Evaluating The Distributional Effects Of Trump's Economic Policies

Table of Contents

The Tax Cuts and Jobs Act of 2017 and its Impact

The Tax Cuts and Jobs Act of 2017 (TCJA) stands as a cornerstone of Trump's economic agenda. Its distributional effects remain a subject of intense scrutiny and ongoing debate.

Benefits for High-Income Earners

The TCJA significantly reduced both corporate and individual income tax rates. This resulted in disproportionate benefits for high-income earners and corporations.

- Significant tax rate reductions: The top individual income tax rate was lowered from 39.6% to 37%, while corporate tax rates plummeted from 35% to 21%.

- Increased after-tax income for the top 1%: Numerous studies indicate that the wealthiest Americans experienced a substantial increase in after-tax income due to the TCJA. This fueled concerns about increasing wealth concentration and exacerbating income inequality.

- Impact on wealth concentration: The tax cuts, combined with other policies, arguably contributed to a further widening of the wealth gap between the wealthiest 1% and the rest of the population. This increase in wealth concentration is a significant distributional effect that warrants further investigation.

Effects on the Middle and Lower Classes

While proponents argued the TCJA would stimulate economic growth through "trickle-down economics," its impact on the middle and lower classes was less pronounced and more contested.

- Limited tax burden reduction for many: Many middle-class families experienced only modest reductions in their tax burdens, if any. The benefits were often temporary, outweighed by other factors such as rising healthcare costs or stagnant wages.

- Potential for increased national debt: The TCJA significantly increased the national debt, raising concerns about its long-term consequences for future generations. This debt burden could disproportionately affect lower and middle-income families through reduced government spending on social programs and infrastructure.

- Trickle-down economics debate: The effectiveness of trickle-down economics as a mechanism for broadly distributing economic benefits remains a hotly debated topic among economists. Empirical evidence supporting this theory remains limited and inconclusive, particularly with regards to the TCJA.

The Impact of Trump's Trade Policies

Trump's administration pursued a protectionist trade agenda, initiating trade wars with several countries, most notably China. This had profound and varied distributional consequences.

Trade Wars and Their Consequences

The imposition of tariffs on imported goods from China and other nations had a ripple effect throughout the US economy.

- Tariffs on Chinese goods: These tariffs led to higher prices for consumers on many imported goods, affecting all income groups, but disproportionately impacting lower-income households who spend a larger share of their income on necessities.

- Impact on specific industries: Industries such as agriculture and manufacturing experienced both benefits and hardships. While some domestic industries benefited from increased protection, others faced retaliatory tariffs from other countries, leading to job losses.

- Costs and benefits of protectionism: The trade wars highlighted the complexities of protectionist policies. While some sectors saw short-term gains, the overall economic impact was arguably negative, with higher prices and reduced global trade.

- Job losses and gains: Data on job losses and gains varied considerably across sectors and regions. While some domestic industries saw employment increases, others suffered significant job losses due to reduced exports and retaliatory tariffs.

Winners and Losers in the Trade Wars

The distributional effects of Trump's trade policies were uneven, creating a clear divide between winners and losers.

- Beneficiaries: Certain domestic industries, particularly those that received significant tariff protection, experienced increased profits and employment.

- Negative consequences: Consumers faced higher prices for imported goods, and some industries reliant on exports suffered significant losses. Workers in export-oriented sectors experienced job losses or wage stagnation.

- Geographic distribution: The winners and losers were not uniformly distributed geographically. Some states and regions benefited from the trade policies more than others, leading to regional economic disparities.

- Long-term implications: The trade wars had lasting implications for global trade relations, creating uncertainty and harming long-term economic growth and stability.

Deregulation and its Distributional Effects

The Trump administration pursued a significant deregulation agenda, affecting various sectors of the economy. This had far-reaching distributional consequences.

Environmental Regulations and their Impact

The rollback of environmental regulations had a disproportionate impact on low-income communities and communities of color.

- Weakening of environmental protections: The easing of environmental regulations led to increased pollution and environmental degradation.

- Disproportionate impact on vulnerable communities: Low-income communities and communities of color often bear the brunt of environmental hazards, experiencing higher rates of respiratory illnesses and other health problems.

