Significant US Growth Slowdown Predicted By Deloitte

Table of Contents

Deloitte's Methodology and Data Sources

Deloitte's prediction of a significant US growth slowdown is not a mere guess; it's the result of rigorous analysis using sophisticated economic modeling. Their methodology incorporates a multi-faceted approach, leveraging a combination of econometric models, comprehensive surveys, and meticulous data analysis. Key data sources include government reports like those published by the Bureau of Economic Analysis (BEA) and the Federal Reserve, alongside industry-specific data and detailed consumer spending statistics.

The data supporting Deloitte's prediction reveals a concerning trend:

- Declining Consumer Confidence: Surveys consistently show a drop in consumer confidence, indicating reduced spending and investment.

- Rising Inflation: Persistently high inflation continues to erode purchasing power and dampens consumer demand.

- Supply Chain Disruptions: Ongoing supply chain bottlenecks contribute to higher prices and limit production capacity.

- Weakening Housing Market: A decline in home sales and rising mortgage rates signal a significant contraction in a key sector of the US economy.

These data points, analyzed through robust forecasting methodology and economic indicators, underscore the seriousness of Deloitte's prediction. Understanding the depth and breadth of their data analysis is critical to grasping the potential severity of the predicted US economic slowdown.

Key Factors Contributing to the Predicted Slowdown

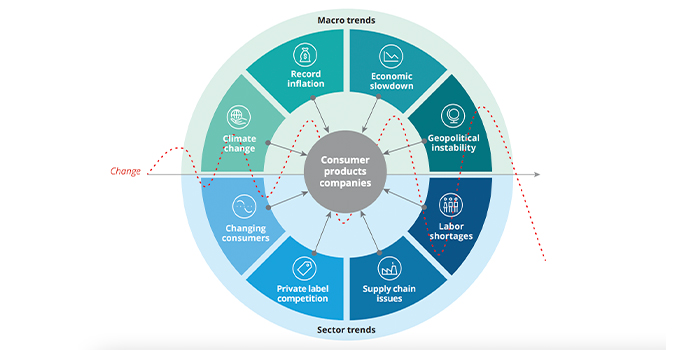

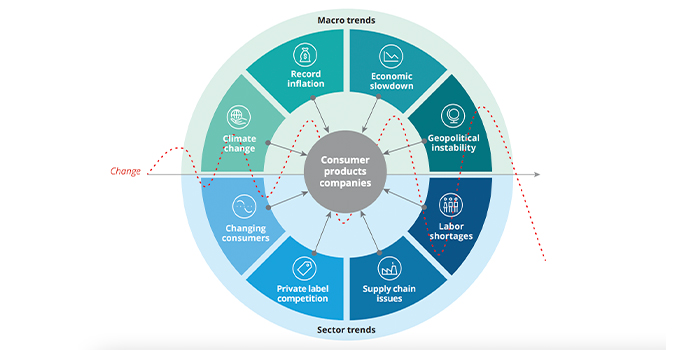

Several interconnected factors contribute to Deloitte's forecast of reduced US GDP growth. Understanding these factors is vital for informed decision-making.

Inflation and Rising Interest Rates

High inflation remains a dominant force, eroding purchasing power and stifling economic growth. The Federal Reserve's response, involving aggressive interest rate hikes, aims to curb inflation but simultaneously risks slowing economic activity. Rising interest rates increase borrowing costs for businesses and consumers, making investments and large purchases less attractive. This directly impacts consumer spending and business investment, two key drivers of US economic growth. The impact is felt across various sectors, from housing (with higher mortgage rates) to manufacturing (with increased borrowing costs for equipment).

Geopolitical Uncertainty and Supply Chain Disruptions

Global geopolitical instability, including the ongoing war in Ukraine and persistent trade tensions, significantly impacts the US economy. These events disrupt global supply chains, leading to shortages, increased commodity prices, and heightened economic uncertainty. The resulting price increases fuel inflation and contribute to decreased consumer confidence. Specific examples include disruptions in energy supplies, impacting transportation costs and manufacturing, and shortages of crucial materials, delaying production and increasing prices for various goods.

Labor Market Dynamics and Productivity

The US labor market exhibits complex dynamics that influence economic productivity and overall growth. While unemployment remains relatively low, businesses face significant challenges in finding and retaining skilled workers, leading to labor shortages. This, coupled with robust wage growth, contributes to inflationary pressures. The relationship between wage growth, inflation, and productivity is a delicate balance. While wage increases can boost consumer spending, they also contribute to higher production costs, potentially hindering economic growth if productivity doesn't keep pace.

Conclusion: Preparing for the Predicted US Growth Slowdown

Deloitte's prediction of a significant US growth slowdown is a serious concern, driven primarily by high inflation, rising interest rates, ongoing geopolitical uncertainty, supply chain disruptions, and labor market dynamics. Understanding this forecast is crucial for businesses and investors to develop effective strategies for navigating potential economic headwinds.

For businesses, proactive measures are essential. These might include:

- Diversifying supply chains: Reducing reliance on single sources and geographical regions.

- Implementing cost-cutting measures: Identifying areas for efficiency improvements and reducing unnecessary expenses.

- Developing robust contingency plans: Preparing for various economic scenarios and potential disruptions.

Individuals can also take steps to mitigate the impact of a potential slowdown:

- Reviewing financial plans: Assessing savings, investments, and debt levels.

- Building an emergency fund: Creating a financial safety net to cushion against unexpected expenses.

- Seeking professional financial advice: Consulting with a financial advisor to develop a personalized plan.

The potential for a US growth slowdown warrants careful attention. Deloitte's economic forecast provides valuable insights into the likely challenges ahead. Don't wait until the slowdown hits; take proactive steps now to prepare your business or personal finances for the potential economic downturn. Learn more about Deloitte's full economic forecast and develop a robust strategy to navigate the predicted US growth slowdown.

Featured Posts

-

Belinda Bencics Postpartum Triumph First Wta Victory

Apr 27, 2025

Belinda Bencics Postpartum Triumph First Wta Victory

Apr 27, 2025 -

Government Appoints Vaccine Skeptic To Head Autism Vaccine Study

Apr 27, 2025

Government Appoints Vaccine Skeptic To Head Autism Vaccine Study

Apr 27, 2025 -

Deloittes Prediction A Significant Slowdown In Us Economic Growth

Apr 27, 2025

Deloittes Prediction A Significant Slowdown In Us Economic Growth

Apr 27, 2025 -

Mubadala Abu Dhabi Open Rybakina Edges Jabeur In Dramatic Final

Apr 27, 2025

Mubadala Abu Dhabi Open Rybakina Edges Jabeur In Dramatic Final

Apr 27, 2025 -

Grand National Horse Deaths A Look Ahead To 2025

Apr 27, 2025

Grand National Horse Deaths A Look Ahead To 2025

Apr 27, 2025