Land Your Dream Private Credit Job: 5 Essential Tips

Table of Contents

Master the Core Skills of Private Credit

Private credit roles demand a strong grasp of financial analysis. This includes proficiency in credit analysis, financial modeling, valuation techniques, and due diligence processes. Understanding leveraged finance principles is also crucial, as many private credit transactions involve leveraged buyouts or refinancing. Proficiency in these areas will significantly improve your chances of landing your dream private credit job.

- Develop expertise in financial modeling: Mastering Excel and potentially specialized software like Argus or Bloomberg is paramount. Practice building complex models that accurately reflect the financial health and projections of businesses.

- Understand different valuation methodologies: Become proficient in discounted cash flow (DCF) analysis, precedent transactions, and comparable company analysis to accurately assess the value of potential investments.

- Master the art of credit underwriting and risk assessment: Develop a deep understanding of credit risk, including assessing collateral, analyzing financial statements, and identifying potential red flags.

- Gain practical experience: Internships in private equity, investment banking, or directly within private credit firms provide invaluable hands-on experience. Consider undertaking personal projects to build your portfolio and demonstrate your skills.

- Build a strong understanding of leveraged finance principles: Understand concepts such as leverage ratios, debt covenants, and the impact of debt on company performance.

Build a Strong and Targeted Resume & Cover Letter

Your resume and cover letter are your first impression. Tailoring these documents to each specific private credit job application is critical. Highlight relevant skills and experiences using keywords from the job description to optimize your chances of getting noticed by recruiters and Applicant Tracking Systems (ATS).

- Quantify your achievements: Instead of simply listing responsibilities, quantify your accomplishments whenever possible. For instance, replace "Managed client relationships" with "Managed a portfolio of 20+ clients, resulting in a 15% increase in client retention."

- Use action verbs: Start your bullet points with strong action verbs that showcase your impact (e.g., "analyzed," "developed," "implemented," "managed").

- Highlight relevant coursework, projects, and extracurricular activities: Showcase relevant skills gained through academic projects, coursework in finance, or participation in finance clubs.

- Customize your cover letter: Generic cover letters won't cut it. Tailor each cover letter to the specific job description and the company culture.

- Optimize your resume and LinkedIn profile for ATS: Use keywords relevant to private credit, ensuring your resume is easily parsed by ATS software.

Network Strategically within the Private Credit Industry

Networking is crucial in securing a private credit job. Actively cultivate relationships with professionals in the industry to gain insights, learn about potential opportunities, and build your professional brand.

- Attend industry conferences and workshops: These events provide excellent opportunities to meet professionals, learn about industry trends, and make valuable connections.

- Join relevant professional organizations: Membership in organizations like the American Investment Council or similar regional groups can help you connect with like-minded individuals and gain access to exclusive networking events.

- Actively network on LinkedIn and other professional platforms: Engage in relevant discussions, share insightful articles, and connect with professionals in private credit.

- Conduct informational interviews: Reach out to professionals in private credit for informational interviews to learn more about their career paths and gain valuable insights.

- Seek out mentorship opportunities: Mentorship can provide invaluable guidance and support as you navigate your career in private credit.

Prepare for the Private Credit Interview Process

The interview process for private credit roles often includes technical questions on financial modeling, credit analysis, and market knowledge, as well as behavioral questions assessing your personality and fit within the team.

- Practice your answers to common behavioral interview questions (STAR method): Use the STAR method (Situation, Task, Action, Result) to structure your answers and highlight your achievements and problem-solving skills.

- Prepare for technical questions related to financial modeling and credit analysis: Practice building models, interpreting financial statements, and assessing credit risk. Be prepared to discuss your understanding of different valuation methodologies.

- Research the firm and the interviewers beforehand: Demonstrate your genuine interest by thoroughly researching the firm's investment strategy, recent transactions, and the interviewers' backgrounds.

- Practice case studies relevant to private credit investing: Be prepared to analyze a hypothetical investment opportunity, assessing the risks and potential returns.

- Prepare insightful questions to ask the interviewer: Asking thoughtful questions demonstrates your engagement and interest in the role and the firm.

Showcase Your Passion and Unique Value Proposition

Demonstrate your genuine interest in private credit and highlight what makes you a unique and valuable candidate. What sets you apart from other applicants? Show your passion for the industry and your commitment to success.

- Highlight your unique skills and experiences: What unique skills or experiences do you bring to the table? Focus on your strengths and how they align with the specific requirements of the role.

- Demonstrate your understanding of market trends and industry dynamics: Stay informed about current events and trends in the private credit market.

- Showcase your passion for the private credit industry: Express your enthusiasm for the industry and explain why you are particularly interested in this specific career path.

- Emphasize your long-term career goals within private credit: Demonstrate your commitment to a long-term career in private credit and articulate how this role fits into your overall career aspirations.

- Articulate your personal brand and how it aligns with the firm's culture: Develop a clear understanding of your personal brand and how it aligns with the firm's values and culture.

Conclusion

Landing your dream private credit job is achievable with the right preparation and strategy. By mastering core skills, crafting compelling application materials, networking effectively, preparing for interviews, and showcasing your unique value proposition, you'll significantly increase your chances of success. Don't delay – start working on these five essential tips today and begin your journey towards a rewarding career in private credit. Start building your skills and network now to secure your ideal private credit career!

