Canada's Economic Outlook: Prioritizing Fiscal Responsibility

Table of Contents

Current State of the Canadian Economy

The Canadian economy is currently navigating a period of significant change, presenting both opportunities and challenges related to Canada's fiscal responsibility. Understanding this current state is crucial for informed policy decisions.

Inflation and Interest Rates

Inflation remains a key concern. The Bank of Canada has been actively raising interest rates to combat rising prices, impacting various sectors of the economy.

- Current inflation figures: As of [Insert most recent data – e.g., October 2023], inflation sits at [Insert percentage]%, exceeding the Bank of Canada's target range.

- Projected inflation rates: Forecasts vary, but most economists predict a gradual decline in inflation over the next [ timeframe, e.g., 12-18 months].

- Impact on mortgage rates: Higher interest rates have led to significantly increased mortgage payments, impacting affordability for many Canadians and potentially slowing housing market activity.

- Impact on business investment: Increased borrowing costs can discourage businesses from investing in expansion and hiring, potentially hindering economic growth. This is a crucial consideration for maintaining Canada's fiscal responsibility.

Government Debt and Deficit

Canada's government debt levels are a significant factor in its economic outlook and fiscal health. Managing this debt responsibly is critical.

- Federal debt-to-GDP ratio: The federal debt-to-GDP ratio currently stands at [Insert percentage]%, [Add context, e.g., higher/lower than previous years, compared to other G7 nations].

- Provincial debt levels: Provincial governments also face varying levels of debt, which necessitates careful fiscal management at both the federal and provincial levels for Canada's fiscal responsibility.

- Potential risks associated with high debt levels: High debt levels can limit the government's ability to respond to future economic shocks or invest in crucial infrastructure projects, hindering long-term economic growth. The risk of debt servicing costs outweighing other priorities needs careful consideration as part of Canada’s fiscal responsibility.

- Comparisons with other G7 nations: Comparing Canada's debt levels to other G7 countries provides valuable context and highlights the importance of maintaining responsible fiscal policies.

