Stock Market Volatility: Investors Anticipate Continued Challenges

Table of Contents

Macroeconomic Factors Driving Stock Market Volatility

Several macroeconomic factors are significantly contributing to the current stock market volatility. These interconnected elements create a complex and often unpredictable environment for investors. Understanding these factors is key to developing a robust investment strategy that can withstand market fluctuations.

-

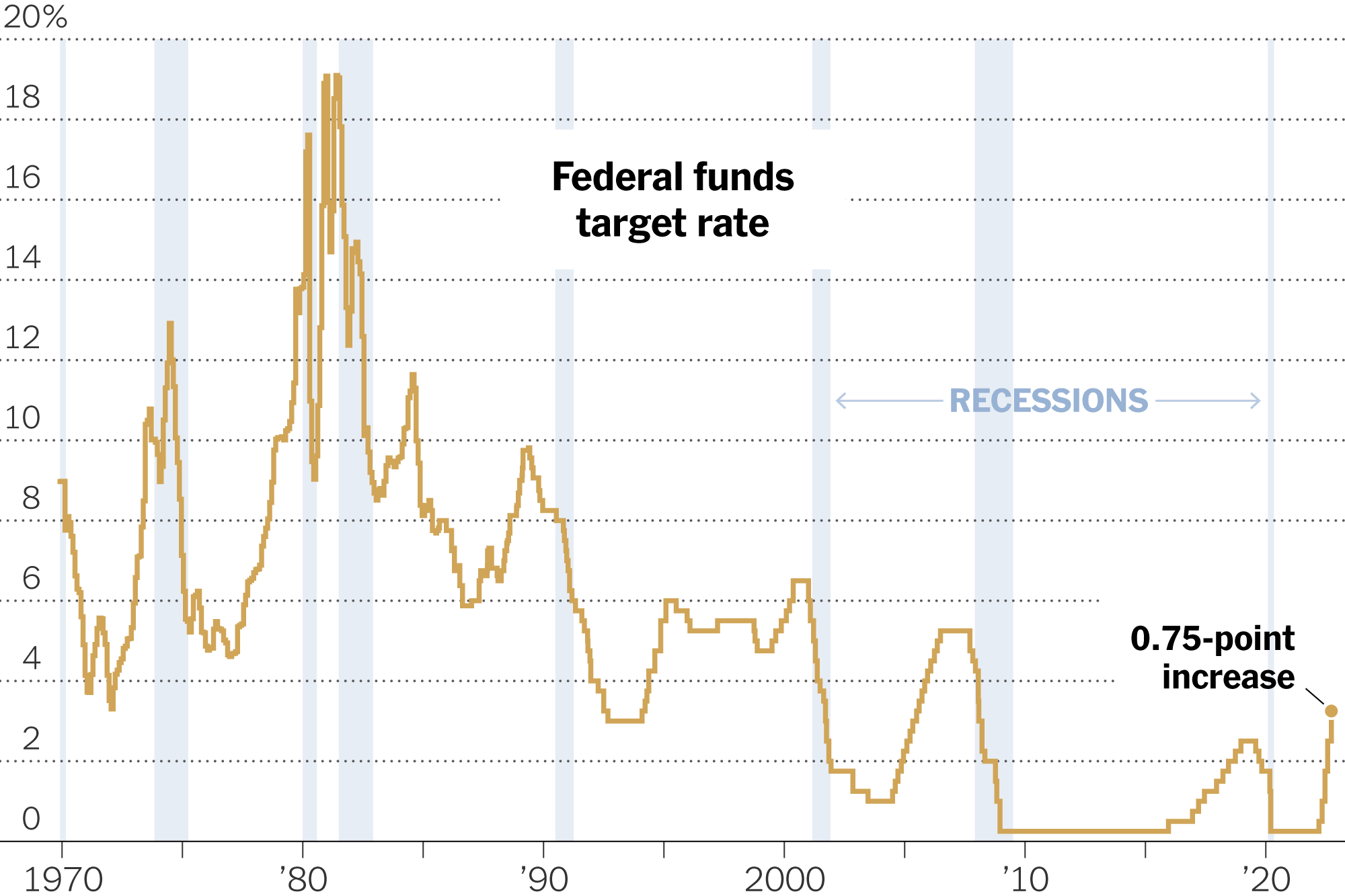

High Inflation and Interest Rates: High inflation erodes purchasing power, impacting consumer spending and corporate profits. Central banks respond by raising interest rates, aiming to curb inflation. However, aggressive interest rate hikes increase borrowing costs for businesses and consumers, potentially slowing economic growth and even triggering a recession. This creates a delicate balancing act with significant implications for market volatility. The interplay between inflation and interest rates is a major driver of current market uncertainty.

-

Geopolitical Uncertainty: Global geopolitical instability, such as the ongoing war in Ukraine, introduces significant uncertainty into the market. These events disrupt supply chains, impact energy prices, and create uncertainty about future economic growth, all contributing to increased market volatility. The ripple effects of geopolitical events can be substantial and unpredictable, making risk management even more critical.

-

Supply Chain Disruptions: Persistent supply chain disruptions continue to fuel inflationary pressures. The inability to consistently and efficiently produce and distribute goods contributes to higher prices and increased uncertainty for businesses, further impacting market stability. These disruptions are a lingering consequence of the pandemic and are exacerbating existing economic challenges.

