Time Interview: Trump's Support For Ban On Congressional Stock Trading

Table of Contents

Trump's Stance on a Congressional Stock Trading Ban

The Time Interview Statements

During the Time interview, Donald Trump expressed strong support for a ban on congressional stock trading, stating (and here we would insert direct quotes from the interview if available). His reasoning centered on the perception of impropriety and the potential for conflicts of interest. He argued that such a ban would significantly boost public trust in government and restore faith in elected officials. While the exact wording needs verification from the interview transcript, his support seemed unequivocal. One might speculate that his endorsement, coming from a prominent figure outside the current political establishment, could be strategically aimed at appealing to voters concerned about government ethics.

- Direct Quote 1: [Insert direct quote from the Time interview here]

- Direct Quote 2: [Insert direct quote from the Time interview here]

- Summary of Reasoning: Trump emphasized the need for restoring public trust and eliminating the appearance of corruption.

- Potential Political Motivations: Trump's stance could be interpreted as an attempt to appeal to voters disillusioned with Washington's ethical standards, potentially gaining political advantage.

Comparison to Previous Statements

Trump's current stance on a congressional stock trading ban appears consistent with previous comments he's made regarding government ethics reform. While specific instances need to be researched and detailed here, [insert examples of previous statements or actions related to ethics reform]. However, a thorough analysis of his past record is necessary to fully understand the consistency or evolution of his views.

- Example 1: [Insert example of a past statement or action]

- Example 2: [Insert example of a past statement or action]

- Inconsistencies/Shifts: [Analyze any inconsistencies or shifts in his position over time.]

Public Reaction to Trump's Support

The public reaction to Trump's endorsement of a ban on congressional stock trading has been largely positive, with many praising the move as a necessary step towards greater government transparency. [Insert summary of media responses from various news outlets and journalistic perspectives]. Public opinion polls on this matter will need to be examined to get a clear view of the popular consensus.

- Media Responses: [Summarize media coverage, highlighting positive and negative reactions.]

- Public Opinion Polls: [Cite any relevant polls and surveys reflecting public sentiment on this issue.]

- Analysis of Public Sentiment: [Provide an overall assessment of the public's reaction to Trump's statement.]

Arguments For and Against a Congressional Stock Trading Ban

Arguments in Favor

The primary arguments in favor of a ban on congressional stock trading center on ethical concerns and the prevention of conflicts of interest. Proponents argue that such a ban would:

- Increased Public Trust: Eliminating the possibility of insider trading would significantly improve public confidence in the integrity of the government.

- Reduced Potential for Insider Trading: A ban would directly address the inherent conflict of interest present when lawmakers have access to non-public information.

- Strengthened Ethical Standards: The ban would set a higher ethical standard for lawmakers, promoting greater transparency and accountability.

- Improved Transparency: A clear prohibition would remove any ambiguity about what constitutes acceptable financial behavior for members of Congress.

Arguments Against

Opponents of a congressional stock trading ban raise concerns about practicality, individual liberties, and potential unintended consequences. They argue:

- Restricting Lawmakers' Financial Freedom: A ban might unfairly limit lawmakers' investment options and their ability to manage their personal finances.

- Challenges in Defining and Enforcing the Ban: Creating and enforcing a comprehensive ban that addresses all potential loopholes could prove difficult and resource-intensive.

- Potential for Unintended Consequences: The ban might inadvertently create new problems or discourage qualified individuals from seeking public office.

- Impact on Diversity of Political Representation: The ban could disproportionately affect certain demographics or political affiliations, limiting the diversity of representation in Congress.

The Current Legislative Landscape Regarding Congressional Stock Trading

Existing Regulations

Currently, existing regulations governing the financial activities of members of Congress are [insert details about existing laws and regulations, including their effectiveness and examples of violations/penalties]. These regulations often lack the clarity and enforcement mechanisms needed to address the complexities of modern financial markets.

- Description of Existing Rules: [Detailed description of current regulations.]

- Evaluation of Effectiveness: [Assess how effective the current rules are in preventing conflicts of interest.]

- Examples of Past Violations and Penalties: [Provide specific examples to illustrate any shortcomings.]

Proposed Legislation

Several bills and proposals aimed at banning or reforming congressional stock trading are currently under consideration in Congress. [Insert details about key proposals, their likelihood of passage, and comparisons of different approaches]. The debate is ongoing, and the specifics of any legislation are likely to evolve.

- Summary of Key Proposals: [Summarize the main features of different proposed bills.]

- Analysis of Likelihood of Passage: [Assess the chances of different proposals becoming law.]

- Comparison of Different Approaches: [Compare and contrast the various approaches to regulating congressional stock trading.]

Conclusion

Donald Trump's outspoken support for a ban on congressional stock trading, as highlighted in his recent Time interview, has placed this critical issue firmly in the national spotlight. The arguments for and against a ban are complex, touching on ethical concerns, practical challenges, and the potential impact on the integrity of American democracy. The current legislative landscape reflects a need for reform, with existing regulations proving insufficient to prevent conflicts of interest. While concerns about unintended consequences must be carefully considered, the potential benefits of increased public trust and reduced opportunities for insider trading make the debate over a Congressional Stock Trading Ban crucial.

