Stock Market Valuations: BofA Assures Investors, Explains Why

Table of Contents

BofA's Key Arguments for Current Market Valuations

BofA's positive outlook on stock market valuations isn't based on blind optimism; it's grounded in a careful analysis of several key factors. Their assessment considers the interplay of interest rates, inflation, future earnings growth, and a comparison to historical market trends.

The Role of Interest Rates and Inflation

BofA acknowledges the impact of interest rate hikes and inflation on equity valuations. Higher interest rates generally increase borrowing costs for companies, potentially slowing down growth and reducing the present value of future earnings. Inflation, on the other hand, erodes purchasing power and can impact corporate profits.

- BofA's Interest Rate Outlook: BofA anticipates that interest rate hikes will eventually slow, possibly even pausing or reversing course as inflation cools. They believe that the Federal Reserve's actions are intended to tame inflation without causing a significant economic downturn.

- Inflation's Impact on Discounted Cash Flow: While inflation does affect corporate earnings, BofA’s analysis suggests that many companies are successfully passing increased costs onto consumers, mitigating some of the negative impact on profit margins. Furthermore, their discounted cash flow (DCF) valuations incorporate projected inflation, offering a more realistic assessment of future returns.

- BofA's Overall Valuation Assessment: Considering the interplay of these factors, BofA concludes that while inflation and interest rates present challenges, their impact on valuations is less severe than initially feared. Their models suggest that current stock prices, while high, are largely supported by expected future earnings growth.

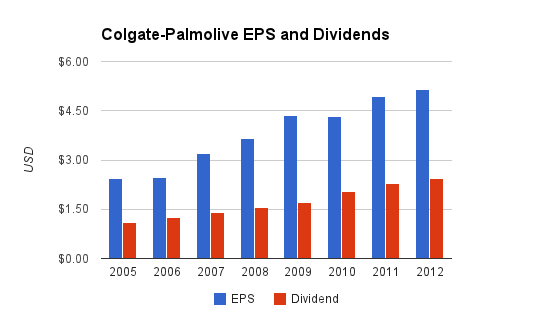

Earnings Growth Projections and Their Impact

BofA's positive outlook hinges significantly on their earnings growth projections for the coming years. They foresee continued, albeit potentially moderated, growth in corporate earnings.

- Strong Growth Sectors: BofA highlights specific sectors poised for strong growth, including technology, healthcare, and select areas of the consumer discretionary sector. These projections are based on their analysis of industry trends, technological advancements, and consumer spending patterns.

- Methodology behind Earnings Projections: BofA utilizes a combination of top-down macroeconomic forecasting and bottom-up analysis of individual companies to arrive at their earnings projections. This comprehensive approach considers a wide range of factors to enhance accuracy.

- Potential Risks and Uncertainties: However, BofA acknowledges potential risks, such as geopolitical instability, supply chain disruptions, and the possibility of a more severe-than-anticipated economic slowdown. These uncertainties are factored into their projections, providing a more nuanced view.

