Tesla's Reduced Q1 Profitability: A Consequence Of Musk's Association With The Trump Administration

Table of Contents

The Decline in Tesla's Q1 Profitability: A Detailed Look at the Numbers

Financial Performance Analysis:

Tesla's Q1 2024 financial report revealed a concerning downturn. Key metrics paint a stark picture:

- Revenue: A [Insert Actual Percentage]% decrease compared to Q4 2023, falling to [Insert Actual Figure].

- Net Income: A significant drop of [Insert Actual Percentage]%, reaching [Insert Actual Figure].

- Profit Margins: A sharp decline from [Insert Previous Quarter's Margin]% to [Insert Q1 2024 Margin]%, indicating reduced efficiency and profitability.

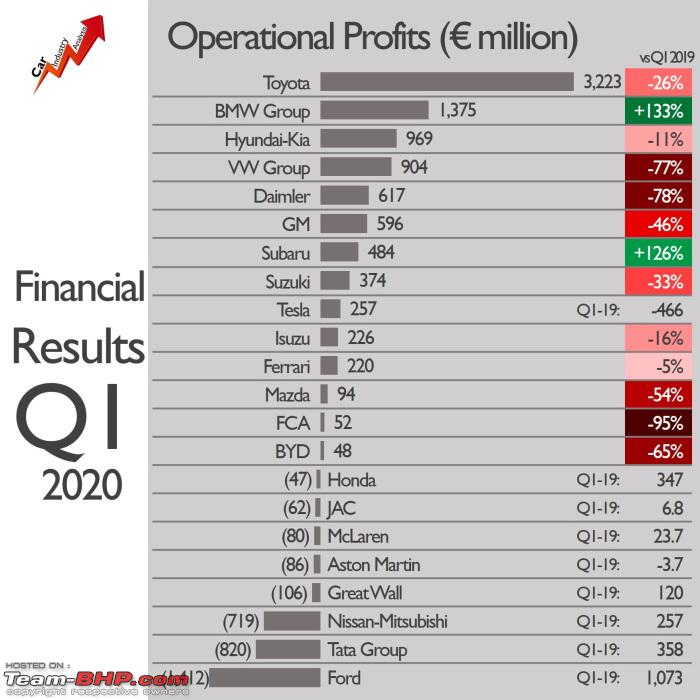

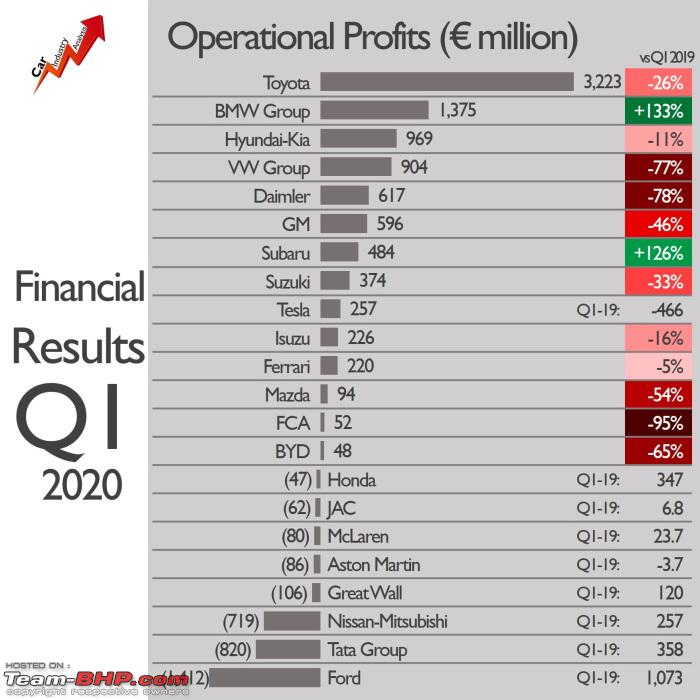

[Insert Chart or Graph visually representing the above data]. This performance fell considerably short of analyst expectations, fueling concerns amongst investors.

Factors Contributing to Reduced Profitability (Beyond Musk/Trump):

While Musk's political affiliations are a key focus, it's crucial to acknowledge other contributing factors to Tesla's Q1 slump:

- Supply Chain Disruptions: Ongoing global supply chain issues continued to impact Tesla's production and component sourcing, leading to increased costs and potential delays. News reports from [cite source] highlighted difficulties securing crucial materials.

- Increased Competition: The electric vehicle (EV) market is becoming increasingly competitive, with established automakers and new entrants vying for market share. This intensified competition puts pressure on pricing and profitability.

