Shifting Global LPG Trade: China's Reliance On Middle East Grows

Table of Contents

Rising LPG Demand in China

China's rapid economic expansion is the primary driver behind its soaring Liquefied Petroleum Gas (LPG) consumption. This growth is fueled by several key factors.

Fueling Economic Growth

- Increasing Population: China's massive population necessitates a constant supply of energy for cooking and heating, driving up LPG demand, particularly in rural areas.

- Rising Disposable Incomes: As disposable incomes rise, more Chinese households can afford LPG, replacing traditional fuels like coal and wood. This shift towards cleaner-burning LPG is also environmentally beneficial.

- Expanding Industrial Sector: China's booming industrial sector utilizes LPG in various manufacturing processes, further adding to the overall demand.

- Government Initiatives: The Chinese government is actively promoting energy access in rural areas through initiatives that often involve the provision of LPG.

This surge in China LPG consumption significantly outpaces the nation's domestic LPG production capacity, leading to increased reliance on imports. The disparity between China LPG consumption and domestic LPG production is widening, creating a substantial gap filled by international suppliers.

Shortfalls in Domestic Production

China's domestic LPG production struggles to keep pace with the country's burgeoning needs. Several factors contribute to this shortfall:

- Dependence on Crude Oil Refining: Much of China's LPG is a byproduct of crude oil refining, limiting the ability to independently scale LPG production based on demand.

- Limited LPG Extraction: China's natural gas reserves, a key source of LPG, are not sufficient to meet the country's rapidly growing energy needs.

- Environmental Regulations: Stringent environmental regulations are impacting domestic LPG production, potentially leading to reduced output from some refineries.

This inherent limitation in China LPG production capacity necessitates a substantial reliance on imports to meet the country’s energy needs, making international LPG markets increasingly vital.

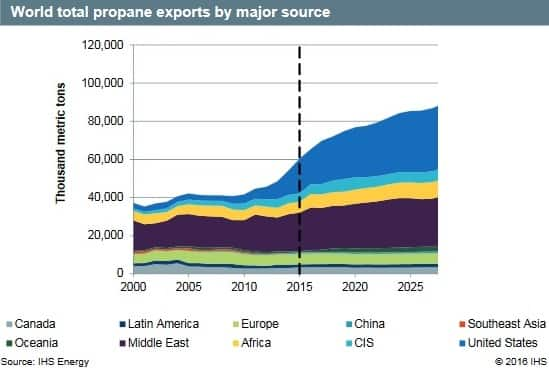

The Middle East: A Reliable LPG Supplier

The Middle East emerges as a key solution to China's LPG deficit, offering substantial resources and strategic partnerships.

Abundant Resources

The Middle East boasts some of the world's largest LPG reserves and possesses considerable production capacity.

- Major LPG Producing Countries: Countries like Saudi Arabia, Qatar, and the UAE are significant LPG exporters, possessing both the infrastructure and resources to meet significant international demands.

- Efficient Production Processes: Middle Eastern LPG production facilities are often highly efficient, able to process large quantities of LPG at competitive costs.

- Favorable Geographic Location: The Middle East's proximity to major shipping lanes provides efficient and cost-effective transport of LPG to China.

This abundance of resources, combined with efficient production and advantageous geography, positions the Middle East as a natural and reliable LPG supplier for China. Middle East LPG exports are therefore crucial in balancing the global supply and demand of LPG.

Strategic Partnerships and Investments

The growing energy relationship between China and the Middle East is underscored by significant strategic partnerships and investments in the LPG sector.

- Long-term Contracts: Long-term contracts ensure a stable supply of LPG for China, reducing price volatility and securing energy security.

- Joint Ventures: Joint ventures between Chinese and Middle Eastern companies foster technological exchange and capacity building.

- Pipeline Projects: Investments in pipelines could further enhance the efficiency and security of LPG transportation.

- Financial Investments: Financial investments in Middle Eastern LPG production facilities secure a continuous flow of LPG to China.

These strategic partnerships highlight the depth of the collaborative effort in securing LPG supplies for China, indicating a long-term commitment from both sides. China-Middle East LPG trade is shaping the geopolitical landscape of the global energy market.