Global Economic Factors

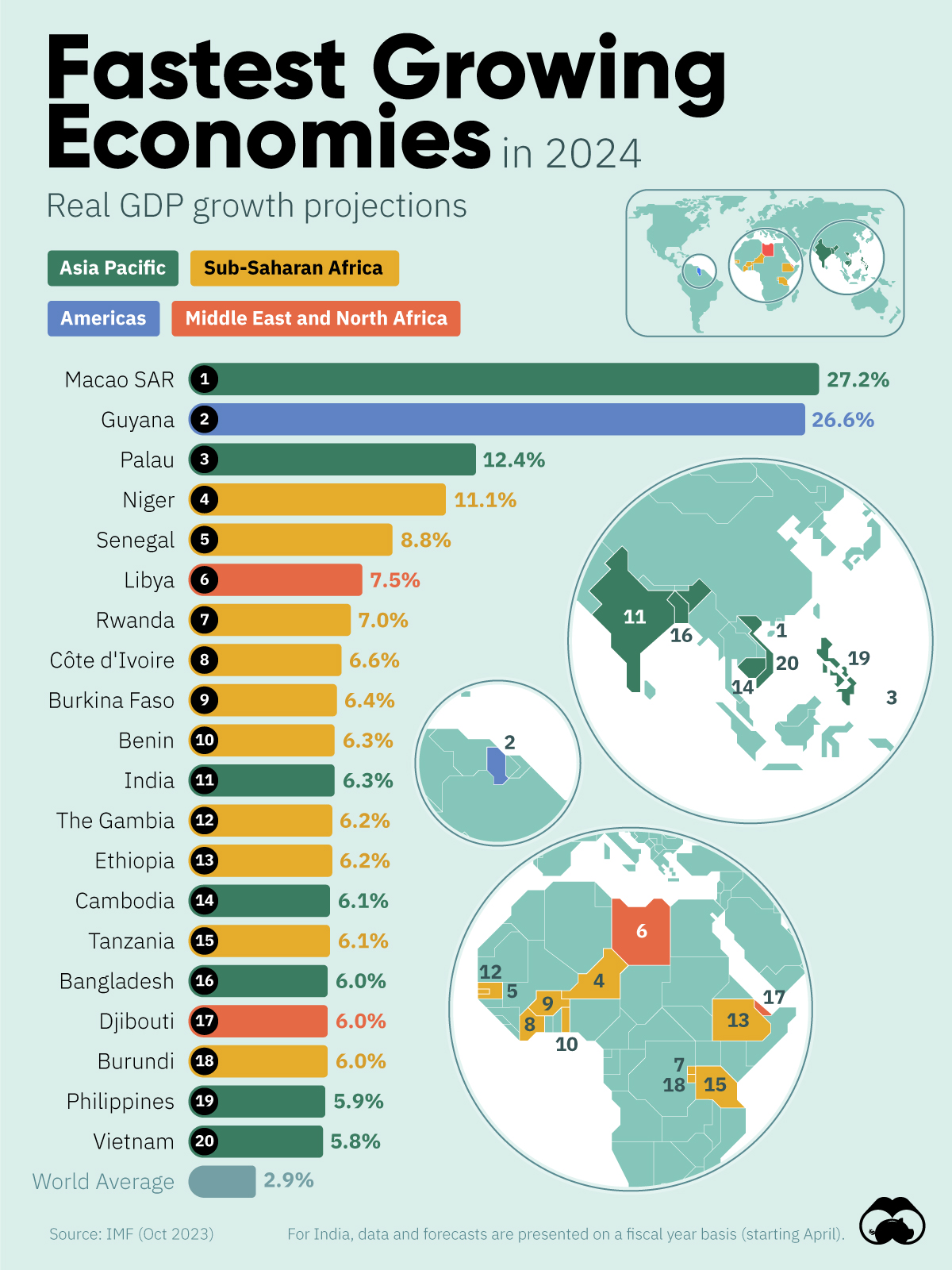

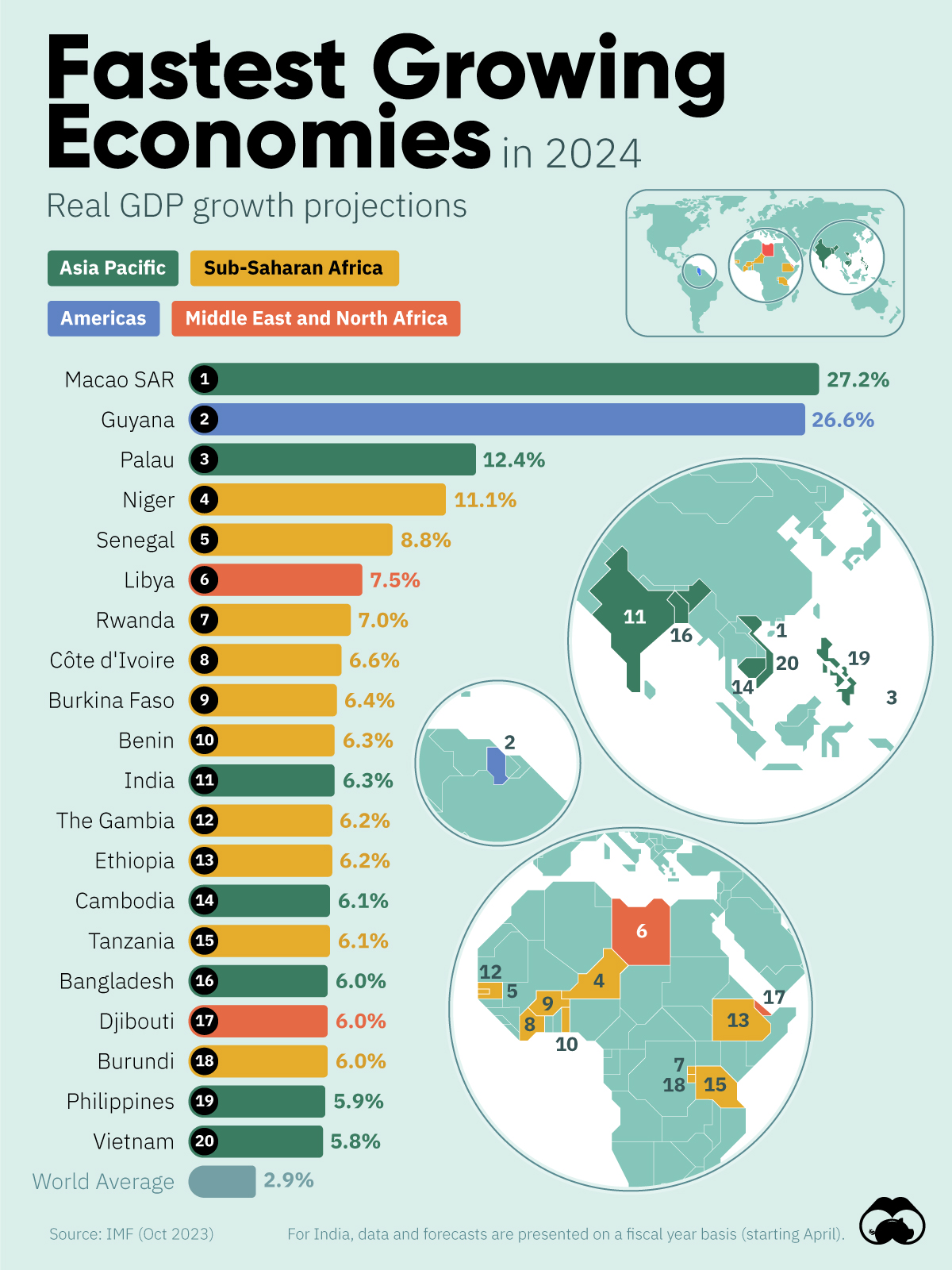

Global economic uncertainties significantly impact the Canadian economy, requiring proactive fiscal management.

- Impact of the war in Ukraine: The ongoing conflict has disrupted global supply chains and energy markets, impacting inflation and economic growth in Canada.

- Supply chain challenges: Persistent supply chain disruptions continue to affect various sectors, leading to higher prices and production delays.

- Global recession risks: The risk of a global recession presents a significant challenge to Canada's economic outlook and the need for responsible fiscal planning.

- Impact on Canadian exports: Global economic slowdowns can reduce demand for Canadian exports, impacting key industries and potentially leading to job losses.

Strategies for Fiscal Responsibility

Achieving sustainable economic growth requires strategic approaches to fiscal responsibility. This necessitates careful consideration of revenue generation and expenditure management.

Revenue Generation

Increasing government revenue through sustainable means is vital for maintaining Canada's fiscal responsibility.

- Potential tax reforms: Reforms to the tax system could focus on closing loopholes, broadening the tax base, or adjusting tax rates to ensure fairness and efficiency.

- Improving tax compliance: Strengthening tax collection measures can help reduce tax evasion and increase government revenue.

- Exploring new revenue streams: Exploring potential new revenue streams, such as carbon taxes or levies on certain industries, could also be considered, but need careful public consultation and consideration to balance equity and effectiveness in Canada's fiscal responsibility.

Expenditure Management

Effective expenditure management is key to responsible fiscal policy.

- Areas for potential spending cuts: Careful review of government spending can identify areas where efficiencies can be achieved without compromising essential services. This needs to be a transparent and well-communicated process for Canada's fiscal responsibility.

- Improving government efficiency: Streamlining government processes and reducing administrative costs can free up resources for essential programs and services.

