AbbVie's Upbeat Q[Quarter Number] Earnings: New Drugs Fuel Profit Beat

![AbbVie's Upbeat Q[Quarter Number] Earnings: New Drugs Fuel Profit Beat AbbVie's Upbeat Q[Quarter Number] Earnings: New Drugs Fuel Profit Beat](https://coucou-freiburg.de/image/abb-vies-upbeat-q-quarter-number-earnings-new-drugs-fuel-profit-beat.jpeg)

Table of Contents

Strong Performance Across Key Therapeutic Areas

AbbVie's Q3 success stems from a broad-based performance across its key therapeutic areas, demonstrating the company's diversified approach to drug development and market penetration.

Humira's Continued Success (Despite Biosimilar Competition)

Despite facing increasing biosimilar competition, Humira continues to be a significant revenue generator for AbbVie. While sales figures have naturally declined compared to previous years before biosimilar entry, the impact has been less dramatic than initially predicted. This is attributable to several factors:

- Strategic Pricing and Marketing: AbbVie has implemented innovative pricing strategies and targeted marketing campaigns to maintain market share in the face of biosimilar competition. These strategies focus on highlighting Humira's long-term efficacy and safety profile.

- Strong Physician and Patient Loyalty: Years of successful use have fostered strong physician and patient loyalty to Humira, contributing to its sustained market presence.

- Continued Sales in Specific Indications: AbbVie is focusing on maintaining sales in specific indications where Humira still holds a strong competitive advantage. This includes leveraging data that highlights unique benefits in certain patient populations.

Keywords: Humira sales, biosimilar competition, Humira biosimilars, AbbVie Humira strategy, Humira market share

Skyrocketing Sales of Rinvoq and Other Newer Drugs

The exceptional growth of Rinvoq (upadacitinib) and other newer drugs in AbbVie's portfolio has been a key driver of the Q3 profit beat. Rinvoq, a highly effective treatment for various autoimmune diseases, is experiencing rapid market penetration across key therapeutic areas:

- Rheumatology: Rinvoq's strong efficacy and safety profile in rheumatoid arthritis and other autoimmune conditions is driving substantial growth.

- Immunology: Rinvoq is expanding into other areas within immunology, providing AbbVie with a diverse revenue stream.

- Clinical Trial Success: Positive clinical trial data continues to support Rinvoq's efficacy and safety, bolstering physician confidence and patient uptake. This data is regularly presented at key medical conferences, strengthening its market position.

Other new drugs also contributed significantly to AbbVie's Q3 success, showcasing the strength of their R&D pipeline.

Keywords: Rinvoq sales, Rinvoq market share, Upadacitinib, AbbVie new drugs, new drug revenue, AbbVie drug pipeline

Solid Growth in Emerging Markets

AbbVie's expansion into emerging markets continues to yield positive results. Growth drivers in these regions include:

- Increased Access to Healthcare: Expanding access to healthcare in developing countries is providing new opportunities for AbbVie's products.

- Strategic Partnerships: AbbVie's collaborations with local partners are facilitating market penetration and distribution in these regions.

- Tailored Marketing Strategies: Adapting marketing strategies to suit the specific needs and cultural contexts of each emerging market contributes to success.

Keywords: AbbVie emerging markets, international growth, global expansion, AbbVie international sales

Financial Highlights of AbbVie's Q3 Earnings

AbbVie's Q3 2023 financial results significantly exceeded analyst expectations, showcasing the company's robust financial health.

Revenue and Earnings per Share (EPS) Surpassing Expectations

AbbVie reported [Insert Actual Revenue Figure] in revenue, surpassing analyst estimates of [Insert Analyst Estimate] and exceeding the previous quarter's revenue by [Insert Percentage Increase]. Earnings per share (EPS) reached [Insert Actual EPS Figure], significantly higher than the anticipated [Insert Analyst Estimate] and representing a [Insert Percentage Increase] increase compared to the same period last year.

Keywords: AbbVie revenue, AbbVie EPS, Q3 revenue, earnings per share growth, AbbVie financial results

Strong Research and Development (R&D) Investment

AbbVie's substantial investment in R&D ($[Insert R&D Spending Figure]) underscores its commitment to innovation and future growth. This investment is reflected in:

- Promising Drug Pipeline: The company's robust drug pipeline holds considerable potential for future revenue growth.

- New Drug Approvals: AbbVie has secured several new drug approvals during the quarter, further bolstering its product portfolio.

- Ongoing Clinical Trials: Numerous clinical trials are underway, indicating ongoing efforts to develop innovative treatments and strengthen its presence in existing therapeutic areas.

Keywords: AbbVie R&D, drug pipeline, clinical trials, new drug approvals, AbbVie innovation

Future Outlook and Implications for Investors

AbbVie's Q3 performance paints a promising picture for the remainder of the year and beyond.

Management's Guidance for the Rest of the Year

AbbVie's management has provided positive guidance for the remaining quarters of the year, predicting [Insert Management's Guidance]. This projection is based on several factors, including the continued success of existing products and the anticipated launch of new drugs. However, potential risks and challenges such as increased competition and regulatory hurdles were also acknowledged.

