Is Gold A Safe Haven Asset Amidst Global Trade Conflicts? A Price Rally Analysis

Table of Contents

Gold's Historical Performance During Trade Wars

Examining Past Trade Conflicts

History offers valuable insights into gold's behavior during times of trade friction. Several significant trade disputes provide relevant case studies:

- The Smoot-Hawley Tariff Act (1930): This act, enacted during the Great Depression, significantly escalated global trade tensions. While the Great Depression was a multifaceted economic crisis, gold prices did see some increases during this period, though attributing this solely to Smoot-Hawley is difficult.

- Recent US-China Trade Wars (2018-present): The escalating trade conflict between the US and China in recent years led to considerable market volatility. Gold prices generally saw a rise during periods of heightened trade tensions, suggesting a potential safe-haven effect. For instance, in 2019, gold prices increased by approximately 18% amidst escalating tariffs.

However, it's crucial to note that simply observing price increases doesn't establish a direct causal link.

Correlation vs. Causation

While gold prices may rise during trade wars, correlation doesn't equal causation. Several other factors can simultaneously influence gold's price:

- Inflation: Rising inflation often drives investors towards gold as a hedge against currency devaluation.

- Currency Fluctuations: A weakening US dollar, for example, can increase the demand for dollar-denominated gold, pushing prices upward.

- Economic Uncertainty: Broader economic uncertainty, unrelated to specific trade disputes, can boost gold's appeal as a safe haven.

Therefore, using historical data alone to predict future gold price movements related solely to trade conflicts is unreliable. A nuanced analysis that considers multiple factors is essential.

Gold's Role as a Hedge Against Geopolitical Risk

Safe Haven Asset Characteristics

A "safe haven" asset is typically characterized by:

- Low Volatility: It tends to maintain relative stability during periods of market turmoil.

- Negative Correlation with Risk Assets: Its price tends to move inversely to riskier assets like stocks.

- Liquidity: It's easily bought and sold.

Gold exhibits several characteristics that align with this definition:

- Tangible Asset: Gold is a physical commodity, unlike many other investments.

- Limited Supply: Its scarcity contributes to its value as a store of wealth.

- Low Counterparty Risk: Unlike bonds or other debt instruments, gold doesn't carry the risk of default.

Investor Behavior During Trade Wars

During heightened geopolitical risk, investors often engage in a "flight to safety," seeking assets perceived as less risky. This behavior significantly impacts gold demand:

- Increased Demand: Fear and uncertainty often drive investors towards gold, pushing prices higher.

- Portfolio Diversification: Gold is frequently incorporated into diversified portfolios to mitigate risk associated with other assets, particularly during trade conflicts.

Current Market Conditions and Gold's Price Rally

Analyzing Recent Gold Price Movements

Recent gold price movements demonstrate a notable upward trend. While trade tensions certainly play a role, other significant factors contribute to this rally:

- Inflationary Pressures: Persistent inflation globally has increased the appeal of gold as an inflation hedge.

- Interest Rate Hikes: While interest rate increases can theoretically diminish gold's appeal, the current context includes persistent inflation which offsets the interest rate effect.

- US Dollar Weakness: A weaker US dollar typically strengthens gold's price.

[Insert chart or graph showing recent gold price movements here, citing the source.]

Factors Influencing Current Gold Prices

While trade disputes are a factor, the current gold price rally is a complex phenomenon driven by multiple influences:

- Geopolitical Uncertainty: Broader global uncertainties beyond specific trade wars contribute to investor anxiety and increased gold demand.

- Inflationary Expectations: Market expectations of persistent inflation are a primary driver.

- Monetary Policy: Central bank policies, including interest rate decisions and quantitative easing, significantly influence gold prices.

Conclusion: Is Gold a Safe Haven During Trade Conflicts? A Summary and Call to Action

Our analysis reveals that while gold prices often rise during periods of global trade conflict, the relationship isn't always straightforward. While gold exhibits characteristics of a safe haven asset and often sees increased demand during times of uncertainty, attributing price increases solely to trade disputes is an oversimplification. Numerous other macroeconomic factors, including inflation, interest rates, and currency fluctuations, significantly impact gold's price.

