior Changes: Price increases may lead to changes in consumer behavior, potentially impacting sales volume and market share. Colgate will need to closely monitor these trends.

Comparison to Competitors: Navigating the Tariff Landscape

How did Colgate fare against its competitors? (Name key competitors like Procter & Gamble, Unilever, etc. and compare their Q3 performance related to tariff impacts, using data from their respective earnings reports). This comparative analysis helps understand the unique challenges Colgate faced.

- Competitor Performance: (Provide a brief comparison of the impact of tariffs on major competitors. Mention any similar or different strategies employed).

- Industry Trends: The tariff hikes have impacted the entire consumer goods industry, highlighting the need for increased agility and diversification within supply chains.

- Expert Opinions: (Include relevant quotes or summaries from industry analysts on the overall effect of the tariffs on the sector).

Analyzing Colgate's Q3 Earnings and the Future

In conclusion, Colgate's Q3 earnings clearly demonstrate the significant impact of tariffs on the consumer goods sector. The $200 million loss underscores the vulnerability of global businesses to volatile trade policies. Colgate's strategic response, combining price adjustments, cost-cutting, and supply chain diversification, indicates a proactive approach to mitigating future risks. However, the long-term impact on consumer behavior and future earnings remains to be seen. Stay updated on Colgate's Q3 earnings and the latest developments in the consumer goods industry by following the company's financial news and subscribing to relevant industry publications.

![Colgate's Q[Quarter] Earnings: Tariff Hikes Slash Profits By $200 Million Colgate's Q[Quarter] Earnings: Tariff Hikes Slash Profits By $200 Million](https://coucou-freiburg.de/image/colgates-q-quarter-earnings-tariff-hikes-slash-profits-by-200-million.jpeg)

