Improving Canada's Fiscal Health: A Call For Responsible Governance

Table of Contents

Understanding the Current State of Canada's Fiscal Health

Analyzing the National Debt and Deficit

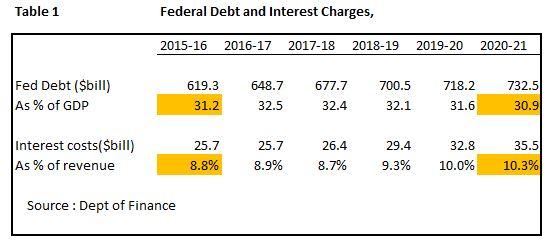

Canada's national debt and deficit are significant concerns impacting its fiscal health. The debt-to-GDP ratio, a key indicator of a country's fiscal health, reflects the size of the national debt relative to the size of its economy. A high debt-to-GDP ratio can indicate vulnerability to economic shocks and limit government's ability to respond effectively to crises.

- Data Points: As of [Insert most recent data], Canada's debt-to-GDP ratio stands at approximately [Insert Percentage]%. Projected deficits for the next [Number] years are expected to be around [Insert Dollar Amount] annually. Major credit rating agencies such as Moody's, S&P, and Fitch assign Canada a [Insert Credit Rating] rating, reflecting [Insert Interpretation of Credit Rating].

- Implications: A high national debt leads to increased interest payments, consuming a larger portion of government budget which could otherwise be allocated to essential services like healthcare, education, and infrastructure. This reduced spending flexibility limits the government's capacity to address emerging challenges and invest in long-term growth. The current trajectory of Canada's fiscal health necessitates urgent action.

Assessing Provincial Fiscal Situations

Provincial governments also face diverse fiscal challenges. Variations in resource revenues, population demographics, and spending priorities contribute to differing fiscal health across provinces. Some provinces boast strong fiscal positions, while others struggle with high debt levels and limited revenue streams.

- Examples: Provinces like [Insert Example of Province with Strong Fiscal Health] demonstrate sound fiscal management, while provinces like [Insert Example of Province with Fiscal Challenges] face significant budgetary constraints. These disparities underscore the need for tailored fiscal strategies at the provincial level.

- Interprovincial Impact: The varying fiscal health across provinces impacts the overall Canadian fiscal health. Fiscal imbalances can lead to interprovincial transfers, impacting both contributing and recipient provinces, potentially leading to further fiscal stress. Addressing provincial fiscal challenges is vital for achieving national fiscal stability.

Identifying Key Areas Requiring Reform

Improving Government Spending Efficiency

Optimizing government spending is crucial for improving Canada's fiscal health. This requires careful evaluation of program effectiveness and elimination of redundancies. Streamlining government operations and leveraging technology can also lead to significant cost savings.

- Program Restructuring: Examples include consolidating overlapping social programs, modernizing procurement processes, and evaluating the efficiency of various government departments. A comprehensive review of government programs is needed to identify areas for improvement.

- Technology Adoption: Implementing digital technologies can automate processes, reduce paperwork, and improve service delivery, leading to significant cost savings and increased efficiency across various government functions.

Enhancing Tax Revenue Collection

Strengthening tax revenue collection is vital for improving Canada's fiscal health. This involves enhancing tax collection efficiency, improving fairness in the tax system, and broadening the tax base to ensure that all Canadians contribute their fair share. Addressing tax evasion and avoidance is also crucial.

- Tax System Reforms: Potential reforms include reviewing income tax brackets, corporate tax rates, and exploring options like a carbon tax or a wealth tax to generate additional revenue. A thorough review of the existing tax system is necessary to identify opportunities for improvement.

- Tax Compliance: Initiatives to improve tax compliance and reduce tax avoidance should include increased audits, enhanced enforcement mechanisms, and public awareness campaigns to promote responsible tax behavior.

Promoting Sustainable Economic Growth

Fostering long-term economic growth is essential for strengthening Canada's fiscal health. Policies promoting productivity, innovation, and competitiveness are critical. Investment in human capital and infrastructure lays the foundation for long-term economic prosperity.

- Productivity and Innovation: Investing in research and development, fostering entrepreneurship, and promoting technological advancements can drive productivity and innovation, leading to increased economic output and tax revenues.

- Human Capital and Infrastructure: Investing in education, skills development, and modernizing infrastructure are crucial for ensuring a skilled workforce and a productive economy, which will further boost government revenue.

Strategies for Improving Canada's Fiscal Health

Implementing Fiscal Responsibility Legislation

Enacting robust fiscal responsibility legislation is crucial to enhance transparency and accountability in government budgeting and spending. This legislation should set clear fiscal targets, require regular reporting, and establish independent oversight mechanisms.

- Features of Effective Legislation: Such legislation should include balanced budget requirements, limits on government debt, and transparent reporting mechanisms to foster accountability.

- International Best Practices: Examining best practices from other countries with strong fiscal responsibility frameworks can provide valuable insights.

Strengthening Public-Private Partnerships

Public-private partnerships (P3s) can play a role in financing infrastructure projects and other initiatives. However, careful consideration of the advantages and disadvantages of P3s is vital to ensure their effective implementation.

- Advantages and Disadvantages: P3s can leverage private sector expertise and capital, but risks related to cost overruns and potential conflicts of interest need careful management. Thorough due diligence is crucial in structuring effective P3 agreements.

- Best Practices: Successful P3s require clear contractual agreements, robust risk allocation mechanisms, and effective oversight to ensure value for money and accountability.

Promoting Fiscal Transparency and Accountability

Transparency and accountability are crucial for maintaining public trust and ensuring the responsible use of taxpayer funds. Open data initiatives, independent audits, and strong oversight mechanisms are essential for promoting good governance.

- Open Data Initiatives: Making government financial data publicly accessible promotes transparency and allows citizens to scrutinize government spending.

- Independent Audits and Oversight: Regular independent audits and strong parliamentary oversight mechanisms are necessary to ensure accountability and prevent fiscal mismanagement.

Conclusion

Improving Canada's fiscal health requires a multifaceted approach encompassing responsible governance, efficient spending, effective revenue generation, and sustainable economic growth. By addressing the key areas outlined in this article – analyzing the current fiscal landscape, identifying areas needing reform, and implementing effective strategies – Canada can secure a more prosperous and sustainable future. We need proactive measures and a commitment from all levels of government to achieve long-term improvements in Canada's fiscal health. Only through concerted effort and responsible governance can we ensure a healthier financial future for all Canadians. Let's work together to strengthen Canada's fiscal health and build a more secure economic future.

Featured Posts

-

Is Canadas Fiscal Future At Risk Examining Liberal Spending

Apr 24, 2025

Is Canadas Fiscal Future At Risk Examining Liberal Spending

Apr 24, 2025 -

7

Apr 24, 2025

7

Apr 24, 2025 -

65 Hudsons Bay Leases Generate Investor Interest

Apr 24, 2025

65 Hudsons Bay Leases Generate Investor Interest

Apr 24, 2025 -

Selling Sunset Star Condemns La Landlord Price Gouging After Fires

Apr 24, 2025

Selling Sunset Star Condemns La Landlord Price Gouging After Fires

Apr 24, 2025 -

Decoding Indias Market Why Is Nifty Showing Such Strength

Apr 24, 2025

Decoding Indias Market Why Is Nifty Showing Such Strength

Apr 24, 2025