BofA's Take On High Stock Market Valuations And Investor Concerns

Table of Contents

High stock market valuations are a significant concern for investors navigating today's complex financial landscape. Bank of America (BofA), a leading global financial institution, recently shared its perspective on this critical issue, highlighting potential risks and opportunities. This article dives deep into BofA's key findings and explores the implications for your investment strategy.

BofA's Valuation Concerns

Elevated Price-to-Earnings Ratios (P/E)

BofA's assessment reveals that current Price-to-Earnings (P/E) ratios across several sectors are significantly elevated compared to historical averages. This suggests that the market may be pricing in future growth at a rate that may not be sustainable. Certain sectors, in particular, are exhibiting particularly high valuations, raising red flags for potential overvaluation.

- Examples of overvalued sectors according to BofA: While BofA's specific reports may not publicly list every sector, past analyses have often highlighted technology and consumer discretionary sectors as potentially overvalued during periods of high market valuations. This is often due to their sensitivity to interest rate changes and consumer spending.

- Comparison of current P/E ratios to long-term averages: BofA likely uses a comparison of current P/E ratios to long-term averages (e.g., 10-year or 20-year averages) to establish a benchmark for determining whether current valuations are unusually high. This historical context is vital for assessing potential risks.

- Specific metrics BofA used to determine valuations: BofA's analysts employ a range of valuation metrics beyond P/E ratios, likely including Price-to-Sales (P/S), Price-to-Book (P/B), and Discounted Cash Flow (DCF) analysis to develop a comprehensive picture of market valuation.

Impact of Interest Rate Hikes

BofA's analysis emphasizes the significant impact of rising interest rates on stock valuations. Higher interest rates generally lead to decreased company earnings, as borrowing costs increase, and reduce investor appetite for riskier assets like equities. This inverse relationship between interest rates and stock prices is a key factor influencing market performance.

- Explanation of the inverse relationship between interest rates and stock prices: Higher interest rates make bonds more attractive, diverting investment away from stocks. Furthermore, higher rates increase the cost of borrowing for companies, impacting profitability and potentially slowing economic growth.

- BofA's predictions for future interest rate increases: BofA's economists and strategists regularly provide forecasts for future interest rate movements. These predictions are crucial for investors in assessing the potential impact on their portfolios. (Note: Specific predictions are dynamic and change frequently, so checking BofA's latest reports is essential.)

- How these rate hikes might impact different sectors differently: Interest rate hikes impact different sectors differently. Companies with high debt levels are particularly vulnerable, while those with strong cash flows may be more resilient. BofA's analysis likely highlights these sectoral variations.

Investor Concerns Highlighted by BofA

Inflationary Pressures

BofA recognizes inflationary pressures as a significant concern for investors. Persistent inflation erodes purchasing power, impacting corporate profits and investor confidence. High inflation can lead to increased input costs for businesses, squeezing profit margins and potentially impacting future earnings growth.

- How persistent inflation erodes purchasing power and impacts investment returns: Inflation reduces the real value of returns. If inflation is higher than investment returns, investors experience a net loss in purchasing power.

- BofA's prediction for future inflation rates: BofA regularly publishes inflation forecasts, providing insights into the potential trajectory of inflation and its impact on the market. These forecasts are crucial to understanding the outlook for investment strategies.

- Specific sectors particularly vulnerable to inflation: Sectors with high input costs, such as consumer staples and energy, tend to be more vulnerable to inflation. BofA's analysis likely highlights these sensitivities.

Geopolitical Uncertainty

Geopolitical uncertainty is another factor contributing to investor concerns, according to BofA's analysis. Unpredictable global events can create significant market volatility and negatively impact investor sentiment.

- Examples of geopolitical events cited by BofA: BofA's reports often cite specific geopolitical events such as international conflicts, trade disputes, and political instability as factors influencing market performance.

- Explanation of how these events create market volatility: Uncertainty surrounding geopolitical events can trigger market sell-offs as investors seek safer assets.

- BofA's suggested strategies for mitigating geopolitical risk: BofA likely recommends strategies such as diversification across different geographic regions and asset classes to mitigate geopolitical risk.

BofA's Recommendations and Strategies

Diversification Strategies

BofA emphasizes the importance of diversification to manage risk effectively. A well-diversified portfolio spreads investments across different asset classes, reducing the impact of any single investment's underperformance.

- Specific asset classes recommended by BofA for diversification: BofA likely recommends a mix of equities (stocks), fixed income (bonds), alternative investments (e.g., real estate, commodities), and cash. The optimal mix depends on the investor's risk tolerance and investment goals.

- Strategies to reduce portfolio volatility: Diversification is a key strategy to reduce volatility. Other strategies include hedging against market risks and adopting a long-term investment horizon.

- Importance of considering risk tolerance when diversifying: Investors should carefully assess their risk tolerance before deciding on an appropriate level of diversification.

Long-Term Investment Outlook

Despite concerns about high valuations, BofA maintains a long-term positive outlook for the stock market. However, the bank suggests that investors should adopt a disciplined, long-term approach to manage risk and maximize returns.

- BofA's prediction for long-term market growth: BofA's long-term forecasts typically incorporate assumptions about economic growth, inflation, and interest rates. These forecasts help investors develop long-term investment strategies.

- Advice for investors with a long-term time horizon: Investors with longer time horizons can often ride out market fluctuations, benefiting from the potential for long-term growth. BofA's advice likely emphasizes this aspect.

- The importance of staying disciplined in the face of market fluctuations: Maintaining a disciplined investment approach is crucial, even during periods of market uncertainty. This involves sticking to your investment strategy and avoiding emotional decision-making.

Conclusion

BofA's analysis highlights significant concerns about high stock market valuations, driven by factors such as elevated P/E ratios, rising interest rates, inflation, and geopolitical uncertainty. However, BofA also offers valuable guidance for investors, emphasizing the importance of diversification and a long-term perspective. Understanding BofA's take on high stock market valuations is crucial for informed investment decisions. Stay informed about market trends and consult with a financial advisor to develop a robust investment strategy that addresses your specific financial goals and risk tolerance. Learn more about managing high stock market valuations and protecting your portfolio today.

Featured Posts

-

The Closure Of Anchor Brewing Company A Look Back At Its Legacy

Apr 24, 2025

The Closure Of Anchor Brewing Company A Look Back At Its Legacy

Apr 24, 2025 -

Breast Cancer Awareness Tina Knowles Experience Highlights Mammogram Importance

Apr 24, 2025

Breast Cancer Awareness Tina Knowles Experience Highlights Mammogram Importance

Apr 24, 2025 -

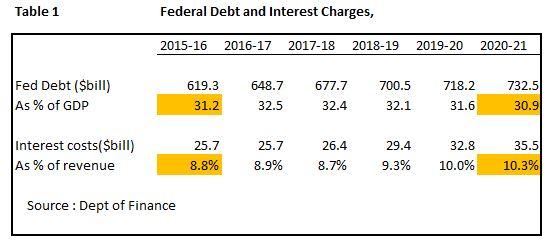

Is Canadas Fiscal Future At Risk Examining Liberal Spending

Apr 24, 2025

Is Canadas Fiscal Future At Risk Examining Liberal Spending

Apr 24, 2025 -

Land Your Dream Private Credit Job 5 Dos And Don Ts To Follow

Apr 24, 2025

Land Your Dream Private Credit Job 5 Dos And Don Ts To Follow

Apr 24, 2025 -

Instagrams Latest App A Direct Challenge To Tik Toks Dominance

Apr 24, 2025

Instagrams Latest App A Direct Challenge To Tik Toks Dominance

Apr 24, 2025