Strong Performance Of Emerging Market Equities Vs. US Decline

Table of Contents

The Rise of Emerging Market Equities

The superior performance of Emerging Market Equities can be attributed to several key factors. The consistent outperformance isn't a fluke; it's driven by fundamental economic strengths and compelling valuations.

Strong Economic Growth in Emerging Markets

Several emerging economies are experiencing significantly faster growth rates than their developed counterparts. This robust expansion is fueled by various factors:

- India: Benefitting from a young, burgeoning population and significant investments in infrastructure, India's GDP growth consistently outpaces many developed nations.

- Vietnam: Its export-oriented economy and strategic location have contributed to impressive economic expansion and strong foreign investment.

- Indonesia: The world's fourth most populous nation boasts a large domestic market and significant natural resources, driving substantial economic growth.

- Technological advancements: Rapid adoption of technology across various sectors is boosting efficiency and productivity in many emerging markets.

- Infrastructure development: Significant investments in infrastructure are enhancing connectivity, facilitating trade, and supporting economic activities.

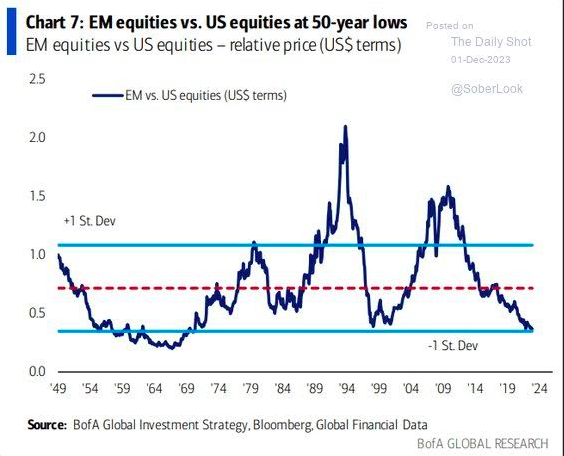

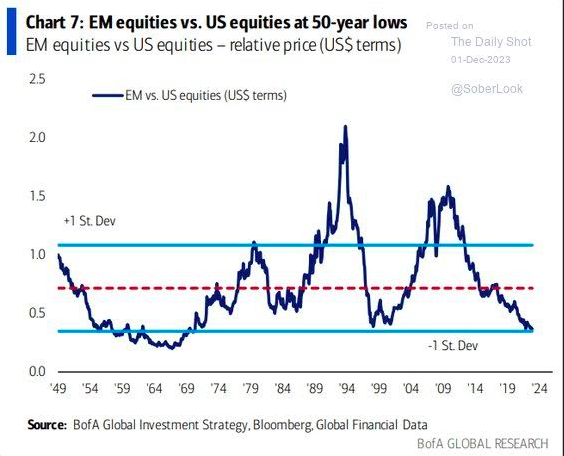

Attractive Valuations in Emerging Market Equities

Compared to their US counterparts, emerging market equities often present more attractive valuations. This is evident in several key metrics:

- Lower Price-to-Earnings Ratios (P/E): Many emerging market companies boast lower P/E ratios than their US equivalents, suggesting potential undervaluation.

- Higher Dividend Yields: Some emerging markets offer higher dividend yields, providing investors with a potentially greater income stream.

- Undervalued Growth Potential: The robust growth prospects of many emerging economies translate into potentially higher returns for investors in the long term. For example, several sectors in India's economy are currently undervalued compared to their global counterparts.

Diversification Benefits of Emerging Market Equities

Investing in emerging market equities offers significant diversification benefits. The relatively low correlation between emerging market and US equity markets means that adding emerging market exposure to a portfolio can reduce overall portfolio risk.

- Reduced Portfolio Volatility: Emerging markets often exhibit different economic cycles compared to developed markets, helping to buffer against market downturns in the US.

- Enhanced Risk-Adjusted Returns: By diversifying geographically, investors can potentially achieve higher returns for a given level of risk.

- Access to Untapped Growth Opportunities: Emerging markets offer access to a vast pool of high-growth companies and sectors, providing investors with unique opportunities for significant returns.

Factors Contributing to the US Market Decline

The underperformance of the US market can be attributed to several intertwined factors.

