Decoding India's Market: Why Is Nifty Showing Such Strength?

Table of Contents

Strong Domestic Economic Fundamentals

The Indian economy's robust performance is a primary driver of the Nifty's strength. Several key factors contribute to this positive trend:

-

Robust GDP Growth: India's consistent GDP growth, fueled by increased domestic consumption and investment, provides a solid foundation for stock market performance. This growth is not just a headline figure; it translates into tangible improvements in various sectors, boosting corporate earnings and investor confidence. The expectation of continued strong GDP growth is a key factor supporting the Nifty's upward trajectory.

-

Rising Foreign Direct Investment (FDI): A significant influx of FDI signifies global confidence in India's economic future. This investment fuels infrastructure development, creates jobs, and boosts overall economic activity, all of which positively impact the stock market. Increased FDI in sectors like technology and manufacturing further strengthens the Nifty's performance.

-

Government Initiatives: The Indian government's focus on infrastructure development, digitalization, and ease of doing business creates a favorable environment for businesses to thrive. Initiatives like "Make in India" and the Digital India program are attracting investment and driving economic growth, directly impacting the Nifty's performance.

-

Booming Domestic Demand: A burgeoning middle class with increasing purchasing power is a significant driver of domestic demand. This robust consumer spending boosts sales for companies across various sectors, contributing directly to the positive performance of the Nifty 50 and related indices.

-

Positive Government Policies: Supportive government policies, aimed at streamlining regulations and fostering a business-friendly environment, encourage both domestic and foreign investment, further bolstering the Indian economy and the Nifty.

Global Macroeconomic Tailwinds

While domestic factors are crucial, global macroeconomic trends also play a significant role in the Nifty's strength:

-

Relative Global Stability: Amidst global economic uncertainty, India's relative stability makes it an attractive investment destination. Compared to other volatile markets, the Nifty offers a haven for investors seeking safer returns.

-

Emerging Market Shift: A shift in investor sentiment towards emerging markets, with India being a prominent example, has led to increased capital inflows. India's demographic dividend and potential for future growth make it a compelling investment opportunity.

-

US Dollar Decline: A potential weakening of the US dollar can benefit emerging market currencies, including the Indian Rupee. This makes Indian assets more attractive to foreign investors, increasing demand and positively impacting the Nifty.

-

Increased Foreign Portfolio Investment (FPI): Higher FPI flows into India are a clear indication of growing international confidence in the Indian economy and its potential for future growth. This influx of capital directly boosts market liquidity and drives up prices.

-

Geopolitical Stability: India's relatively stable geopolitical position compared to some other regions makes it a less risky investment option for global investors. This stability adds to the attractiveness of the Indian market and contributes to the Nifty's upward momentum.

Specific Sectoral Performances

The strength of the Nifty is not uniform across all sectors. Specific sectors have performed exceptionally well, contributing significantly to the overall index's performance:

-

IT Sector: The Indian IT sector continues to be a strong performer, driven by global demand for technology services.

-

Pharmaceutical Sector: The pharmaceutical sector has also seen robust growth, driven by both domestic demand and exports.

-

FMCG Sector: The fast-moving consumer goods (FMCG) sector benefits from the rising consumption levels of India's growing middle class.

-

Banking Sector: The banking sector, reflected in the Nifty Bank index, shows strong performance driven by increased credit disbursement and positive economic sentiment. The performance of the Nifty Bank index often correlates strongly with the overall Nifty 50 performance. Analyzing individual bank stocks and their contributions to the Nifty Bank Index offers a granular view of market trends.

Improving Investor Sentiment and Confidence

The rising Nifty is also a reflection of improving investor sentiment and confidence:

-

Retail Investor Participation: Increased participation of retail investors significantly increases market liquidity and drives demand for stocks.

-

Mutual Fund Investments: The growth in mutual fund investments indicates a long-term perspective and increased confidence among investors. This sustained investment signals a belief in the long-term growth potential of the Indian economy.

-

Positive Sentiment despite Volatility: Even amidst periods of market volatility, the overall sentiment remains largely positive, indicating underlying confidence in the Indian economy’s trajectory.

-

Government Measures: Government measures to enhance investor confidence play a critical role in boosting market sentiment and encouraging further investment.

-

Market Sentiment Indicators: Analysis of various market sentiment indicators, like the VIX (Volatility Index), provides insights into investor behavior and its impact on the Nifty's performance.

Conclusion

The Nifty's recent strength is a result of a confluence of factors, including robust domestic economic fundamentals, supportive global macroeconomic trends, strong sectoral performances, and improving investor sentiment. India's positive economic outlook, coupled with strategic government initiatives, positions the Nifty for continued growth. Understanding these drivers is crucial for navigating the Indian stock market effectively.

Call to Action: Understanding the drivers of the Nifty's performance is crucial for investors looking to navigate the Indian stock market. Further research into specific sectors and macroeconomic indicators will help you make informed decisions regarding investments in the Nifty and the broader Indian economy. Stay informed on the dynamics influencing the Nifty, its constituent stocks, and the broader Indian economy to make the most of the opportunities in India's evolving market. Analyze the Nifty Bank index and other key sectoral indices to gain a deeper understanding of the market's direction and potential investment strategies.

