Understanding High Stock Market Valuations: BofA's Rationale For Investor Calm

Table of Contents

BofA's Core Argument: Why High Valuations Aren't Necessarily a Cause for Alarm

BofA's central argument against immediate concern regarding high stock market valuations rests on a multi-faceted analysis of the current economic environment. They contend that several factors justify the seemingly elevated price levels and suggest a more nuanced perspective than simply focusing on high price-to-earnings (P/E) ratios alone. These factors contribute to a more optimistic outlook, even in the face of seemingly high valuations.

-

Low interest rates justify higher P/E ratios: When interest rates are low, the opportunity cost of investing in stocks is reduced. This allows investors to justify paying more for future earnings, leading to higher P/E ratios. Low borrowing costs also benefit companies, boosting investment and growth.

-

Robust corporate earnings growth supports current valuations: Strong corporate earnings demonstrate the underlying strength of the economy and the ability of companies to generate profits. This positive trend supports the current market valuations, suggesting that prices reflect real value creation.

-

Positive economic outlook and anticipated future growth prospects: BofA's analysis incorporates projections for continued economic growth, which further supports the case for higher valuations. Future earnings expectations play a crucial role in determining present-day stock prices.

-

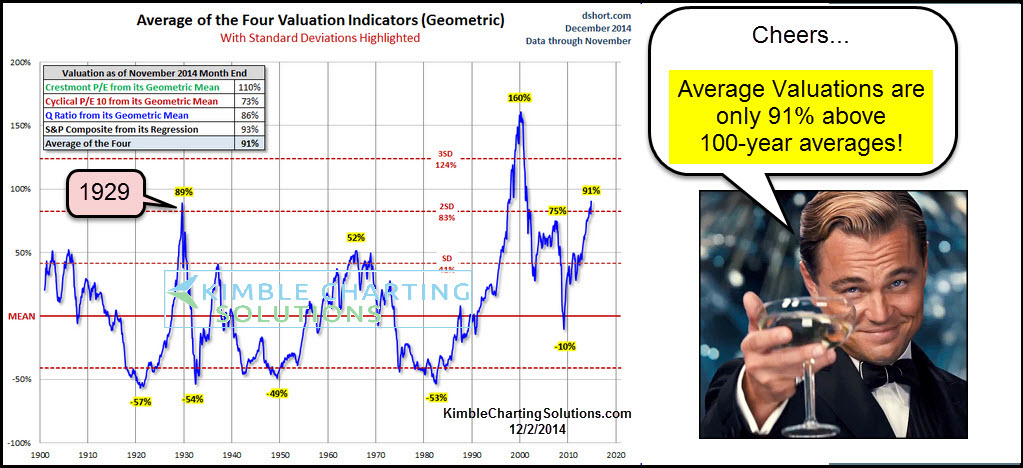

Comparison to historical valuations in similar economic environments: By comparing current valuations to those seen in past periods with similar economic conditions (low interest rates, strong earnings growth), BofA aims to contextualize the current market, suggesting that the current valuations may not be as extreme as they initially appear. This historical perspective helps temper immediate concerns.

Analyzing Key Valuation Metrics: Beyond Simple P/E Ratios

While the price-to-earnings (P/E) ratio is a widely used valuation metric, relying solely on it can be misleading. A more comprehensive approach requires considering other key metrics that provide a more balanced and nuanced understanding of market valuations.

-

Price-to-Sales ratio: This metric compares a company's market capitalization to its revenue. It's particularly useful for valuing companies with negative earnings or those in high-growth industries where current earnings may not fully reflect future potential.

-

PEG ratio: The Price/Earnings to Growth ratio considers both the P/E ratio and the company's expected earnings growth rate. This provides a more refined view by incorporating the speed of earnings growth into the valuation. A lower PEG ratio suggests the stock may be undervalued compared to its growth rate.

-

Discounted Cash Flow (DCF) analysis: This sophisticated method projects future cash flows and discounts them back to their present value. This provides a measure of intrinsic value, helping to determine whether a stock is overvalued or undervalued relative to its projected future cash flows.

These metrics, used in conjunction, provide a more holistic picture of a company's valuation, offering insights that a simple P/E ratio alone cannot capture. They assist in making more informed decisions when assessing high stock market valuations.

The Role of Interest Rates and Monetary Policy in Supporting High Valuations

A crucial factor underpinning BofA's rationale is the inverse relationship between interest rates and stock valuations. Low interest rates make borrowing cheaper for companies, stimulating investment and growth. Conversely, they also make bonds less attractive, pushing investors toward higher-yielding assets like stocks.

-

Inverse relationship between interest rates and stock prices: When interest rates fall, the cost of capital decreases, making it more appealing for companies to invest and expand. This increased investment often leads to higher earnings and stock prices.