It's crucial for investors to carefully consider a range of factors influencing gold prices before making investment decisions. While gold's historical performance during trade wars offers some insight, it doesn't guarantee future behavior.

Therefore, we encourage you to conduct your own thorough research and consider incorporating gold into your investment portfolio as part of a diversified strategy, particularly in times of global trade uncertainty. Understanding gold's role in a diversified portfolio, and considering gold as a safe haven asset during trade conflicts, is crucial for effective risk management in today's complex market environment. Investing in gold during trade conflicts should be a part of a broader investment strategy, and not a singular solution.

Featured Posts

-

Ai Powered Blockchain Security Chainalysis Acquisition Of Alterya

Apr 26, 2025

Ai Powered Blockchain Security Chainalysis Acquisition Of Alterya

Apr 26, 2025 -

Florida A Cnn Anchors Favorite Vacation Spot

Apr 26, 2025

Florida A Cnn Anchors Favorite Vacation Spot

Apr 26, 2025 -

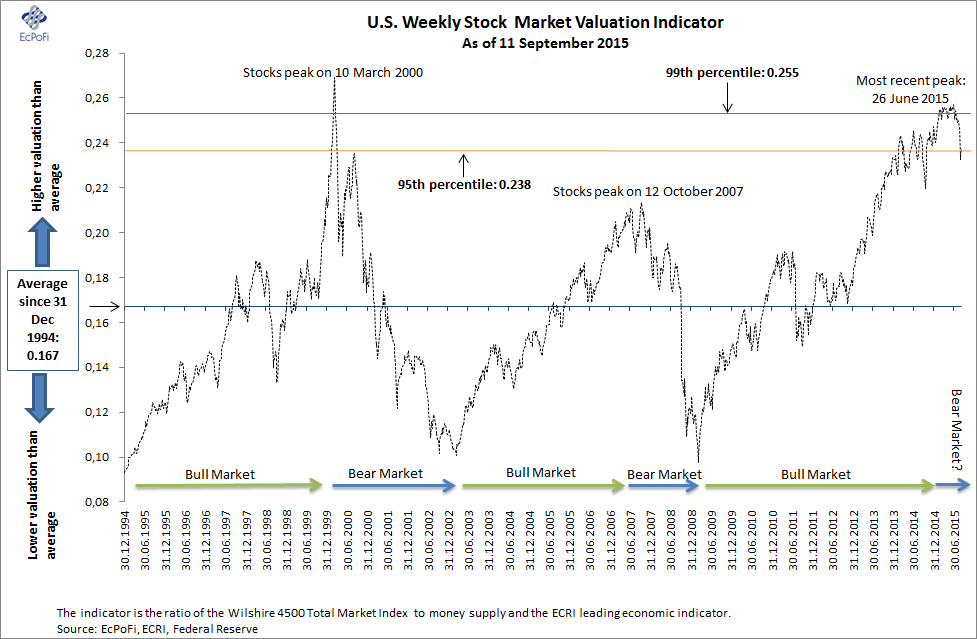

Dismissing Stock Market Valuation Concerns Bof As Rationale

Apr 26, 2025

Dismissing Stock Market Valuation Concerns Bof As Rationale

