Netflix's Resilience Amidst Big Tech Downturn: A Wall Street Tariff Haven?

Table of Contents

The recent big tech downturn has sent shockwaves through Wall Street, yet amidst the turmoil, Netflix stands as a beacon of relative stability. While many tech giants grapple with declining valuations, Netflix's performance suggests a different narrative, hinting at its potential status as a "Wall Street Tariff Haven." This article will explore the factors contributing to Netflix's resilience, analyzing its robust content strategy, adaptable subscription model, operational efficiency, and ultimately, its position as a comparatively safe investment during these challenging economic times. We will delve into whether Netflix truly represents a haven for investors seeking shelter from the storm.

H2: Netflix's Strong Content Strategy as a Protective Shield

Netflix's success hinges on its unwavering commitment to original content. This strategic investment acts as a significant protective shield against market fluctuations.

H3: Original Content Investment and ROI:

- Netflix invests billions annually in producing original series and films, a strategy that has paid significant dividends.

- The global success of shows like Stranger Things, Squid Game, and The Crown has driven substantial subscriber growth and boosted brand loyalty, leading to higher retention rates.

- While precise ROI figures are not publicly released, the consistent subscriber growth and high engagement metrics suggest a strong return on Netflix's massive content investment, outperforming many competitors struggling to replicate this success.

H3: Diverse Content Library and Global Appeal:

- Netflix offers a diverse content library catering to a vast global audience, encompassing genres like drama, comedy, documentaries, and reality TV.

- The inclusion of international programming, such as Money Heist (Spain) and Lupin (France), has been instrumental in expanding its global subscriber base, mitigating reliance on any single market.

- Netflix's sophisticated localization strategies, including dubbing and subtitling, ensure content accessibility and relevance across different cultures, further enhancing its global reach and resilience.

H2: Subscription Model Resilience in a Changing Market

Netflix's subscription model has proven remarkably resilient in a rapidly evolving entertainment landscape.

H3: Subscription Model Advantages Over Advertising-Based Platforms:

- Unlike many competitors incorporating ad-supported tiers, Netflix's core strategy remains a subscription-only model. This provides a predictable revenue stream, less susceptible to fluctuations in ad spending.

- The control over pricing and the ability to adjust subscription tiers allows Netflix to optimize revenue streams and maintain profitability.

- While subscriber churn is inevitable, Netflix's retention rates, compared to ad-supported platforms, are generally higher, indicating the value proposition of ad-free streaming resonates strongly with consumers.

H3: Pricing Strategies and Value Proposition:

- Netflix offers various pricing tiers, catering to different budgets and viewing preferences. This flexibility allows it to attract a wider range of subscribers.

- Despite inflationary pressures, Netflix's pricing adjustments have been relatively modest compared to other streaming services, reflecting its commitment to maintaining a strong value proposition.

- While competition is intense, Netflix's brand recognition and diverse content library enable it to maintain a competitive pricing structure without significantly compromising profitability.

H2: Netflix's Operational Efficiency and Cost Management

Netflix's commitment to operational efficiency and cost management further strengthens its resilience.

H3: Streamlining Operations and Reducing Expenses:

- Netflix has consistently focused on streamlining its operations and identifying areas for cost reduction without sacrificing quality.

- This includes initiatives aimed at optimizing content production costs and reducing marketing expenses.

- Compared to other streaming giants burdened by expansive infrastructure and diverse ventures, Netflix's focused strategy allows for greater agility and cost control.

H3: Technological Innovation and Infrastructure:

- Netflix's significant investment in technology and infrastructure ensures a seamless and reliable streaming experience for its global subscriber base.

- This robust platform allows Netflix to handle peak demand, deliver high-quality content, and adapt to evolving viewing habits.

- Continuous technological advancements improve efficiency, reduce operational costs, and enhance the overall user experience, strengthening its competitive advantage.