Impact of Interest Rate Hikes

The Federal Reserve's aggressive interest rate hikes aim to curb inflation, but they also significantly impact the US stock market:

- Increased Borrowing Costs: Higher interest rates increase borrowing costs for companies, reducing profitability and potentially hindering investment.

- Higher Bond Yields: Rising interest rates make bonds more attractive to investors, potentially diverting capital away from equities.

- Reduced Corporate Valuations: Higher discount rates used in valuation models lead to lower valuations for companies, particularly those with high debt levels.

Persistent Inflationary Pressures

Persistent high inflation erodes purchasing power and dampens economic growth, negatively impacting US equity performance:

- Reduced Consumer Spending: Inflation reduces consumers' real disposable income, leading to decreased spending and slower economic growth.

- Squeezed Corporate Profits: Rising input costs due to inflation squeeze corporate profit margins, impacting stock prices.

- Uncertainty about Future Growth: High inflation creates uncertainty about future economic growth, leading to investor hesitancy.

Geopolitical Risks Affecting US Equities

Geopolitical uncertainties contribute to market volatility and negatively affect investor sentiment:

- The War in Ukraine: The ongoing conflict has significantly impacted global energy markets and supply chains, contributing to inflation and economic uncertainty.

- US-China Relations: Trade tensions between the US and China create uncertainty and impact various sectors of the US economy.

- Global Political Instability: Increased global political instability can lead to decreased investor confidence and increased market volatility.

Investing in Emerging Market Equities: Opportunities and Risks

Investing in emerging market equities offers significant opportunities but also presents certain risks.

Strategies for Investing in Emerging Markets

Investors can access emerging markets through various strategies:

- Exchange-Traded Funds (ETFs): ETFs offer diversified exposure to a basket of emerging market stocks, providing a convenient and cost-effective investment approach.

- Mutual Funds: Mutual funds provide professional management and diversification across various emerging market companies.

- Individual Stocks: Direct investment in individual companies allows for a more targeted approach, but it requires more in-depth research and carries higher risk.

Managing Risks in Emerging Markets

Investing in emerging markets involves several inherent risks:

- Political Instability: Political instability can significantly impact market performance and investment returns.

- Currency Fluctuations: Changes in exchange rates can impact the value of investments denominated in foreign currencies.

- Regulatory Changes: Unpredictable regulatory changes can affect the operating environment for companies and investor returns.

- Liquidity Concerns: Some emerging markets may have lower trading volumes than developed markets, making it challenging to buy or sell investments quickly.

Mitigation strategies include: diversifying across different emerging markets and asset classes, carefully assessing political and economic risks, and considering hedging strategies to mitigate currency fluctuations.

Conclusion

The strong performance of emerging market equities stands in stark contrast to the challenges facing the US market. Factors such as robust economic growth, attractive valuations, and diversification benefits make emerging markets an increasingly compelling investment proposition. However, it's crucial to acknowledge the inherent risks associated with these markets and implement appropriate risk management strategies. To capitalize on the potential of these dynamic economies, investors should carefully consider the various investment strategies available, conduct thorough research, and perhaps seek professional financial advice. Explore emerging market equities today and consider diversifying your portfolio with these potentially high-growth investments. Remember to assess your risk tolerance and investment goals before making any decisions. Consider the potential of emerging market investments and take the first step toward a more diversified and potentially higher-yielding portfolio.

Featured Posts

-

Over The Counter Birth Control A New Era Of Reproductive Healthcare

Apr 24, 2025

Over The Counter Birth Control A New Era Of Reproductive Healthcare

Apr 24, 2025 -

Anchor Brewings Closure 127 Years Of Brewing History Ends

Apr 24, 2025

Anchor Brewings Closure 127 Years Of Brewing History Ends

Apr 24, 2025 -

John Travolta Honors Late Son Jett Travoltas 33rd Birthday With Poignant Photo

Apr 24, 2025

John Travolta Honors Late Son Jett Travoltas 33rd Birthday With Poignant Photo

Apr 24, 2025 -

Sharp Drop In Teslas Q1 Profits The Musk Trump Administration Connection

Apr 24, 2025

Sharp Drop In Teslas Q1 Profits The Musk Trump Administration Connection

Apr 24, 2025 -

Viral Whataburger Video Propels Hisd Mariachi To Uil State Competition

Apr 24, 2025

Viral Whataburger Video Propels Hisd Mariachi To Uil State Competition

Apr 24, 2025