Featured Posts

-

Ray Epps Defamation Lawsuit Against Fox News January 6th Allegations

Apr 26, 2025

Ray Epps Defamation Lawsuit Against Fox News January 6th Allegations

Apr 26, 2025 -

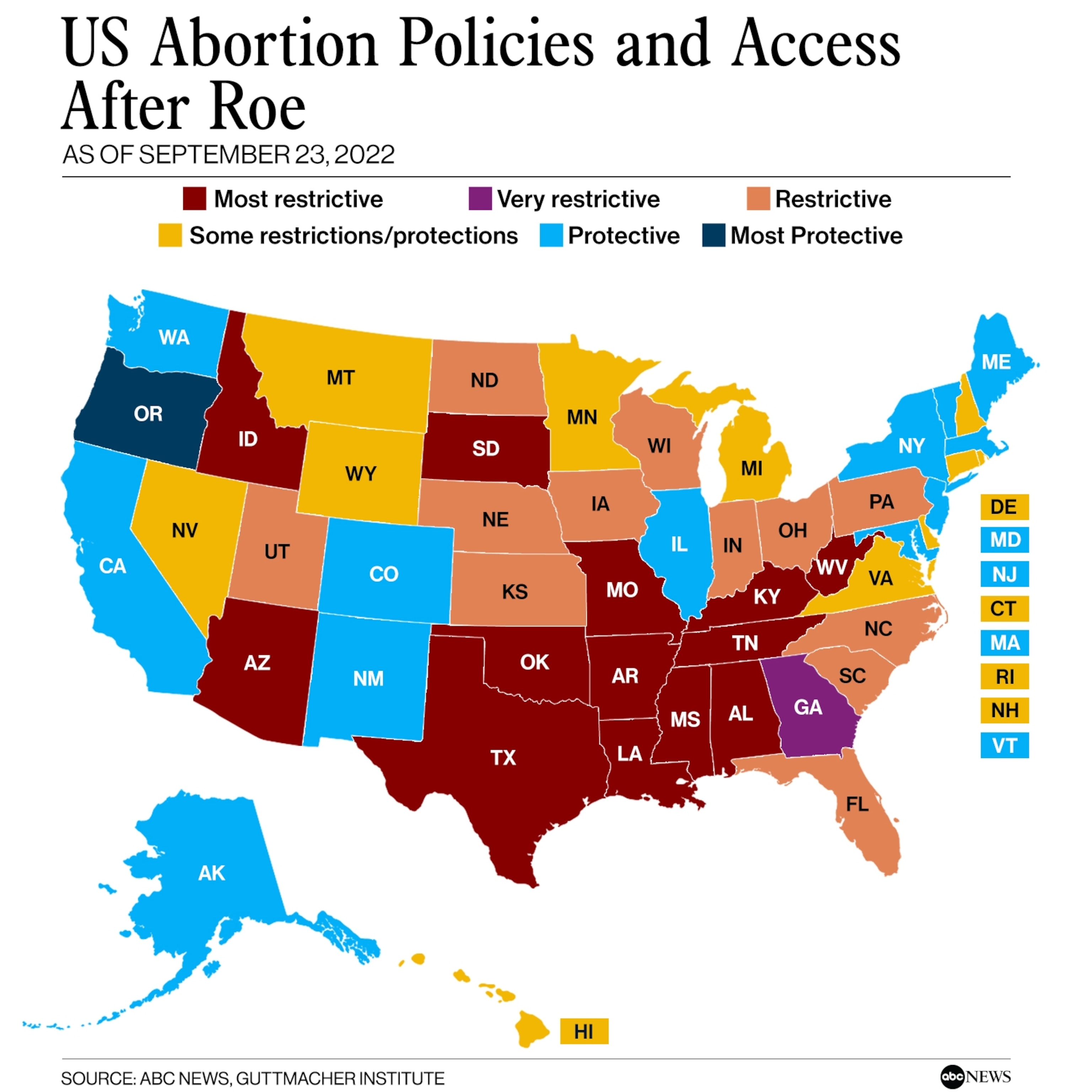

Over The Counter Birth Control Implications For Reproductive Freedom After Roe V Wade

Apr 26, 2025

Over The Counter Birth Control Implications For Reproductive Freedom After Roe V Wade

