Why Investors Shouldn't Fear High Stock Market Valuations: BofA's Perspective

Table of Contents

BofA's Rationale for Dismissing Valuation Concerns

BofA's core argument rests on the belief that several factors mitigate the risks typically associated with high valuations. They contend that current market conditions justify higher price-to-earnings (P/E) ratios and that focusing solely on valuation metrics provides an incomplete picture.

-

Low Interest Rates Justify Higher P/E Ratios: Historically low interest rates significantly impact valuations. When borrowing costs are low, investors are willing to pay more for future earnings, leading to higher P/E multiples. This is because the opportunity cost of investing in stocks, relative to bonds, is reduced.

-

Strong Corporate Earnings Growth Potential: BofA points to robust corporate earnings growth potential as a key factor offsetting valuation concerns. Many companies are experiencing strong revenue growth and improving profitability, indicating a sustainable foundation for higher stock prices. This growth, they argue, justifies current valuations.

-

Long-Term Growth Focus: The bank emphasizes the importance of focusing on long-term growth prospects rather than reacting to short-term market fluctuations. They encourage investors to consider the long-term trajectory of businesses and their ability to generate value over time, rather than fixating on immediate valuation metrics.

-

Supporting Economic Indicators: BofA likely supports its claims with economic data, such as moderate inflation rates and sustained GDP growth. These indicators, when considered alongside corporate earnings projections, contribute to their optimistic outlook. Analyzing these macroeconomic factors is crucial for understanding the broader economic context influencing stock valuations.

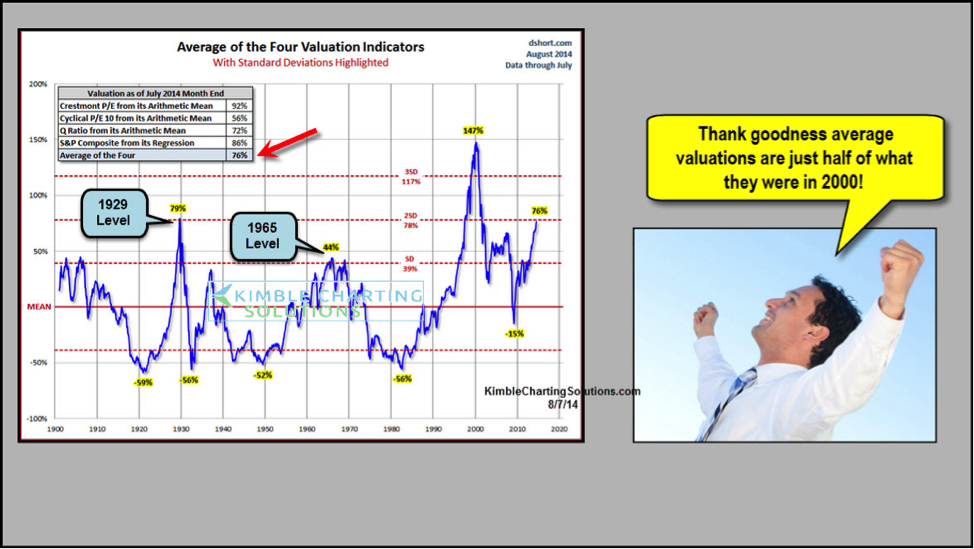

Addressing Common Valuation Metrics and Their Limitations

Traditional valuation metrics like P/E ratios, Price-to-Sales ratios, and others are frequently employed to assess the relative attractiveness of investments. However, BofA might argue that these metrics have limitations in the current environment.

-

Limitations of Historical P/E Ratios: Relying solely on historical P/E ratios can be misleading. Past performance doesn't guarantee future results, and comparing current multiples to those from previous eras may ignore significant changes in the economic landscape and technological innovation.

-

Impact of Technological Advancements: Rapid technological advancements and industry disruption render traditional valuation methods less effective. High-growth technology companies, for instance, might have high P/E ratios but demonstrate exceptional future earning potential, making simplistic valuation metrics inadequate.

-

Qualitative Factors Beyond Quantitative Metrics: BofA likely emphasizes the importance of considering qualitative factors alongside quantitative data. These factors include a company's competitive advantages, management quality, and innovative capacity, all of which significantly impact long-term value creation and should not be overlooked.

BofA's Strategic Investment Recommendations in a High-Valuation Market

Despite concerns about high stock market valuations, BofA likely advocates for a strategic approach to investing rather than complete market avoidance. Their recommendations probably include:

-

Sector-Specific Recommendations: BofA might suggest focusing on sectors expected to continue experiencing robust growth, such as technology, healthcare, and renewable energy. These sectors often present opportunities for strong long-term returns, even within a high-valuation market.

-

Strong Growth Potential and Competitive Advantages: The bank likely encourages investment in companies demonstrating strong growth potential and sustainable competitive advantages. These companies are better positioned to navigate market volatility and generate superior returns.

-

Portfolio Diversification: Diversifying investments across different asset classes and sectors is crucial for mitigating risk. This is particularly important in a potentially volatile market characterized by high valuations.

-

Risk Management: BofA would likely emphasize the importance of risk management strategies, such as carefully assessing individual investment risks and implementing appropriate risk mitigation techniques.

Counterarguments and Rebuttals (Addressing Criticisms of BofA's Stance)

Naturally, BofA's perspective isn't without potential criticisms. Addressing these counterarguments is vital for a complete understanding of the issue.

-

Potential Market Bubbles: Critics might argue that current valuations indicate the presence of market bubbles. BofA would likely counter by emphasizing the underlying strength of the economy and corporate earnings, suggesting that valuations aren't solely driven by speculation.

-

Sustainability of Earnings Growth: Concerns about the sustainability of current earnings growth are valid. BofA would likely respond by pointing to factors such as ongoing technological innovation, global economic expansion (where applicable), and increasing consumer demand.

-

Market Corrections: The possibility of a market correction is acknowledged, but BofA might view this as a potential buying opportunity for long-term investors. Strategic adjustments to portfolios may be advised during such periods, but a complete retreat from the market isn't necessarily recommended.

Investing Wisely Despite High Stock Market Valuations: A Call to Action

BofA's perspective suggests that high stock market valuations don't automatically equate to imminent market crashes. By focusing on long-term growth prospects, utilizing a diversified investment strategy, and carefully considering both quantitative and qualitative factors, investors can navigate the current market effectively. Don't let concerns about high stock market valuations paralyze your investment strategy. Learn more about BofA's approach and build a robust portfolio tailored to your financial goals, focusing on companies with strong fundamentals and sustainable competitive advantages. Remember, understanding and managing the risks associated with high stock market valuations is key to long-term investment success.

Featured Posts

-

Trade War Concerns Dow Futures And Dollar React Live Market Analysis

Apr 22, 2025

Trade War Concerns Dow Futures And Dollar React Live Market Analysis

Apr 22, 2025 -

Hegseth Under Fire New Signal Chat And Pentagon Chaos Claims

Apr 22, 2025

Hegseth Under Fire New Signal Chat And Pentagon Chaos Claims

Apr 22, 2025 -

Ignoring High Stock Market Valuations A Risk Worth Taking Bof A

Apr 22, 2025

Ignoring High Stock Market Valuations A Risk Worth Taking Bof A

Apr 22, 2025 -

The Zuckerberg Trump Dynamic Impact On Tech And Politics

Apr 22, 2025

The Zuckerberg Trump Dynamic Impact On Tech And Politics

Apr 22, 2025 -

Hear The Voices Nationwide Protests Against Trumps Policies

Apr 22, 2025

Hear The Voices Nationwide Protests Against Trumps Policies

Apr 22, 2025