The Trump-Powell Conflict: President Calls For Fed Chair's Termination

Table of Contents

The Roots of the Conflict: Trump's Economic Agenda vs. Fed Independence

The Trump-Powell conflict stemmed from a fundamental disagreement over economic policy. Trump's administration championed a strategy of rapid economic growth fueled by significant tax cuts and deregulation. This approach prioritized short-term gains, aiming for robust GDP growth and a booming stock market. Conversely, the Federal Reserve, under Chairman Powell, adhered to its dual mandate of price stability and maximum employment. This mandate often necessitates actions, such as interest rate hikes, that can curb economic expansion in the short term to prevent inflation and ensure long-term stability. This inherent difference in priorities formed the bedrock of the Trump-Powell conflict.

- Trump's criticism of Powell's interest rate hikes: Trump consistently viewed the Fed's interest rate increases as detrimental to his economic agenda, publicly declaring them "too fast" and "too far." He believed these hikes stifled economic growth and hurt the stock market.

- The tension between Trump's desire for a weaker dollar and the Fed's focus on inflation control: A weaker dollar, while beneficial for exports, can fuel inflation. Trump's repeated calls for a weaker dollar clashed directly with the Fed's primary concern of controlling inflation.

- The political pressure on the Fed to prioritize short-term economic gains over long-term stability: Trump's actions exerted immense political pressure on the Fed, pushing it to prioritize short-term economic gains, potentially at the expense of long-term economic stability.

The Importance of Fed Independence

The independence of the Federal Reserve is a cornerstone of a healthy US economy. Historically, central banks operating under direct political control have often succumbed to short-sighted policies, leading to inflation, financial instability, and economic crises. An independent Fed, shielded from immediate political pressures, can take a longer-term perspective, making decisions based on sound economic principles rather than short-term political expediency. This independence is supported by numerous academic studies highlighting the positive correlation between central bank independence and macroeconomic stability (e.g., research by Alesina and Summers). The Trump-Powell conflict served as a stark reminder of the importance of preserving this crucial independence.

Public Attacks and Calls for Removal: Escalation of the Conflict

Trump's criticism of Powell escalated from occasional murmurs to consistent, public attacks. He frequently used Twitter and interviews to express his displeasure, employing harsh rhetoric and openly questioning Powell's competence.

- Specific examples of Trump's harsh rhetoric against Powell: Trump frequently labeled Powell's policies as "crazy" and "terrible," publicly expressing his deep dissatisfaction.

- Analysis of the political motivations behind Trump's attacks: Analysts suggest Trump's attacks were motivated by a desire to boost the economy before the 2020 election, believing lower interest rates would stimulate growth.

- Examination of the legal limitations on the President's ability to remove a Fed Chair: While the President can technically remove a Fed Chair, doing so requires "cause" – which is a high legal bar and is rarely met. This limited Trump's ability to directly replace Powell.