- Trade-offs between economic growth and environmental protection: The debate over deregulation highlighted the trade-offs between economic growth and environmental protection.

- Environmental and health consequences: Data suggests a correlation between the weakening of environmental regulations and increased environmental damage and negative health outcomes in vulnerable populations.

Financial Regulations and Their Impact

Changes to financial regulations also carried significant distributional implications.

- Easing of financial oversight: The weakening of financial regulations increased the risk of another financial crisis and potentially benefited large financial institutions at the expense of smaller players and consumers.

- Impact on financial stability: Reduced regulation increased systemic risk and potentially destabilized the financial system.

- Increased inequality: The relaxation of financial regulations could lead to increased inequality, with wealth concentrating further in the hands of a select few.

- Access to credit and financial services: Changes in financial regulations had varying impacts on different income groups' access to credit and financial services.

Conclusion

This article examined the distributional effects of Donald Trump's economic policies, focusing on the Tax Cuts and Jobs Act, trade policies, and deregulation. The analysis revealed a complex picture, with significant benefits accruing to high-income earners while the effects on the middle and lower classes were less clear and often debated. The impacts of trade policies varied across sectors and regions, and deregulation carried both potential economic benefits and environmental/social costs. Understanding the complex interplay of these policies and their diverse effects on different segments of the population remains a crucial endeavor.

Call to Action: Further research is crucial to fully understand the long-term consequences of Trump's economic policies on income inequality and wealth distribution. A thorough and ongoing evaluation of the distributional effects of these policies is necessary to inform future economic policy decisions and ensure a more equitable and sustainable economic future. Continue the conversation by researching and discussing the various impacts of Trump's economic policies and their long-term effects on the American economy and its citizens.

