Trade War Concerns: Dow Futures And Dollar React — Live Market Analysis

Table of Contents

Impact of Trade War on Dow Futures

Trade war uncertainty significantly impacts the Dow Jones Industrial Average futures. The Dow, a leading indicator of US stock market performance, is highly sensitive to trade policy changes. Tariff announcements, trade negotiation outcomes, and overall investor sentiment directly influence futures prices. Even the threat of new tariffs can trigger volatility.

Factors driving Dow futures fluctuations include:

- Tariff Announcements: The imposition or even the announcement of new tariffs creates uncertainty, leading to immediate market reactions. For example, the announcement of tariffs on steel and aluminum in 2018 caused a significant dip in Dow futures.

- Trade Negotiations: The progress (or lack thereof) in trade negotiations significantly affects investor confidence. Positive developments usually lead to a rise in futures, while setbacks trigger declines. The ongoing trade discussions between the US and China, for instance, have been a major driver of Dow futures volatility.

- Investor Sentiment: Investor fear and uncertainty surrounding trade wars significantly impact trading activity. Negative sentiment often leads to selling pressure, driving down futures prices. Conversely, positive sentiment can lead to buying and increased futures prices.

Specific examples of how recent trade actions affected Dow futures:

- The announcement of increased tariffs on Chinese goods in 2019 led to a sharp drop in Dow futures.

- Positive news regarding a potential trade deal between the US and China often resulted in a surge in Dow futures.

Key economic indicators impacted by trade wars include GDP growth (often reduced by trade disputes), inflation (potentially impacted by tariffs on imported goods), and business investment (often hesitant during times of trade uncertainty). Analyzing investor behavior shows a shift towards risk aversion during periods of heightened trade tensions, with investors often moving funds to safer assets.

Short-Term vs. Long-Term Effects on Dow Futures

The short-term effects of trade war developments on Dow futures are typically characterized by increased volatility and potentially sharp price swings. In the long term, prolonged trade wars can lead to slower economic growth, impacting corporate earnings and ultimately depressing Dow futures. The long-term impact depends on the resolution of trade disputes and the overall global economic environment. However, prolonged uncertainty can lead to a sustained period of underperformance.

The US Dollar's Response to Trade War Tensions

The US dollar often acts as a safe-haven asset during periods of global economic uncertainty, including trade wars. When investors are concerned about risk, they often move their funds into US dollars, increasing its demand and strengthening its value. However, this relationship isn't always straightforward.

Factors influencing the dollar's strength or weakness during trade war periods include:

- Flight to Safety: During times of trade war uncertainty, investors often seek refuge in the perceived safety and stability of the US dollar, leading to its appreciation.

- Investor Confidence: Positive developments in trade negotiations can boost investor confidence, leading to a stronger dollar. Conversely, negative news can trigger a decline.

- Global Economic Outlook: The overall global economic outlook plays a role. If the US economy appears to be weathering the trade war better than others, the dollar may strengthen.

Examples of how the dollar has reacted to specific trade-related news events:

- Positive trade news often leads to a slight weakening of the dollar as investors move into riskier assets.

- Negative trade news tends to strengthen the dollar as investors seek safety.

The impact on foreign exchange markets is significant, affecting international trade and investment flows. The potential for currency wars, where countries manipulate their currencies to gain a trade advantage, adds another layer of complexity. A weaker dollar can make US exports more competitive, but it also increases the cost of imports.

Dollar Volatility and its Implications for Businesses

Fluctuations in the dollar's value create significant challenges for international businesses. Importers and exporters face uncertainty in their pricing and profitability, potentially impacting their investment decisions. Hedging strategies become crucial to mitigate currency risk. The volatility also affects investment strategies as investors need to factor in currency risk alongside other market variables.

Analyzing Market Sentiment and Predicting Future Trends

Interpreting market indicators and news is crucial for anticipating future trends in Dow futures and the dollar. A combination of technical and fundamental analysis is often employed.

Technical analysis involves studying price charts and historical data to identify patterns and predict future price movements. Key technical indicators include moving averages, relative strength index (RSI), and support/resistance levels.

Fundamental analysis focuses on evaluating underlying economic factors, such as GDP growth, inflation, interest rates, and trade data.

Key data points to watch for include:

- Employment reports: These provide insights into the health of the US economy and influence investor sentiment.

- Consumer confidence: High consumer confidence generally points towards strong economic growth.

- Geopolitical events: Unexpected geopolitical events can significantly impact market sentiment and volatility.

Risk Management Strategies during Trade Wars

During periods of trade war uncertainty, risk management is crucial. Investors and businesses can employ several strategies:

- Diversification: Spreading investments across different asset classes can help mitigate risk.