- Rising Production Costs: Inflationary pressures, particularly in raw materials like lithium and cobalt, significantly impacted Tesla's production costs, squeezing profit margins. [Cite relevant industry reports].

- Price Wars: Tesla's recent price cuts, aimed at boosting sales volume, likely also contributed to the reduction in profit margins.

Examining Elon Musk's Relationship with the Trump Administration

Public Endorsements and Political Alignments:

Elon Musk's public support for the Trump administration was consistent and highly visible. This included:

- Tweets: Numerous tweets expressing support for specific Trump policies and praising the former president. [Provide links to specific tweets].

- Interviews: Public endorsements and appearances alongside Trump administration officials. [Cite interview sources].

- Advisory Roles: [Mention any advisory roles or meetings with Trump administration officials, if applicable, and cite sources.]

Potential Negative Impacts on Tesla's Brand Image and Investor Sentiment:

Musk's political stances potentially alienated a segment of Tesla's customer base and investors:

- Boycotts: Calls for boycotts of Tesla products from consumers opposed to Musk's political views emerged on social media and in some news outlets. [Cite examples].

- Negative Media Coverage: Extensive media coverage focused on the potential negative impact of Musk's political associations on Tesla's brand. [Cite examples].

- Stock Price Fluctuations: While difficult to isolate this factor, Tesla's stock price experienced fluctuations correlating with periods of heightened controversy surrounding Musk's political statements. [Cite financial news sources].

Connecting the Dots: The Potential Causal Link Between Musk's Politics and Tesla's Finances

The Role of Political Polarization in Business:

The increasing political polarization in society significantly impacts business. Companies are increasingly under pressure to demonstrate a commitment to Corporate Social Responsibility (CSR).

- CSR and Brand Reputation: Alignment with controversial political figures can damage a company's brand reputation and alienate customers.

- Investor Pressure: Investors are increasingly considering ESG (environmental, social, and governance) factors when making investment decisions. Association with a controversial political figure can negatively impact ESG ratings.

- Regulatory Scrutiny: Political affiliations can sometimes lead to increased regulatory scrutiny and potential legal challenges.

Analyzing the Correlation (Not Causation):

It is crucial to emphasize that correlation does not equal causation. While a correlation might exist between Musk's political leanings and Tesla's financial performance, it's impossible to definitively prove a direct causal link. However, some potential indirect effects warrant consideration:

- Consumer Sentiment: Negative consumer sentiment toward Musk's political stances could have translated into decreased demand for Tesla vehicles.

- Regulatory Hurdles: Potential policy changes or increased regulatory scrutiny due to Musk's political affiliations might have negatively affected Tesla's operations.

- Investor Behavior: Investors concerned about the potential long-term risks associated with Musk's political stances may have reduced their holdings in Tesla.

Conclusion: Tesla's Reduced Q1 Profitability: A Complex Equation

Tesla's reduced Q1 profitability is a complex issue with multiple contributing factors. While the decline in profitability is undeniable, attributing it solely to Elon Musk's political associations is an oversimplification. Supply chain issues, increased competition, and rising production costs all played a significant role. However, the potential negative impact of Musk's relationship with the Trump administration on Tesla's brand image and investor sentiment cannot be ignored. Further research is needed to fully understand the interplay of these factors. What is your take on the relationship between Tesla's reduced Q1 profitability and Elon Musk's political alignments?

Featured Posts

-

Ted Lassos Revival Brett Goldsteins Resurrected Cat Analogy

Apr 24, 2025

Ted Lassos Revival Brett Goldsteins Resurrected Cat Analogy

Apr 24, 2025 -

Middle Management A Crucial Link In Organizational Effectiveness And Employee Satisfaction

Apr 24, 2025

Middle Management A Crucial Link In Organizational Effectiveness And Employee Satisfaction

Apr 24, 2025 -

Sophie Nyweide Child Actor In Mammoth And Noah Dies At 24

Apr 24, 2025

Sophie Nyweide Child Actor In Mammoth And Noah Dies At 24

Apr 24, 2025 -

Canadas Economic Outlook Prioritizing Fiscal Responsibility

Apr 24, 2025

Canadas Economic Outlook Prioritizing Fiscal Responsibility

Apr 24, 2025 -

Analysis Chinese Stock Market Rally In Hong Kong And Trade Relations

Apr 24, 2025

Analysis Chinese Stock Market Rally In Hong Kong And Trade Relations

Apr 24, 2025