Ace The Private Credit Job Hunt: 5 Dos And Don'ts For Success

Table of Contents

DO: Tailor Your Resume and Cover Letter to Each Private Credit Job Application

Creating a generic resume and cover letter won't cut it in the competitive private credit job market. Each application requires a personalized touch that highlights your most relevant skills and experiences.

Highlight Relevant Skills:

To stand out, showcase skills directly applicable to private credit. This includes:

- Financial Modeling: Demonstrate proficiency in building and interpreting complex financial models using tools like Excel, Argus, or comparable software. Quantify your achievements – for example, “Developed a financial model that accurately predicted cash flows, resulting in a 10% improvement in investment decision-making.”

- Credit Analysis: Detail your experience in assessing credit risk, performing due diligence, and evaluating borrower creditworthiness. Use keywords such as “credit underwriting,” “risk assessment,” and “loan structuring” throughout your resume.

- Underwriting and Due Diligence: Highlight your experience in reviewing financial statements, conducting industry research, and evaluating collateral. Quantify your contributions, like "Successfully completed due diligence on 15+ loan transactions, identifying and mitigating potential risks."

- Relevant Software Proficiency: Showcase your expertise with industry-standard software, including Bloomberg Terminal, Argus, Moody's Analytics, and other relevant platforms.

Emphasize Private Credit Specific Experience:

Even if your background isn't solely in private credit, transferable skills from related fields are valuable.

- Bridge the Gap: If you lack direct private credit experience, showcase transferable skills from roles in banking, commercial lending, investment banking, or accounting. For example, experience in loan origination or portfolio management can be effectively presented as relevant experience.

- Highlight Transferable Skills: Explain how skills like financial statement analysis, risk management, and relationship building translate directly to private credit analysis. Use action verbs and quantify your achievements whenever possible.

- Showcase Your Understanding: Demonstrate your understanding of credit risk assessment, portfolio management, and the intricacies of the private credit market. Mention any relevant coursework, certifications (e.g., CFA, CAIA), or independent study that further strengthens your profile.

DO: Network Strategically Within the Private Credit Industry

Networking is crucial for landing a private credit job. A proactive approach can significantly boost your chances of securing an interview and ultimately, a job offer.

Attend Industry Events:

Industry events provide invaluable networking opportunities.

- Targeted Participation: Focus on conferences, workshops, and seminars specifically focused on private credit, alternative lending, and private equity.

- Prepare an Elevator Pitch: Develop a concise and engaging elevator pitch that highlights your skills and career aspirations within the private credit industry. Practice it until it flows naturally.

- Engage Actively: Don't just attend; actively participate in discussions, ask insightful questions, and engage genuinely with other attendees.

- Follow Up: After the event, follow up with individuals you met, expressing your appreciation for their time and reinforcing your interest in private credit opportunities.

Leverage LinkedIn:

LinkedIn is a powerful tool for professional networking.

- Optimize Your Profile: Create a compelling LinkedIn profile that showcases your expertise in private credit. Use relevant keywords and highlight your accomplishments.

- Join Relevant Groups: Join groups focused on private credit, alternative lending, finance, and related fields. Participate in discussions and share insightful content.

- Connect with Professionals: Connect with professionals working in private credit firms. Send personalized connection requests, highlighting your shared interests or relevant experience.

- Share Industry Insights: Share relevant articles, industry news, and thoughtful posts related to private credit to establish yourself as a knowledgeable professional within the field.

DO: Prepare for Behavioral and Technical Interview Questions

Thorough preparation is key to succeeding in private credit interviews. Both behavioral and technical questions will assess your fit for the role.

Behavioral Questions:

Behavioral questions assess your personality, work style, and problem-solving abilities.

- STAR Method Mastery: Practice answering common behavioral questions using the STAR method (Situation, Task, Action, Result). This structured approach ensures you provide clear and concise answers that highlight your achievements.

- Showcase Soft Skills: Prepare examples demonstrating your teamwork, problem-solving, communication, leadership, and adaptability skills.