-

Analysis of the current interest rate environment and its influence: The current low-interest-rate environment significantly influences stock market valuations. This environment encourages investment and risk-taking, contributing to higher stock prices.

-

Discussion on the potential future trajectory of interest rates and its impact on valuations: Future interest rate projections play a vital role in understanding the sustainability of current valuations. Any potential increases in interest rates could impact market valuations negatively.

-

Mention of quantitative easing and other monetary policy tools: Monetary policy tools like quantitative easing (QE) directly impact interest rates and liquidity in the market. These policies can inflate asset prices, including stocks, contributing to high market valuations.

Potential Risks and Considerations: Understanding the Caveats

While BofA's analysis provides a reasoned perspective on high stock market valuations, it’s crucial to acknowledge potential risks. Elevated valuations always carry the inherent risk of future corrections or downturns.

-

Inflationary pressures and their potential impact on valuations: Rising inflation can erode corporate profits and potentially lead to higher interest rates, impacting stock prices negatively.

-

Geopolitical risks and uncertainties affecting market sentiment: Global events and political uncertainties can significantly influence investor sentiment, potentially leading to market volatility and corrections.

-

Potential for shifts in monetary policy leading to higher interest rates: A sudden shift in monetary policy toward higher interest rates could trigger a market correction, as investors adjust to a higher cost of capital and potentially lower future earnings expectations.

-

The impact of unexpected economic downturns: Economic downturns, even unexpected ones, can significantly impact corporate earnings and valuations. This highlights the importance of diversification and risk management.

Conclusion

BofA's analysis suggests that high stock market valuations aren't necessarily a cause for immediate panic. Their rationale centers on factors such as low interest rates, strong corporate earnings, and positive future growth projections. However, they emphasize the importance of considering multiple valuation metrics beyond simple P/E ratios, including metrics like Price-to-Sales, PEG ratio, and Discounted Cash Flow analysis. The role of interest rates and monetary policy, along with potential risks like inflation and geopolitical uncertainties, must also be carefully considered. While understanding high stock market valuations is crucial, remember that individual investment decisions should be based on your own risk tolerance and financial goals. Continue to research and understand the factors influencing high stock market valuations to make informed decisions about your portfolio. Learn more about managing your investments in the face of fluctuating valuations and contact a financial advisor for personalized guidance.

Featured Posts

-

Mlb Game Recap Twins Top Mets 6 3

Apr 28, 2025

Mlb Game Recap Twins Top Mets 6 3

Apr 28, 2025 -

Car Dealerships Step Up Resistance To Electric Vehicle Requirements

Apr 28, 2025

Car Dealerships Step Up Resistance To Electric Vehicle Requirements

Apr 28, 2025 -

Office365 Breach Nets Millions For Hacker Fbi Says

Apr 28, 2025

Office365 Breach Nets Millions For Hacker Fbi Says

Apr 28, 2025 -

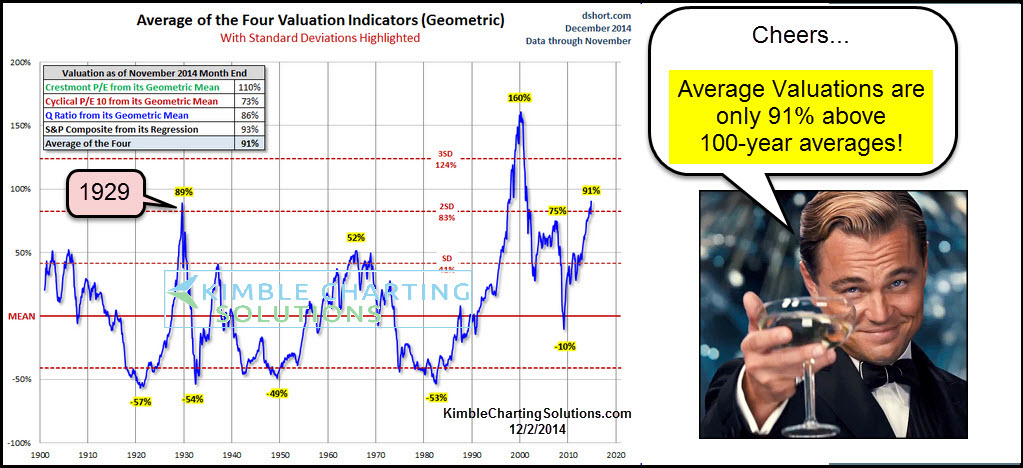

Boston Red Sox Lineup Changes For Doubleheaders First Game

Apr 28, 2025

Boston Red Sox Lineup Changes For Doubleheaders First Game

Apr 28, 2025 -

Beyond Elite Schools Understanding The Nationwide Effects Of Trumps Campus Policies

Apr 28, 2025

Beyond Elite Schools Understanding The Nationwide Effects Of Trumps Campus Policies

Apr 28, 2025