Bitcoin (BTC) Price Surge: Trump's Actions And Fed Influence

Table of Contents

Trump's Influence on Bitcoin's Price

The presidency of Donald Trump was marked by significant policy shifts and unpredictable pronouncements, creating a period of heightened political and economic uncertainty. This uncertainty significantly impacted global financial markets, and Bitcoin, as a decentralized asset, was not immune.

Political Uncertainty and Safe Haven Assets

Trump's actions, often communicated via Twitter, frequently introduced unexpected market volatility. These actions, ranging from trade disputes to shifting political alliances, created a climate of uncertainty that pushed investors towards perceived safe haven assets. Bitcoin, often seen as a hedge against traditional market instability, benefited from this flight to safety.

- Increased regulatory uncertainty under Trump administration: The lack of clear regulatory frameworks surrounding cryptocurrencies during the Trump era contributed to market uncertainty, impacting Bitcoin price.

- Impact of Trump's trade wars on investor confidence: The trade wars initiated by the Trump administration negatively impacted global economic confidence, driving investors toward alternative assets like Bitcoin.

- Flight to safety driving Bitcoin investment: As traditional markets experienced volatility due to Trump's actions, investors sought refuge in decentralized assets like Bitcoin, increasing demand and price.

For example, specific tweets from Trump announcing significant policy changes or trade decisions were often followed by notable shifts in the Bitcoin price, highlighting a potential correlation between political uncertainty and Bitcoin's value.

Impact of Trump's Economic Policies

Trump's economic policies, including significant tax cuts and deregulation efforts, also played a role in shaping the Bitcoin market. While these policies aimed to stimulate economic growth, their impact was complex and influenced investor risk appetite, consequently affecting Bitcoin investment.

- Stimulus packages and their effect on inflation: The stimulus packages implemented during the Trump administration, while intended to boost the economy, also contributed to inflationary pressures, potentially driving up demand for Bitcoin as an inflation hedge.

- Impact of deregulation on financial markets and Bitcoin adoption: While not directly targeting cryptocurrency, deregulation in other financial sectors could have indirectly influenced Bitcoin adoption and price by fostering a more risk-tolerant environment.

- Correlation between economic growth and Bitcoin price: While the correlation isn't always straightforward, periods of economic growth under Trump's administration did sometimes coincide with periods of increased Bitcoin price.

The Federal Reserve's Role in Bitcoin's Price Fluctuations

The Federal Reserve's monetary policies have a profound impact on global financial markets and consequently, on Bitcoin's price. The Fed's actions, particularly concerning interest rates and quantitative easing, directly influence investor behavior and asset allocation.

Interest Rate Hikes and Bitcoin's Safe-Haven Status

The Federal Reserve's decision to raise interest rates affects traditional financial markets significantly, impacting bond yields and the attractiveness of traditional investments. These hikes often lead investors to seek alternative, less correlated assets like Bitcoin.

- Impact of higher interest rates on bond yields: As interest rates rise, bond yields become more attractive, potentially drawing investment away from riskier assets like Bitcoin in the short term. However, this can also lead to inflation concerns, eventually boosting Bitcoin's appeal as an inflation hedge.

- Attractiveness of Bitcoin as a hedge against inflation: Higher interest rates, if they fail to control inflation, can increase the attractiveness of Bitcoin as a hedge against inflation, leading to increased demand and price appreciation.

- Increased demand for Bitcoin during periods of monetary tightening: Periods of monetary tightening by the Fed can create uncertainty in traditional markets, driving investors towards alternative assets like Bitcoin.

Quantitative Easing and its Impact on Bitcoin

Quantitative easing (QE) policies, involving the injection of large sums of money into the economy, can lead to increased inflation and affect the value of fiat currencies. This can influence Bitcoin's price, creating both opportunities and risks.

- Inflationary pressures and their effect on Bitcoin's value: Increased money supply through QE can lead to inflation, potentially increasing the demand for Bitcoin as a store of value and hedge against inflation.

- Increased liquidity and its impact on risk assets, including Bitcoin: QE policies increase liquidity in the market, often leading to increased investment in riskier assets, including Bitcoin.

- Bitcoin as a potential inflation hedge: Many view Bitcoin as a potential inflation hedge, as its supply is limited, unlike fiat currencies that can be printed at will. Periods of high inflation often result in increased Bitcoin investment.

Conclusion

This analysis highlights the intricate relationship between macroeconomic factors, specifically the actions of former President Trump and the Federal Reserve's monetary policies, and the price fluctuations of Bitcoin (BTC). While correlation doesn't equal causation, the evidence suggests a notable influence. Understanding these complex interactions is crucial for navigating the volatile world of cryptocurrency investing. Future price movements will likely depend on continued economic uncertainty, evolving regulatory landscapes, and the ongoing evolution of the Bitcoin market itself.

Call to Action: Stay informed about the latest developments impacting Bitcoin (BTC) price and continue your research to make informed investment decisions. Learn more about the factors influencing Bitcoin's price and how to effectively manage your cryptocurrency portfolio. Understanding the complexities of the Bitcoin (BTC) market is key to navigating its potential.