- Highlight Successes: Focus on instances where you overcame challenges, achieved significant results, and demonstrated initiative.

Technical Questions:

Technical questions test your understanding of financial concepts and private credit principles.

- Financial Modeling Proficiency: Practice building and interpreting financial models, including discounted cash flow (DCF) analysis, leveraged buyout (LBO) models, and other relevant techniques.

- Credit Analysis Expertise: Demonstrate your understanding of various credit risk assessment methodologies, including credit scoring models, financial ratios, and qualitative factors.

- Market Awareness: Stay updated on current market trends, economic indicators, and industry news impacting the private credit market. Be ready to discuss your insights.

DON'T: Neglect the Importance of Due Diligence on Potential Employers

Just as employers assess you, you should thoroughly research potential employers.

Research the Firm:

Thorough research demonstrates your genuine interest and professionalism.

- Investment Strategy: Understand the firm's investment strategy, target industries, and typical deal sizes. Look for alignment between their strategy and your career goals.

- Portfolio Composition: Analyze their current portfolio to gain insights into their investment philosophy and risk appetite.

- Recent Transactions: Research their recent transactions to understand their deal flow and the types of companies they invest in.

- Firm Culture: Research the firm's culture and values through online resources like Glassdoor and LinkedIn. Assess if the firm's culture aligns with your preferences and work style.

Underestimate the Interview Process:

Each stage of the interview process is important.

- Prepare Thoughtful Questions: Prepare insightful questions to ask interviewers at each stage. This demonstrates your engagement and interest.

- Professionalism: Dress professionally and present yourself with confidence. Your appearance and demeanor reflect your professionalism and commitment.

- Follow Up: Always send a thank-you note after each interview, reiterating your interest and highlighting key points from the conversation.

DON'T: Rush the Job Search Process; Be Patient and Persistent

Landing the ideal private credit job takes time and effort.

Develop a Realistic Timeline:

Avoid getting discouraged; the job search process can take longer than expected.

- Organized Tracking: Maintain a spreadsheet or document tracking your applications, interview stages, and follow-up efforts.

- Positive Attitude: Maintain a positive attitude and focus on your long-term career goals. Setbacks are opportunities for learning and improvement.

- Seek Feedback: After each interview, request feedback to identify areas for improvement. Use this feedback to enhance your performance in future interviews.

Settle for a Role That Doesn’t Excite You:

Don't compromise on your career aspirations.

- Consider Long-Term Growth: Evaluate the firm’s culture, team dynamics, and long-term career growth opportunities to ensure alignment with your career path.

- Align With Your Values: Ensure the firm's values and mission resonate with your personal and professional values. A good fit is essential for job satisfaction and long-term success.

Conclusion:

Securing a position in private credit requires a strategic and well-planned approach. By following these dos and don'ts—tailoring your application, networking effectively, preparing thoroughly for interviews, conducting due diligence on potential employers, and maintaining patience—you can significantly increase your chances of acing your private credit job hunt. Remember to leverage your unique skills and experience, and don't hesitate to reach out to professionals in the field for guidance. Start your successful private credit job hunt today!