- Prioritizing essential government services: Careful prioritization of government programs ensures that resources are allocated to the areas with the greatest need and impact on Canadian citizens. Prioritization must be transparent and justified for maintaining Canada's fiscal responsibility.

Investment in Infrastructure

Strategic investments in infrastructure are crucial for long-term economic growth.

- Types of infrastructure investments needed: Investments are needed in areas such as transportation, energy, and digital infrastructure to support economic growth and improve productivity.

- Economic benefits of infrastructure spending: Infrastructure investments create jobs, stimulate economic activity, and improve the quality of life for Canadians.

- Potential private-public partnerships: Exploring private-public partnerships can leverage private sector expertise and capital to finance large-scale infrastructure projects and enhance the efficiency of Canada's fiscal responsibility.

The Role of Fiscal Policy in Canada's Economic Future

Fiscal policy plays a vital role in shaping Canada's economic future. Long-term planning and proactive measures are needed.

Long-Term Sustainability

Ensuring Canada's long-term economic sustainability requires forward-looking fiscal planning.

- Developing long-term fiscal plans: Creating comprehensive long-term fiscal plans is crucial for managing debt, investing in infrastructure, and ensuring the country's resilience to economic shocks.

- Incorporating climate change considerations into fiscal policy: Addressing climate change requires significant investments and policy changes which must be integrated into long-term fiscal plans. This is paramount for Canada's fiscal responsibility and long-term sustainability.

- Assessing long-term risks and opportunities: Proactively identifying and addressing potential long-term risks and opportunities is essential for robust fiscal planning.

Promoting Economic Growth

Responsible fiscal policy is a key driver of economic growth.

- Incentivizing investment and innovation: Tax incentives, grants, and other measures can encourage investment in new technologies and businesses, boosting productivity and creating jobs.

- Supporting small and medium-sized businesses: Small and medium-sized businesses are a key engine of economic growth, and government support is crucial for their success.

