US Economic Growth To Slow Considerably: Deloitte's Forecast

Table of Contents

Deloitte's Key Predictions for US Economic Slowdown

Deloitte's forecast paints a concerning picture of the US economic outlook. Their analysis projects a significant deceleration in GDP growth compared to previous years. While specific numbers may vary based on the time of release and further analysis, the overall trend is consistent: a substantial reduction in US economic growth.

- GDP growth projection for 2024: Deloitte's most recent report (insert link to report if available) projected a GDP growth rate of [insert percentage] for 2024, significantly lower than previous years' growth. This figure will be subject to revision as new economic data becomes available.

- Projected impact on key sectors: The slowdown is expected to impact various sectors differently. Manufacturing might face reduced output due to decreased consumer demand and supply chain disruptions. The technology sector, while resilient, could see a decrease in investment and slower growth. Consumer spending, a crucial driver of US economic growth, is anticipated to fall.

- Deloitte's methodology and data sources: Deloitte's forecast utilizes a robust methodology, incorporating a range of economic indicators, including CPI, PPI, consumer confidence indices, and business surveys. Their analysis draws on extensive data sources from government agencies, private sector organizations, and their own proprietary research.

Factors Contributing to the Predicted Slowdown in US Economic Growth

Several intertwined factors contribute to Deloitte's prediction of a significant slowdown in US economic growth. These include:

-

Inflationary pressures: High inflation, as measured by the Consumer Price Index (CPI) and Producer Price Index (PPI), erodes purchasing power, dampening consumer spending and business investment. Persistent inflation forces the Federal Reserve to take action, leading to the next contributing factor.

- Example: A sustained CPI above [percentage]% significantly reduces consumer discretionary spending, impacting retail sales and overall economic activity.

-

Interest rate hikes: The Federal Reserve's response to inflation involves raising interest rates. Higher interest rates increase borrowing costs for businesses and consumers, impacting investment decisions and consumer spending.

- Example: An increase of [percentage]% in the federal funds rate leads to higher mortgage rates, reducing housing demand and impacting related industries.

-

Supply chain disruptions: Global supply chain issues continue to affect production costs and the availability of goods, contributing to inflation and hampering economic growth.

- Example: Shipping delays and shortages of key components continue to constrain manufacturing output and increase prices for many consumer goods.

