Simkus Warns Of Further ECB Rate Cuts Due To Trade Slowdown

Table of Contents

Simkus's Rationale: Analyzing the Trade Slowdown's Impact

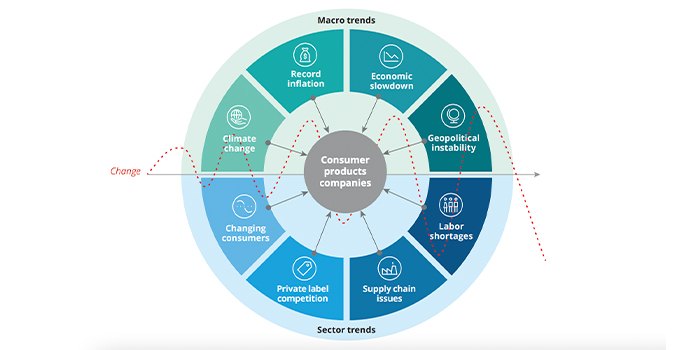

Simkus's prediction of further ECB rate cuts is rooted in a comprehensive analysis of the current global trade slowdown's devastating impact on the Eurozone. He points to several key indicators signaling a significant economic downturn:

- Decreased Export Volumes: Eurozone exports, a crucial driver of economic growth, have experienced a notable decline in recent months. This reduction reflects weakening global demand and increasing trade barriers.

- Weakening Global Demand: Reduced consumer spending and business investment globally have directly translated into lower demand for Eurozone goods and services. This is further exacerbated by persistent inflation in many key markets.

- Supply Chain Disruptions: Ongoing supply chain bottlenecks, stemming from geopolitical instability and lingering effects of the pandemic, continue to hamper production and increase costs, further dampening export competitiveness.

- Geopolitical Uncertainties: The ongoing war in Ukraine, coupled with escalating tensions in other regions, introduces significant geopolitical risk, making businesses hesitant to invest and impacting trade flows negatively.

Simkus supports his claims with data showing a sharp contraction in key economic indicators, including a decline in industrial production and a weakening Purchasing Managers' Index (PMI). These trends paint a concerning picture for the Eurozone's economic prospects, making further ECB intervention highly likely. Relevant keywords here include: global trade, Eurozone exports, economic indicators, geopolitical risk.

ECB's Current Monetary Policy and Potential Future Actions

The European Central Bank (ECB) has already implemented several monetary policy measures to combat inflation and support economic growth. However, given the intensifying trade slowdown, further action might be necessary. The current monetary policy stance includes:

- Current Interest Rate Levels: While interest rates have already been raised in recent months to curb inflation, they remain below pre-pandemic levels. Further reductions are possible if the economic outlook worsens significantly.

- Quantitative Easing (QE) Programs: The ECB might restart or expand its QE programs, purchasing government bonds and other assets to inject liquidity into the financial system and lower long-term interest rates.

- Potential for Negative Interest Rates: Although the possibility of further negative interest rates remains a contentious issue, it cannot be entirely ruled out if the economic situation deteriorates drastically.

- Other Policy Tools: The ECB might employ other policy tools, such as targeted lending programs to specific sectors, to support economic activity and prevent a deeper recession.

Simkus’s analysis suggests a high likelihood of further interest rate reductions, potentially coupled with renewed QE programs, to counter the negative impacts of the trade slowdown. Keywords: ECB monetary policy, interest rate reduction, quantitative easing, negative interest rates.

Economic Implications of Further ECB Rate Cuts

Further ECB rate cuts could have both positive and negative consequences for the Eurozone economy.

- Impact on Inflation: While rate cuts can stimulate economic growth, they also risk exacerbating inflationary pressures. This is particularly concerning given the existing inflationary environment.

- Effects on Borrowing Costs: Lower interest rates reduce borrowing costs for businesses and consumers, potentially boosting investment and spending. However, this also has the risk of inflating asset bubbles.

- Stimulus to Economic Growth or Potential Risks: Lower interest rates aim to stimulate economic growth by encouraging borrowing and investment. However, if the trade slowdown is primarily structural, rather than cyclical, rate cuts might be ineffective and even lead to further economic instability.

- Potential for Currency Devaluation: Rate cuts can weaken the Euro's exchange rate relative to other currencies, potentially making imports more expensive but exports more competitive.

The overall impact of further ECB rate cuts depends heavily on the severity and duration of the trade slowdown, as well as the ECB's ability to manage the associated risks. Keywords: economic growth, inflation, borrowing costs, Eurozone economy, currency exchange rate.

Alternative Economic Scenarios and Expert Opinions

While Simkus’s prediction is compelling, alternative perspectives exist. Some economists argue that the trade slowdown might be temporary, and that the ECB’s current monetary policy is already sufficiently accommodative.

- Optimistic vs. Pessimistic Economic Forecasts: Forecasts vary widely, ranging from optimistic projections of a mild slowdown to more pessimistic scenarios involving a protracted recession.

- Different Interpretations of Economic Data: Different economists interpret the same economic data differently, leading to varied conclusions about the appropriate policy response.

- Divergent Opinions among Experts: There is significant disagreement among experts regarding the effectiveness of further rate cuts in addressing the current challenges faced by the Eurozone economy.

It's crucial to consider these diverse viewpoints when evaluating the potential impact of further ECB rate cuts. Keywords: economic forecast, expert opinion, economic uncertainty, risk assessment.

Conclusion: Staying Informed About Potential ECB Rate Cuts and Their Impact

Simkus's warning of further ECB rate cuts due to the global trade slowdown is a significant development with potentially far-reaching consequences for the Eurozone economy. The key drivers behind this prediction are the weakening global demand, decreased export volumes, persistent supply chain disruptions, and significant geopolitical uncertainties. Staying informed about the ECB's monetary policy decisions and their impact is crucial for businesses, investors, and consumers alike. To navigate these uncertain times, follow Simkus's work, stay updated on economic news, and consider seeking professional financial advice to manage your investments in light of potential ECB rate cuts and the ongoing trade slowdown.

Featured Posts

-

Significant Us Growth Slowdown Predicted By Deloitte

Apr 27, 2025

Significant Us Growth Slowdown Predicted By Deloitte

Apr 27, 2025 -

Bucking Fastard Werner Herzogs New Film With Real Life Sister Leads

Apr 27, 2025

Bucking Fastard Werner Herzogs New Film With Real Life Sister Leads

Apr 27, 2025 -

Ariana Grande Debuts Dramatic Hair And Tattoo Changes Professional Stylist Involved

Apr 27, 2025

Ariana Grande Debuts Dramatic Hair And Tattoo Changes Professional Stylist Involved

Apr 27, 2025 -

Where To Buy Ariana Grande Lovenote Fragrance Set Online A Complete Guide

Apr 27, 2025

Where To Buy Ariana Grande Lovenote Fragrance Set Online A Complete Guide

Apr 27, 2025 -

The Growing Problem Of Wildfire Speculation A Los Angeles Perspective

Apr 27, 2025

The Growing Problem Of Wildfire Speculation A Los Angeles Perspective

Apr 27, 2025