Featured Posts

-

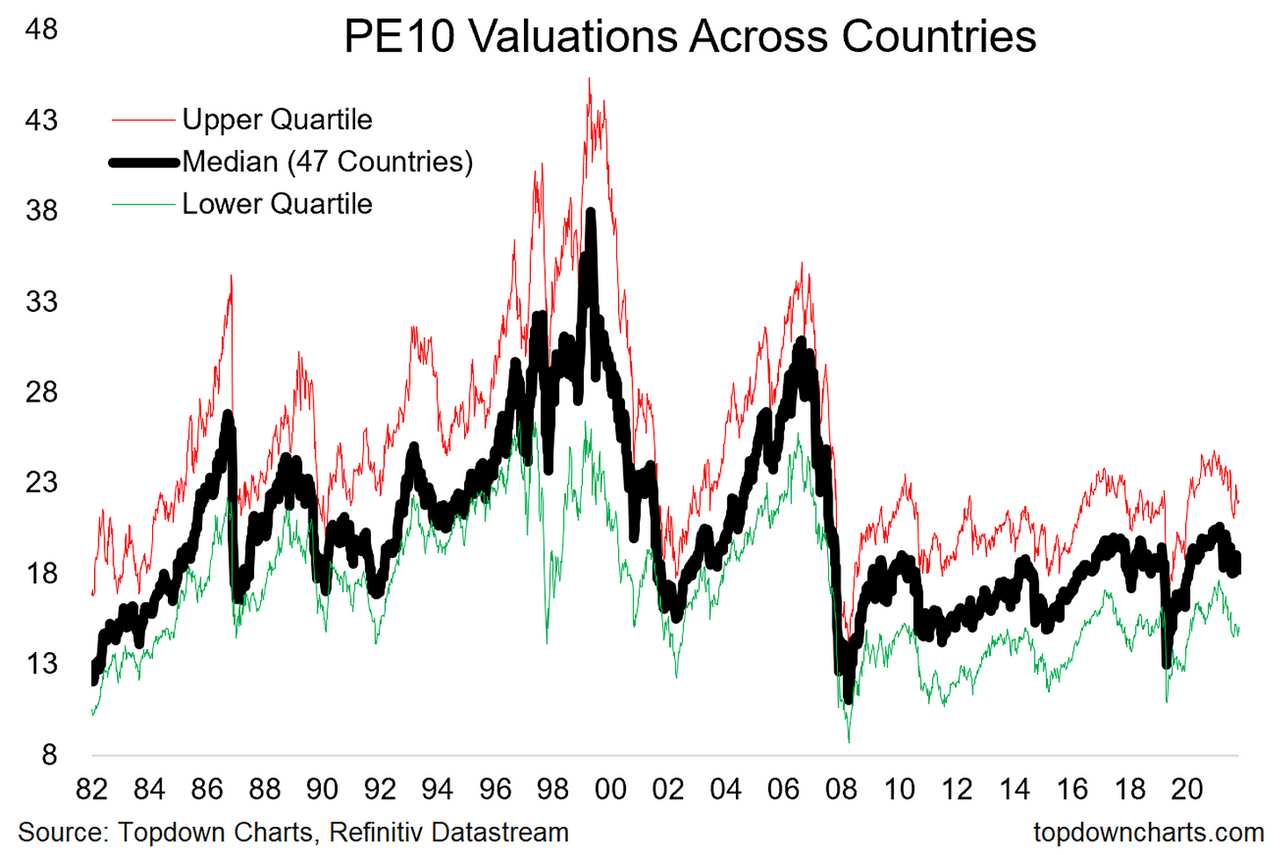

Investor Concerns About High Stock Market Valuations Bof As Response

Apr 24, 2025

Investor Concerns About High Stock Market Valuations Bof As Response

Apr 24, 2025 -

Improving Canadas Fiscal Health A Call For Responsible Governance

Apr 24, 2025

Improving Canadas Fiscal Health A Call For Responsible Governance

Apr 24, 2025 -

Real Time Stock Market Data Dow S And P 500 And Nasdaq April 23

Apr 24, 2025

Real Time Stock Market Data Dow S And P 500 And Nasdaq April 23

Apr 24, 2025 -

John Travoltas Shocking Rotten Tomatoes Record A Deep Dive

Apr 24, 2025

John Travoltas Shocking Rotten Tomatoes Record A Deep Dive

Apr 24, 2025 -

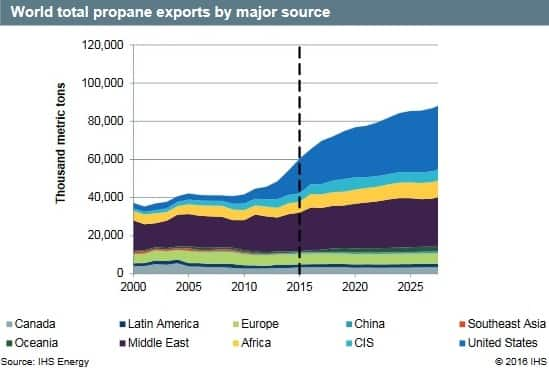

Shifting Global Lpg Trade Chinas Reliance On Middle East Grows

Apr 24, 2025

Shifting Global Lpg Trade Chinas Reliance On Middle East Grows

Apr 24, 2025