Spot Market For Russian Gas: EU Discussion On Phaseout Strategies

Table of Contents

Challenges of Reducing Reliance on Russian Pipeline Gas

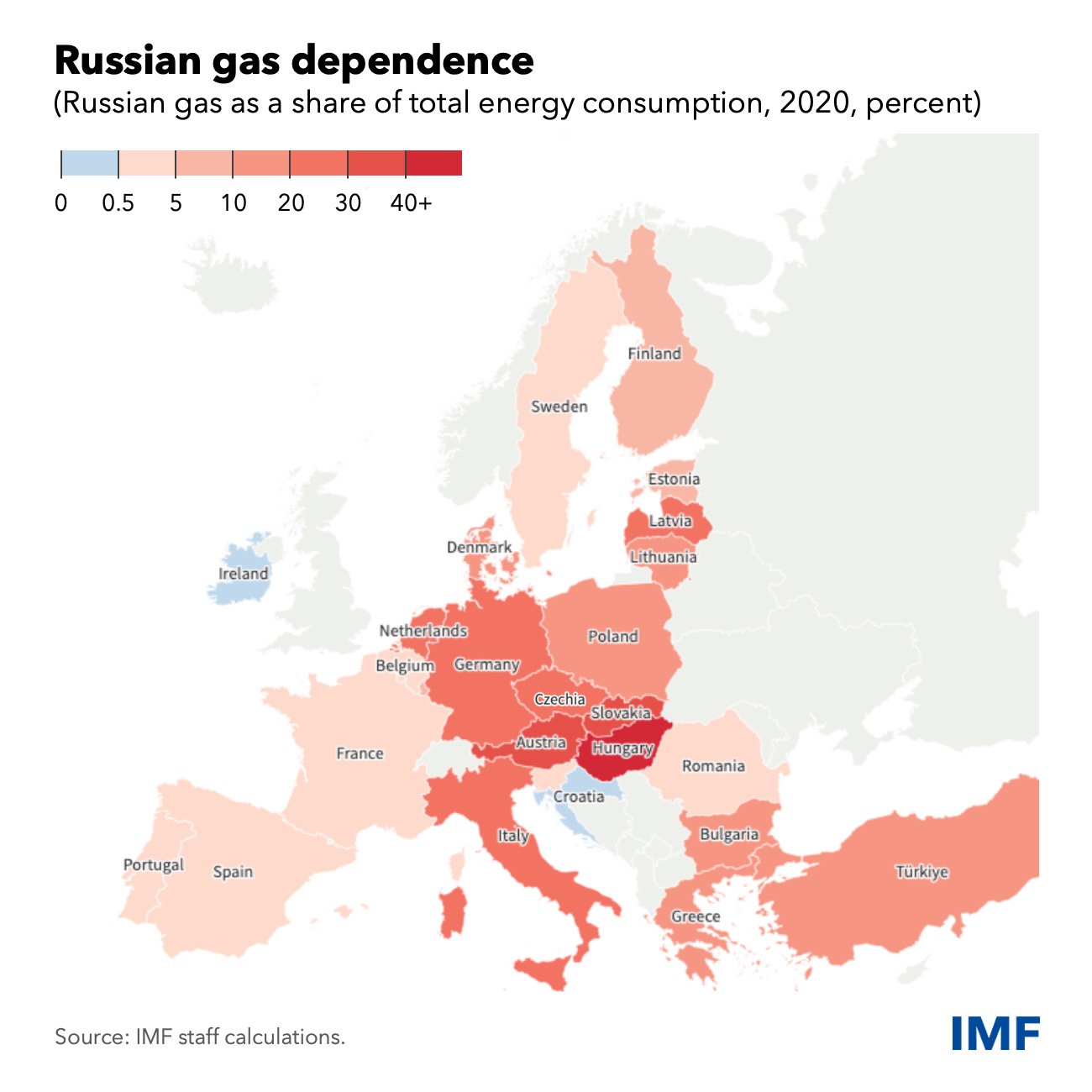

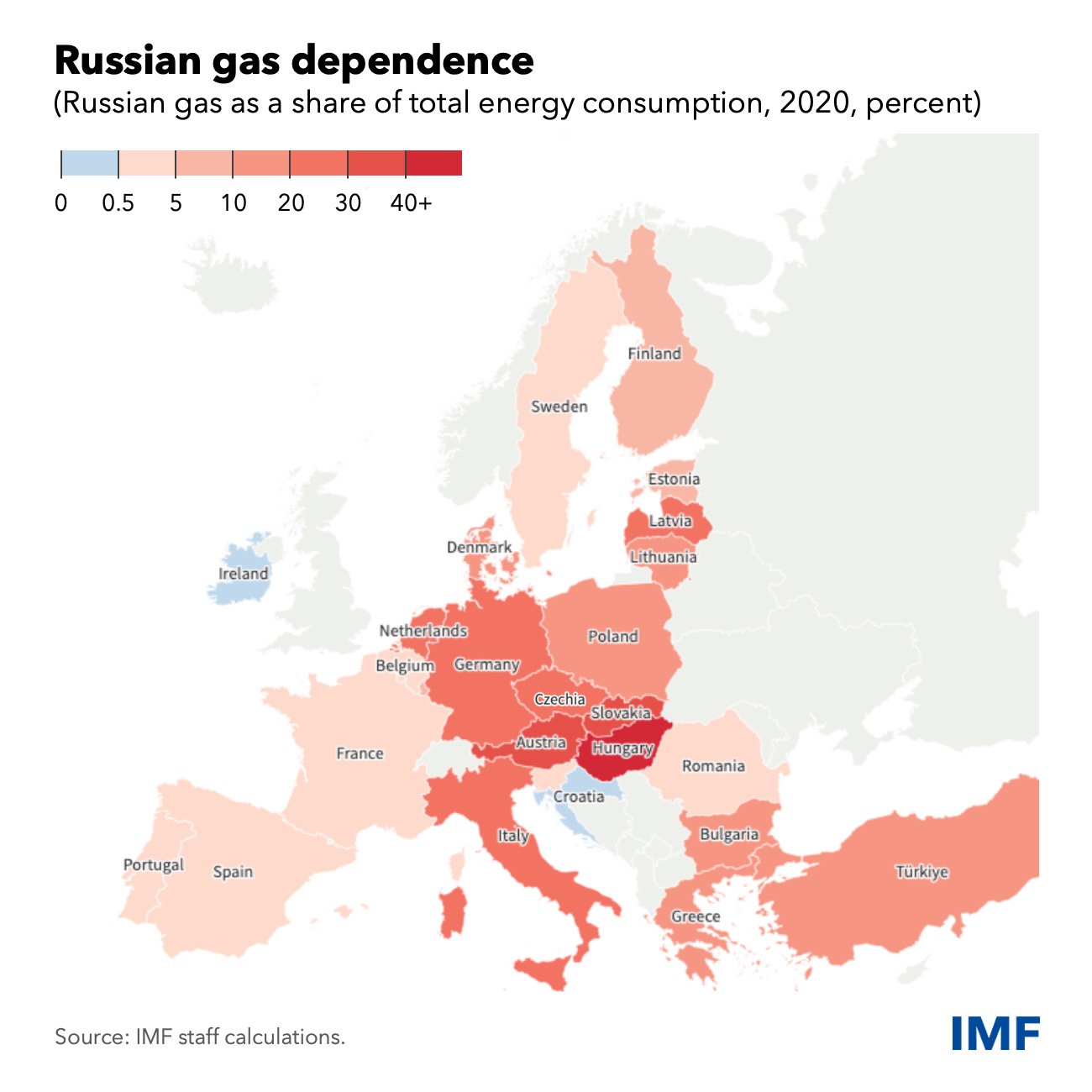

The EU's historical dependence on Russian pipeline gas has created significant vulnerabilities. For decades, many member states relied heavily on long-term contracts with Russia, creating a complex web of interconnected pipelines and a significant energy deficit if supplies were interrupted. Quickly replacing this substantial supply presents considerable infrastructure challenges. Existing pipeline networks may not be adequate to handle increased flows from alternative sources, and storage capacity across the EU needs significant expansion.

- High initial investment costs for alternative infrastructure: Building new pipelines and upgrading existing infrastructure requires substantial upfront investment, posing a financial burden on member states.

- Geographic limitations of pipeline access for some member states: Some EU countries are geographically less well-positioned to receive gas from alternative sources via pipeline, requiring more innovative solutions.

- Potential for supply bottlenecks during the transition period: The shift away from Russian gas will inevitably lead to temporary supply constraints, demanding careful planning and coordination.

- Need for enhanced gas storage capacity across the EU: Increased storage capacity is vital to buffer against supply disruptions and price volatility in the spot market.

