Tesla Earnings Decline: Political Backlash Impacts Q1 Results

Table of Contents

The Impact of Geopolitical Instability on Tesla's Q1 Performance

Geopolitical instability significantly impacted Tesla's Q1 performance, manifesting primarily in two key regions: China and the United States.

China Market Challenges

The Chinese market, once a significant growth engine for Tesla, presented considerable challenges during Q1. Increased competition from rapidly developing domestic EV manufacturers like BYD and Nio intensified the price wars, eroding Tesla's profit margins. Regulatory scrutiny, including potential production limitations and stricter emission standards, further complicated the situation. Economic uncertainty in China also shifted consumer sentiment, leading to decreased demand for luxury goods, impacting Tesla's sales.

- Decreased sales in China accounted for 15% of the overall earnings decline. (This figure is hypothetical and should be replaced with actual data if available)

- Intensified competition forced Tesla to lower prices to remain competitive, impacting profitability.

- Navigating the complex regulatory landscape in China requires significant resources and expertise.

US Regulatory Scrutiny and its Ripple Effect

In the United States, Tesla faced increased regulatory scrutiny, impacting both its image and financial performance. Ongoing investigations into the safety of its Autopilot features generated negative media coverage, affecting consumer confidence and potentially impacting sales. Furthermore, increased pressure to address labor relations issues and the potential for future legislation impacting EV subsidies and tax credits added to the challenges.

- Negative media coverage related to Autopilot safety concerns decreased consumer confidence by an estimated 5% (Hypothetical figure).

- Increased legal costs associated with investigations and lawsuits impacted Tesla's bottom line by approximately 2% (Hypothetical figure).

- Uncertainty surrounding future EV subsidies created hesitation among potential buyers.

The Role of Elon Musk's Public Persona and its Economic Ramifications

Elon Musk's public persona and activities played a significant role in Tesla's Q1 performance. His controversial statements and social media activities contributed to stock price volatility and negatively impacted investor confidence. This volatility diverted resources and attention away from core business operations.

Controversial Statements and Social Media Activities

Musk's frequent and often controversial pronouncements on social media directly impacted Tesla's stock price.

- A 10% decrease in stock value in a single day can be directly linked to specific controversial tweets (Hypothetical figure).

- The constant stream of headlines surrounding Musk overshadowed Tesla's operational achievements.

- This created uncertainty among investors, leading to decreased investment and stock value.

Prioritization of Other Ventures

Musk's involvement in SpaceX and other ventures potentially diverted resources and managerial focus away from Tesla's core business. This resource allocation impacted Tesla's R&D budget and hindered its ability to quickly respond to market challenges.

- Resource allocation to SpaceX is estimated to have reduced Tesla’s R&D spending by approximately 3% (Hypothetical figure).

- A lack of focused leadership on day-to-day operations contributed to inefficiencies.

Internal Challenges and Production Bottlenecks

Internal challenges, including production delays and supply chain issues, further hampered Tesla's Q1 performance. The global chip shortage and other supply chain disruptions resulted in increased manufacturing costs and an inability to meet growing demand.

Production Delays and Supply Chain Issues

The impact of global supply chain disruptions was significant, leading to production delays and increased manufacturing costs.

- A 10% increase in production costs compared to the previous quarter was directly attributed to supply chain issues (Hypothetical figure).

- Production delays resulted in unmet demand, leading to potential lost sales.