The Time interview has brought the crucial issue of a Congressional Stock Trading Ban into sharp focus. It's time for informed citizens to engage with this debate, contact their elected officials, and demand greater transparency and accountability from their representatives. Learn more about proposed legislation and advocate for stronger ethical standards in Congress. Understanding the implications of a ban on congressional stock trading is essential for preserving the integrity of our government.

Featured Posts

-

Land Your Dream Private Credit Job 5 Essential Tips

Apr 26, 2025

Land Your Dream Private Credit Job 5 Essential Tips

Apr 26, 2025 -

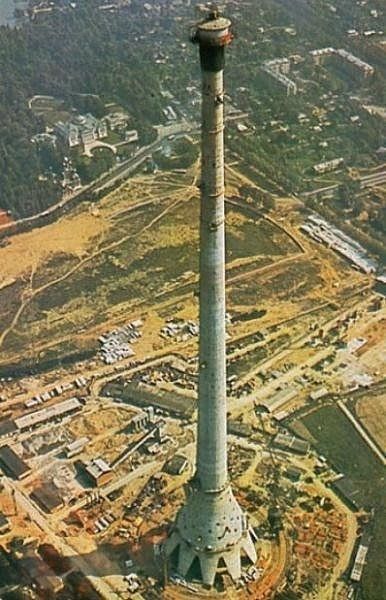

After A Decade Of Silence Work Resumes On Worlds Tallest Abandoned Building

Apr 26, 2025

After A Decade Of Silence Work Resumes On Worlds Tallest Abandoned Building

Apr 26, 2025 -

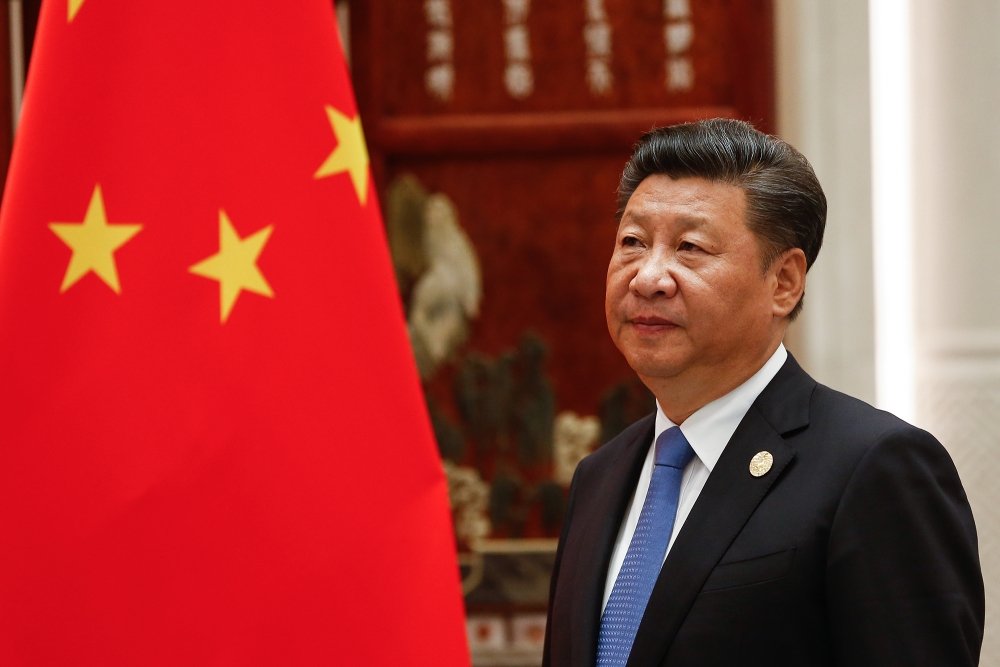

The Military Base At The Heart Of Us China Rivalry

Apr 26, 2025

The Military Base At The Heart Of Us China Rivalry

Apr 26, 2025 -

Stock Market Valuation Concerns Bof As Perspective And Analysis

Apr 26, 2025

Stock Market Valuation Concerns Bof As Perspective And Analysis

Apr 26, 2025 -

Geopolitical Showdown A Key Military Base And The Us China Power Struggle

Apr 26, 2025

Geopolitical Showdown A Key Military Base And The Us China Power Struggle

Apr 26, 2025

Latest Posts

-

Professional Styling Decoded Understanding Ariana Grandes Dramatic Makeover

Apr 27, 2025

Professional Styling Decoded Understanding Ariana Grandes Dramatic Makeover

Apr 27, 2025 -

Exploring Ariana Grandes Hair And Tattoo Transformation Professional Commentary

Apr 27, 2025

Exploring Ariana Grandes Hair And Tattoo Transformation Professional Commentary

Apr 27, 2025 -

Ariana Grandes Bold New Look A Professional Assessment Of Her Hair And Tattoos

Apr 27, 2025

Ariana Grandes Bold New Look A Professional Assessment Of Her Hair And Tattoos

Apr 27, 2025 -

Analyzing Ariana Grandes New Style Professional Opinions On Her Transformation

Apr 27, 2025

Analyzing Ariana Grandes New Style Professional Opinions On Her Transformation

Apr 27, 2025 -

The Professionals Take On Ariana Grandes Latest Hair And Tattoo Choices

Apr 27, 2025

The Professionals Take On Ariana Grandes Latest Hair And Tattoo Choices

Apr 27, 2025