Impact Of US Tariffs: China's Turn To Middle East For LPG Supply

Table of Contents

Rising US Tariffs and their Impact on China's LPG Imports

US tariffs on various goods, including those indirectly affecting LPG imports to China, have significantly altered the landscape of China's energy market. The increased cost of importing LPG from the US – whether through direct tariffs or tariffs on related products impacting transportation or processing – has rendered US-sourced LPG less competitive. This price increase has forced Chinese importers to seek alternative, more cost-effective sources.

- Specific tariff rates and their effective dates: While there may not be direct tariffs on LPG, tariffs on related petrochemical products or shipping costs have indirectly increased the price of US LPG imports into China. Specific data on these rates and their implementation dates would require further investigation from relevant trade organizations.

- Quantifiable effects on import costs: The indirect impact of these tariffs has led to a measurable increase in the cost of US LPG for Chinese buyers. A detailed analysis would involve comparing import prices before and after the tariff implementation, considering fluctuations in global energy markets.

- Analysis of market share changes due to tariffs: This shift is reflected in the dwindling market share of US LPG imports into China post-tariff implementation. Detailed import/export data from organizations like the Chinese customs authority and the US Census Bureau could provide concrete figures demonstrating this decline. This data is crucial to quantifying the impact of US trade policies.

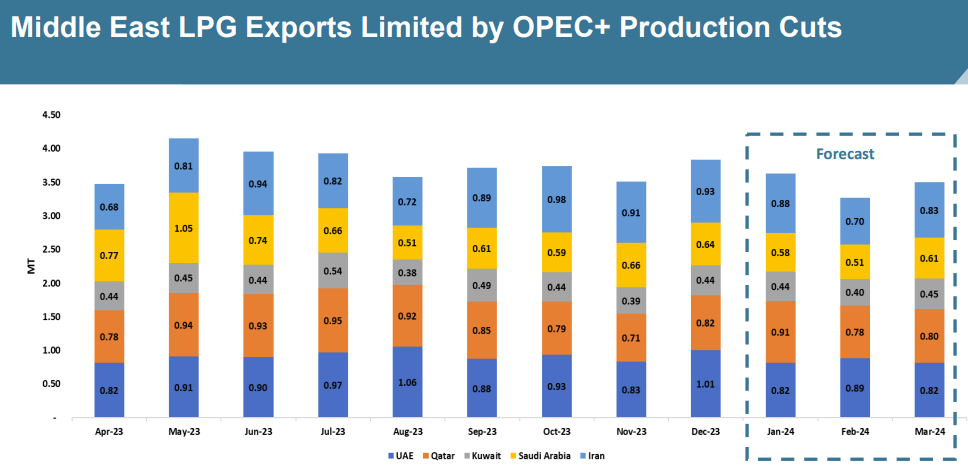

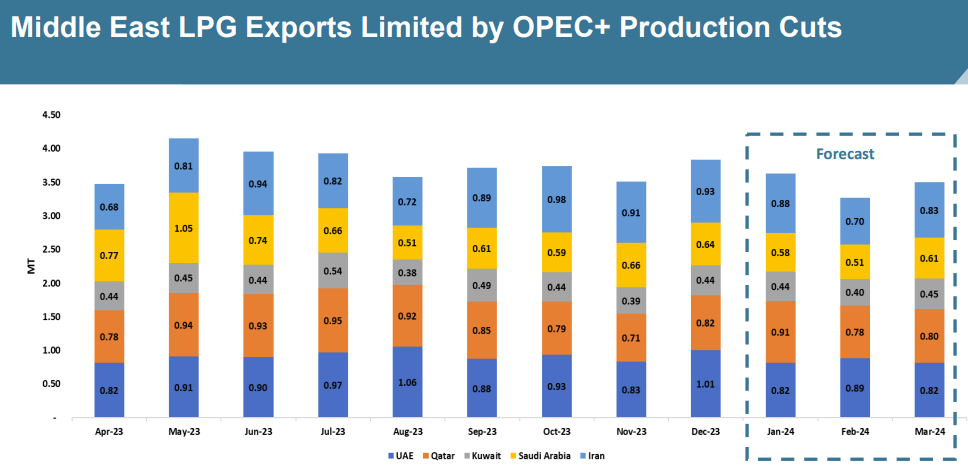

The Middle East: An Emerging LPG Supplier for China

The Middle East, with its burgeoning LPG production capacity and strategic geographical location, is ideally positioned to fill the gap left by the reduced reliance on US supplies. Countries like Saudi Arabia and Qatar possess substantial LPG export capabilities and robust infrastructure, making them attractive partners for China. The shorter shipping distances translate to lower transportation costs and faster delivery times, further enhancing their competitiveness. This geographic proximity also promotes stronger trade relations, paving the way for bilateral agreements that benefit both sides.

