Is Canada's Fiscal Future At Risk? Examining Liberal Spending

Table of Contents

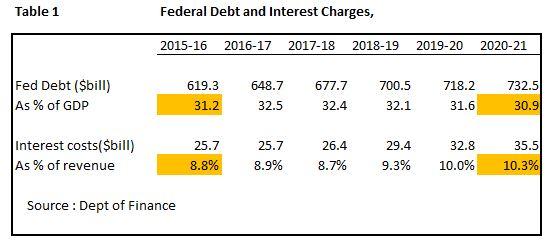

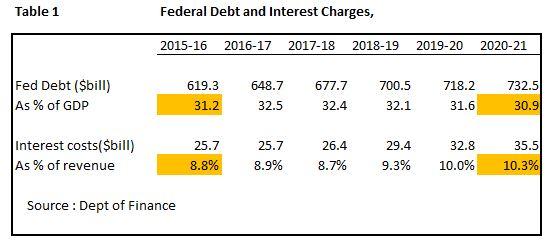

Rising National Debt and Deficit

Canada's national debt and deficit are on an upward trajectory. The debt-to-GDP ratio, a key indicator of a country's fiscal health, has been steadily increasing. While the pandemic undeniably exacerbated the situation, pre-existing trends of increased government spending were already contributing to this rise. Several factors fuelled this growth, including increased social program spending under the Liberal government.

- Increased social program spending: Expansions to programs like the Canada Child Benefit, while beneficial to many families, have significantly increased government expenditure.

- Infrastructure investments: While necessary for long-term economic growth, infrastructure projects represent substantial upfront costs that add to the national debt.

- Tax policies and their impact on revenue: Changes in tax policies, including potential reductions or avoidance strategies, can impact government revenue collection capabilities.

- Economic growth vs. spending growth: A key concern is the rate of spending growth exceeding the rate of economic growth, creating an unsustainable trajectory.

Analyzing these factors necessitates a detailed look at the specific programs implemented.

Analysis of Key Liberal Spending Initiatives

The Liberal government has implemented various programs with wide-ranging impacts on the economy. Let's examine some key initiatives and their fiscal implications:

Canada Child Benefit (CCB)

- Cost: The CCB represents a significant annual expense in the federal budget.

- Benefits: Reduces child poverty, provides financial support for families.

- Potential Risks: Long-term cost implications need careful consideration, particularly as the population ages and more families qualify.

Infrastructure Investments

- Cost: Billions of dollars have been allocated to infrastructure projects across the country.

- Benefits: Improved transportation, utilities, and public services; stimulation of economic growth.

- Potential Risks: Project overruns, potential for cost inflation, and the need for ongoing maintenance costs.

These examples highlight the complexity of evaluating the fiscal impact of Liberal spending initiatives. It’s vital to balance the social benefits with the long-term financial sustainability of such programs.

Alternative Economic Perspectives and Policy Recommendations

The Liberal government's approach to fiscal management is not without its critics. Economists offer various perspectives, advocating for different strategies:

- Fiscal conservatism approaches: Proponents of this approach emphasize fiscal restraint, reducing spending, and controlling the debt-to-GDP ratio.

- Targeted spending strategies: This approach advocates for focusing spending on high-impact programs with measurable results, maximizing efficiency.

- Revenue generation strategies: Increased tax revenue through efficient collection mechanisms and targeted tax reforms could help offset increased spending.

These differing views underscore the need for a nuanced and comprehensive approach to managing Canada's finances.

Long-Term Economic Outlook and Risks

The current spending trajectory poses several long-term risks:

- Impact on credit rating: A continuously high national debt could lead to a downgrade in Canada's credit rating, increasing borrowing costs.

- Potential for increased taxes: To address the growing debt, future governments may need to implement significant tax increases, impacting individuals and businesses.

- Reduced government ability to respond to future crises: A high debt load limits the government's capacity to respond effectively to unforeseen economic downturns or emergencies.

Conclusion: Securing Canada's Fiscal Future: A Call to Action

The analysis reveals considerable challenges to Canada’s fiscal future. While Liberal spending initiatives offer benefits, their long-term sustainability needs careful review. The rising national debt and deficit, coupled with the potential for negative impacts on credit rating and economic stability, necessitate a balanced approach to government spending. Responsible fiscal management requires open dialogue, transparency, and a commitment to sustainable fiscal policies. Understanding the implications of Liberal spending is crucial for securing Canada's fiscal future; demand transparency and accountability from your elected officials. Let's work towards a future with responsible government spending and a strong, healthy Canadian economy.

Featured Posts

-

Exclusive Probe Launched Into World Economic Forum Founder Klaus Schwab

Apr 24, 2025

Exclusive Probe Launched Into World Economic Forum Founder Klaus Schwab

Apr 24, 2025 -

A Day In The Life The Untold Stories Of Chalet Girls In Europe

Apr 24, 2025

A Day In The Life The Untold Stories Of Chalet Girls In Europe

Apr 24, 2025 -

The Closure Of Anchor Brewing Company A Look Back At Its Legacy

Apr 24, 2025

The Closure Of Anchor Brewing Company A Look Back At Its Legacy

Apr 24, 2025 -

Instagrams New Video Editing App A Threat To Tik Tok

Apr 24, 2025

Instagrams New Video Editing App A Threat To Tik Tok

Apr 24, 2025 -

World Economic Forum New Investigation Into Klaus Schwab

Apr 24, 2025

World Economic Forum New Investigation Into Klaus Schwab

Apr 24, 2025