Tesla Q1 Earnings: Net Income Plunges 71% Amidst Political Headwinds

Table of Contents

Deep Dive into Tesla's Q1 2024 Financial Performance

Net Income Decline

Tesla's Q1 2024 net income plummeted to [Insert Exact Amount], a dramatic 71% decrease compared to the same period last year and a significant drop from the previous quarter's [Insert Previous Quarter's Net Income]. This resulted in a considerably reduced earnings per share (EPS) of [Insert EPS figure]. The shrinking profit margin, now at [Insert Profit Margin Percentage]%, reflects the challenges the company faced.

- Increased Production Costs: Rising raw material prices, particularly for battery components, significantly impacted profitability.

- Aggressive Price Reductions: Tesla's decision to implement substantial price cuts to boost sales volume, while increasing market share, negatively affected short-term profitability.

- Supply Chain Disruptions: Ongoing global supply chain issues continued to exert pressure on production efficiency and costs.

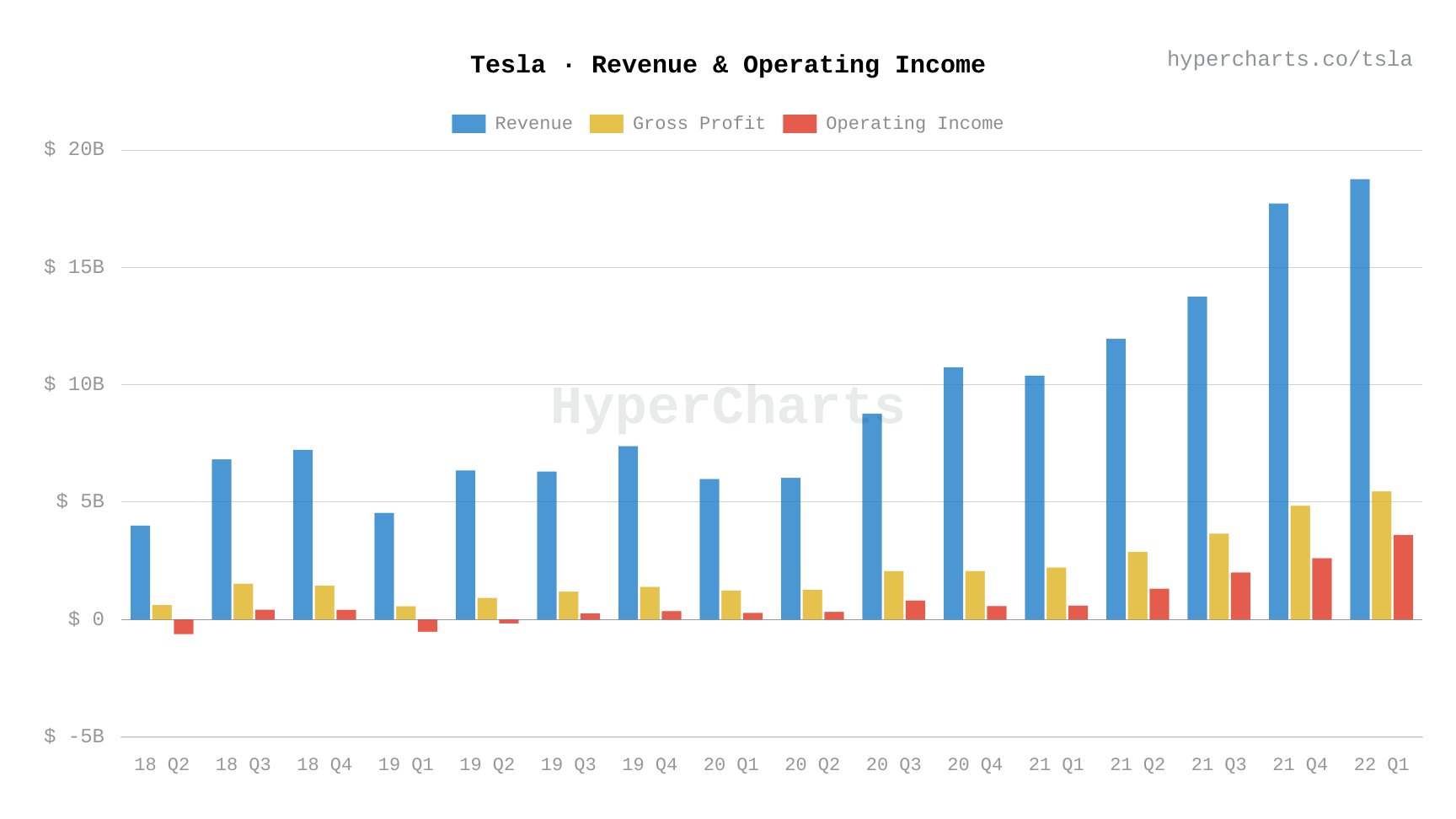

[Insert Chart/Graph showing Tesla's net income trend over the past few quarters. Clearly label axes and include a title such as "Tesla Net Income Trend (Q1 2023 - Q1 2024)" ]

Revenue Analysis

While net income took a significant hit, Tesla's Q1 2024 revenue reached [Insert Exact Revenue Figure], showing [Increase/Decrease Percentage] compared to the previous quarter. This indicates that although sales volume increased, the price reductions significantly impacted the overall profit margin. The revenue breakdown highlights the continued strength of the automotive segment but also reflects the contributions of the energy generation and storage business.