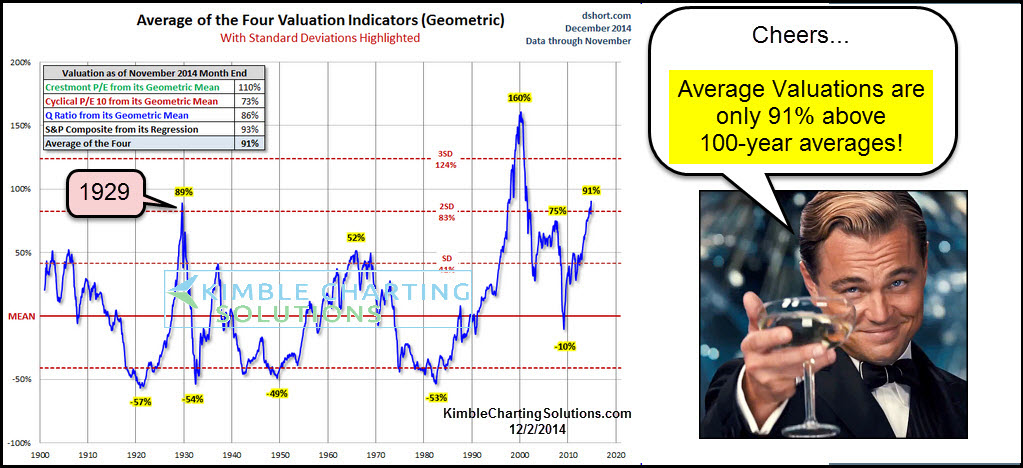

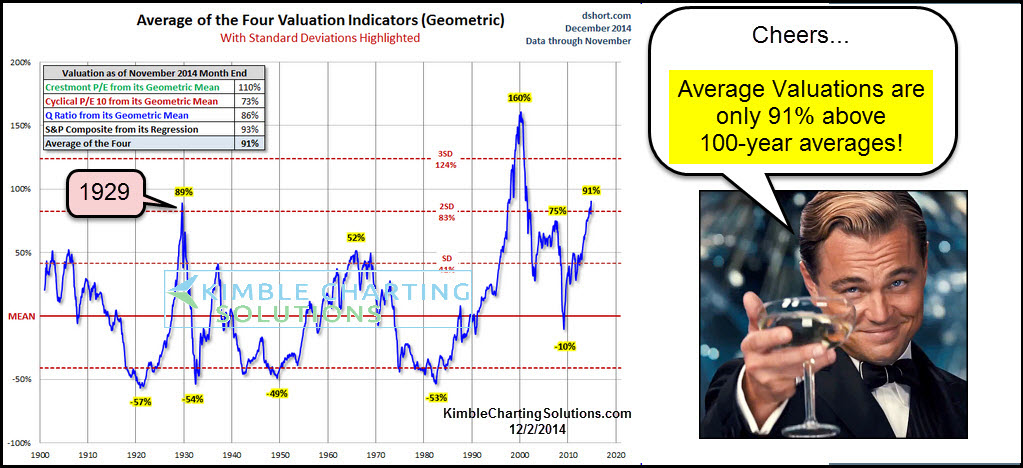

Comparison to Historical Valuations and Market Cycles

To contextualize current valuations, BofA compares them to historical averages and previous market cycles. This analysis helps determine whether current prices represent a significant overvaluation or fall within a reasonable range relative to past performance.

- Visual Representation: Charts and graphs comparing current price-to-earnings (P/E) ratios, Shiller P/E ratios (CAPE), and other valuation metrics to historical data illustrate BofA's findings. These visuals make the comparison more readily understandable for investors.

- Longer-Term Perspective: BofA emphasizes the importance of considering the long-term perspective. They argue that focusing solely on short-term market fluctuations can be misleading and that current valuations are justifiable within a broader historical context.

- Limitations of Historical Comparisons: BofA acknowledges the limitations of relying solely on historical data. Past performance is not necessarily indicative of future results, and the current economic landscape differs from previous cycles.

Addressing Investor Concerns and Risks

While BofA presents a relatively positive outlook, it's crucial to acknowledge potential downsides and market risks. Ignoring these could lead to uninformed investment decisions.

Potential Downsides and Market Risks

Several factors could negatively impact stock market valuations. A prudent investor should carefully consider these possibilities.

- Geopolitical Uncertainties: Ongoing geopolitical tensions and conflicts can create volatility and uncertainty in the markets, impacting investor sentiment and potentially leading to sell-offs.

- Economic Slowdowns or Recessions: The possibility of an economic slowdown or recession presents a significant risk. Such events typically lead to reduced corporate earnings and lower stock prices.

- Other Negative Factors: Other factors to consider include unexpected inflation spikes, changes in monetary policy, and significant shifts in consumer behavior.