Apr 26, 2025 -

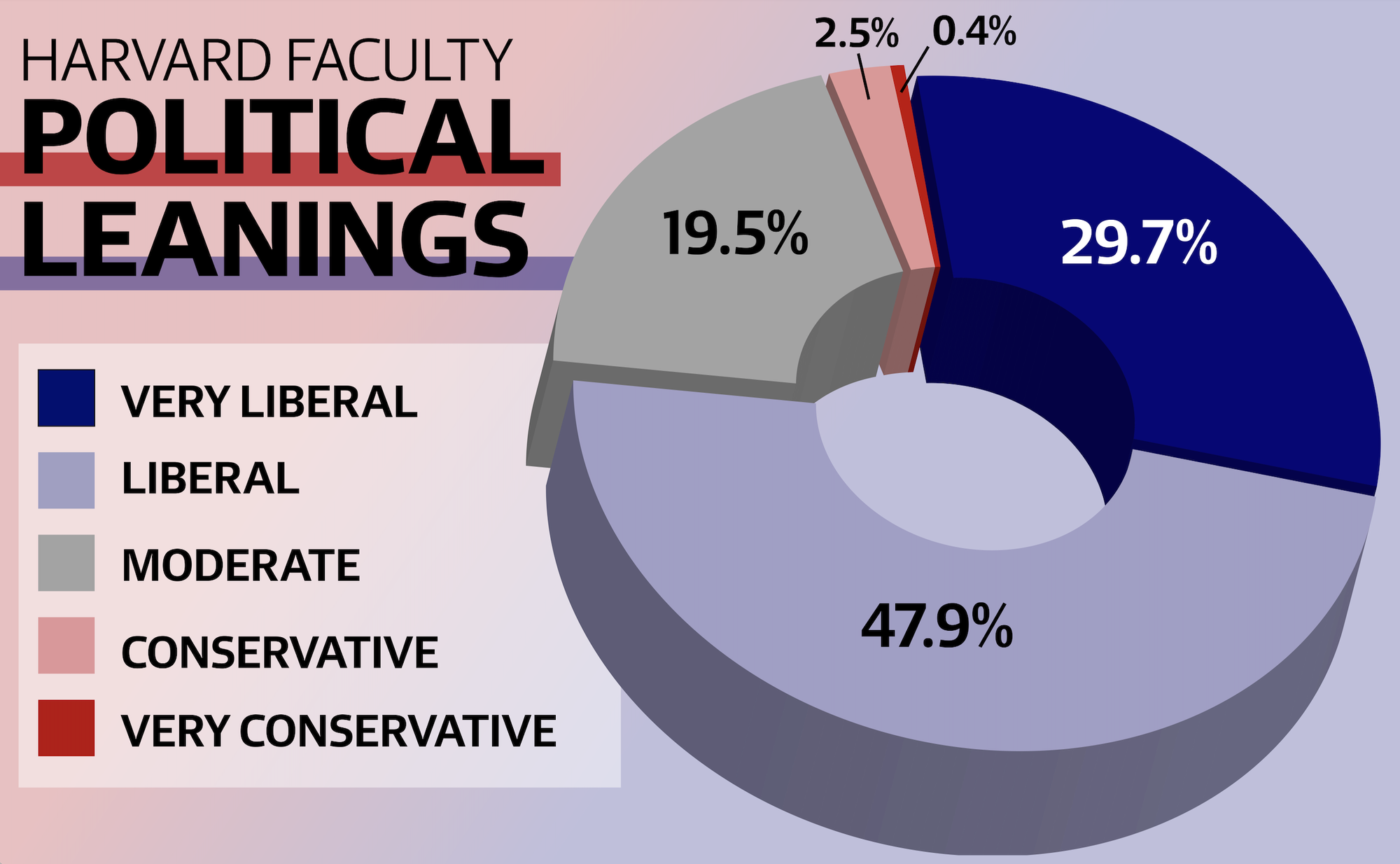

Harvard University A Conservative View On Its Revitalization

Apr 26, 2025

Harvard University A Conservative View On Its Revitalization

Apr 26, 2025 -

Congressional Stock Trading Ban Trumps Position Revealed In Time Interview

Apr 26, 2025

Congressional Stock Trading Ban Trumps Position Revealed In Time Interview

Apr 26, 2025 -

Analysis Of Trumps Comments On Banning Congressional Stock Trades The Time Interview

Apr 26, 2025

Analysis Of Trumps Comments On Banning Congressional Stock Trades The Time Interview

Apr 26, 2025

Latest Posts

-

Pne Groups German Expansion New Permits Granted For Wind And Solar Energy

Apr 27, 2025

Pne Groups German Expansion New Permits Granted For Wind And Solar Energy

Apr 27, 2025 -

Two Wind Farms And A Pv Plant Approved For Pne Group In Germany

Apr 27, 2025

Two Wind Farms And A Pv Plant Approved For Pne Group In Germany

Apr 27, 2025 -

German Renewables Expansion Pne Group Receives Permits For Wind And Pv Projects

Apr 27, 2025

German Renewables Expansion Pne Group Receives Permits For Wind And Pv Projects

Apr 27, 2025 -

Pne Group Awarded Permits For Two Wind Farms And A Solar Plant In Germany

Apr 27, 2025

Pne Group Awarded Permits For Two Wind Farms And A Solar Plant In Germany

Apr 27, 2025 -

Thueringen Artenvielfalt Von Amphibien Und Reptilien Im Neuen Atlas Dokumentiert

Apr 27, 2025

Thueringen Artenvielfalt Von Amphibien Und Reptilien Im Neuen Atlas Dokumentiert

Apr 27, 2025