The Role of the Spot Market in the Phaseout Strategy

The spot market for natural gas is playing an increasingly crucial role in the EU’s efforts to secure alternative gas supplies. While offering flexibility and access to a wider range of suppliers, it also introduces challenges. The spot market is characterized by significant price volatility, making it a riskier option compared to long-term contracts. Effective market mechanisms are crucial to mitigate price spikes and ensure fair competition.

- Increased price volatility compared to long-term contracts: Spot prices can fluctuate dramatically based on supply and demand, creating uncertainty for consumers and businesses.

- Potential for supply shortages during periods of high demand: During peak demand periods, competition for available gas in the spot market can intensify, potentially leading to shortages.

- Need for strategic reserves to mitigate supply disruptions: Maintaining sufficient gas reserves is crucial to cushion against unforeseen supply disruptions in the volatile spot market.

- Importance of transparent and efficient spot market trading mechanisms: Well-functioning market rules and regulatory frameworks are essential to ensure fair competition and prevent market manipulation.

Diversification of Gas Sources and Infrastructure

Diversifying gas supply sources is paramount to reducing reliance on Russia. This involves increased reliance on Liquefied Natural Gas (LNG) imports, the development of new LNG terminals, and exploration of alternative energy sources. The EU is actively investing in new LNG import terminals, expanding pipeline connections with non-Russian suppliers, and accelerating the deployment of renewable energy sources to reduce overall gas demand. Strengthening energy cooperation between EU member states is also crucial.

- Increased investment in LNG import terminals across Europe: New LNG terminals provide crucial infrastructure for importing gas from a wider range of suppliers.

- Expansion of pipeline connections with non-Russian suppliers: Diversifying pipeline networks reduces reliance on a single supplier.

- Acceleration of renewable energy deployment to reduce gas demand: Transitioning to renewable energy reduces the overall demand for natural gas.

- Strengthening of energy cooperation between EU member states: Collaboration between member states is essential for efficient resource allocation and market stability.

The Impact of Sanctions on the Spot Market for Russian Gas

EU sanctions on Russian gas imports have had a profound impact on the spot market, causing significant price fluctuations and impacting energy security. The immediate consequence was a surge in energy prices, particularly in the spot market, as buyers scrambled for alternative supplies. This created increased competition for available LNG globally and potential supply disruptions to certain member states. The long-term geopolitical implications for the EU's energy independence are also profound.

- Increased energy prices following the imposition of sanctions: Sanctions have directly contributed to higher energy costs for consumers and businesses.

- Potential for disruption of gas supply to certain member states: The sanctions have created vulnerabilities in the gas supply chain for some countries.

- Increased competition for available LNG supplies globally: The EU's increased demand for LNG has led to intensified competition in the global market.

- Long-term geopolitical implications for the EU's energy independence: The crisis has highlighted the importance of achieving energy independence for the EU.

Conclusion

The EU's phaseout of Russian gas presents significant challenges, requiring a comprehensive strategy that addresses pipeline gas dependence, utilizes the spot market effectively, and prioritizes supply diversification. The transition needs substantial investment in infrastructure, enhanced market mechanisms, and a commitment to accelerating renewable energy deployment. Understanding the complexities of the spot market for Russian gas is crucial for policymakers and energy stakeholders alike. Continued monitoring of market trends, investment in alternative energy sources, and transparent policy decisions are vital for ensuring the EU's energy security and achieving a successful phaseout of Russian gas. Stay informed on the latest developments in the EU's gas market to navigate this critical transition effectively.

Featured Posts

-

Diversification Of Lpg Sources Chinas Response To Us Trade Policies

Apr 24, 2025

Diversification Of Lpg Sources Chinas Response To Us Trade Policies

Apr 24, 2025 -

Living With A 77 Inch Lg C3 Oled A Comprehensive Review

Apr 24, 2025

Living With A 77 Inch Lg C3 Oled A Comprehensive Review

Apr 24, 2025 -

Chinese Buyout Firm Weighs Sale Of Utac Chip Tester

Apr 24, 2025

Chinese Buyout Firm Weighs Sale Of Utac Chip Tester

Apr 24, 2025 -

The Post Roe Landscape Examining The Role Of Otc Birth Control

Apr 24, 2025

The Post Roe Landscape Examining The Role Of Otc Birth Control

Apr 24, 2025 -

Elite Universities Facing Trump Administration Funding Cuts A Financial Response

Apr 24, 2025

Elite Universities Facing Trump Administration Funding Cuts A Financial Response

Apr 24, 2025