Featured Posts

-

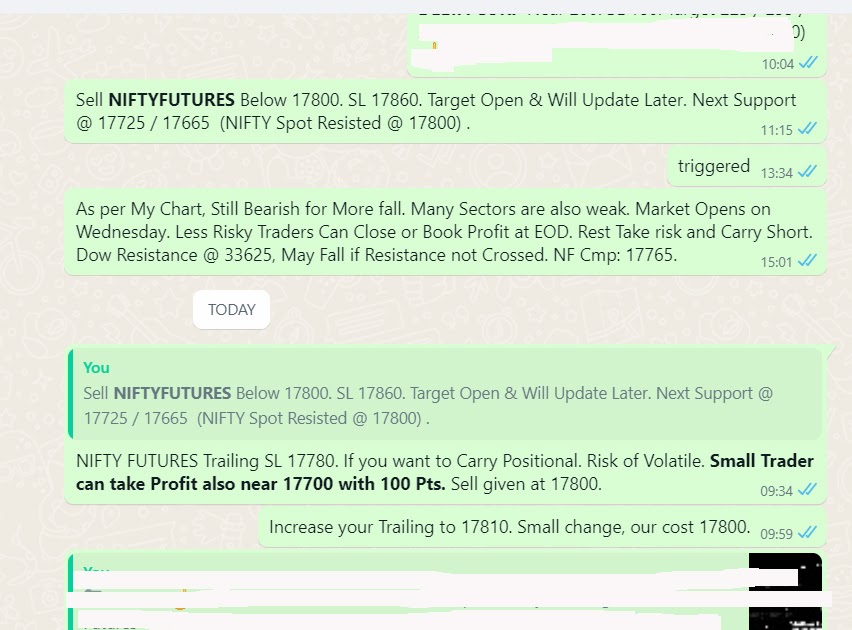

Impact Of Us Tariffs Chinas Turn To Middle East For Lpg Supply

Apr 24, 2025

Impact Of Us Tariffs Chinas Turn To Middle East For Lpg Supply

Apr 24, 2025 -

Us Stock Futures Surge Trumps Powell Comments Boost Markets

Apr 24, 2025

Us Stock Futures Surge Trumps Powell Comments Boost Markets

Apr 24, 2025 -

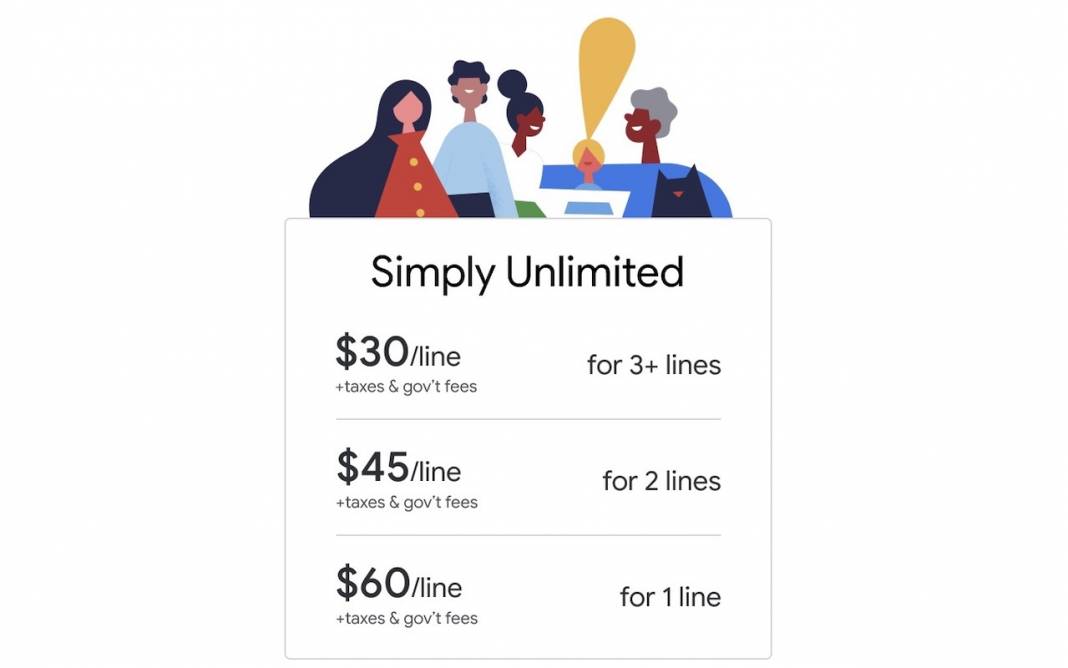

Google Fis 35 Month Unlimited Plan A Comprehensive Guide

Apr 24, 2025

Google Fis 35 Month Unlimited Plan A Comprehensive Guide

Apr 24, 2025 -

Identifying And Analyzing The Countrys Fastest Growing Business Areas

Apr 24, 2025

Identifying And Analyzing The Countrys Fastest Growing Business Areas

Apr 24, 2025 -

Save With Google Fi The 35 Unlimited Plan Unveiled

Apr 24, 2025

Save With Google Fi The 35 Unlimited Plan Unveiled

Apr 24, 2025