- Automotive Revenue: [Insert Percentage]% of total revenue, driven by increased vehicle deliveries despite price cuts.

- Energy Generation and Storage Revenue: [Insert Percentage]% of total revenue, showcasing steady growth in this sector.

- Other Revenue: [Insert Percentage]% of total revenue, encompassing service and other revenue streams.

[Insert Chart illustrating revenue breakdown by segment. Clearly label each segment and provide percentages.]

Impact of Political Headwinds on Tesla's Performance

Regulatory Challenges

Tesla faced considerable regulatory challenges during Q1 2024, impacting its operational efficiency and profitability. These challenges stemmed from various sources, creating regulatory uncertainty and hindering growth.

- Environmental Regulations: Stricter emissions standards in certain key markets increased compliance costs.

- Trade Disputes: Ongoing trade tensions and tariffs added to the cost of imported components and impacted export markets.

- Government Investigations: Investigations into various aspects of Tesla's operations, including Autopilot safety and manufacturing practices, diverted resources and added to legal expenses.

Geopolitical Risks

Geopolitical instability significantly influenced Tesla's Q1 performance. The ongoing conflict in [mention specific region] disrupted supply chains, leading to delays and increased costs. Economic sanctions imposed on certain countries also impacted Tesla's ability to access critical materials and operate smoothly in those markets.

- Supply Chain Disruptions: The war in [mention specific region] hampered the supply of key raw materials, impacting production schedules.

- Market Volatility: Geopolitical uncertainty led to increased market volatility, affecting investor sentiment and overall demand.

- Currency Fluctuations: Changes in exchange rates added complexity to international operations and financial reporting.

Tesla's Response to the Earnings Decline

Price Adjustments and Sales Strategies

In response to the declining net income, Tesla implemented aggressive price adjustments and sales strategies to maintain market share and boost sales volume. The price cuts, although impacting short-term profitability, aimed to stimulate demand and secure a larger share of the expanding EV market.

- Price Cuts Across Model Range: Significant price reductions were implemented across all Tesla vehicle models.

- Sales Promotions and Incentives: Limited-time offers and incentives were introduced in certain markets to further encourage sales.

- Expansion of Supercharger Network: Continued investments in the Supercharger network were aimed at enhancing customer experience and expanding market reach.

Future Outlook and Projections

Tesla's guidance for the remaining quarters of 2024 remains cautiously optimistic, anticipating a gradual improvement in profitability driven by increased production efficiency and cost reductions. The company acknowledges the ongoing challenges posed by geopolitical risks, regulatory hurdles, and intense competition in the EV market.

- Increased Production Capacity: Planned expansion of production facilities will aim to increase vehicle output.

- Cost Optimization Initiatives: Efforts to streamline production processes and reduce costs are underway.

- New Product Launches: Anticipated launches of new models and upgrades will aim to further diversify the product portfolio and appeal to a broader range of customers.

Conclusion

Tesla's Q1 2024 earnings revealed a significant drop in net income, largely attributed to a combination of aggressive price reductions, increased production costs, supply chain disruptions, and considerable political headwinds. While revenue remained relatively strong, the impact of these factors on the profit margin is undeniable. Understanding these challenges and Tesla's strategic responses is key to comprehending the company's performance and future prospects. The company's future trajectory will depend heavily on its ability to navigate these challenges effectively and capitalize on growth opportunities. Stay tuned for our analysis of Tesla's upcoming Q2 earnings to see how the company navigates these challenges and the implications for future Tesla Q2 Earnings. Subscribe to our newsletter for updates and insights into the evolving EV market.

Featured Posts

-

Instagrams Latest App A Direct Challenge To Tik Toks Dominance

Apr 24, 2025

Instagrams Latest App A Direct Challenge To Tik Toks Dominance

Apr 24, 2025 -

John Travolta Honors Late Son Jett Travoltas 33rd Birthday With Poignant Photo

Apr 24, 2025

John Travolta Honors Late Son Jett Travoltas 33rd Birthday With Poignant Photo

Apr 24, 2025 -

John Travolta Shares Moving Photo On Late Son Jetts Birthday

Apr 24, 2025

John Travolta Shares Moving Photo On Late Son Jetts Birthday

Apr 24, 2025 -

Tesla Q1 Profit Decline Impact Of Musks Trump Ties

Apr 24, 2025

Tesla Q1 Profit Decline Impact Of Musks Trump Ties

Apr 24, 2025 -

The Destruction Of Pope Francis Fishermans Ring Tradition And Symbolism

Apr 24, 2025

The Destruction Of Pope Francis Fishermans Ring Tradition And Symbolism

Apr 24, 2025