Economists Weigh In: Understanding The Bank Of Canada's Interest Rate Decision

Table of Contents

The Bank of Canada's Rationale Behind the Decision

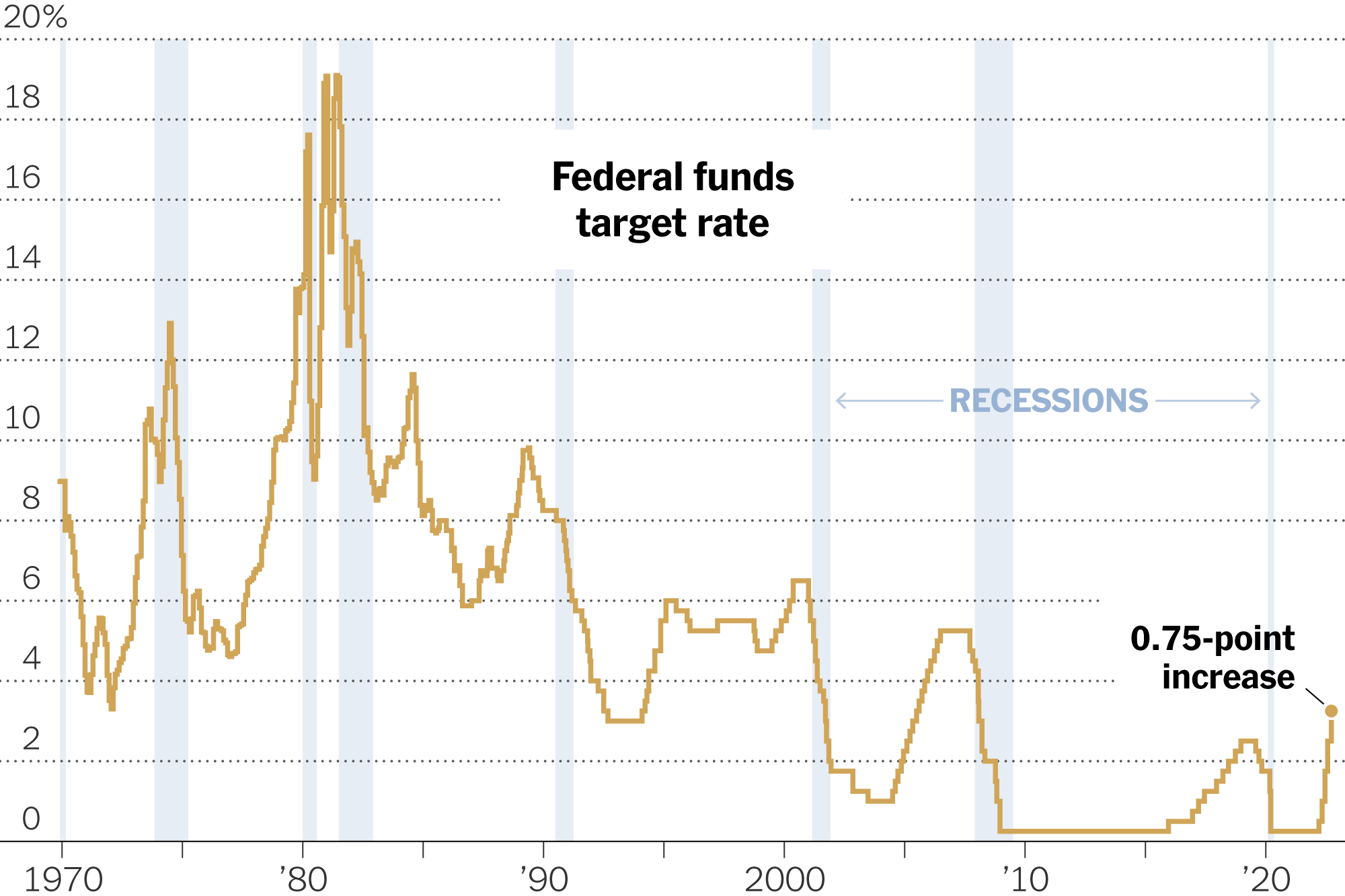

The Bank of Canada's decision on interest rates is a complex process influenced by a multitude of factors. Their primary mandate is to maintain price stability and promote sustainable economic growth. The recent Bank of Canada's interest rate decision was largely shaped by the following considerations:

- Inflation Rate: Persistently high inflation, as measured by the Consumer Price Index (CPI), remains a significant concern. The Bank cited CPI figures consistently above their target range as a key driver for their decision.

- Employment Rate: While unemployment remains relatively low, the Bank considered the tightness of the labor market and its contribution to wage pressures and inflationary pressures.

- Economic Growth: The Bank’s assessment of Canada's economic growth trajectory, including projections for Gross Domestic Product (GDP) growth, played a significant role. Concerns about overheating prompted tighter monetary policy.