- Key Middle Eastern LPG-producing countries: Saudi Arabia, Qatar, and the UAE are key players in the Middle Eastern LPG market, boasting significant production and export capacities. Iran also plays a role, though geopolitical complexities affect its trade relations.

- Details on their export capacities and infrastructure: These countries have invested heavily in developing efficient LPG export terminals and liquefaction facilities to meet the growing global demand. Specific details on their production and export capacities are available through industry reports and governmental publications.

- Examples of recent trade deals or agreements: Increasing cooperation between China and Middle Eastern nations is reflected in several recent energy agreements. Further research will reveal specific examples of trade deals facilitating LPG imports from the Middle East into China.

Economic and Geopolitical Implications of this Shift

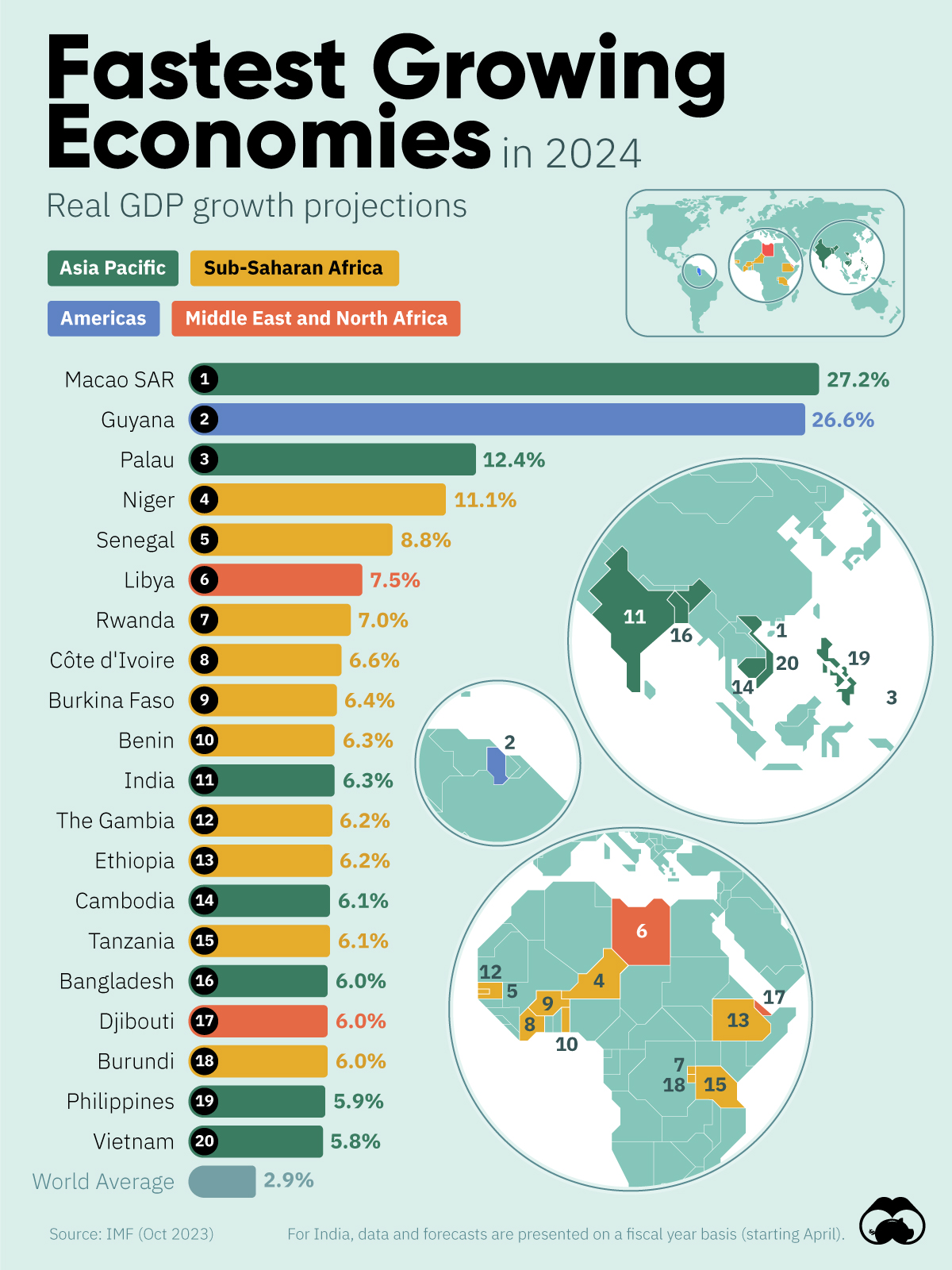

This realignment of China's LPG sourcing has profound economic and geopolitical consequences. For the Middle East, increased LPG exports to China translate into substantial economic gains, boosting national revenues and strengthening their positions in the global energy market. For China, diversification of its energy supply sources enhances energy security and reduces reliance on a single major supplier. Furthermore, this shift strengthens China's ties with Middle Eastern nations, creating new alliances and influencing regional geopolitics.

- Potential economic benefits for Middle Eastern economies: Increased LPG exports can significantly boost GDP growth, create jobs, and generate revenue for Middle Eastern countries.

- Changes in global LPG market dynamics: The increased demand from China will impact global LPG pricing and the overall market dynamics.

- Geopolitical consequences of closer China-Middle East relations: The strengthened economic partnerships may lead to increased political cooperation and influence in the region.

Future Outlook: Long-Term Implications for the Global LPG Market

The shift toward Middle Eastern LPG supplies is likely to be a long-term trend, driven by continuing demand in China and the competitive advantages offered by Middle Eastern producers. However, challenges remain. Fluctuations in global oil prices, geopolitical instability in the region, and potential infrastructural limitations could impact the sustainability of this new trading relationship.