Featured Posts

-

Orlandos Hottest New Restaurants 7 To Try In 2025 Beyond Disney

Apr 26, 2025

Orlandos Hottest New Restaurants 7 To Try In 2025 Beyond Disney

Apr 26, 2025 -

Analyzing The Countrys Thriving Business Ecosystems

Apr 26, 2025

Analyzing The Countrys Thriving Business Ecosystems

Apr 26, 2025 -

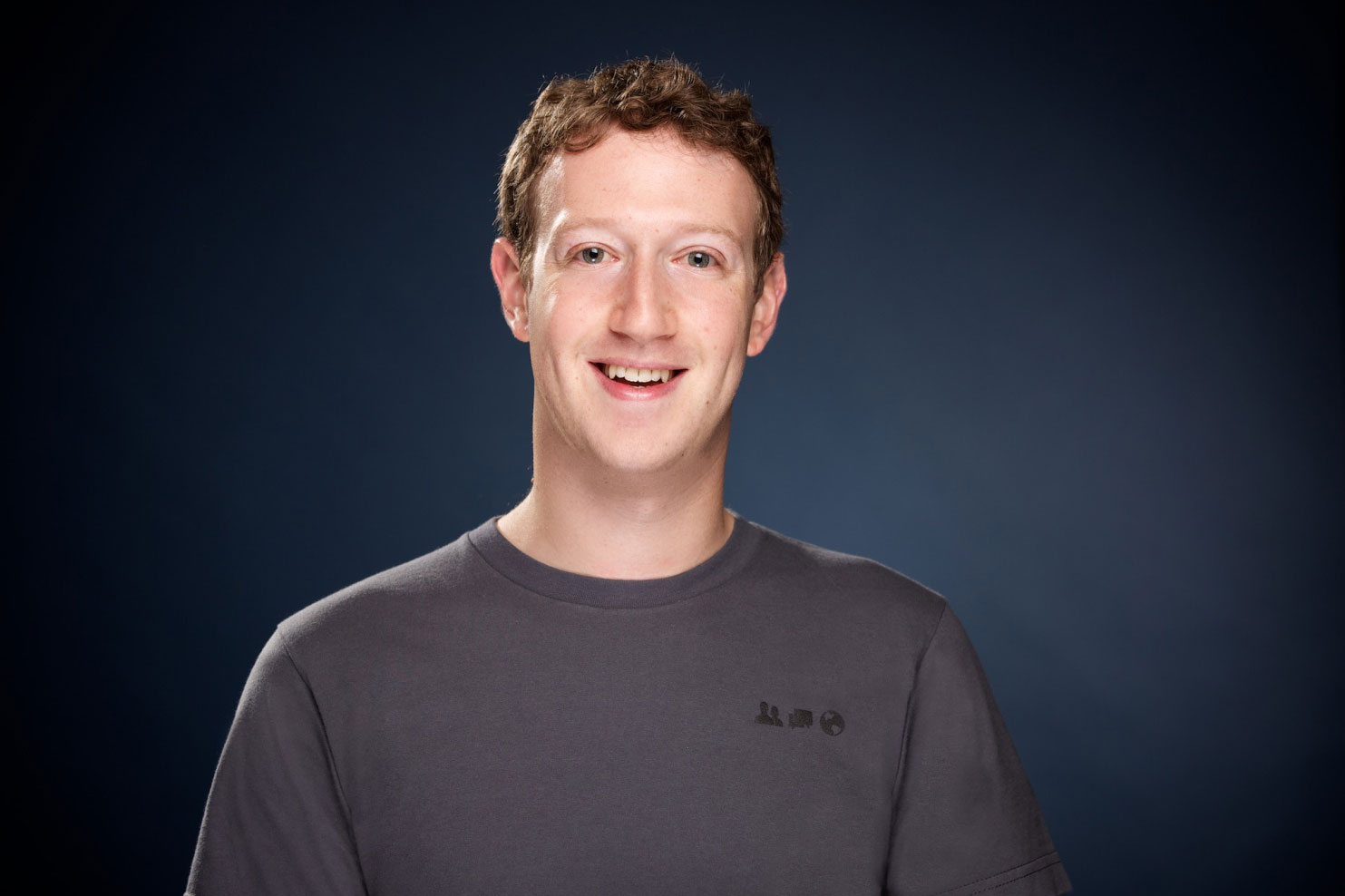

Metas Future Under President Trump Zuckerbergs Strategic Response

Apr 26, 2025

Metas Future Under President Trump Zuckerbergs Strategic Response

Apr 26, 2025 -

Ukraines Nato Path Obstacles And Trumps Influence

Apr 26, 2025

Ukraines Nato Path Obstacles And Trumps Influence

Apr 26, 2025 -

Land Your Dream Private Credit Job 5 Essential Tips

Apr 26, 2025

Land Your Dream Private Credit Job 5 Essential Tips

Apr 26, 2025

Latest Posts

-

How Professionals Helped Ariana Grande Achieve Her New Look

Apr 27, 2025

How Professionals Helped Ariana Grande Achieve Her New Look

Apr 27, 2025 -

The Impact Of Professional Help On Celebrity Image Ariana Grandes Case Study

Apr 27, 2025

The Impact Of Professional Help On Celebrity Image Ariana Grandes Case Study

Apr 27, 2025 -

Hair And Tattoo Transformations Learning From Ariana Grandes Choices

Apr 27, 2025

Hair And Tattoo Transformations Learning From Ariana Grandes Choices

Apr 27, 2025 -

Ariana Grandes Bold New Look A Look At Professional Styling And Body Art

Apr 27, 2025

Ariana Grandes Bold New Look A Look At Professional Styling And Body Art

Apr 27, 2025 -

Understanding Ariana Grandes Style Changes The Importance Of Professional Guidance

Apr 27, 2025

Understanding Ariana Grandes Style Changes The Importance Of Professional Guidance

Apr 27, 2025