- Global Economic Conditions: The Bank also considered global economic factors, including international inflation, geopolitical instability, and supply chain disruptions, which all affect the Canadian economy.

Specific Data Points Cited by the Bank of Canada:

- CPI for [Month]: [Specific Percentage]

- Unemployment Rate for [Month]: [Specific Percentage]

- GDP Growth Projection for [Year]: [Specific Percentage]

The Bank's communication strategy involved a detailed press release, explaining the rationale behind the decision and offering forward guidance on potential future interest rate adjustments. Transparency and clear communication are vital for managing market expectations.

Expert Opinions on the Interest Rate Decision

The Bank of Canada's interest rate decision has elicited a range of responses from leading economists across the country. Analyzing these diverse perspectives offers a more nuanced understanding of the implications.

-

Dr. X, Chief Economist at [Financial Institution]: Dr. X praised the Bank's proactive approach to tackling inflation, arguing that a decisive interest rate hike was necessary to prevent a wage-price spiral. He foresees a gradual slowdown in economic activity but believes it’s a necessary correction.

-

Professor Y, Department of Economics, [University]: Professor Y expressed concerns about the potential negative impact of higher interest rates on vulnerable segments of the population and small businesses. She advocates for a more cautious approach, emphasizing the importance of considering social equity alongside economic stability.

Summary of Economist Opinions:

- Supportive: Many economists believe the Bank of Canada acted appropriately given the high inflation figures.

- Cautious: Other economists are concerned about the potential negative effects on economic growth and employment.

- Divergent Views: The range of opinions highlights the complexity of the issue and the uncertainty surrounding future economic conditions.

Impact on Key Economic Sectors

The Bank of Canada's interest rate decision will have a ripple effect across various sectors of the Canadian economy.

-

Housing Market: Higher interest rates are expected to cool down the overheated housing market by increasing mortgage rates and reducing borrowing capacity, potentially leading to decreased home prices.

-

Manufacturing: Increased borrowing costs could dampen business investment and reduce manufacturing output. Businesses might postpone expansion plans due to higher financing costs.

-

Consumer Spending: Higher interest rates lead to reduced consumer confidence and discretionary spending as individuals face higher borrowing costs on credit cards and loans.

Impact Summary:

- Positive Impacts: A potential slowdown in inflation.

- Negative Impacts: Reduced economic growth, potential job losses in some sectors, decreased consumer spending.

Long-Term Implications and Future Predictions

Economists offer varying predictions regarding future interest rate movements. Several scenarios are possible:

-

Scenario 1: Gradual Rate Increases: Continued inflation could necessitate further interest rate increases in the coming months, gradually slowing economic growth.

-

Scenario 2: Pause and Assessment: The Bank may pause rate hikes to assess the impact of previous increases on inflation and economic activity.

-

Scenario 3: Rate Cuts: If inflation falls significantly, the Bank may consider cutting interest rates to stimulate economic growth.

Global events, such as shifts in energy prices or geopolitical instability, could significantly impact the Canadian economy and influence future Bank of Canada decisions.

Future Scenarios:

- Risk: A prolonged period of high inflation could lead to more aggressive rate hikes.

- Opportunity: A successful inflation reduction could allow for a quicker return to economic growth.

Conclusion

The Bank of Canada's interest rate decision is a pivotal moment in the Canadian economy, impacting inflation, employment, and various economic sectors. Economists offer differing perspectives on the decision's effectiveness and long-term implications, highlighting the complexities involved. Understanding the Bank of Canada's interest rate decision is vital for both individuals and businesses in navigating the current financial landscape. To stay informed, follow the Bank of Canada's official website for updates and further analysis. Continue your learning by exploring resources from reputable financial institutions and economic research organizations. Keeping abreast of future Bank of Canada's interest rate decisions is key to making informed financial choices.

Featured Posts

-

1 Billion More Trump Administration Deepens Cuts To Harvard Funding

Apr 22, 2025

1 Billion More Trump Administration Deepens Cuts To Harvard Funding

Apr 22, 2025 -

Hegseths Private Signal Messages Details Of Military Strategies Disclosed

Apr 22, 2025

Hegseths Private Signal Messages Details Of Military Strategies Disclosed

Apr 22, 2025 -

Statement On The Passing Of Pope Francis

Apr 22, 2025

Statement On The Passing Of Pope Francis

Apr 22, 2025 -

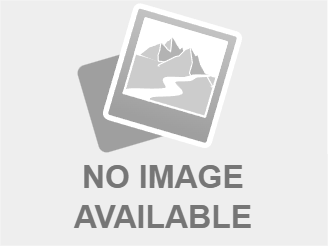

Trumps Economic Legacy Winners And Losers

Apr 22, 2025

Trumps Economic Legacy Winners And Losers

Apr 22, 2025 -

Pope Franciss Legacy The Conclave And The Future Of The Papacy

Apr 22, 2025

Pope Franciss Legacy The Conclave And The Future Of The Papacy

Apr 22, 2025