- Predictions for future LPG demand in China: China's continuing economic growth and urbanization will likely sustain strong demand for LPG for years to come.

- Forecasting the potential growth of Middle Eastern LPG exports: Middle Eastern nations are likely to invest further in expanding their production and export capacities to meet this growing demand.

- Discussion on potential risks and uncertainties: Geopolitical risks, price volatility, and unforeseen supply disruptions could pose challenges to this new trade relationship.

Conclusion: The Impact of US Tariffs and China's LPG Sourcing Strategies

US tariffs have undeniably played a significant role in reshaping China's LPG import strategy, driving a substantial shift towards the Middle East. This redirection carries substantial economic implications for both China and the Middle East, while also reshaping the global geopolitical landscape. The long-term implications are multifaceted and involve navigating potential challenges while capitalizing on new opportunities. The future of China's LPG imports and the global LPG market will be shaped by this evolving dynamic. Stay informed about the evolving global energy market and the continuing impact of US tariffs on international trade and the global LPG supply chain. For further research and updates on the impact of US tariffs on China's LPG supply, [insert relevant link here].

Featured Posts

-

High Rollers Movie An Exclusive Preview Of Posters And Photos Featuring John Travolta

Apr 24, 2025

High Rollers Movie An Exclusive Preview Of Posters And Photos Featuring John Travolta

Apr 24, 2025 -

John Travolta Shares Moving Photo On Late Son Jetts Birthday

Apr 24, 2025

John Travolta Shares Moving Photo On Late Son Jetts Birthday

Apr 24, 2025 -

Hong Kongs Chinese Stock Market A Rally Driven By Trade Deal Prospects

Apr 24, 2025

Hong Kongs Chinese Stock Market A Rally Driven By Trade Deal Prospects

Apr 24, 2025 -

Canadas Economic Outlook Prioritizing Fiscal Responsibility

Apr 24, 2025

Canadas Economic Outlook Prioritizing Fiscal Responsibility

Apr 24, 2025 -

Credit Card Companies Feel The Pinch As Consumers Cut Back On Spending

Apr 24, 2025

Credit Card Companies Feel The Pinch As Consumers Cut Back On Spending

Apr 24, 2025