Featured Posts

-

T Mobile Data Breaches 16 Million Fine Highlights Security Gaps

Apr 22, 2025

T Mobile Data Breaches 16 Million Fine Highlights Security Gaps

Apr 22, 2025 -

The Anti Trump Movement Citizen Voices From Across America

Apr 22, 2025

The Anti Trump Movement Citizen Voices From Across America

Apr 22, 2025 -

Strengthening Nordic Security The Role Of Swedish Tanks And Finnish Troops

Apr 22, 2025

Strengthening Nordic Security The Role Of Swedish Tanks And Finnish Troops

Apr 22, 2025 -

Trade War Concerns Dow Futures And Dollar React Live Market Analysis

Apr 22, 2025

Trade War Concerns Dow Futures And Dollar React Live Market Analysis

Apr 22, 2025 -

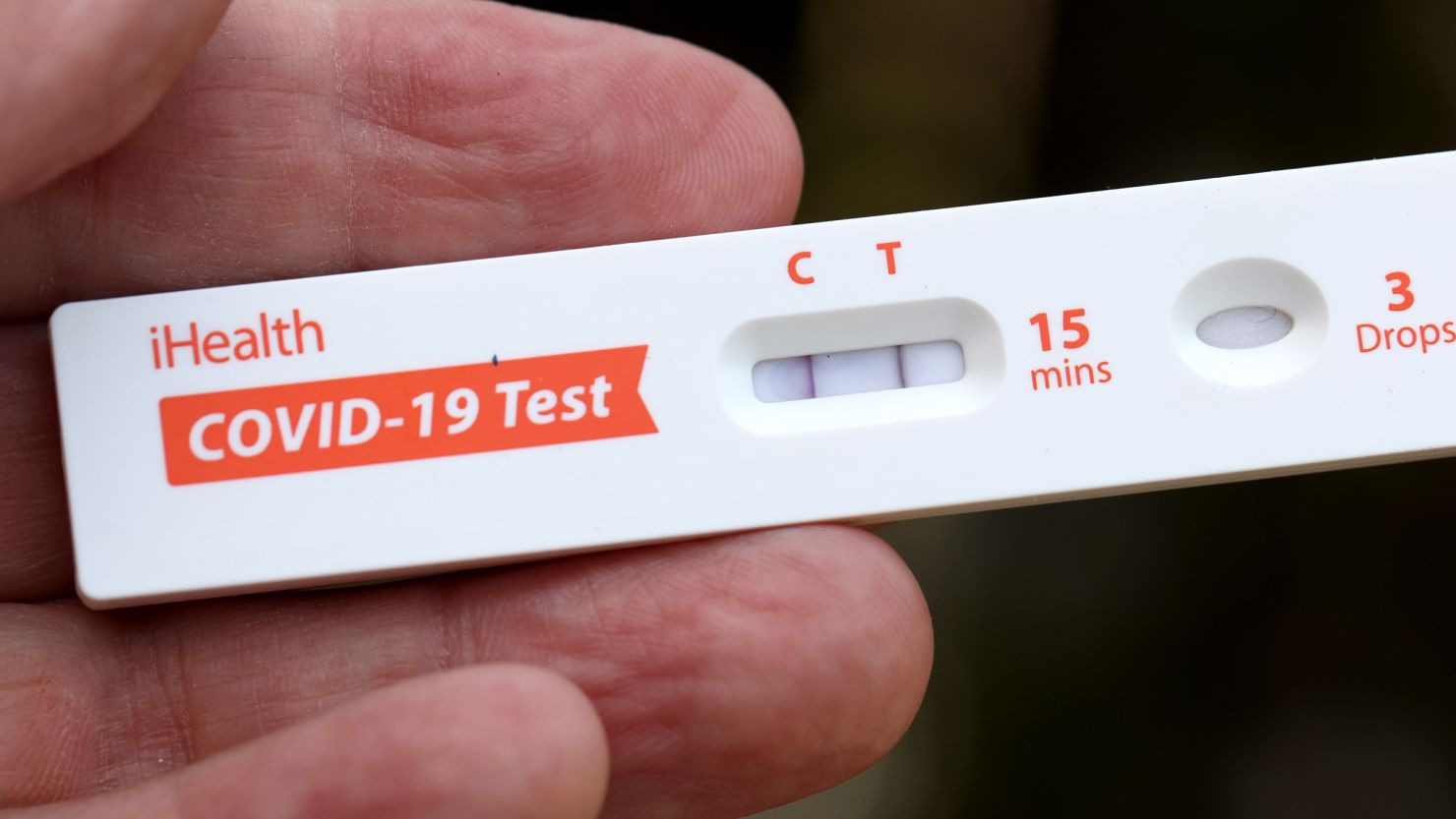

Guilty Plea Lab Owner Faked Covid 19 Test Results During Pandemic

Apr 22, 2025

Guilty Plea Lab Owner Faked Covid 19 Test Results During Pandemic

Apr 22, 2025