Tesla's Q1 2024 Financial Performance: Significant Net Income Decrease

Table of Contents

Tesla, the leading electric vehicle (EV) manufacturer, recently reported its Q1 2024 financial results, revealing a significant decrease in net income compared to the previous quarter and the same period last year. This unexpected downturn has sent ripples through the financial markets and raises crucial questions about the company's future performance and the overall health of the burgeoning EV market. This article delves into the key factors contributing to this decline, analyzing the implications for Tesla's stock and the broader EV industry.

Significant Decline in Net Income: A Detailed Analysis

Keywords: Tesla net income decrease, Tesla Q1 profitability, Tesla earnings decline, Tesla financial report.

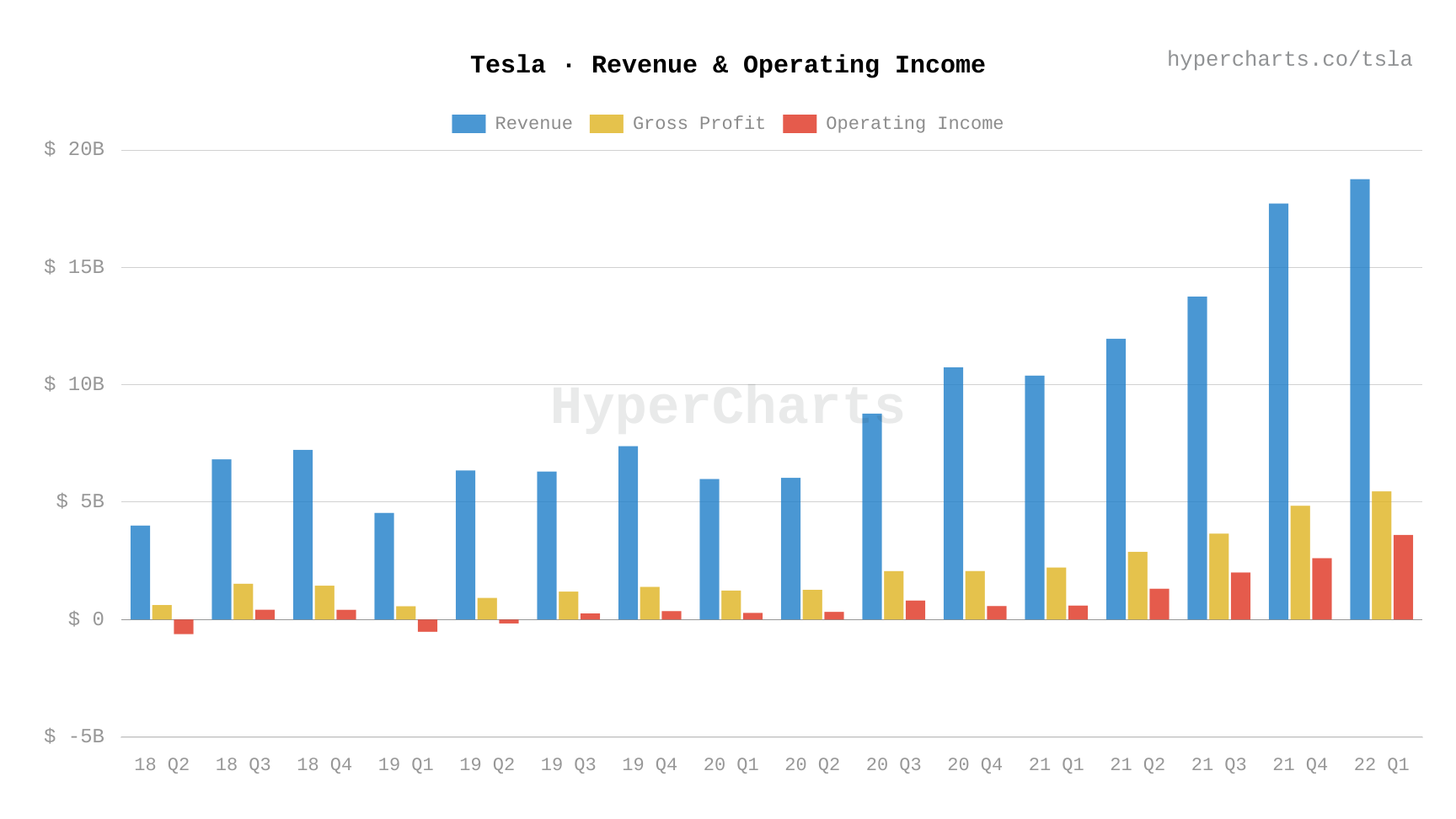

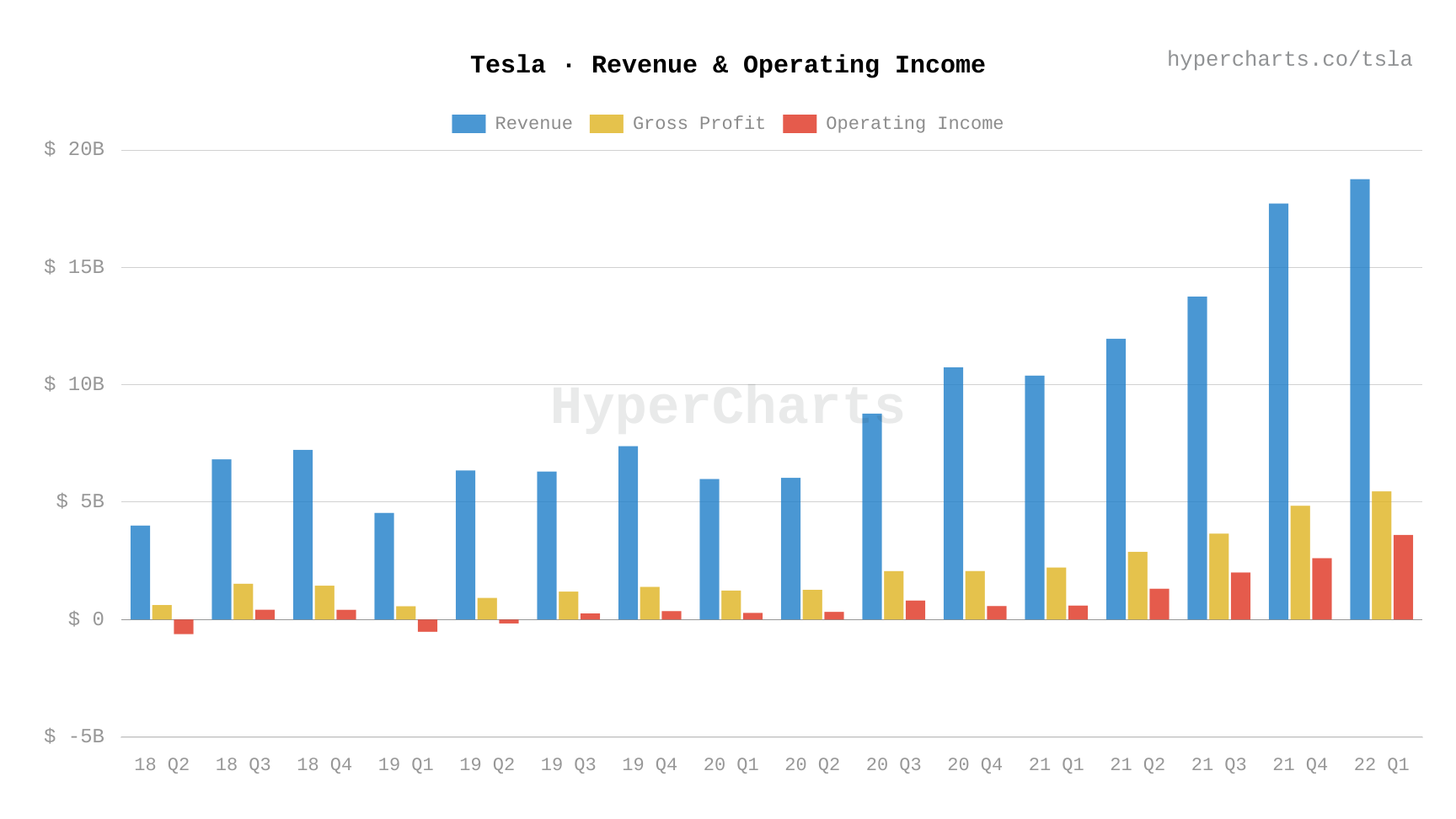

Tesla's Q1 2024 financial report painted a concerning picture. The company announced a net income drop of X% compared to Q4 2023, representing a substantial decrease from $[Amount] to $[Amount]. Compared to Q1 2023, the decline was even steeper, at Y%, falling from $[Amount] to $[Amount]. This significant fall dramatically undershot analyst expectations, which had predicted a net income of $[Amount]. The market reacted swiftly, with Tesla's stock price experiencing a [Percentage]% drop following the earnings announcement. This volatility highlights the significant impact of the results on investor confidence. It is important to note that [Mention any accounting adjustments or one-time charges that affected the results, e.g., restructuring costs, asset write-downs]. These factors must be considered when interpreting the overall financial performance.