Implications for the Global LPG Market

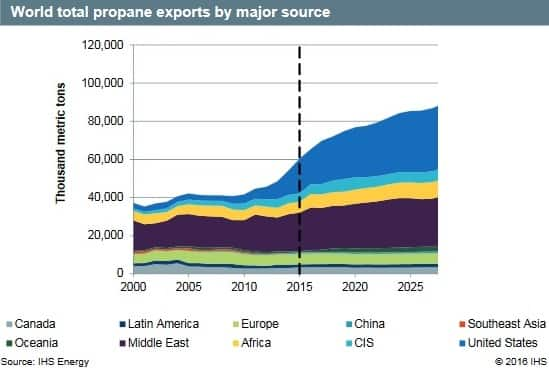

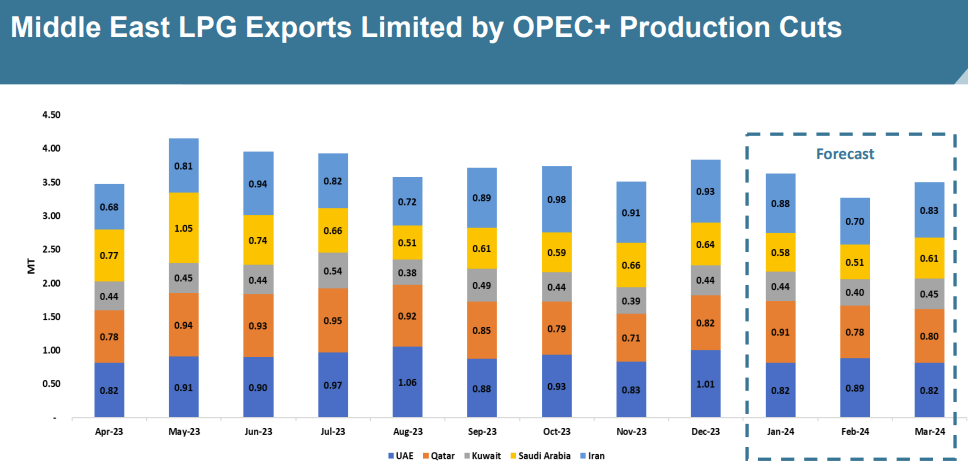

China's increased reliance on Middle Eastern LPG has significant implications for the global LPG market.

Increased Competition

The massive increase in China's LPG imports significantly impacts the global LPG market.

- Price Fluctuations: Increased demand from China can influence global LPG prices, creating volatility and affecting other importing countries.

- Impact on Other LPG Importing Countries: Competition for LPG supplies could intensify, potentially affecting the availability and cost of LPG in other regions.

- Shifts in Global Trade Routes: The increased trade volume between China and the Middle East may lead to adjustments in global LPG shipping routes.

This heightened competition reshapes the dynamics of the global LPG prices, making it a crucial aspect for both producers and consumers.

Geopolitical Significance

The growing energy interdependence between China and the Middle East carries significant geopolitical implications.

- Energy Security for China: Diversifying energy sources through the Middle East enhances China's energy security, reducing dependence on other regions.

- Strategic Alliances: The deepening energy relationship strengthens strategic alliances between China and Middle Eastern countries.

- Regional Stability Implications: The substantial LPG trade between these regions contributes to regional stability and economic cooperation.

The interplay of economic incentives and geopolitical strategies is reshaping the landscape of global energy politics, making the China-Middle East LPG relationship a key factor in global affairs.

Conclusion

China's rising LPG demand, driven by its rapid economic growth and limitations in domestic production, is fundamentally shifting global LPG trade. The Middle East has emerged as a crucial supplier, forging strong strategic partnerships with China to meet this demand. This development has far-reaching implications for global LPG prices, competition among suppliers, and the geopolitical landscape. Understanding the shifting dynamics of global LPG trade, particularly China's growing reliance on the Middle East, is crucial for businesses and policymakers alike. Further research into the specifics of Liquefied Petroleum Gas (LPG) trade agreements and future market projections is vital for navigating this evolving landscape. Stay informed about the latest developments in the global LPG market.

Featured Posts

-

Impact Of Us Tariffs Chinas Turn To Middle East For Lpg Supply

Apr 24, 2025

Impact Of Us Tariffs Chinas Turn To Middle East For Lpg Supply

Apr 24, 2025 -

John Travolta Posts Birthday Tribute To Late Son Jett Travolta

Apr 24, 2025

John Travolta Posts Birthday Tribute To Late Son Jett Travolta

Apr 24, 2025 -

Wildfire Speculation Examining The Market For Los Angeles Fire Bets

Apr 24, 2025

Wildfire Speculation Examining The Market For Los Angeles Fire Bets

Apr 24, 2025 -

Fox News Faces Defamation Lawsuit From Ray Epps Over Jan 6th Reporting

Apr 24, 2025

Fox News Faces Defamation Lawsuit From Ray Epps Over Jan 6th Reporting

Apr 24, 2025 -

A Fathers Love John Travoltas Touching Birthday Message For Jett

Apr 24, 2025

A Fathers Love John Travoltas Touching Birthday Message For Jett

Apr 24, 2025