Trump's Trade Policies And The Future Of American Financial Dominance

Table of Contents

The Tariffs and Trade Wars Era

Trump's trade policies were defined by the widespread imposition of tariffs, triggering a series of trade wars, most notably with China. These tariffs, ranging from import tariffs on steel and aluminum to sweeping levies on countless Chinese goods, aimed to protect American industries and reduce the US trade deficit. However, the consequences were far-reaching and complex.

- Examples of specific tariffs imposed: 25% tariffs on steel and aluminum imports, tariffs on various Chinese goods totaling hundreds of billions of dollars.

- Impact on specific industries: The agricultural sector faced significant challenges due to retaliatory tariffs from China, while some US manufacturing sectors initially benefited from increased domestic demand.

- Short-term economic consequences: Tariffs contributed to increased inflation for consumers, while some sectors experienced job losses due to reduced exports. Conversely, certain domestic industries saw job growth and increased production.

- Retaliatory measures taken by other countries: China, the European Union, and other countries responded with their own tariffs, escalating the trade conflicts and disrupting global supply chains. These retaliatory tariffs targeted key US exports, negatively impacting American businesses.

Renegotiation of Trade Agreements

A central element of Trump's trade agenda was the renegotiation of existing trade agreements. The most significant example is the replacement of NAFTA (North American Free Trade Agreement) with USMCA (United States-Mexico-Canada Agreement).

- Key differences between NAFTA and USMCA: USMCA included stricter rules of origin for automobiles, strengthened intellectual property protections, and addressed digital trade issues.

- Arguments for and against the renegotiation: Supporters argued that USMCA offered better terms for the US, protecting American jobs and industries. Critics contended that the changes were minimal and offered little real improvement.

- Impact on North American trade and supply chains: While trade continued between the three countries, the renegotiation caused uncertainty and disruption to established supply chains.

- Long-term economic effects on member countries: The long-term economic effects of USMCA are still being assessed, but early indications suggest a mixed impact on the economies of the three participating nations. The shift towards more regionalized trade may have unforeseen consequences.

Impact on Global Supply Chains and American Businesses

Trump's trade policies significantly impacted global supply chains, prompting discussions about reshoring and nearshoring—the relocation of manufacturing back to the US or to nearby countries.

- Examples of businesses relocating production: Some companies moved manufacturing operations from China to other countries like Vietnam or Mexico to avoid tariffs.

- The challenges and benefits of reshoring and nearshoring: While reshoring can boost domestic employment and reduce reliance on foreign suppliers, it also faces challenges such as higher labor costs and potential infrastructure limitations. Nearshoring offers a compromise, leveraging lower costs in neighboring countries while minimizing logistical complexities.

- Impact on American job creation and competitiveness: The impact on American job creation was mixed, with some sectors benefiting from reshoring while others faced challenges. The long-term competitiveness of American businesses remains a topic of debate.

- The long-term sustainability of these shifts: The long-term sustainability of these shifts depends on various factors, including labor costs, infrastructure development, and the overall global trade environment.

The Role of the World Trade Organization (WTO)

The Trump administration frequently clashed with the World Trade Organization (WTO), criticizing its rules and challenging its authority. This adversarial relationship undermined the multilateral trading system and potentially weakened American influence within the organization. The challenges to the WTO's dispute settlement mechanism further complicated the resolution of trade disputes. This approach questioned the long-held commitment to trade liberalization and challenged the established rules-based system of global trade, potentially impacting future trade agreements.

Conclusion

Trump's trade policies represent a significant departure from previous administrations' approaches. While aiming to bolster American industries and reduce the trade deficit, the tariffs and trade wars resulted in economic uncertainty and disrupted established global supply chains. The renegotiation of NAFTA into USMCA brought modest changes but also contributed to supply chain disruptions. The impact on global supply chains spurred discussion of reshoring and nearshoring, with mixed results for American businesses and employment. The confrontational stance toward the WTO further complicated the global trade landscape. Ultimately, the long-term effects of Trump's trade policies on American financial dominance remain a subject of ongoing debate and analysis. What does the future hold for American financial dominance in a post-Trump trade environment? Further research and discussion are crucial to fully understand the lasting implications of this era of trade policy.

Featured Posts

-

Ukraine Faces Renewed Russian Aerial Offensive Us Peace Initiative In Play

Apr 22, 2025

Ukraine Faces Renewed Russian Aerial Offensive Us Peace Initiative In Play

Apr 22, 2025 -

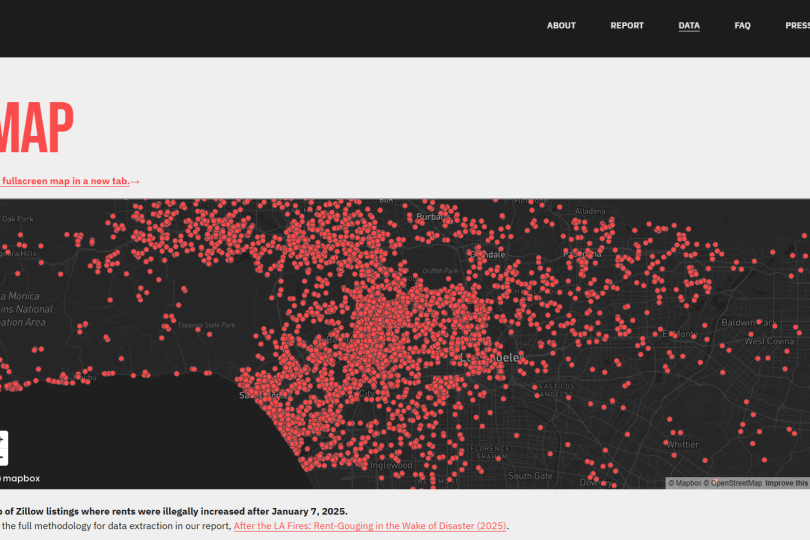

Rising Rent In La After Fires Allegations Of Price Gouging Surface

Apr 22, 2025

Rising Rent In La After Fires Allegations Of Price Gouging Surface

Apr 22, 2025 -

Trumps Economic Agenda Who Pays The Price

Apr 22, 2025

Trumps Economic Agenda Who Pays The Price

Apr 22, 2025 -

T Mobile Data Breaches 16 Million Fine Highlights Security Gaps

Apr 22, 2025

T Mobile Data Breaches 16 Million Fine Highlights Security Gaps

Apr 22, 2025 -

Live Stock Market Updates Dow Futures Dollar And Trade Worries

Apr 22, 2025

Live Stock Market Updates Dow Futures Dollar And Trade Worries

Apr 22, 2025