- Promoting skills development and education: Investing in education and skills development equips Canadians with the skills needed for a competitive workforce and future economic prosperity.

Conclusion

Maintaining Canada's fiscal responsibility is paramount for ensuring a strong and stable economy. By implementing prudent fiscal policies that balance revenue generation, expenditure management, and strategic investments, Canada can navigate current challenges and secure a prosperous future. Understanding the current economic landscape and proactively addressing fiscal issues are crucial steps towards achieving long-term economic sustainability. Learn more about the intricacies of Canada's fiscal responsibility and its impact on your future by exploring related government resources and economic reports. Take control of your financial future by staying informed about Canada’s fiscal responsibility and its implications for your personal finances and the nation’s economic well-being.

Featured Posts

-

Rep Nancy Mace Confronted By South Carolina Voter A Heated Exchange

Apr 24, 2025

Rep Nancy Mace Confronted By South Carolina Voter A Heated Exchange

Apr 24, 2025 -

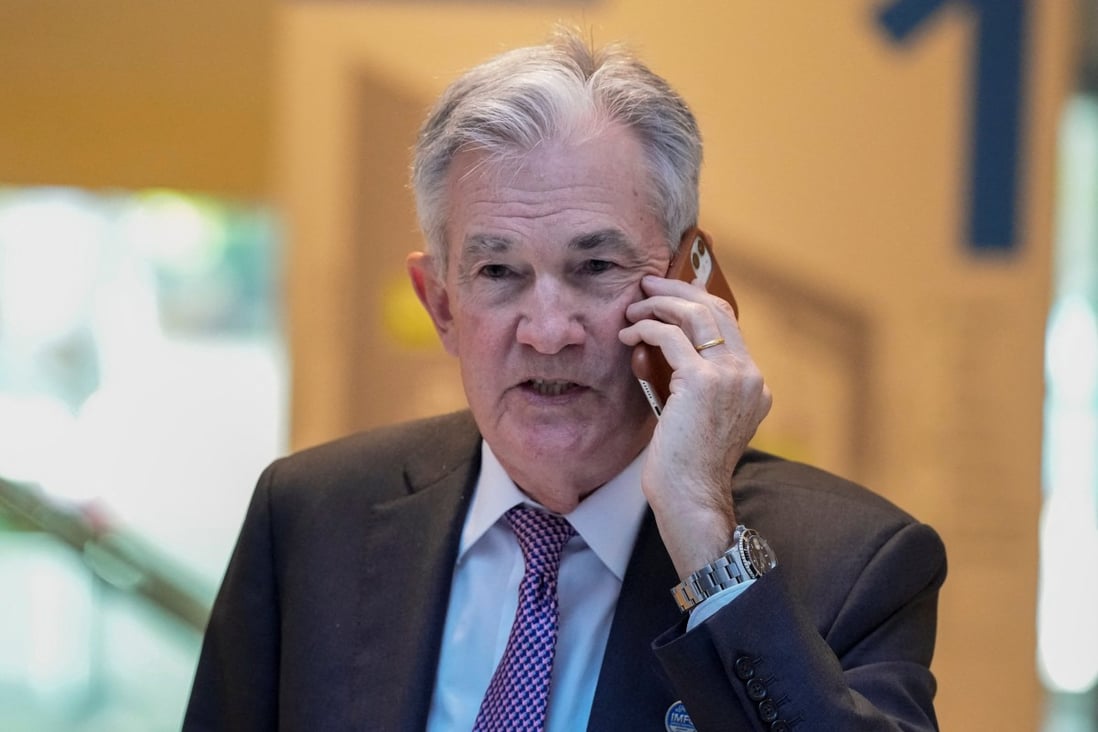

President Trump On Jerome Powell No Immediate Dismissal Expected

Apr 24, 2025

President Trump On Jerome Powell No Immediate Dismissal Expected

Apr 24, 2025 -

Optimus Robot Development How Chinas Rare Earth Policy Creates Challenges For Tesla

Apr 24, 2025

Optimus Robot Development How Chinas Rare Earth Policy Creates Challenges For Tesla

Apr 24, 2025 -

Is Google Chrome Next For Open Ai Chat Gpt Leadership Weighs In

Apr 24, 2025

Is Google Chrome Next For Open Ai Chat Gpt Leadership Weighs In

Apr 24, 2025 -

South Carolina Voters Confrontation With Rep Nancy Mace Details Emerge

Apr 24, 2025

South Carolina Voters Confrontation With Rep Nancy Mace Details Emerge

Apr 24, 2025