Featured Posts

-

Secret Service Closes Investigation Into White House Cocaine Discovery

Apr 22, 2025

Secret Service Closes Investigation Into White House Cocaine Discovery

Apr 22, 2025 -

The Potential Impact Of A Google Breakup On The Tech Industry

Apr 22, 2025

The Potential Impact Of A Google Breakup On The Tech Industry

Apr 22, 2025 -

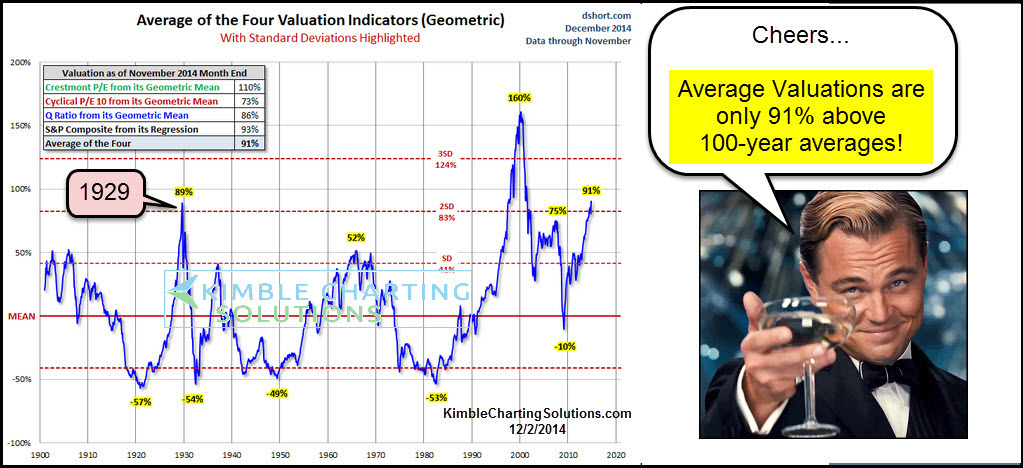

Understanding High Stock Market Valuations Insights From Bof A

Apr 22, 2025

Understanding High Stock Market Valuations Insights From Bof A

Apr 22, 2025 -

Identifying Promising New Business Locations Nationwide

Apr 22, 2025

Identifying Promising New Business Locations Nationwide

Apr 22, 2025 -

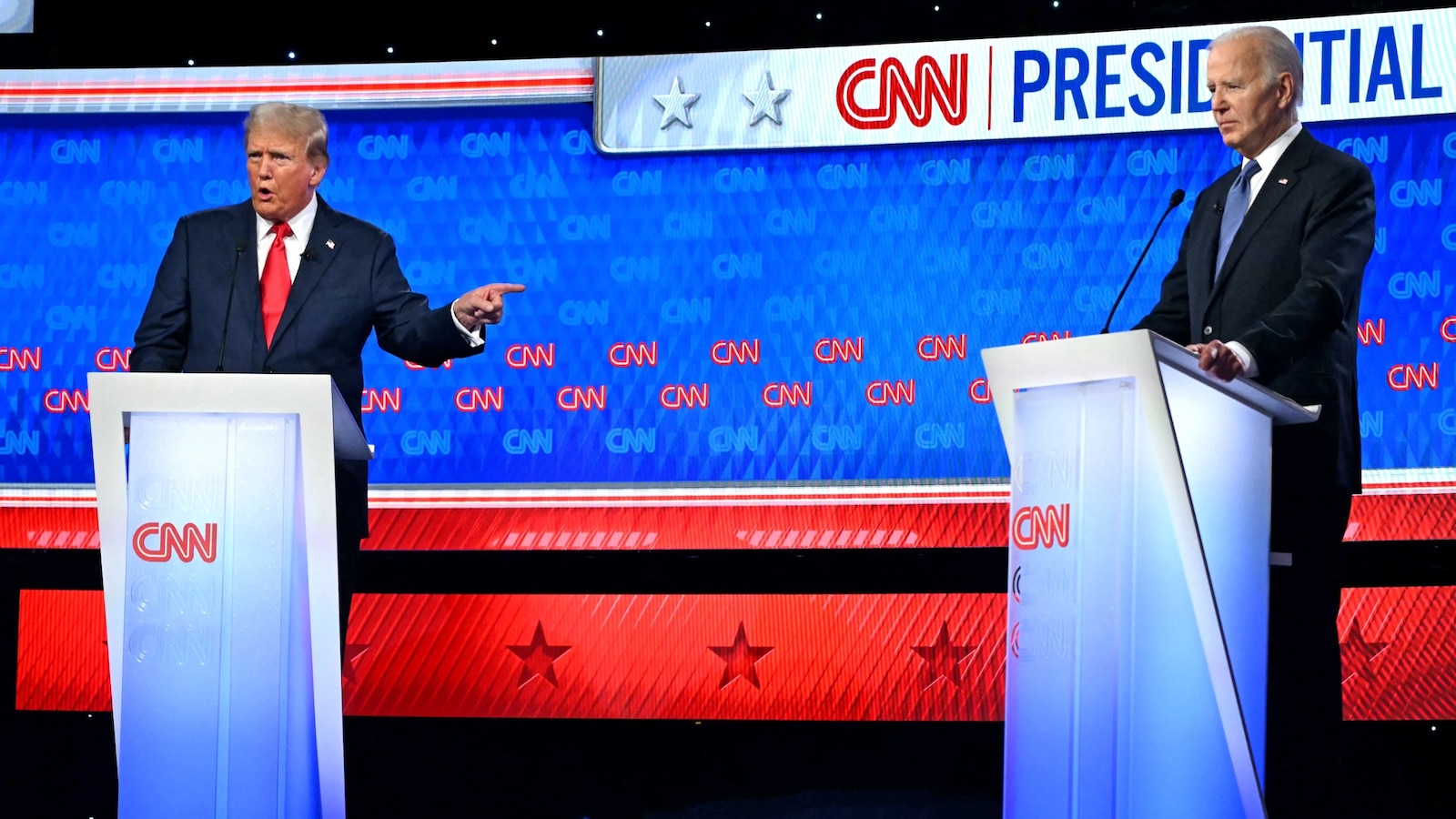

Analyzing The Economy Top 5 Takeaways From The English Leaders Debate

Apr 22, 2025

Analyzing The Economy Top 5 Takeaways From The English Leaders Debate

Apr 22, 2025