BofA's Risk Mitigation Strategies and Recommendations

BofA emphasizes the importance of risk mitigation strategies to protect investments during times of uncertainty.

- Diversification: Diversifying across various asset classes (stocks, bonds, real estate) and sectors helps reduce the overall risk of a portfolio.

- Sector Selection: BofA suggests focusing on sectors with strong growth potential and resilience to economic downturns.

- Long-Term Investment Horizon: Maintaining a long-term investment horizon reduces the impact of short-term market fluctuations. This strategy requires patience and a focus on long-term growth.

Practical Implications for Investors

BofA's analysis provides valuable insights for investors to refine their strategies.

How to Interpret BofA's Analysis for Your Investment Strategy

Investors should use BofA's analysis as one piece of information in their decision-making process.

- Adjustments Based on Risk Tolerance: Investors should adjust their investment strategy based on their individual risk tolerance. Conservative investors might opt for a more defensive approach, while those with higher risk tolerance might maintain or even increase their exposure to equities.

- Portfolio Rebalancing: Periodic portfolio rebalancing ensures that the asset allocation aligns with the investor's risk profile and investment goals.

- Independent Research: It's crucial to conduct independent research and consult with a financial advisor before making any significant investment decisions.

Conclusion

BofA's analysis suggests that while current stock market valuations might appear high, they are largely supported by anticipated earnings growth and are not necessarily indicative of an imminent market crash. However, investors should remain aware of potential risks, including geopolitical uncertainties and economic slowdowns. BofA recommends diversification, focusing on resilient sectors, and maintaining a long-term perspective as key risk mitigation strategies. Understanding stock market valuations is paramount for effective investment management. While BofA offers a reassuring outlook, remember that careful analysis and a well-defined investment strategy are crucial for navigating market fluctuations. Stay informed about changes in stock market valuations and consult with a financial advisor to tailor your approach to your individual needs and risk tolerance. Understanding stock market valuations is key to making sound investment decisions.

Featured Posts

-

Colgate Cl Sales And Profit Decline 200 Million Tariff Impact

Apr 26, 2025

Colgate Cl Sales And Profit Decline 200 Million Tariff Impact

Apr 26, 2025 -

The Military Base At The Heart Of Us China Rivalry

Apr 26, 2025

The Military Base At The Heart Of Us China Rivalry

Apr 26, 2025 -

Is Gold A Safe Haven Asset Amidst Global Trade Conflicts A Price Rally Analysis

Apr 26, 2025

Is Gold A Safe Haven Asset Amidst Global Trade Conflicts A Price Rally Analysis

Apr 26, 2025 -

Covid 19 Pandemic Lab Owner Admits To Falsifying Test Results

Apr 26, 2025

Covid 19 Pandemic Lab Owner Admits To Falsifying Test Results

Apr 26, 2025 -

American Battleground Confronting The Worlds Richest Man

Apr 26, 2025

American Battleground Confronting The Worlds Richest Man

Apr 26, 2025

Latest Posts

-

How Professionals Helped Ariana Grande Achieve Her New Look

Apr 27, 2025

How Professionals Helped Ariana Grande Achieve Her New Look

Apr 27, 2025 -

The Impact Of Professional Help On Celebrity Image Ariana Grandes Case Study

Apr 27, 2025

The Impact Of Professional Help On Celebrity Image Ariana Grandes Case Study

Apr 27, 2025 -

Hair And Tattoo Transformations Learning From Ariana Grandes Choices

Apr 27, 2025

Hair And Tattoo Transformations Learning From Ariana Grandes Choices

Apr 27, 2025 -

Ariana Grandes Bold New Look A Look At Professional Styling And Body Art

Apr 27, 2025

Ariana Grandes Bold New Look A Look At Professional Styling And Body Art

Apr 27, 2025 -

Understanding Ariana Grandes Style Changes The Importance Of Professional Guidance

Apr 27, 2025

Understanding Ariana Grandes Style Changes The Importance Of Professional Guidance

Apr 27, 2025