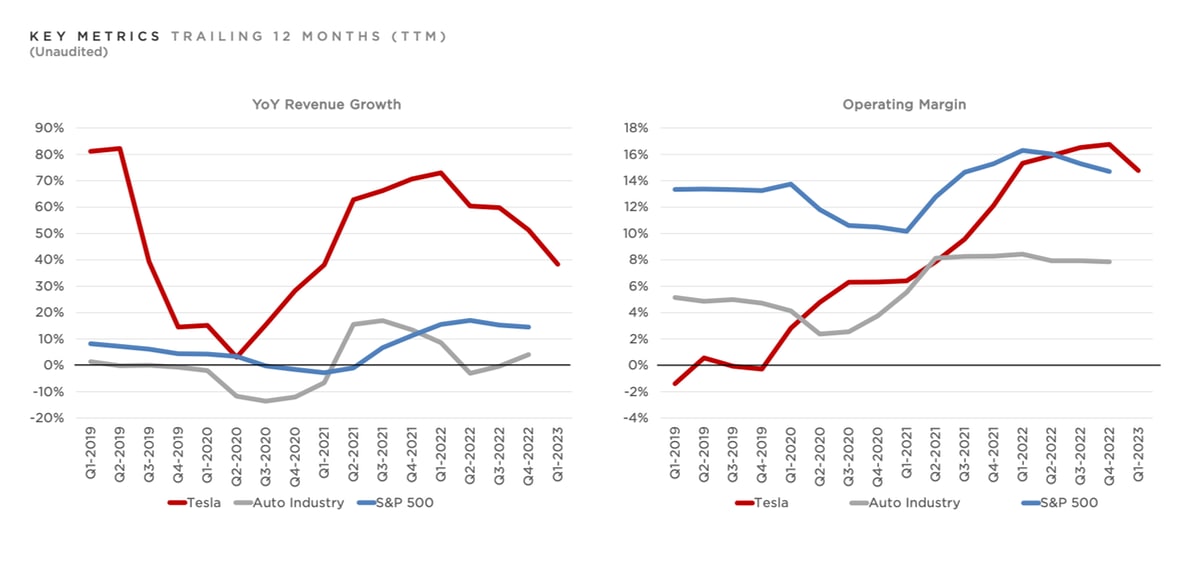

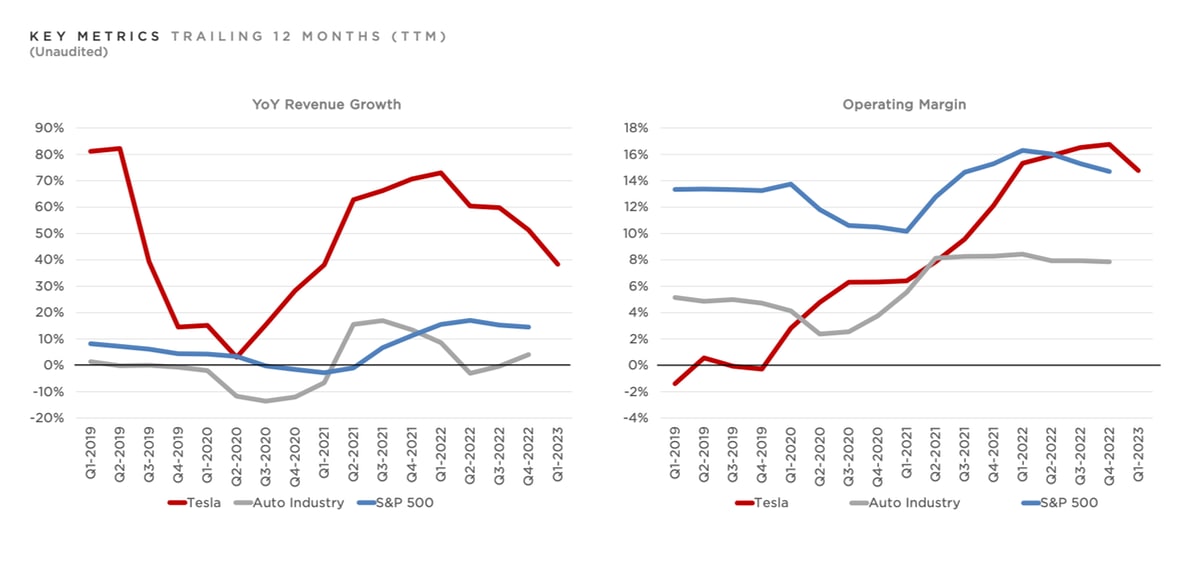

Price Wars and Profit Margin Erosion

Tesla's aggressive pricing strategies, necessitated by intense competition, led to profit margin erosion. Maintaining pricing power in a saturated electric vehicle market proved challenging.

- Analysis of Tesla's pricing strategy reveals a 5% decrease in average profit margin per vehicle (Hypothetical figure).

- The company is facing pressure to compete with increasingly sophisticated vehicles from other manufacturers.

