The Need For Fiscal Responsibility In Canada's Economic Vision

Table of Contents

The Current State of Canada's Finances: A Reality Check

Canada's fiscal outlook is a complex picture. While the economy has shown resilience in recent years, the national debt continues to climb. The impact of the COVID-19 pandemic, necessitating substantial government spending on support programs, significantly exacerbated the existing deficit. Coupled with global economic uncertainties and fluctuating commodity prices, the challenge of achieving fiscal stability becomes even more pronounced.

- Canadian Debt: The total national debt, as a percentage of GDP, remains a key indicator of Canada's fiscal health. Analysis of this percentage reveals a concerning upward trend over the past decade. [Insert chart or graph visualizing Canadian debt levels over time].

- National Deficit: The annual budget deficit represents the difference between government spending and revenue. Sustained deficits contribute directly to the accumulation of national debt. [Insert chart or graph visualizing Canada's annual budget deficits].

- Government Spending: A detailed breakdown of government spending across various sectors (healthcare, education, infrastructure, social programs, etc.) is crucial to understanding where fiscal pressures originate and where potential efficiencies may lie.

- Economic Indicators: Examining key economic indicators like GDP growth, inflation rates, and unemployment figures helps contextualize the fiscal situation and assess the potential impact of different policy decisions.

The Long-Term Consequences of Fiscal Irresponsibility

Ignoring the need for fiscal responsibility carries severe long-term consequences for Canada. High debt levels translate into:

- Reduced Credit Rating: A lower credit rating increases borrowing costs for the government, meaning more money spent on interest payments rather than essential services.

- Increased Interest Payments: A larger portion of government revenue will be allocated to servicing the debt, leaving less for crucial investments in infrastructure, education, and healthcare.

- Crowding Out Private Investment: Government borrowing can compete with private sector borrowing for funds, potentially hindering private investment and economic growth. This is particularly relevant in considering the impact of government debt on long-term economic growth.

The implications extend beyond immediate financial burdens. Fiscal irresponsibility undermines intergenerational equity, burdening future generations with the debt accumulated today, impacting their access to vital social programs and economic opportunities. This lack of fiscal stability threatens long-term economic growth and places a considerable strain on social programs and infrastructure development.

Strategies for Achieving Fiscal Responsibility in Canada

Addressing Canada's fiscal challenges necessitates a multi-pronged approach encompassing strategic spending cuts, tax reforms, revenue generation, and improved government efficiency:

- Spending Cuts: Identifying areas for potential spending reductions requires careful consideration. This might involve streamlining government programs, eliminating redundancies, and prioritizing spending on high-impact initiatives.

- Tax Reforms: Improving the tax system's efficiency could involve closing tax loopholes, simplifying the tax code, and broadening the tax base. Careful consideration must be given to the potential impact on different income groups and sectors.

- Revenue Generation: Exploring options for increasing government revenue without stifling economic growth is essential. This might involve evaluating the potential of carbon taxes or exploring other revenue sources.

- Improved Government Efficiency: Reducing bureaucratic waste, improving the effectiveness of government programs, and adopting more efficient procurement processes are crucial steps towards better fiscal management.

Transparency in budgeting and accountability mechanisms are equally vital. Open and accessible budget information empowers citizens to scrutinize government spending and hold elected officials responsible for fiscal decisions. Implementing strong and effective budget planning is also crucial.

The Role of Canadians in Promoting Fiscal Responsibility

Fiscal responsibility is not solely the responsibility of the government; it requires active participation from all Canadians. Informed civic engagement is crucial:

- Fiscal Literacy: Canadians need to understand fundamental fiscal concepts, such as debt, deficits, and the implications of government spending decisions. Improved education on fiscal issues and promoting fiscal literacy are paramount.

- Political Accountability: Holding elected officials accountable for their fiscal decisions through informed voting and active participation in the political process is crucial. Canadians need to be engaged in demanding responsible governance.

- Media and Civil Society: The media and civil society organizations play a significant role in promoting public awareness of fiscal issues and holding the government accountable. A robust and independent media is essential in maintaining fiscal responsibility.

Building a Fiscally Responsible Future for Canada

Fiscal responsibility is not just a financial imperative; it’s the cornerstone of a strong and prosperous Canada. By addressing the current challenges and implementing the strategies outlined above, Canada can build a more sustainable and equitable future. This requires a collective commitment to responsible budgeting, effective tax policy, and transparent governance. By demanding fiscal responsibility from our elected officials and promoting greater fiscal literacy among Canadians, we can collectively build a stronger and more secure economic future for our nation. Let's work together to champion fiscal responsibility in Canada!

Featured Posts

-

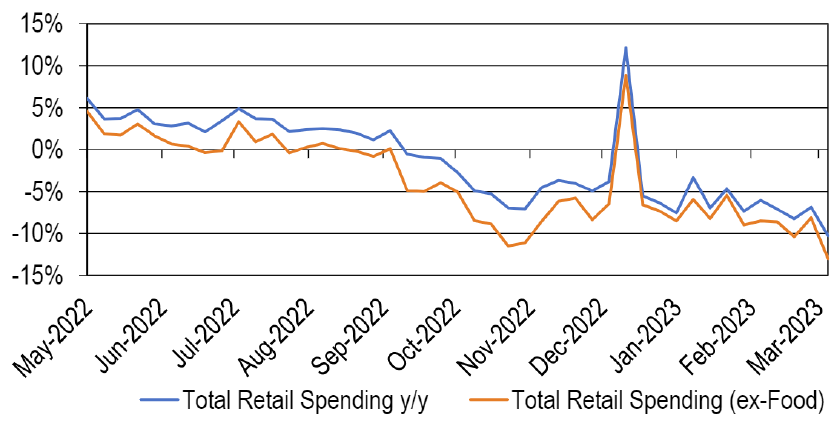

Credit Card Issuers Respond To Shifting Consumer Spending Habits

Apr 24, 2025

Credit Card Issuers Respond To Shifting Consumer Spending Habits

Apr 24, 2025 -

Wednesday April 9 The Bold And The Beautiful Recap Bill Finn And Liams Impact On Steffy

Apr 24, 2025

Wednesday April 9 The Bold And The Beautiful Recap Bill Finn And Liams Impact On Steffy

Apr 24, 2025 -

President Trump On Jerome Powell No Immediate Dismissal Expected

Apr 24, 2025

President Trump On Jerome Powell No Immediate Dismissal Expected

Apr 24, 2025 -

5 Dos And Don Ts For Landing A Private Credit Job

Apr 24, 2025

5 Dos And Don Ts For Landing A Private Credit Job

Apr 24, 2025 -

Instagrams Latest App A Direct Challenge To Tik Toks Dominance

Apr 24, 2025

Instagrams Latest App A Direct Challenge To Tik Toks Dominance

Apr 24, 2025