Keywords: AbbVie outlook, future guidance, financial projections, AbbVie forecast

Investment Implications and Stock Performance

The positive Q3 earnings report has had a positive impact on AbbVie's stock price, which [Insert Stock Price Movement]. This strong performance makes AbbVie an attractive investment for investors seeking exposure to the pharmaceutical sector. However, potential investors should conduct their own due diligence and consider various factors before making investment decisions.

Keywords: AbbVie stock, AbbVie investment, stock price analysis, AbbVie stock performance

Conclusion: AbbVie's Strong Q3 Results Underscore Success

AbbVie's strong Q3 2023 earnings demonstrate the company's successful strategy of leveraging its established brands while simultaneously driving growth through innovative new drugs. The success of Rinvoq and other newer drugs, combined with the continued performance of Humira and strong growth in emerging markets, has fueled a significant profit beat. This performance, coupled with positive future guidance, positions AbbVie favorably for continued success. To stay informed about AbbVie's earnings and future developments, subscribe to our newsletter or follow AbbVie's official news channels. Learn more about AbbVie's new drugs and their impact on patient care.

![AbbVie's Upbeat Q[Quarter Number] Earnings: New Drugs Fuel Profit Beat AbbVie's Upbeat Q[Quarter Number] Earnings: New Drugs Fuel Profit Beat](https://coucou-freiburg.de/image/abb-vies-upbeat-q-quarter-number-earnings-new-drugs-fuel-profit-beat.jpeg)

Featured Posts

-

A Conservative Harvard Professors Prescription For Harvards Future

Apr 26, 2025

A Conservative Harvard Professors Prescription For Harvards Future

Apr 26, 2025 -

Bullions Rise How Trade Wars Drive Gold Prices To Record Highs

Apr 26, 2025

Bullions Rise How Trade Wars Drive Gold Prices To Record Highs

Apr 26, 2025 -

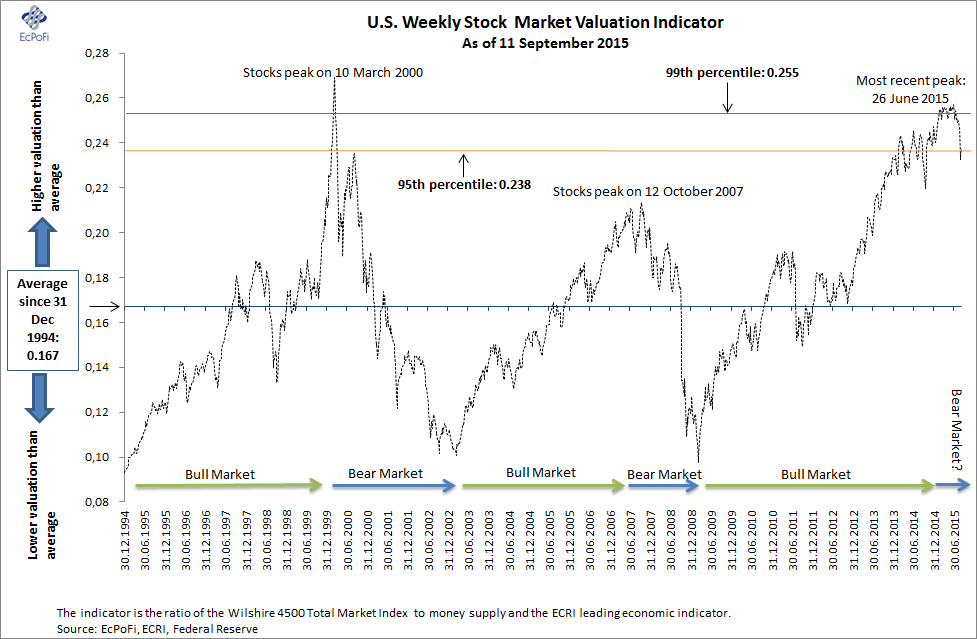

Dismissing Stock Market Valuation Concerns Bof As Rationale

Apr 26, 2025

Dismissing Stock Market Valuation Concerns Bof As Rationale

Apr 26, 2025 -

Exploring Florida A Cnn Anchors Perspective

Apr 26, 2025

Exploring Florida A Cnn Anchors Perspective

Apr 26, 2025 -

Nfl Drafts First Round Green Bays Big Night

Apr 26, 2025

Nfl Drafts First Round Green Bays Big Night

Apr 26, 2025

Latest Posts

-

How Professionals Helped Ariana Grande Achieve Her New Look

Apr 27, 2025

How Professionals Helped Ariana Grande Achieve Her New Look

Apr 27, 2025 -

The Impact Of Professional Help On Celebrity Image Ariana Grandes Case Study

Apr 27, 2025

The Impact Of Professional Help On Celebrity Image Ariana Grandes Case Study

Apr 27, 2025 -

Hair And Tattoo Transformations Learning From Ariana Grandes Choices

Apr 27, 2025

Hair And Tattoo Transformations Learning From Ariana Grandes Choices

Apr 27, 2025 -

Ariana Grandes Bold New Look A Look At Professional Styling And Body Art

Apr 27, 2025

Ariana Grandes Bold New Look A Look At Professional Styling And Body Art

Apr 27, 2025 -

Understanding Ariana Grandes Style Changes The Importance Of Professional Guidance

Apr 27, 2025

Understanding Ariana Grandes Style Changes The Importance Of Professional Guidance

Apr 27, 2025