Apr 26, 2025 -

Karen Reads Murder Trials Key Dates And Events

Apr 26, 2025

Karen Reads Murder Trials Key Dates And Events

Apr 26, 2025 -

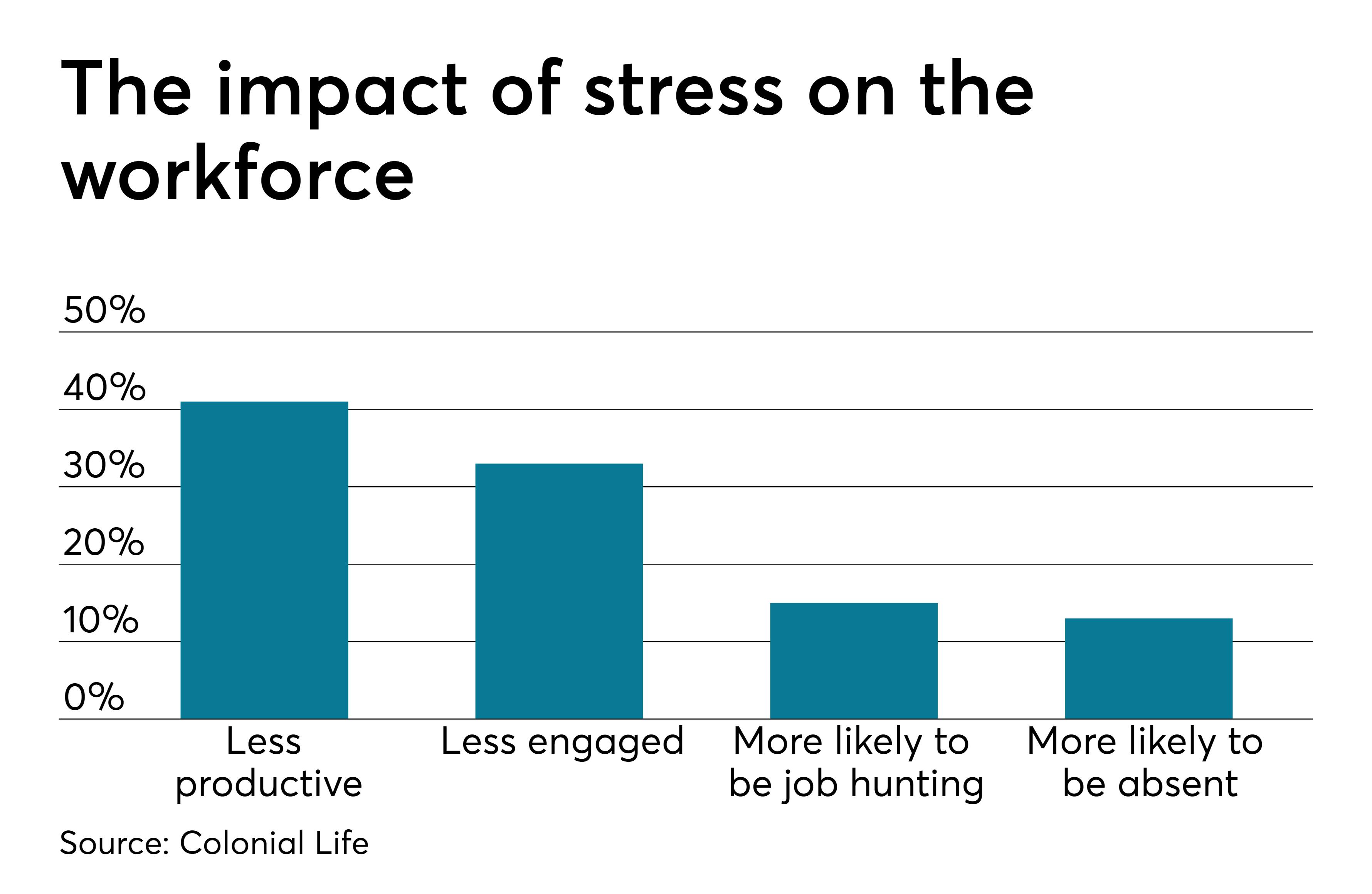

Rethinking Middle Management Their Impact On Company Culture And Productivity

Apr 26, 2025

Rethinking Middle Management Their Impact On Company Culture And Productivity

Apr 26, 2025

Latest Posts

-

How Professionals Helped Ariana Grande Achieve Her New Look

Apr 27, 2025

How Professionals Helped Ariana Grande Achieve Her New Look

Apr 27, 2025 -

The Impact Of Professional Help On Celebrity Image Ariana Grandes Case Study

Apr 27, 2025

The Impact Of Professional Help On Celebrity Image Ariana Grandes Case Study

Apr 27, 2025 -

Hair And Tattoo Transformations Learning From Ariana Grandes Choices

Apr 27, 2025

Hair And Tattoo Transformations Learning From Ariana Grandes Choices

Apr 27, 2025 -

Ariana Grandes Bold New Look A Look At Professional Styling And Body Art

Apr 27, 2025

Ariana Grandes Bold New Look A Look At Professional Styling And Body Art

Apr 27, 2025 -

Understanding Ariana Grandes Style Changes The Importance Of Professional Guidance

Apr 27, 2025

Understanding Ariana Grandes Style Changes The Importance Of Professional Guidance

Apr 27, 2025