Impact of Price Cuts on Profit Margins

Keywords: Tesla price cuts, Tesla profit margins, EV price war, Tesla sales volume, Tesla pricing strategy.

Tesla's aggressive price cuts across its vehicle lineup played a significant role in the reduced profitability. While these cuts boosted sales volume, they undeniably compressed profit margins. The company's strategy appears to prioritize market share and sales growth over maintaining high profit margins, a move potentially triggered by intensifying competition in the EV market. The increased sales volume, while beneficial in terms of overall revenue, couldn't offset the impact of significantly lower per-unit profits. This trade-off between volume and margin is a key factor in understanding Tesla’s Q1 2024 performance. Compared to competitors like [Competitor A] and [Competitor B], Tesla's pricing strategy appears [More/Less] aggressive, influencing its market position and profitability. The resulting automotive gross margin dropped from [Previous Percentage]% to [Current Percentage]%.

Challenges in the EV Market and Supply Chain Issues

Keywords: EV market competition, EV supply chain, Tesla production, battery supply, raw material costs.

The electric vehicle market is becoming increasingly competitive, with established automakers and new entrants vying for market share. This fierce competition, coupled with persistent supply chain disruptions, further contributed to Tesla's Q1 struggles. The availability of crucial components, particularly batteries and certain raw materials, remains a challenge. Rising raw material costs, exacerbated by geopolitical factors like [mention specific geopolitical events, e.g., the war in Ukraine], have significantly increased Tesla's manufacturing expenses, putting pressure on profitability. Production targets might have also been affected by these factors, further influencing the financial results. The global chip shortage, though easing, still presents ongoing challenges for the entire automotive industry, including Tesla.

Future Outlook and Investor Sentiment

Keywords: Tesla stock price, Tesla future prospects, investor confidence, Tesla investment, EV market outlook.

The Q1 2024 results have undoubtedly impacted investor sentiment. Tesla's stock price took a hit immediately after the earnings announcement, reflecting concerns about the company's near-term profitability. However, the long-term outlook for Tesla remains a subject of debate. The company's innovative technology, strong brand recognition, and ongoing development of new products, including [mention upcoming products e.g., Cybertruck, next-generation battery technology] offer potential for future growth and a return to higher profitability. Successful execution of its long-term strategy, focusing on [mention key strategic areas, e.g., expansion into new markets, cost reductions] will be crucial for regaining investor confidence and achieving sustainable growth. Future product launches and technological advancements will be key drivers of future financial performance.

Conclusion

Tesla's Q1 2024 financial report revealed a significant decrease in net income, primarily attributed to price cuts impacting profit margins, intense competition within the EV market, and persistent supply chain challenges. While the company faces considerable headwinds, its long-term prospects remain tied to its innovative technology and its ability to navigate the complex and rapidly evolving electric vehicle landscape. The strategic decisions made regarding pricing and production will be critical for its future financial performance.

Call to Action: Stay informed on the latest developments in Tesla's financial performance and the wider EV market. Continue following our analysis for updates on Tesla's Q2 2024 earnings and insights into future Tesla financial performance and Tesla stock predictions.

Featured Posts

-

A More Responsible Canada Rethinking Fiscal Policy Under The Liberals

Apr 24, 2025

A More Responsible Canada Rethinking Fiscal Policy Under The Liberals

Apr 24, 2025 -

The Countrys Top Emerging Business Hubs A Geographic Analysis

Apr 24, 2025

The Countrys Top Emerging Business Hubs A Geographic Analysis

Apr 24, 2025 -

Instagrams Latest App A Direct Challenge To Tik Toks Dominance

Apr 24, 2025

Instagrams Latest App A Direct Challenge To Tik Toks Dominance

Apr 24, 2025 -

What To Expect On The Bold And The Beautiful Hope Liam Steffy And Lunas Upcoming Conflicts

Apr 24, 2025

What To Expect On The Bold And The Beautiful Hope Liam Steffy And Lunas Upcoming Conflicts

Apr 24, 2025 -

Nepoznata Suradnja Tarantino I Travolta U Filmu Koji Je Redatelj Odbacio

Apr 24, 2025

Nepoznata Suradnja Tarantino I Travolta U Filmu Koji Je Redatelj Odbacio

Apr 24, 2025