The Impact of Presidential Criticism

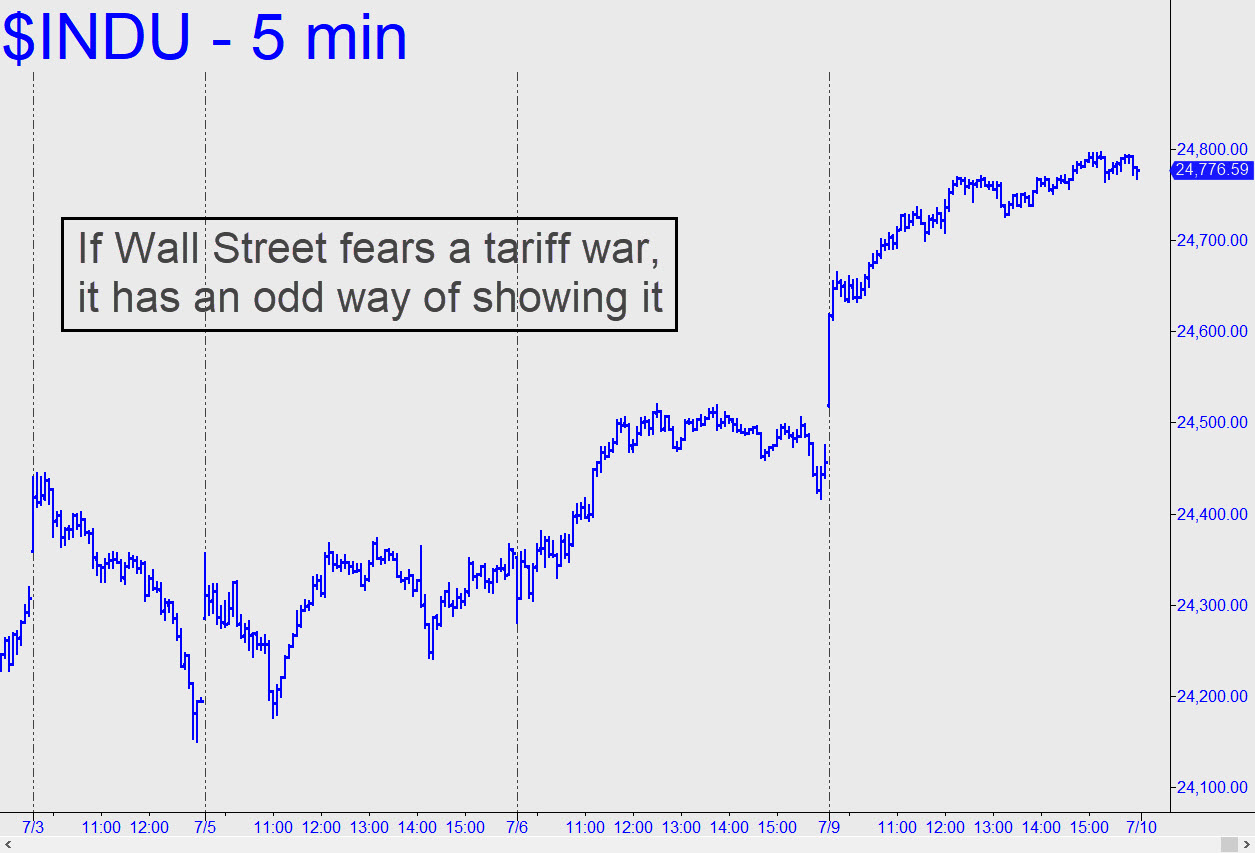

Trump's consistent public attacks significantly impacted market confidence and investor sentiment. The uncertainty surrounding the Fed's independence and the potential for political interference created volatility in the financial markets. While precisely quantifying the impact is difficult, many analysts link periods of heightened market uncertainty to Trump's most aggressive public criticisms of Powell and the Trump-Powell conflict in general.

Consequences and Long-Term Implications of the Trump-Powell Conflict

The Trump-Powell conflict had far-reaching consequences, impacting not only domestic markets but also US-China trade relations and global markets.

- The impact on investor confidence and market volatility: The conflict increased uncertainty, leading to market fluctuations and investor hesitation.

- The effect on the Fed's credibility and independence: The unprecedented public pressure raised concerns about the Fed's long-term independence and its ability to make impartial decisions.

- The longer-term implications for the relationship between the executive branch and the central bank: The conflict underscored the fragility of the relationship between the executive branch and an independent central bank and the need for clear lines of communication and respect for institutional boundaries.

Lessons Learned

The Trump-Powell conflict offers valuable lessons about safeguarding the Fed's independence and the need for respectful dialogue between the executive branch and independent institutions. It highlights the importance of clear communication, avoiding public attacks that undermine confidence, and ensuring a robust legal framework to protect the Fed from undue political influence. Protecting the independence of the Federal Reserve remains crucial for maintaining a stable and prosperous US economy.

Conclusion

The Trump-Powell conflict serves as a stark reminder of the delicate balance between political pressures and the need for an independent central bank. Trump's repeated attacks on Powell highlighted the potential risks of politicizing monetary policy and jeopardizing the Fed's ability to maintain price stability and full employment. The conflict's impact on market confidence and the long-term health of the US economy cannot be overstated.

Call to Action: Understanding the intricacies of the Trump-Powell Conflict is crucial for anyone interested in US economic policy and the delicate interplay between the executive branch and independent institutions. Further research into the legal aspects and economic consequences of this historic clash will provide a deeper understanding of the challenges faced by central banks in a politically charged environment. Continue learning about this pivotal moment in US economic history by exploring additional resources on the Trump-Powell conflict and the importance of an independent Federal Reserve.

Featured Posts

-

Milwaukee Sets Record With Nine Stolen Bases In First Four Innings

Apr 23, 2025

Milwaukee Sets Record With Nine Stolen Bases In First Four Innings

Apr 23, 2025 -

Nine Run Lead Dominant Strikeout A Cy Young Winners April To Remember

Apr 23, 2025

Nine Run Lead Dominant Strikeout A Cy Young Winners April To Remember

Apr 23, 2025 -

Netflixs Resilience Amidst Big Tech Downturn A Wall Street Tariff Haven

Apr 23, 2025

Netflixs Resilience Amidst Big Tech Downturn A Wall Street Tariff Haven

Apr 23, 2025 -

Reds Historic Losing Streak 1 0 Defeat Ties All Time Mlb Record

Apr 23, 2025

Reds Historic Losing Streak 1 0 Defeat Ties All Time Mlb Record

Apr 23, 2025 -

Diamondbacks 5 2 Win Over Brewers A Comprehensive Report

Apr 23, 2025

Diamondbacks 5 2 Win Over Brewers A Comprehensive Report

Apr 23, 2025