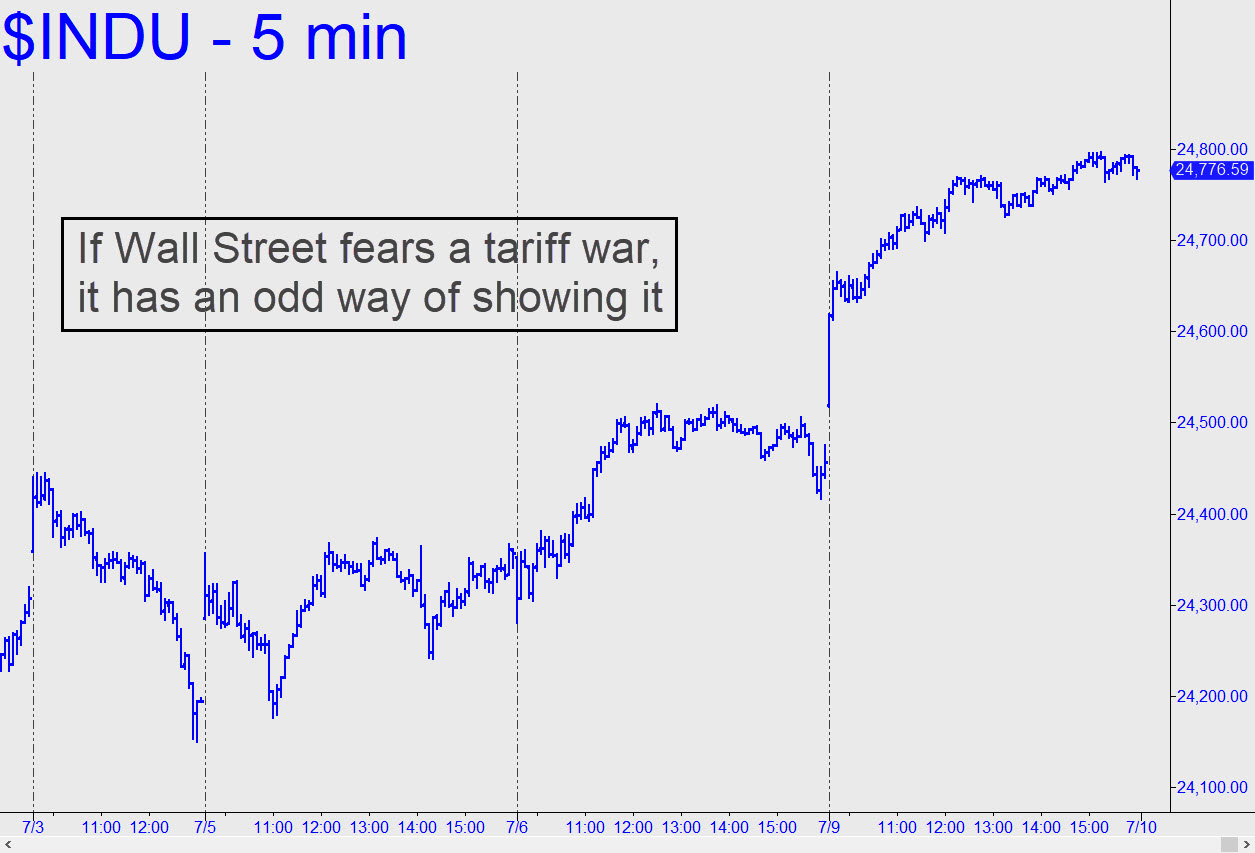

H2: The "Wall Street Tariff Haven" Argument

The evidence suggests Netflix may indeed be fulfilling the role of a "Wall Street Tariff Haven" during the current tech downturn.

H3: Relative Stability Compared to Other Tech Stocks:

- While not immune to market fluctuations, Netflix's stock performance has demonstrated relative stability compared to other big tech companies during the recent downturn.

- Investor sentiment towards Netflix, while not always positive, remains more resilient than many of its tech peers, reflecting a perception of its long-term growth potential.

- This perceived safety, contrasted with the volatility experienced by other tech stocks, positions Netflix as a more secure investment option.

H3: Factors Contributing to Netflix's Perceived Safety:

- Netflix's strong content library, diversified revenue streams, and efficient operations contribute to investor confidence.

- The long-term growth potential of the streaming industry offers further reassurance, despite short-term market uncertainty.

- While risks associated with competition, content costs, and regulatory changes exist, these factors seem to be less impactful on Netflix's stability compared to those affecting other tech giants.

Conclusion:

In summary, Netflix's resilience amidst the broader big tech downturn stems from its strategic content investments, adaptable subscription model, and commitment to operational efficiency. Its relative stability in comparison to other tech stocks strengthens the "Wall Street Tariff Haven" argument. Key takeaways include the significance of original content, the advantages of a subscription-based model, and the effectiveness of Netflix's cost management strategies. Investigate Netflix as a Wall Street Tariff Haven today and learn more about its resilience in the current market by exploring in-depth financial analyses. [Link to relevant financial news source]

Featured Posts

-

Michael Lorenzens Transition To Different Roles In Baseball

Apr 23, 2025

Michael Lorenzens Transition To Different Roles In Baseball

Apr 23, 2025 -

Milwaukee Sets Record With Nine Stolen Bases In First Four Innings

Apr 23, 2025

Milwaukee Sets Record With Nine Stolen Bases In First Four Innings

Apr 23, 2025 -

Lane Thomas Impresses In First Guardians Spring Training

Apr 23, 2025

Lane Thomas Impresses In First Guardians Spring Training

Apr 23, 2025 -

Ninth Inning Magic Diamondbacks Beat Brewers In Walk Off Thriller

Apr 23, 2025

Ninth Inning Magic Diamondbacks Beat Brewers In Walk Off Thriller

Apr 23, 2025 -

Five Run Ninth Diamondbacks Defeat Brewers In Walk Off Thriller

Apr 23, 2025

Five Run Ninth Diamondbacks Defeat Brewers In Walk Off Thriller

Apr 23, 2025