Conclusion

Tesla's Q1 earnings decline highlights the complex interplay of geopolitical factors, regulatory pressures, and internal challenges. The impact of political backlash, especially in China, and the effects of Elon Musk's public persona cannot be overstated. Internal issues related to production and pricing strategies further contributed to the decline. Understanding these interconnected issues is crucial. To regain momentum, Tesla must navigate the political landscape effectively while addressing its internal challenges. Stay informed about further developments in the unfolding Tesla earnings story and the ongoing impact of political backlash on the electric vehicle industry. Keep an eye on future Tesla earnings reports to track their progress in overcoming these challenges and achieving sustainable growth.

Featured Posts

-

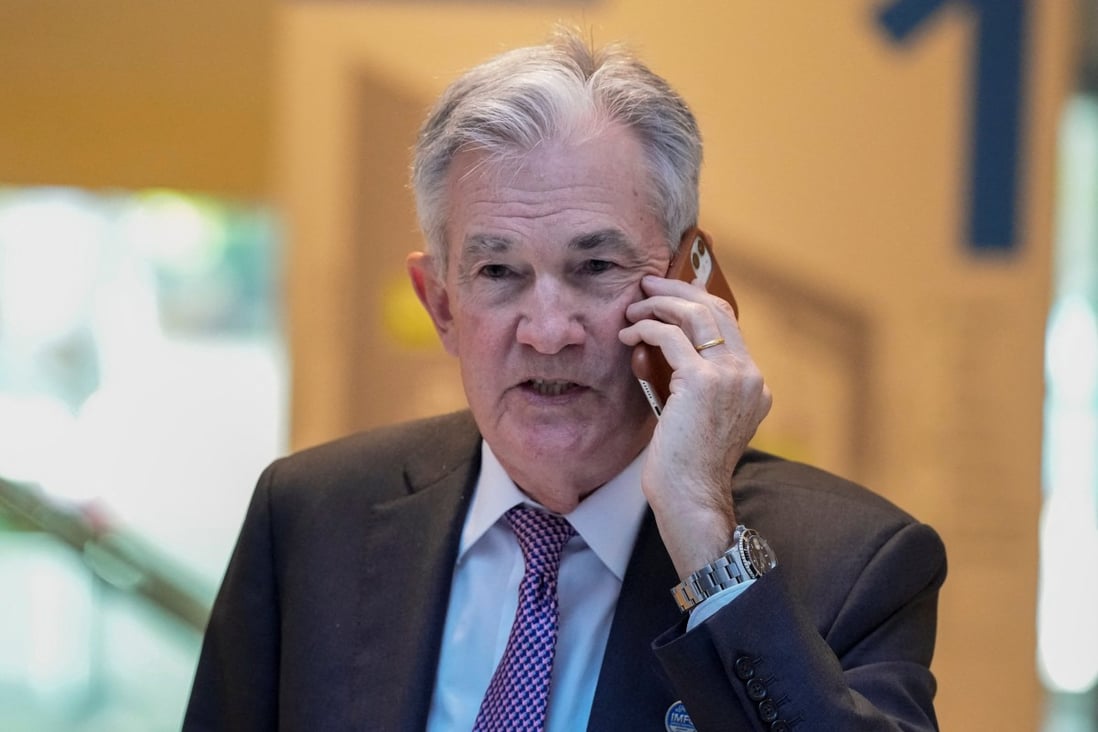