- Hedging: Using financial instruments such as futures contracts and options can help protect against potential losses due to currency fluctuations or stock market declines.

- Staying informed: Keeping up-to-date with the latest trade news and market analysis is vital for making informed decisions.

Trade War Concerns: Dow Futures and Dollar React — Key Takeaways and Next Steps

Trade war concerns significantly influence Dow futures and the US dollar. Dow futures exhibit increased volatility in response to trade-related news, while the dollar often acts as a safe-haven asset during periods of uncertainty. Analyzing market sentiment through technical and fundamental analysis is crucial for predicting future trends. Effective risk management strategies are essential for navigating this period of uncertainty.

To make informed investment decisions, it's vital to stay updated on the latest trade developments and monitor the reaction of Dow futures and the US dollar in real-time. Continue monitoring these crucial market indicators through reliable financial news sources. Subscribe to our newsletter for continued coverage of "Trade War Concerns" and in-depth analysis of how Dow futures and the dollar react to evolving global trade dynamics. [Link to newsletter signup] [Link to relevant resources]

Featured Posts

-

Trumps Ukraine Proposal Kyivs Urgent Response Needed

Apr 22, 2025

Trumps Ukraine Proposal Kyivs Urgent Response Needed

Apr 22, 2025 -

Returning To Fsu After The Shooting Concerns And The Universitys Plan

Apr 22, 2025

Returning To Fsu After The Shooting Concerns And The Universitys Plan

Apr 22, 2025 -

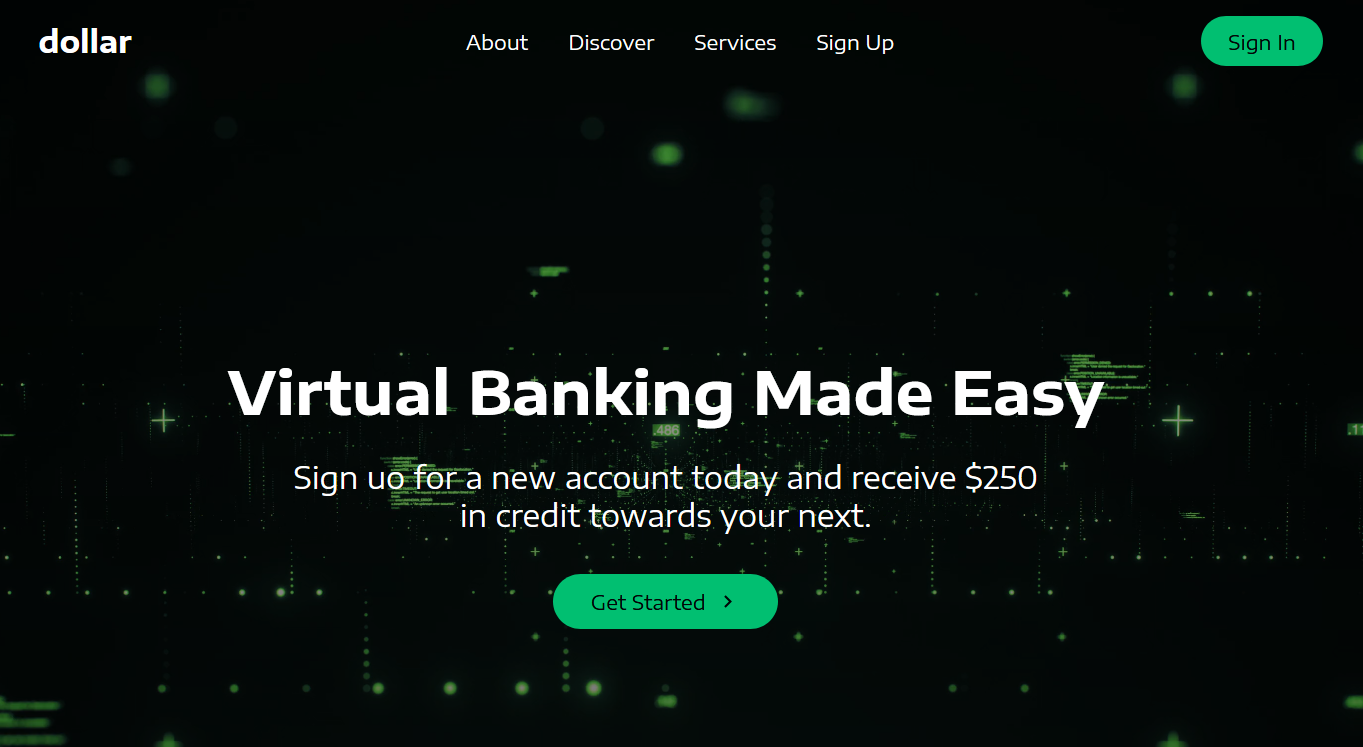

Guilty Plea Lab Owner Faked Covid 19 Test Results During Pandemic

Apr 22, 2025

Guilty Plea Lab Owner Faked Covid 19 Test Results During Pandemic

Apr 22, 2025 -

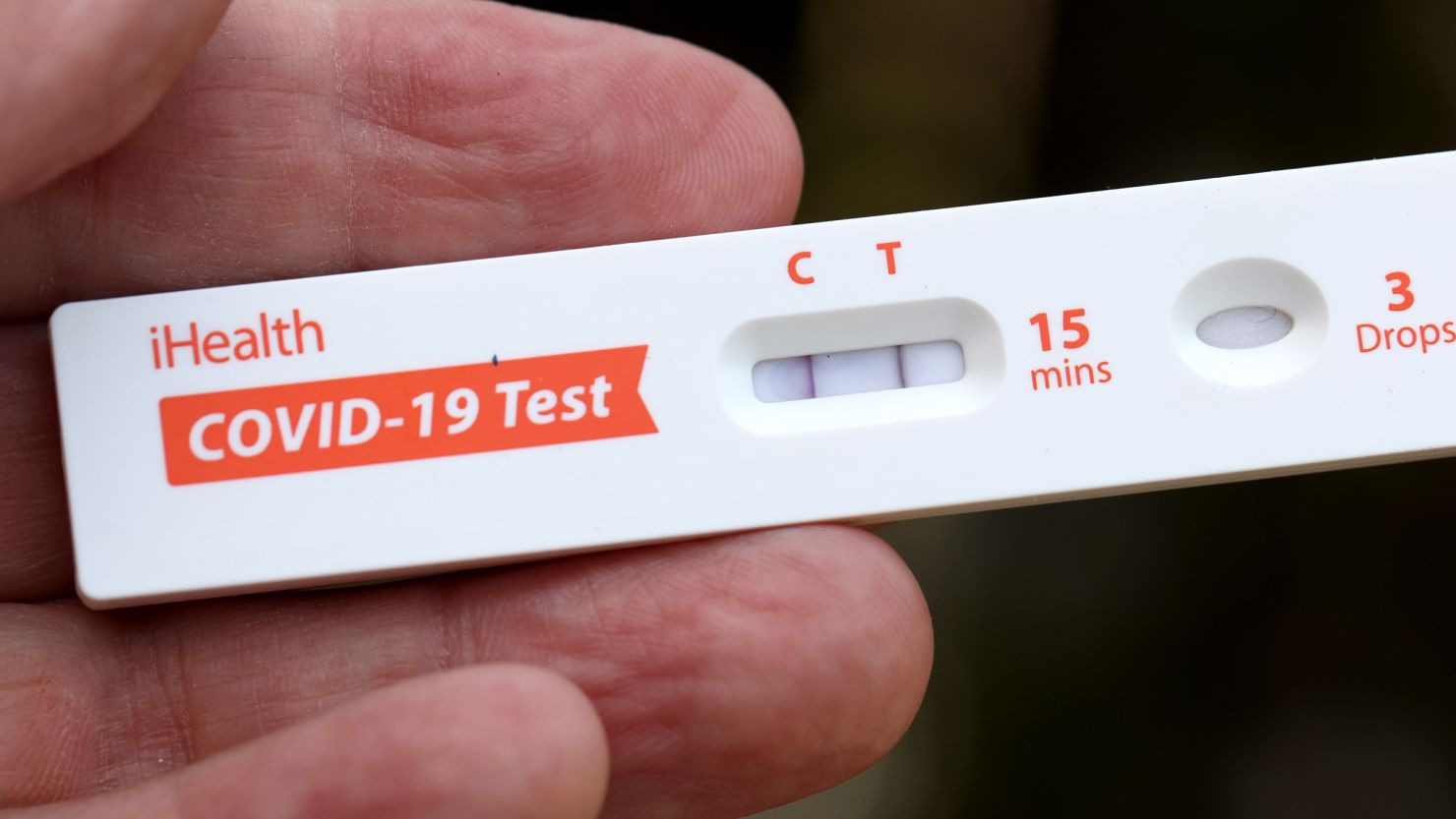

Bof As Rationale Why Current Stock Market Valuations Arent A Worry

Apr 22, 2025

Bof As Rationale Why Current Stock Market Valuations Arent A Worry

Apr 22, 2025 -

Cassidy Hutchinsons Memoir A Jan 6 Witnesss Account

Apr 22, 2025

Cassidy Hutchinsons Memoir A Jan 6 Witnesss Account

Apr 22, 2025