-

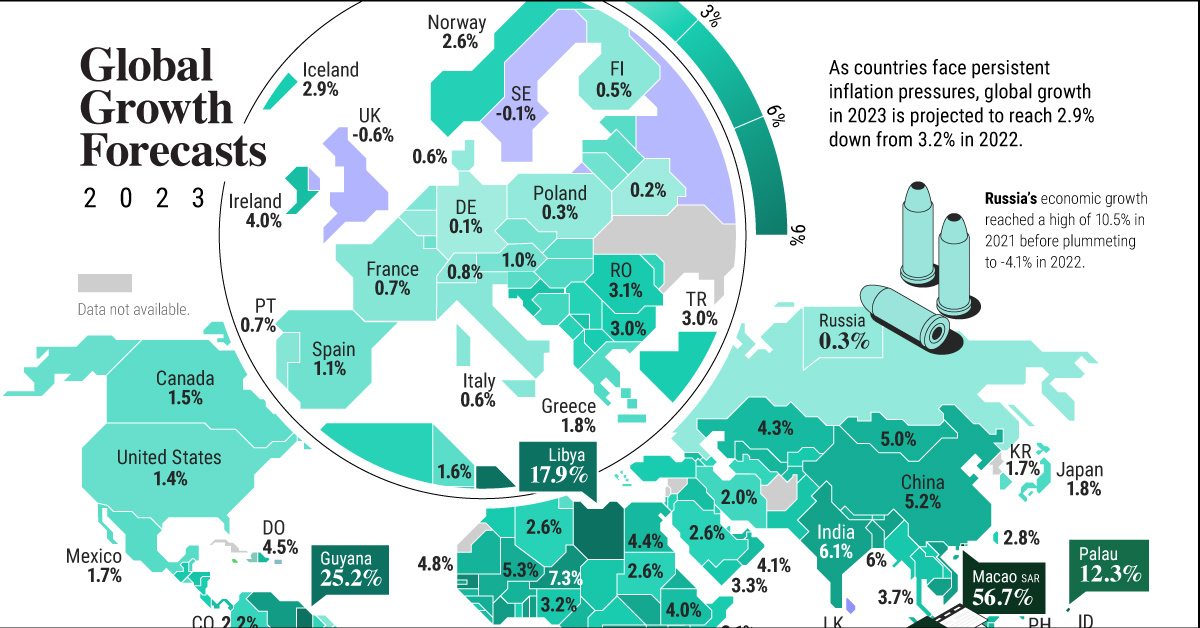

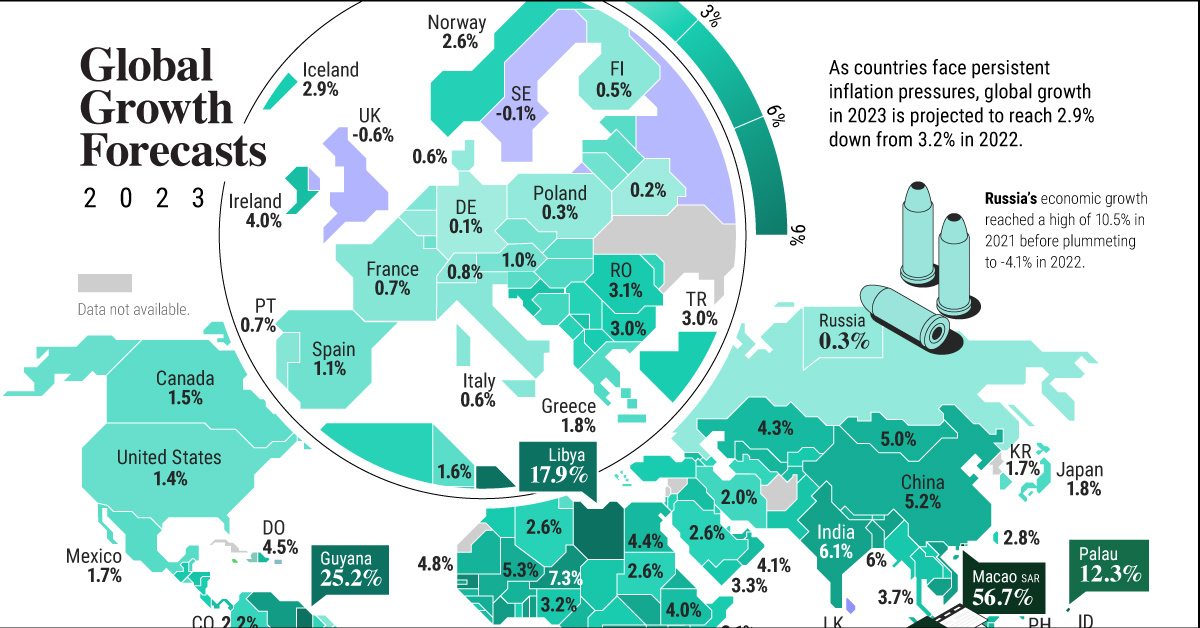

Geopolitical uncertainty: Geopolitical events, such as the war in Ukraine and ongoing trade tensions, introduce significant uncertainty into the global economy and negatively impact US economic growth.

- Example: The war in Ukraine has disrupted energy markets and global supply chains, increasing prices and fueling inflationary pressures.

Potential Implications of Slowed US Economic Growth

A significant slowdown in US economic growth has far-reaching implications:

-

Job market impact: Slower economic growth often translates to slower job creation or even job losses. Specific sectors particularly vulnerable to job losses are discussed in the following section.

- Example: A decline in consumer spending could lead to layoffs in the retail and hospitality sectors.

-

Consumer confidence: A slowing economy typically erodes consumer confidence, further reducing spending and investment. This creates a negative feedback loop, exacerbating the slowdown.

- Example: A decline in consumer confidence indices can predict a reduction in future spending, making businesses hesitant to invest.

-

Investment decisions: Businesses may respond to the slowdown by delaying or canceling investment projects, further dampening economic activity.

- Example: Uncertainty about future demand may lead to companies postponing expansion plans.

-

Government policy response: The government may intervene through fiscal stimulus measures, such as tax cuts or increased government spending, to mitigate the economic downturn. However, such measures can have their own drawbacks, like increasing national debt.

- Example: Government infrastructure spending could stimulate economic activity, but it may be ineffective if consumer and business sentiment remains low.

Industries Most Vulnerable to the Economic Slowdown

Certain industries are expected to be disproportionately affected by the predicted slowdown in US economic growth:

- Housing: The housing market, highly sensitive to interest rate changes, is particularly vulnerable. Rising mortgage rates are already cooling the market.

- Retail: Retail businesses, heavily reliant on consumer spending, are at risk if consumer confidence wanes and purchasing power decreases.

- Manufacturing: Manufacturing is susceptible to both supply chain disruptions and reduced consumer demand.

Conclusion: Navigating the Predicted Slowdown in US Economic Growth

Deloitte's forecast highlights a significant and concerning slowdown in US economic growth, driven by a confluence of factors including high inflation, interest rate hikes, supply chain disruptions, and geopolitical uncertainty. The implications are potentially substantial, impacting the job market, consumer confidence, investment decisions, and specific industries. The potential duration and severity of this slowdown remain uncertain, depending on how quickly the underlying factors are addressed. To better understand the nuances of this complex economic situation and prepare your business accordingly, download Deloitte's complete report to gain a deeper understanding of the projected slowdown in US economic growth and develop proactive strategies to navigate this challenging economic climate. Understanding the factors influencing US economic growth is crucial for informed decision-making in this period of uncertainty.

Featured Posts

-

Increased Rent In La After Fires Price Gouging Concerns Raised By Reality Tv Star

Apr 27, 2025

Increased Rent In La After Fires Price Gouging Concerns Raised By Reality Tv Star

Apr 27, 2025 -

Mafss Sam Carraros Unexpected And Short Lived Love Triangle Appearance On Stan

Apr 27, 2025

Mafss Sam Carraros Unexpected And Short Lived Love Triangle Appearance On Stan

Apr 27, 2025 -

Pne Ag Veroeffentlichung Gemaess Artikel 40 Absatz 1 Wp Hg

Apr 27, 2025

Pne Ag Veroeffentlichung Gemaess Artikel 40 Absatz 1 Wp Hg

Apr 27, 2025 -

Opinion Examining The Controversy Surrounding The Cdcs Recent Vaccine Study Hire

Apr 27, 2025

Opinion Examining The Controversy Surrounding The Cdcs Recent Vaccine Study Hire

Apr 27, 2025 -

Thueringen Amphibien Und Reptilienatlas Ein Umfassender Ueberblick

Apr 27, 2025

Thueringen Amphibien Und Reptilienatlas Ein Umfassender Ueberblick

Apr 27, 2025