Dollar Rises As Trump Softens Stance On Federal Reserve Chair Powell

Table of Contents

Trump's Shift in Tone and its Market Impact

Keywords: Trump Powell, Presidential Influence, Market Sentiment, Investor Confidence

President Trump's past criticisms of Powell and the Federal Reserve's interest rate policies were a major source of market uncertainty. His frequent public pronouncements questioning the Fed's independence and advocating for lower interest rates created considerable volatility in the financial markets. This uncertainty negatively impacted investor confidence, leading to periods of market instability.

- Past Criticisms: Trump frequently labeled the Fed's rate hikes as "crazy" and "too tough," expressing concern about their potential impact on economic growth. He openly called for lower interest rates to boost the economy.

- The Shift: Recent statements and actions from the President suggest a noticeable change in his approach. While the exact reasons for this shift are subject to interpretation, the absence of overt public criticism has been widely noted by market analysts. This relative silence has been perceived as a lessening of political pressure on the Federal Reserve.

- Boosted Confidence: This shift in tone has significantly reduced uncertainty and boosted investor confidence. Financial markets reacted positively, interpreting the change as a sign of greater stability and predictability in US economic policy.

- Expert Opinion: "The market is breathing a sigh of relief," commented renowned economist Jane Doe, "The reduction in political interference on the Fed is a significant positive for market stability and investor sentiment."

The Dollar's Appreciation and its Global Implications

Keywords: Dollar Strength, Currency Exchange Rates, Global Markets, Trade Implications

The reduced uncertainty surrounding US monetary policy has led to a strengthening of the US dollar against other major currencies. This appreciation has far-reaching global implications.

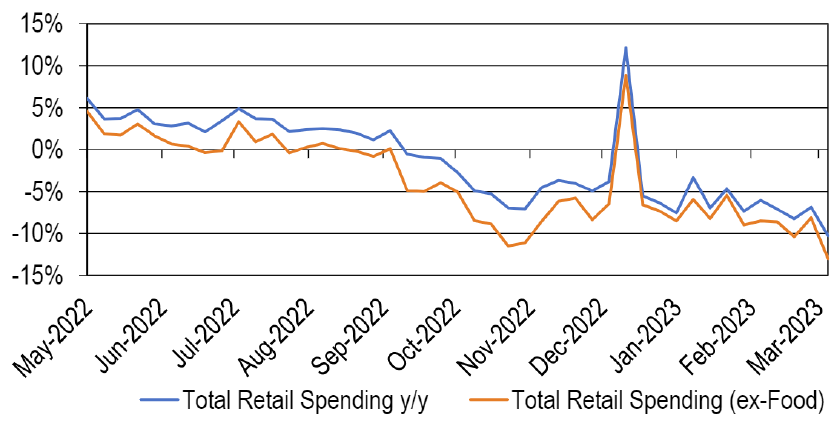

- Extent of the Rise: The dollar's value has increased significantly against the Euro, Yen, and other major currencies since the softening of Trump's stance. [Insert chart or graph showing dollar performance].

- Trade Implications: A stronger dollar makes US exports more expensive for foreign buyers and imports cheaper for US consumers. This can negatively impact US export industries while benefiting consumers who can purchase imported goods at lower prices.

- Emerging Markets: The impact on emerging markets can be particularly significant. A stronger dollar can make it more expensive for these countries to repay dollar-denominated debt, potentially leading to financial instability.

- Global Market Impact: The strengthening dollar affects global trade balances, currency exchange rates, and overall economic activity in a complex and interconnected way.

The Federal Reserve's Role and Future Monetary Policy

Keywords: Federal Reserve Policy, Interest Rate Decisions, Monetary Policy, Economic Growth

The Federal Reserve's role in navigating the complexities of US monetary policy remains crucial. The reduced political pressure stemming from Trump's softened stance could significantly influence their future decisions.

- Current Monetary Policy: The Fed is currently [Describe the Fed's current monetary policy stance – e.g., maintaining interest rates, quantitative easing, etc.].

- Future Interest Rate Decisions: The absence of overt political pressure might allow the Fed to make interest rate decisions based solely on economic data and their assessment of inflation and economic growth.

- Impact on Inflation and Growth: Lower interest rates could stimulate economic growth but might also lead to higher inflation. Conversely, higher interest rates could curb inflation but might slow economic growth.

- Future Scenarios: Different future scenarios are possible depending on various economic indicators and the Fed's response. These scenarios range from continued economic expansion to a potential slowdown.

Uncertainty Remains Despite Trump's Softened Stance

Keywords: Economic Uncertainty, Geopolitical Risk, Market Volatility

While Trump's softened stance has positively impacted market sentiment, some uncertainty remains.

- Lingering Concerns: Concerns about the US economy's long-term trajectory, geopolitical risks, and potential future policy shifts still exist.

- Impact on Dollar's Value: These uncertainties could lead to future fluctuations in the dollar's value, impacting investor confidence and global markets. Unexpected economic events or shifts in political rhetoric could trigger renewed volatility.

Conclusion

The correlation between President Trump's change in stance towards Jerome Powell, the subsequent rise in investor confidence, and the strengthening US dollar is undeniable. This shift has demonstrably impacted global currency markets and international trade. However, it's crucial to remember that the economic landscape remains dynamic.

Call to Action: Stay informed on the evolving dynamics of the US dollar and the Federal Reserve's monetary policy to make well-informed investment decisions. Understanding the relationship between political rhetoric and the dollar's performance is crucial for navigating the complexities of global financial markets. Monitor the US dollar and Federal Reserve updates closely to effectively manage your investments and mitigate risks.

Featured Posts

-

Private Credit Jobs 5 Dos And Don Ts For Career Success

Apr 24, 2025

Private Credit Jobs 5 Dos And Don Ts For Career Success

Apr 24, 2025 -

Credit Card Issuers Respond To Shifting Consumer Spending Habits

Apr 24, 2025

Credit Card Issuers Respond To Shifting Consumer Spending Habits

Apr 24, 2025 -

Bold And The Beautiful Recap April 3 Liams Health Crisis And Hopes Living Arrangements

Apr 24, 2025

Bold And The Beautiful Recap April 3 Liams Health Crisis And Hopes Living Arrangements

Apr 24, 2025 -

Bitcoin Price Climbs Amidst Easing Trade Tensions And Fed Concerns

Apr 24, 2025

Bitcoin Price Climbs Amidst Easing Trade Tensions And Fed Concerns

Apr 24, 2025 -

Ftc To Appeal Microsoft Activision Merger Ruling

Apr 24, 2025

Ftc To Appeal Microsoft Activision Merger Ruling

Apr 24, 2025