President Trump On Jerome Powell No Immediate Dismissal Expected

Apr 24, 2025

President Trump On Jerome Powell No Immediate Dismissal Expected

Apr 24, 2025 -

Open Ais Chat Gpt Under Ftc Scrutiny A Deep Dive Into The Investigation

Apr 24, 2025

Open Ais Chat Gpt Under Ftc Scrutiny A Deep Dive Into The Investigation

Apr 24, 2025 -

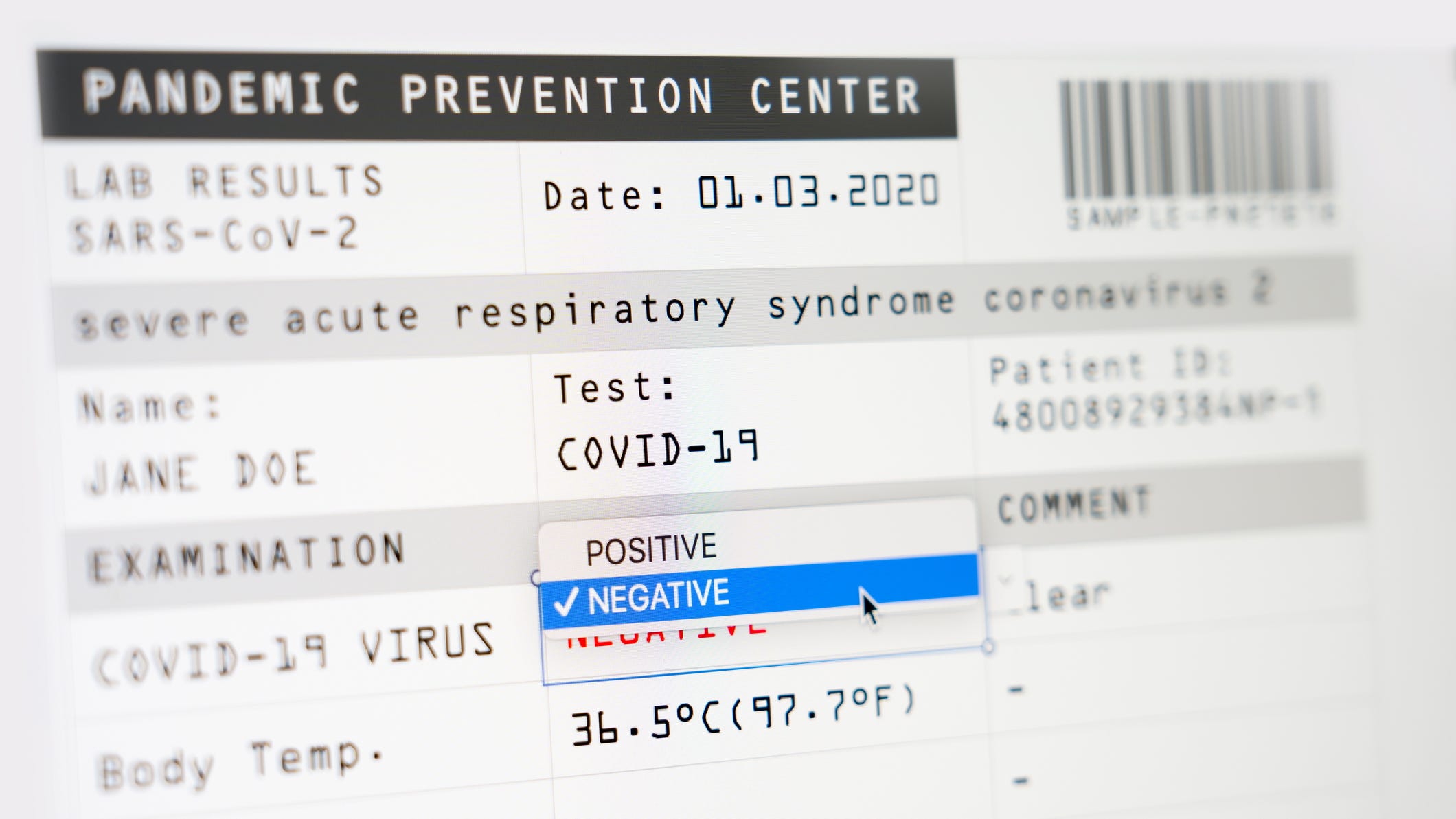

Lab Owner Admits To Faking Covid 19 Test Results During Pandemic

Apr 24, 2025

Lab Owner Admits To Faking Covid 19 Test Results During Pandemic

Apr 24, 2025 -

How Trumps Presidency Will Shape Zuckerbergs Leadership At Meta

Apr 24, 2025

How Trumps Presidency Will Shape Zuckerbergs Leadership At Meta

Apr 24, 2025 -

Facebook Under Trump Zuckerbergs Leadership In A Shifting Political Landscape

Apr 24, 2025

Facebook Under Trump Zuckerbergs Leadership In A Shifting Political Landscape

Apr 24, 2025