-

Recessionary Fears: The threat of a recession looms large, significantly influencing investor sentiment and driving market volatility. Concerns about economic slowdown, coupled with high inflation and rising interest rates, fuel anxiety and lead to increased market fluctuations. Recessionary fears often lead to increased risk aversion and a sell-off in the stock market.

Impact of Volatility on Different Asset Classes

Stock market volatility doesn't impact all asset classes equally. Understanding how different investments react to market fluctuations is crucial for effective portfolio diversification and risk management.

-

Equities (Stocks): Equities are generally the most susceptible to short-term volatility. Stock prices can fluctuate dramatically in response to news, economic data, and investor sentiment. While stocks offer the potential for higher returns over the long term, they also carry greater risk during periods of market uncertainty.

-

Bonds: While often considered less volatile than stocks, bond yields can rise as interest rates increase, impacting bond prices and returns. This inverse relationship between bond prices and interest rates means that rising interest rates can lead to capital losses on bond investments. However, bonds can still offer diversification benefits within a portfolio.

-

Real Estate: Real estate investments can offer some diversification, but their value can be influenced by economic downturns. Factors like interest rates, inflation, and overall economic conditions can impact real estate values and rental income.

-

Alternative Investments: Alternative investments, such as commodities or private equity, may provide some protection during periods of market volatility, but they also come with their own set of risks and complexities. These investments often have less liquidity and can be more difficult to value than traditional asset classes.

-

Portfolio Diversification and Risk Management: Effective portfolio diversification and robust risk management strategies are vital to mitigating the impact of market volatility. A well-diversified portfolio can help reduce the overall risk and improve the chances of achieving long-term investment goals.

Strategies for Managing Volatility

Managing market volatility effectively requires a proactive approach and a clear understanding of your investment goals and risk tolerance.

-

Risk Tolerance: Assessing your personal risk tolerance is the fundamental first step. Understanding your comfort level with potential investment losses helps determine the appropriate asset allocation for your portfolio.

-

Long-Term Investing: A long-term investment horizon is crucial for weathering short-term market fluctuations. Focusing on long-term investment goals helps to minimize the emotional impact of short-term market volatility.

-

Diversification Strategy: Diversifying your portfolio across different asset classes is a cornerstone of effective risk management. This strategy helps reduce the impact of any single asset's poor performance.

-

Dollar-Cost Averaging: Dollar-cost averaging, a strategy that involves investing a fixed amount of money at regular intervals, can help mitigate the impact of market timing on your investment returns. This approach helps smooth out the volatility of buying at different price points.

-

Professional Financial Advice: Seeking professional financial advice from a qualified advisor can provide personalized guidance and support for navigating market volatility. A financial advisor can help create a tailored investment strategy aligned with your risk tolerance and financial goals.

Investor Sentiment and Market Psychology

Investor sentiment and market psychology play a significant role in driving market volatility. Understanding these psychological factors can provide insights into market trends and potential risks.

-

Negative Investor Sentiment: Negative investor sentiment can fuel market downturns through sell-offs, creating a self-fulfilling prophecy. Fear and uncertainty can lead to panic selling, further depressing prices.

-

Fear and Greed: Market psychology is often driven by fear and greed. Fear of further losses can lead to hasty decisions, while greed can lead to over-investment in risky assets. These emotions can create dramatic swings in market sentiment and price movements.

-

Herd Behavior: Herd behavior, where investors mimic the actions of others, can amplify market swings. This phenomenon can lead to bubbles and crashes as investors follow the crowd without considering individual circumstances.

-

Media Influence: Media coverage and narratives can profoundly influence investor sentiment and market volatility. Sensational headlines and biased reporting can exacerbate fear and uncertainty, influencing market behavior.

Conclusion

Stock market volatility is driven by a complex interplay of macroeconomic factors, asset class performances, and investor sentiment. Navigating these challenges requires a well-defined investment strategy, a thorough understanding of your risk tolerance, and potentially, professional financial guidance. Understanding and effectively managing stock market volatility is critical for achieving long-term investment success. Learn more about strategies to mitigate risk and protect your portfolio in a volatile market environment. Contact a financial advisor today to discuss your investment strategy and how to navigate market volatility effectively.

Featured Posts

-

Economists Weigh In Understanding The Bank Of Canadas Interest Rate Decision

Apr 22, 2025

Economists Weigh In Understanding The Bank Of Canadas Interest Rate Decision

Apr 22, 2025 -

How Tik Tok Videos Are Helping Businesses Avoid Trump Tariffs

Apr 22, 2025

How Tik Tok Videos Are Helping Businesses Avoid Trump Tariffs

Apr 22, 2025 -

Evaluating The Distributional Effects Of Trumps Economic Policies

Apr 22, 2025

Evaluating The Distributional Effects Of Trumps Economic Policies

Apr 22, 2025 -

Jeff Bezos Space Ambitions Falter A Bigger Blow Than Katy Perry S

Apr 22, 2025

Jeff Bezos Space Ambitions Falter A Bigger Blow Than Katy Perry S

Apr 22, 2025 -

Court Battle Resumes Dojs Antitrust Case Against Googles Search Dominance

Apr 22, 2025

Court Battle Resumes Dojs Antitrust Case Against Googles Search Dominance

Apr 22, 2025